Equipment Manufacturing

Smart Home Appliance Accessories Production Project of Jilin City

1. Introduction to the Project

1.1 Project background

1.1.1 Product introduction

This project uses materials such as non-oriented silicon steel and galvanized steel in Jilin City to produce motors, appliance casings, back panels, etc. for smart home appliances, extending the industrial chain and driving the development of the industry.

The various motors, generators and casings made of silicon steel and galvanized materials can extend the service life, improve product quality, break through traditional designs, and have strong plasticity.

1.1.2 Market prospect

(1) Status analysis of smart home appliance market

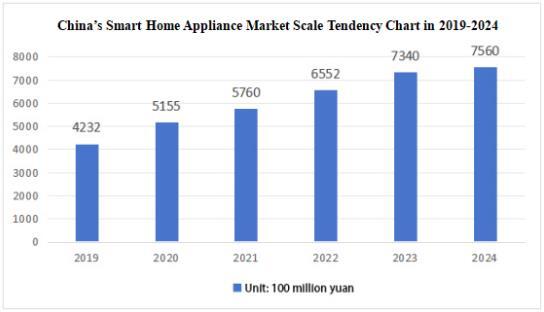

As a component of smart home systems, smart home appliances can be interconnected with other home appliances, furniture, and facilities within a residence to form a system, enabling smart home functions. With the increase in the income level of Chinese consumers, their consumption capacity has gradually improved. Consumers' brand awareness has become stronger, and their requirements for product quality and quality are also gradually rising. As a result, the smart home appliance market has been developing at an accelerating pace. In 2022, the market size of smart home appliances was approximately 655.2 billion yuan, a year-on-year increase of 13.75%. In 2023, it was approximately 734 billion yuan. The market size of smart home appliances exceeded 750 billion yuan in 2024.

Figure 1 China's Smart Home Appliance Market Scale Tendency Chart in 2019-2024

From the perspective of its development process, the Chinese smart home appliance industry can be divided into four stages: exploration period, market startup period, the high-speed development period, and market maturity period. During the exploration period, the Chinese smart home appliance market had a relatively long exploration phase. At this stage, smart home appliances were mainly installed in some villas and high-end residences. After 2010, driven by technologies such as mobile Internet and the Internet of Things, new smart home appliance products emerged continuously. After 2013, the smart home appliance industry entered the market startup period. A number of smart hardware startup enterprises emerged in the Chinese smart home appliance market. During this stage, home appliance manufacturers and Internet companies advanced side by side to develop smart home appliance products. In 2018, the smart home appliance industry entered the high-speed development period. The smart home system platforms and service platforms were established, products were accepted by the market, industry standards were gradually unified, competition among industry giants intensified, and the market developed rapidly. After 2022, the smart home appliance market tended to mature. The entry threshold continued to increase, and market concentration further increased towards the industry giants.

The industrial chain of the smart home appliance industry encompasses multiple links, from upstream component and underlying technology providers, to midstream home appliance manufacturers, and then to downstream sales channels and end consumers. The upstream mainly includes suppliers of key components such as chips, sensors, PCB, MCU, and communication modules. The downstream mainly includes online and offline sales channels, such as e-commerce platforms, physical stores, and exclusive stores.

With the rapid development of artificial intelligence and the Internet of Things, national policies further support the research, development, and application of smart home appliances, promoting the popularization of smart homes and the construction of smart cities. The development of the smart home appliance industry has received multi-level policy support from the national to local levels. These policies cover various aspects such as R&D innovation, environmental protection and energy conservation, consumption stimulation, and the promotion of smart homes, providing a strong guarantee for the healthy development of the smart home appliance industry. In June 2023, the General Office of the Ministry of Commerce and three other departments issued the "Notice on Doing a Good Job in Promoting the Consumption of Green and Smart Home Appliances in 2023". It encourages localities with the conditions to enhance the convenience of handing over old home appliances and claiming subsidies by organizing production enterprises, e-commerce platforms, physical businesses, and recycling enterprises to establish connection mechanisms, build cooperation platforms, and clarify the replacement process. This promotes the upgrading and replacement consumption of green and smart home appliances. It also actively promotes the certification of green and smart home appliances, guiding home appliance enterprises to further enrich the supply of green and smart home appliance products. In March 2024, the National Development and Reform Commission printed and issued the "Action Plan for Promoting the High-quality Construction of National New Areas", in order to consolidate and enhance the competitive advantages of the new area's 100-billion-yuan-level and leading industries, focus on industries such as automobiles, new displays, equipment manufacturing, petrochemicals, smart home appliances, and textiles, where the annual output value of the new areas reaches 100 billion yuan or 1-2 leading industries. The provinces (municipalities) where they are located should put forward targeted policies and measures to support the implementation of the technological transformation and upgrading project of the manufacturing industry, strengthen the guarantee level of resource elements, and attract the agglomeration of key links in the industrial chain.

(2) Home appliance components market

Home appliance components are an important part of home appliance products. They are single parts or components mainly used to form, support, and realize specific functions, including electronic components and mechanical parts. The home appliance industry is a sector with numerous sub-categories and a huge market capacity. Closely related to people's daily lives, it features diversification, high-quality, and personalization. With the development of the economy and the improvement of residents' living standards, the demand for home appliances has been continuously increasing, driving the rapid development of the home appliance component industry.

The home appliance component industry can be divided into multiple fields, mainly including refrigeration components (such as compressors, condensers, and evaporators), display panels (used in color TVs, etc.), control components (such as solenoid valves, electromagnetic pumps, and sensors), motors and pumps (such as washing machine motors and dishwasher pumps), appearance composite materials (such as film-covered sheets and coated sheets), and deep-processed glass products (such as colored crystal glass and coated glass). Each of these components has its own characteristics and together they form the core technology and functional parts of home appliance products.

The upstream of the home appliance component industry chain is mainly the production of basic raw materials, such as bulk materials like plastics, metals, wires, and hoses. The mid-stream is the production of home appliance components, including compressors, clutches, drain pumps, film-covered sheets, and display products. The downstream is mainly the manufacturing of various home appliances, including white goods (refrigerators, washing machines, air conditioners, etc.), black goods (color TVs, etc.), and various small home appliances (coffee machines, robot vacuums, etc.). The main enterprises in each link of the industry chain include upstream raw material companies (such as Aluminium Corporation of China, Kingfa Science and Technology Co., Ltd., etc.), mid-stream component manufacturers (such as Sanhua Intelligent Controls Co., Ltd., Dun'an Environment Co., Ltd., etc.), and downstream home appliance manufacturers (such as Midea, Gree, etc.).

In recent years, the market size of home appliance components has continued to grow. According to data, in 2022, the total revenue of A-share listed companies in China's home appliance component industry exceeded 100 billion yuan, with an annual compound growth rate of over 10%. Among them, there are four enterprises with a revenue scale of over 10 billion yuan, namely Sanhua Intelligent Controls, Shanghai Highly Co., Ltd., Changhong Huayi Compressor Co., Ltd., and Dun'an Environment. These enterprises dominate the home appliance component market with a relatively high market share.

In recent years, the State has continuously promoted the rural market penetration of home appliances and home appliance consumption, focusing on the development of smart and green home appliances. The home appliance component field focuses on core basic components and elements such as bearings, gears, and fasteners, accelerating the breakthrough of key technologies. For example, the "14th Five-year Plan for the Development of the Chinese Home Appliance Industry" proposes to accelerate the transformation and upgrading towards digitalization, intelligence, and green development, and continuously enhance the global competitiveness, innovation, and influence of the home appliance industry.

With the continuous penetration of emerging technologies such as artificial intelligence, the Internet of Things, and big data, home appliance products are developing towards intelligent interconnection. High-performance, environmentally friendly, and reliable materials and components are the keys to the intelligence and high-efficiency energy consumption of home appliance products. Therefore, home appliance component manufacturers are constantly accelerating technological innovation and transformation and upgrading to meet market demands.

The market demand for home appliance components is mainly affected by the downstream home appliance market. As consumers' requirements for the quality and performance of home appliance products increase, the requirements for the quality and performance of home appliance components also rise accordingly. At the same time, the rapid development of the smart home appliance market has also driven the growth of the home appliance component market. For example, coffee machines require higher sensitivity and water flow control of solenoid valves, and smart toilets need to increase the water output and water pressure of pumps.

The home appliance component industry faces challenges mainly including fierce market competition and rising raw material costs. However, with the continuous development of the home appliance market and consumption upgrading, the home appliance component industry has also ushered in new opportunities. For example, undertaking international industrial transfer will bring new impetus to the development of China's home appliance component industry; domestic home appliance component manufacturers have mastered the manufacturing processes of a number of precision components, gradually achieving in-depth domestic substitution of core components; and the rapid development of the smart home appliance market has also provided a new growth point for the home appliance component industry.

1.1.3 Technical analysis

The technology used is not limited to the current ones. If the settled enterprises have innovative technologies, the technologies of the settled enterprises will be adopted. This technical analysis is only for reference.

Technological processes for smart home appliance components:

Material cutting: Cut raw materials into corresponding shapes according to specification requirements.

Stamping: Use a punching press to stamp the pre-cut parts. These parts are the basic components of smart home appliance accessories.

Bending: Bend the stamped parts through the bending process to make them into the shapes required for the finished products.

Punching holes: Punch holes in the finished products to facilitate the installation of electrical components.

Welding: Weld various components together to form complete home appliance accessories.

Baking finish: Conduct surface treatment on the welded accessories to make their appearance smooth and prevent oxidation.

Assembly: Assemble individual accessories into complete home appliance parts.

1.1.4 Advantageous conditions of project construction

(1) Policy advantage

In 2022, the Central Committee of the Communist Party of China and the State Council issued the "Outline of the Strategy for Expanding Domestic Demand (2022-2035)", which clearly stated the need to improve the housing provident fund system, promote the construction of barrier-free facilities, boost home decoration consumption, increase smart home appliance consumption, and drive the development of digital homes.

In 2023, the General Office of the State Council issued the "Notice on Measures for Restoring and Expanding Consumption", clearly promoting products such as smart home appliances, integrated home appliances, and functional furniture, and enhancing the intelligence and greening level of home furnishings.

In 2023, the Ministry of Industry and Information Technology and other departments issued the "Guiding Opinions on Accelerating the Transformation and Upgrading of Traditional Manufacturing Industries", specifying that by 2027, the development level of traditional manufacturing industries in terms of high-end, intelligent, green, and integrated development will be significantly improved, effectively supporting the maintenance of a basically stable proportion of the manufacturing industry, and further consolidating and enhancing its position and competitiveness in the global industrial division of labor.

In 2024, the Ministry of Industry and Information Technology and other departments issued the "Guiding Opinions on Accelerating the Green Development of the Manufacturing Industry", proposing to accelerate the construction of innovation consortia and sources of original technologies in key green low-carbon areas. Build a number of national industrial measurement and testing centers in industries such as steel, petrochemicals, and home appliances, and carry out research and development of key green-low-carbon measurement technologies and equipment.

In 2024, the National Development and Reform Commission issued the "Action Plan for Promoting the High-quality Construction of National New Areas", proposing to focus on industries in national new areas such as automobiles, new displays, equipment manufacturing, petrochemicals, smart home appliances, and textiles, with an annual output value reaching 100 billion yuan or 1-2 leading industries. The provinces (municipalities) where these industries are located should put forward targeted policies and measures to support the implementation of technological transformation and upgrading projects in the manufacturing industry, strengthen the guarantee level of resource elements, and attract the agglomeration of key links in the industrial chain.

The "Investment Promotion Policies of Jilin City" clearly states that projects invested by the Industrial Investment Guidance Fund of Jilin City should comply with national and relevant industrial policies and development plans. The key investment areas include industries related to the "6411" industrial plan of Jilin City, such as tourism, medical and health, aviation, information technology, new materials, advanced equipment manufacturing, biotechnology, energy conservation and environmental protection, new energy, cultural and creative industries, modern agriculture, modern service industries, as well as other fields strongly supported by the municipal government. In addition to the investment method of participating in the establishment of sub-funds, the guidance fund can also adopt methods such as follow-up investment and direct investment. For newly introduced eligible investment projects, they can enjoy tax exemptions and reductions in accordance with current national and provincial tax policies. For projects that contribute significantly to Jilin City, in accordance with the spirit of the "Notice of the State Council on Matters Related to Preferential Policies such as Taxation" (GF [2015] No. 25), relevant departments will assist enterprises in applying for tax exemptions and reductions in accordance with laws and regulations. A special fund for the development of industrial enterprises is set up to encourage the introduction of major projects in traditional industries such as chemicals, automobiles, metallurgy, and agricultural product processing in the "6411" industrial system that comply with national industrial policies, have strong industrial support, and have an obvious driving effect. It also encourages the introduction of emerging industries such as medical and health, new materials, advanced equipment manufacturing, and electronic information. Key preferences will be given in the allocation of production factors, and priority will be given to recommending support from relevant national and provincial special funds.

(2) Resource advantage

The planned area of Longtan Economic Development Zone is 16.66 square kilometers. There is a large stock of developable land resources. Newly added and reserved land can meet the needs of new projects. The land price is at a low level among 41 cities in Northeast China.

Jilin City has great development potential in resources such as hydropower, wind energy, solar energy, biomass energy, and oil shale. The city's power generation capacity is 10 million kilowatts. During the "14th Five-year Plan" period, an additional capacity of 3.279 million kilowatts will be added, with an average annual growth rate of 8.3%. Among them, coal-fired power generation is 3.07 million kilowatts, accounting for 30.7%; gas-fired power generation is 0.86 million kilowatts, accounting for 8.6%; wind power is 1.54 million kilowatts, accounting for 15.4%; photovoltaic power generation is 0.7 million kilowatts, accounting for 7%; hydropower is 3.5 million kilowatts (3.2 million kilowatts of conventional hydropower and 0.3 million kilowatts of pumped-storage hydropower), accounting for 35%; biomass power generation is 0.27 million kilowatts, accounting for 2.7%; waste-to-energy power generation is 0.058 million kilowatts, accounting for 0.6%. The installed capacity of new energy and renewable energy accounts for 60.7% of the total installed capacity. It is estimated that the power generation in 2025 will be 20.63 billion kilowatt-hours, and the total substation capacity of urban and rural power grids will reach 4891.1 MVA.

(3) Industrial advantage

In Jilin City, the light-industry sector takes Jilin Chemical Fiber Group and Jilin Chenming Paper as the leading enterprises. There are 32 enterprises above designated size, mainly engaged in textiles, papermaking, paper packaging, plastics, and wood product processing. In 2020, the output value reached 9.88 billion yuan. Jilin Chemical Fiber Group plays a significant leading role in the provincial textile industry. During the "13th Five-year Plan" period, the product structure of the Chemical Fiber Group further developed towards composite and functional types. By promoting sales through quality, it vigorously developed renewable resources, strengthened the extension of the industrial chain and the development of new products. It expanded the acrylic fiber business, refined the viscose production, strengthened the raw material base, and optimized the bamboo and carbon industries. It is a raw material base for health-functional textile products in China and a national R&D and production base for differential acrylic fibers. Jilin Chenming Paper is the main papermaking base in Northeast China. The company annually produces 220,000 tons of high-end cultural papers such as refined lightly coated paper, lightweight paper, offset paper, teaching-aid-specific paper, and A3 coated paper.

In the future, the development of the light-industry sector in Jilin City will focus on the Economic Development Zone and Longtan District. By 2025, the industry's output value is expected to reach 5 billion yuan. Support will be provided to Jilin Chenming Paper to develop the household paper product field. By 2025, the company's papermaking capacity will reach 300,000 tons per year. Jilin City will actively plan and focus on promoting the project of Hengyuan Paper to produce 100,000 tons of Class A high-strength base paper annually, encourage plastic product enterprises such as Chengfa Jisu Pipe Industry and Dacheng Guangsheng- 34 -Plastic Industry to vigorously develop new products such as building plastic products and automotive plastic products, strengthen the inheritance and innovation of craftsmanship, and promote the healthy development of characteristic arts and crafts industries such as Green Space and Yili Wula Grass, and promote wood-processing enterprises like Rongsheng Wood Industry to develop towards the high-end solid-wood furniture field to increase the added value of products.

In 2022, Jilin Jianlong Iron&Steel Co., Ltd. entered the silicon-steel track. It established a technology research and development center and hired several senior experts in the silicon-steel industry to form a scientific research team. Currently, it can produce 0.2mm high-end new-energy non-oriented silicon-steel products, which are top-level products in the market. Their various performance indexes are more excellent. Compared with ordinary silicon-steel products, the rolling cost of 0.2mm products is approximately 20% to 30% higher, but the benefits are greater, and the application fields are broader.

The upstream materials of the project can cooperate with regional raw-material enterprises to ensure the integrity of the industrial chain and the supply of raw materials.

(4) Talent advantage

Jilin City is home to several universities and colleges, including Northeast Electric Power University, Jilin Institute of Chemical Technology, Beihua University, Jilin Agricultural Science and Technology University, Jilin Medical University, Jilin Vocational and Technical College of Electronic Information, Jilin Vocational and Technical College of Industry, Jilin Railway Vocational and Technical College, and Jilin General Aviation Vocational and Technical College. These institutions provide a continuous stream of talent support for manufacturing enterprises.

Meanwhile, Jilin City has a large number of highly qualified industrial workers. A large group of such workers, after being trained by enterprises and public welfare institutions train them to supply more than 10,000 skilled talents to the society every year, and train more than 20,000 person-times of various types.

Jilin City has obvious advantages in labor resources. The proportion of skilled workers is at a relatively high level among the urban agglomerations in Northeast China. The labor force is in a dividend period, with relatively low labor costs. There is a large team of highly-qualified industrial workers, which can meet the needs of various enterprises.

(5) Location and transportation advantage

Jilin Longtan Economic Development Zone is located in the northwest of Jilin urban area. Longtan District borders Jiaohe City in the east, connects with Fengman District in the southeast, faces Changyi District across the river in the south and west, and adjoins Shulan City in the north. It is located in the middle of the Changchun-Jilin-Tumen Development and Opening Pilot Zone, within the radiation range of the Bohai-Rim Economic Circle, 100 kilometers away from the Changchun Economic Circle and the urban circle, with a total area of 1208.9k㎡. The Changchun-Hunchun Expressway has an entrance within the development zone. The development zone is 88 kilometers away from Changchun, 446 kilometers away from Shenyang, 861 kilometers away from Dalian Port, 20 kilometers away from Jilin Airport, 6.5 kilometers away from Jilin Railway Station, and 1.5 kilometers away from Jilin North Marshalling Station. In the southern area of the development zone, a road network with Hanyang South Street and Xuzhou West Road as the main thoroughfares has been built, and there are also railway special lines within the zone. The convenient transportation environment provides a strong guarantee for the smooth flow of passenger and freight traffic within the development zone.

1.2 Contents and scale of project construction

1.2.1 Construction scale

The project covers an area of 150,000㎡.

1.2.2 Construction contents

The project covers a total construction area of 160,000㎡, which needs to construct raw materials plant, production plant, assembly plant, design and R&D center, warehouse, office house, dormitory, and purchase relevant production equipment.

1.3 Total investment of the project and capital raising

1.3.1 Total investment of the project

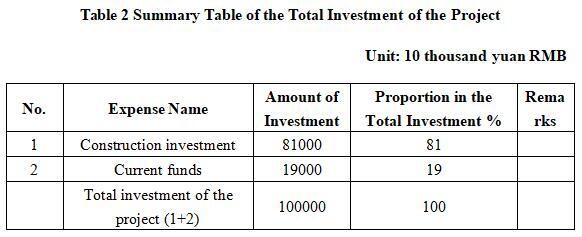

The total investment of the project is 1 billion yuan, including the construction investment 810 million yuan, and current funds 190 million yuan.

1.3.2 Capital raising

Self-raised by the enterprise.

1.4 Financial analysis and social evaluation

1.4.1 Main financial indexes

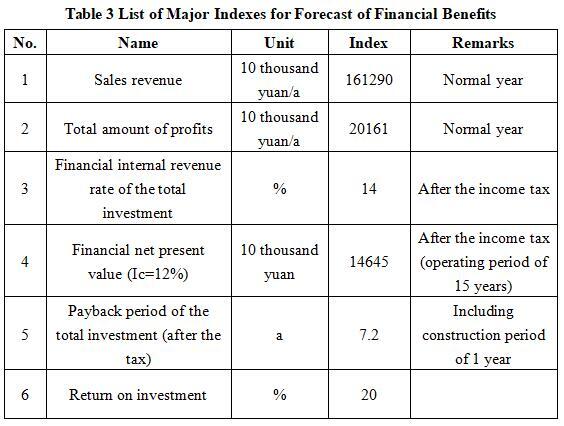

After the project reaches the production capacity, its annual sales income will be 1.6129 billion yuan, its profit will be 201.61 million yuan, its investment payback period will be 7.2 years (after the tax, including construction period of 1 year), and its return on investment will be 20%.

Note: “10 thousand yuan” in the table is in RMB.

1.4.2 Social evaluation

Jilin Jianlong has developed a relatively large production capacity for non-oriented silicon steel products. Extending downstream along the industrial chain based on these products can effectively address the intermediate transition links, directly provide supporting services for end-products, create a synergy effect, and is in line with the development direction of industrial agglomeration.

After the project is completed, application of products such as non-oriented silicon steel and galvanized steel produced by Jilin Jianlong as raw materials can extend the industrial chain, promote the effective utilization of resources, and facilitate industrial upgrading. The production of smart home appliance components requires advanced technological support and R&D capabilities. The construction of this project will also stimulate the scientific and technological innovation vitality of relevant enterprises in Jilin City and drive technological innovation.

1.5 Cooperative way

Joint venture, other methods can be discussed in person.

1.6 What to be invested by the foreign party

Capital, other methods can be discussed in person.

1.7 Construction site of the project

Jilin Longtan Economic Development Zone of Jilin Province.

1.8 Progress of the project

Foreign investment attraction.

2. Introduction to the Partner

2.1 Basic information

Name: Management Committee of Jilin Longtan Economic Development Zone

Address: Jilin Longtan Economic Development Zone

2.2 Overview

Longtan Economic Development Zone is located in the north of Jilin City, within the jurisdiction of Longtan District. It is an important supporting area for the Changchun-Jilin-Tumen Development and Opening-up Pilot Zone and the Changchun-Jilin Integration Strategy. In April 2020, with the approval of the provincial government, Longtan Economic Development Zone was designated as a provincial-level development zone. Its leading industries include metallurgy, chemical industry, new materials, and high-end equipment manufacturing. In 2023, the total industrial output value of enterprises above a designated size in the development zone reached 19.1 billion yuan.

2.3 Contact method

Postal code: 132000

Contact person: Yu Xueming

Tel: +86-13704316345

E-mail: 804196585@qq.com

Contact method of the city (prefecture) where the project is located:

Contact unit: Investment Promotion Service Center of Bureau of Commerce of Jilin City

Contact person: Jiang Yuxiu

Tel: +86-432-62049694

+86-15804325460