New Energy

Electric-Hydrogen-Methanol Integration Demonstration Project of Jilin City

1 Introduction to the Project

1.1 Project background

1.1.1 Product introduction

This project is an integrated project of electricity, hydrogen, and methanol. It adopts wind and solar power generation, green electricity to produce green hydrogen, green hydrogen to produce green ammonia, and uses carbon dioxide and hydrogen separated from recycled biomass boiler flue gas to produce green methanol. After completion, the wind power generation will be 800MW, the photovoltaic installed capacity will be 200MWp, and the energy storage will be 150MW/300MWh. It can produce 100,000 tons of hydrogen, 560,000 tons of synthetic ammonia, and 500,000 tons of green methanol annually.

1.1.2 Market prospect

(1) Current analysis of the new energy market

New energy mainly includes hydro-power, solar energy, wind energy, hydrogen energy, nuclear energy, biomass energy, geothermal energy, etc. According to data, the current global new energy market structure is mainly composed of solar energy and hydro-power. As of 2023, the cumulative installed capacity of solar power generation worldwide is 1.418 billion kilowatts, accounting for 33.31% of the cumulative installed capacity of various types of new energy generation worldwide and the largest share of global new energy generation. China's renewable energy development has continuously achieved new breakthroughs, with significant growth in installed capacity and power generation. By the end of 2023, the installed capacity of renewable energy will reach a new high of 1.45 billion kilowatts, accounting for more than half of the total installed capacity of power generation in China, which demonstrates the strong momentum and solid foundation of China's renewable energy and new energy development.

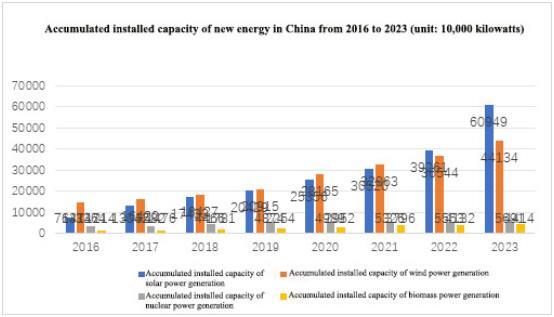

Accumulated installed capacity of wind power generation: In 2023, the installed capacity reached 441.34 million kilowatts, a year-on-year increase of 20.7%. The newly installed capacity was 79.37 million kilowatts, a year-on-year increase of 59.3%, reaching a historical high. Among them, onshore wind power added 72.19 million kilowatts and offshore wind power added 7.183 million kilowatts. The cumulative installed capacity of solar power generation reached 609.49 million kilowatts, a year-on-year increase of 55.2%. The newly added grid-connected solar power generation installed capacity exceeded 200 million kilowatts. The cumulative installed capacity of nuclear power generation was 56.91 million kilowatts, a year-on-year increase of 2.4%. Two new commercial nuclear power units have been added, five new nuclear power units have started construction, and 55 nuclear power units are currently in operation, with a total installed capacity of 57 gigawatts. The power generation reached 434.72 billion kilowatt hours, a year-on-year increase of 4.1%, accounting for nearly 5% of the country's cumulative power generation. Accumulated installed capacity of biomass power generation: The grid-connected installed capacity is about 44.14 million kilowatts, an increase of 2.82 million kilowatts from the previous year, and the on grid electricity in 2023 is about 166.7 billion kilowatt hours.

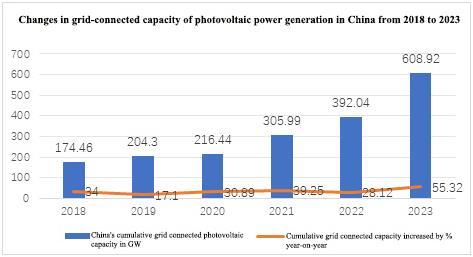

In recent years, China's photovoltaic power generation industry has been making rapid progress, with the scale of new grid-connected projects showing a multiple speed growth trend, and the industry presenting a diversified development trend. There are significant differences in the scale of new installed capacity among provinces, and centralized and distributed photovoltaic projects have their own characteristics in geographical distribution. Based on local regulations, combined with the natural conditions and electricity consumption characteristics of various regions in China, different types of photovoltaic projects shall be developed in a targeted manner. This will not only fully utilize the resources in the western region to develop large-scale photovoltaic bases, but also promote distributed applications in electricity load centers, and thus jointly promote the rapid development of the photovoltaic industry.

The newly added grid-connected capacity of photovoltaic projects in China has significantly increased. From 2018 to 2023, the cumulative grid-connected capacity of photovoltaic power generation in China has maintained a growth trend. In 2023, the cumulative grid-connected capacity of photovoltaic power generation in China reached 608.92GW, and the newly added grid-connected capacity reached 216.88GW, with a year-on-year growth rate exceeding 100% for the first time, reaching as high as 147.45%.

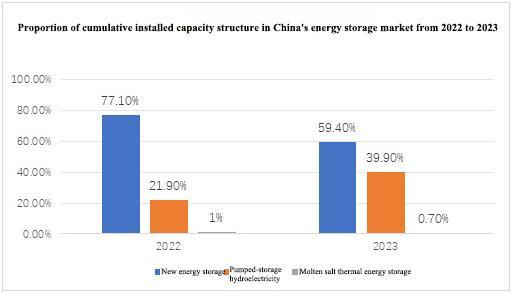

The proportion of the new energy industry in China's energy structure is constantly increasing. As a key link in the new energy industry chain, new energy storage technologies are playing an increasingly important role, not only enhancing the stability and flexibility of the energy system, but also promoting the innovative development of the entire new energy industry. In 2023, China's new energy storage technology will show a trend of large-scale and diversified development, providing strong support for the continuous expansion of the new energy industry.

The new energy storage market in China is developing rapidly, with optimized and upgraded technological structures. In 2023, the cumulative installed power of energy storage in China is about 83.7GW, with over 30 million kilowatts of installed capacity already in operation. Among them, the new energy storage contributes the most (accounting for 59.4%), with a cumulative installed power of about 32.2GW, a year-on-year increase of 196.5%. Pumped-storage hydroelectricity accounts for 39.9% of the total installed capacity of energy storage, with a cumulative installed power of approximately 50.6 GW, a year-on-year increase of 10.6%.

China's new energy is mainly concentrated in the "three north" regions (Northwest China, North China, and Northeast China), while electricity demand is concentrated in the central and eastern parts. It is necessary to enhance cross regional transmission capacity, especially ultra-high voltage technology, to achieve effective power transmission. In 2024, State Grid Corporation of China (SGCC) proposed that the investment scale is expected to exceed 500 billion yuan. With technological progress and policy support, the new energy industry will continue to develop positively.

With the increasingly booming energy storage market, the country strongly supports high-capacity new energy storage projects. Large scale deployment is a necessary path for flexible electrochemical energy storage technology to play a leading role in the power system. Under the same scale, the large capacity of energy storage devices can reduce the number of individual cells used, lower the difficulty of achieving uniform balance among individual cells, and thus reduce the probability of thermal runaway or even fire in batteries.

(2) Hydrogen energy market demand

Hydrogen, as one of the most important elements on earth, mainly exists in its chemical form. Its elemental form, hydrogen, is a clean and efficient energy carrier. In recent years, with the increasing global demand for clean energy, hydrogen and its related technologies have received widespread attention. Especially in the context of carbon peaking and carbon neutrality, hydrogen, as a secondary clean energy source, is regarded as the "ultimate energy of the 21st century".

In recent years, China's hydrogen energy industry has received high attention from governments at all levels and key support from national industrial policies. According to statistics, in 2024, a total of 22 provincial-level administrative regions in China will include hydrogen energy in their government work reports, and each region will actively develop hydrogen energy from different focuses. Since 2024, China has issued a large number of policies at the national level in the hydrogen energy industry, covering industry standard setting, technology research and development, equipment promotion, urban public transportation updates, hydrogen energy transportation, and other aspects, aiming to promote the healthy, orderly, and sustainable development of the hydrogen energy industry.

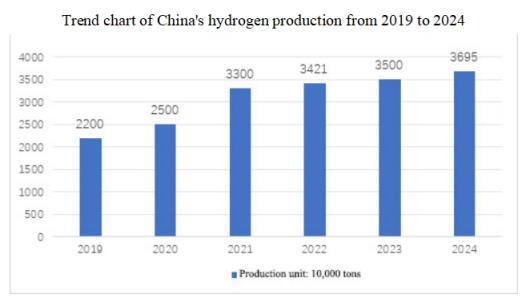

Under the dual promotion of policies and markets, China has become the world's largest hydrogen producing country. As of the end of 2023, the national hydrogen production capacity is about 49 million tons per year, with a production of about 35 million tons, an increase of about 2.3% year-on-year. China's hydrogen production will reach 36.95 million tons by 2024.

Under the goal of carbon neutrality, by 2060, China's annual demand for hydrogen will increase to around 130 million tons, accounting for about 20% of terminal energy consumption. Among them, hydrogen consumption in the industrial sector still accounts for the largest proportion, accounting for 60% of the total demand.

(3) Market demand for synthetic ammonia

The ammonia chemical industry in China has gone through a period of introduction and development, and is currently in a mature stage. Since 2015, it has entered a stage of industrial restructuring, and the production of liquid ammonia has shown a trend of first increasing, then decreasing, and then increasing again. In 2022, China's synthetic ammonia production was 53.2101 million tons, and by 2023, the production of China's synthetic ammonia industry will reach 54.8936 million tons.

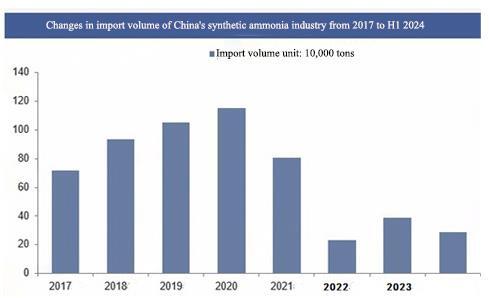

The import volume of China's synthetic ammonia industry has shown a downward trend in recent years. In the first quarter of 2022, the total import volume of synthetic ammonia decreased significantly to 79,600 tons, a decrease of 77.55% compared to the same period last year. In 2023, the import volume will further decrease, with a total import volume of 41,200 tons in December, a year-on-year increase of 170.75%, but a decrease compared to the previous month. In May 2024, the import volume of synthetic ammonia was 52,600 tons, a year-on-year decrease of 48.69%, while the cumulative import volume from January to May was 258,700 tons, a year-on-year decrease of 18.25%.

The apparent consumption of synthetic ammonia in China has shown a trend of increasing year by year in recent years, mainly due to the widespread application of synthetic ammonia in agriculture (nitrogen fertilizers such as urea) and industry (environmental protection fields such as automotive urea and power plant desulfurization and denitrification), as well as the continuous expansion of domestic synthetic ammonia production capacity and the gradual growth of market demand.

It is expected that by 2025, the world's consumption of synthetic ammonia will reach about 199.55 million tons, an increase of 26 million tons from 2020. With the growth of industrial demand in China, the consumption of synthetic ammonia will return to growth, and the consumption in 2025 will increase by more than 6 million tons from 2020. Central and South America has the fastest growth rate, reaching 11.5%, while Mexico, other regions in Northeast Asia (excluding China and Japan), and Canada all enjoy growth rates exceeding 5.0%.

From the perspective of macro industrial policies, the construction of nitrogen fertilizers using oil and natural gas as raw materials, the use of fixed inter-layer gasification technology to synthesize ammonia, and the copper washing method for ammonia synthesis raw gas purification process are classified as restricted. The natural gas atmospheric pressure intermittent conversion process for synthesizing ammonia has been included in the phased out category. Other synthetic ammonia is allowed. However, in some provinces such as Inner Mongolia, Jiangxi, Henan, and Shandong, policies have been clearly issued to restrict the production capacity of synthetic ammonia or nitrogen fertilizer, and no new capacity will be added. Many other provinces also have strict control over the approval of synthetic ammonia production capacity. Under strict industrial policy restrictions, green ammonia has become the new market favorite. At present, the production capacity of green ammonia has exceeded 3.29 million tons according to statistics.

The characteristics of ammonia are suitable for storing and transporting hydrogen. Ammonia is easier to liquefy than hydrogen. Under normal pressure, ammonia can liquefy at -33℃, while hydrogen needs to be below -253℃, and the same volume of liquid ammonia contains at least 60% more hydrogen than liquid hydrogen. The storage and transportation infrastructure for ammonia is well-developed. There are various transportation methods for ammonia, such as pipelines and ships. Among them, the cost of transporting one kilogram of hydrogen by sea through liquid ammonia is 0.1-0.2 US dollars, which is lower than the hydrogen transportation channels through pipelines and ships. Hydrogen, as a clean energy source, has great potential for development, and ammonia, as a hydrogen carrier, has a promising future. Among the currently highly regarded zero carbon energy sources, green ammonia powered ships have significantly higher energy density than hydrogen, and can utilize existing ammonia supply chains and infrastructure, making them promising for promotion and application in the field of long-distance shipping for large vessels such as container ships. According to the prediction of Lloyd's Register (LR), the proportion of ammonia as a shipping fuel will increase from 7% to 20% between 2030 and 2050, taking the place of liquefied natural gas and other fuels as the main shipping fuel; Followed by the hydrogen energy, which is expected to increase from 8% in 2030 to 19%, on par with the importance of ammonia energy.

On the one hand, green ammonia can serve as a carrier for green hydrogen, solving the problem of hydrogen storage and transportation; On the other hand, green ammonia can also be directly applied to fuel cells or used as fuel for combustion. In February 2022, the National Energy Administration (NEA) proposed the development of ammonia energy storage technology in the "14th Five Year Plan" for the Implementation of New Energy Storage Development; In August, the Ministry of Industry and Information Technology (MIIT) proposed the concept of ammonia fuel in the Implementation Plan for Carbon Peaking in the Industrial Sector. Chinese and foreign enterprises and research institutions are actively exploring the use of ammonia as high-temperature kiln fuel, ammonia combustion power generation, ammonia fuel ships, ammonia fuel cells, etc. The green ammonia industry will experience vigorous development.

(4) Current green methanol market

As of June 27, 2024, there are a total of 102 green methanol projects planned globally, with a total planned production capacity of approximately 13.27 million tons per year. Most projects are still in the research and planning stage, with 11 projects in operation, 5 projects under construction, 13 projects in planning, and 73 projects in the announcement or feasibility stage. From a national distribution perspective, Spain, Denmark, and the United States are the three countries with the highest number of green methanol projects, with 13, 10, and 10 projects respectively. In terms of technical route, the electric methanol project dominates, followed by the biomass methanol project.

China is the world's largest consumer and producer of methanol, with a total methanol production capacity of 105 million tons in 2023, accounting for nearly 60% of the global total. Despite China's vast industrial system and huge domestic demand for methanol, it still relies on imports, with an estimated import volume of 14.55 million tons in 2023. Under the promotion of the Carbon Peak and Carbon Neutrality Goals, China's green and low-carbon methanol projects have made rapid progress. As of the end of August 2024, China has accumulated over 90 green and low-carbon methanol projects, with a planned production capacity of over 24 million tons and a total investment of nearly 430 billion yuan. The projects that have already started are mainly small and medium-sized, mainly concentrated in the Northeast and Inner Mongolia regions, with wind power or wind/solar integration becoming the main source of electricity.

Green methanol, as a low-carbon fuel, has great potential in fields such as automotive fuel, fuel cells, marine fuel, and organic additives. The International Maritime Organization has adopted relevant emission reduction strategies to promote the application of green methanol in ship fuel. In addition, the production cost of green methanol is gradually decreasing, and with the reduction of green electricity costs and the expansion of production scale, its economy will be further improved.

1.1.3 Technical analysis

This analysis is not limited to current technology. If the resident enterprise has innovative technology, the resident enterprise's technology will be used. This technical analysis is only for reference.

(1) Hydrogen production technology: The operating current density of PEM electrolysis cells is usually higher than 1A/cm2, which is at least four times higher than that of alkaline water electrolysis cells. It has the advantages of high efficiency, high gas purity, green environmental protection, low energy consumption, no alkali solution, small volume, safety and reliability, and can achieve higher gas production pressure.

(2) Methanol production technology: The project plans to select the copper series catalyst based carbon dioxide hydrogenation to methanol technology from Southwest Chemical Research and Design Institute (SCDRI). The "low-energy two-stage carbon dioxide hydrogenation to methanol technology" of SCDRI has successfully passed the scientific and technological achievement evaluation organized by the China Petroleum and Chemical Industry Federation (CPCC). The overall technology of this achievement is at the international advanced level, and the catalyst performance has reached the international leading level.

1.1.4 Advantageous conditions of project construction

(1) Policy advantageous

In 2024, the NEA issued the Guiding Opinions on Energy Work in 2024, which proposed to deepen the implementation of the Carbon Peak and Carbon Neutrality Goals tasks, vigorously promote the high-quality development of non-fossil energy, consolidate and expand the good development trend of wind, electricity, and solar power, steadily promote the development and construction of hydro-power and nuclear power, continuously improve the policy system for green and low-carbon transformation, accelerate the cultivation of new energy business models, and continuously promote the replacement of clean energy in key areas. The cultivation of new forms and models of energy industry shall be accelerated and the tracking and evaluation of new energy storage pilot demonstrations shall be strengthened to promote the progress of the new energy storage technology industry. Relevant policies shall be formulated to accelerate the high-quality development of the hydrogen energy industry, orderly promote hydrogen energy technology innovation and industrial development, steadily carry out hydrogen energy pilot demonstrations, focus on developing renewable energy hydrogen production, and expand hydrogen energy application scenarios. Low-carbon and zero-carbon transformation is promoted in industrial parks where conditions permit, and green and efficient energy supply and consumption models such as comprehensive energy stations and integrated source grid load storage are promoted. Demonstration projects such as new energy microgrids, microgrids, and high proportion of new energy applications for supply and demand are explored and implemented according to local conditions.

In the Implementation Plan for Promoting High Quality Development of New Energy in the New Era issued by the National Development and Reform Commission and the National Energy Administration in 2022, it is mentioned that in eligible industrial enterprises and industrial parks, efforts shall be made to accelerate the development of new energy projects such as distributed photovoltaic projects and decentralized wind power, support the construction of industrial green micro-grids and integrated projects of source grid-load storage, promote the efficient utilization of multiple energy sources, carry out pilot projects for direct power supply of new energy, and increase the proportion of new energy electricity for terminal energy consumption. The deep integration and development of solar energy and architecture shall be promoted. The integrated application technology system of photovoltaic buildings shall be improved, and the consumer group of photovoltaic power production shall be strengthened. Breakthroughs in key technologies such as efficient solar cells and advanced wind power equipment shall be promoted, and the upgrading of key basic materials, equipment, components, and other technologies shall be accelerated. The development of retired wind turbines, photovoltaic module recycling and processing technologies, and related new industrial chains shall be promoted to achieve closed-loop green development throughout the entire life cycle.

The “14th Five Year” Plan for Industrial Development in Jilin Province clearly states that the development of hydrogen energy equipment and hydrogen fuel cells will be promoted around the entire hydrogen production, storage, transportation, refueling, and utilization chain. The research and development of intelligent heat exchange units and new high-efficiency energy-saving heat exchangers shall be supported. The development of environmental protection equipment such as air pollution control, water pollution control, and solid waste treatment shall be accelerated. Suppliers of new energy system solutions should be cultivated to establish new energy equipment research and development manufacturing bases.

The "Hydrogen Powered Jilin" Medium and Long Term Development Plan (2021-2035) proposes to make the hydrogen energy industry a key focus for cultivating and developing strategic emerging industries. Based on the chemical industry in Jilin City, Baicheng City, and Songyuan City, demonstrations of "Green Jilin Chemical" (hydrogen based chemical) projects shall be carried out to build diversified hydrogen source supply and carbon fiber material industry auxiliary systems, and expand the business scope of the chemical industry.

The Investment Promotion Policy of Jilin City clearly states that the investment projects of Jilin City's Industrial Investment Guidance Fund shall comply with national and relevant industrial policies and development plans, with a focus on investing in tourism, medicine and health, aviation, information technology, new materials, advanced equipment manufacturing, biotechnology, energy conservation and environmental protection, new energy, cultural creativity, modern agriculture, modern service industry and other related industries in Jilin City's "6411" industrial plan, as well as other areas supported by the municipal government for development. Guiding funds can adopt investment methods such as follow-up investment and direct investment, in addition to setting up sub funds through equity participation; Newly introduced investment projects that meet the conditions shall enjoy tax reductions and exemptions in accordance with the current national and provincial tax policies. For projects with a significant contribution rate in Jilin City, in accordance with the spirit of the Notice of the State Council on Relevant Matters Concerning Tax Preferential Policies (Guofa [2015] No. 25), relevant departments shall assist enterprises in applying for tax exemptions and reductions in accordance with the law and regulations; Special funds for the development of industrial enterprises shall be established to encourage the introduction of major projects in traditional industries such as chemical, automotive, metallurgical, and agricultural product processing in the "6411" industrial system that comply with national industrial policies, have strong industrial support, and have significant driving effects; The introduction of emerging industries such as medicine and health, new materials, advanced equipment manufacturing, and electronic information shall be encouraged. Such projects shall be given priority in the allocation of production factors and national and provincial special funds for support.

(2) Resource advantageous

Jilin City has great potential for the development of resources such as hydro-power, wind energy, solar energy, biomass energy, and oil shale. Jilin City has developed water systems and abundant hydro-power resources, consisting of some sections and tributaries of the Songhua River, Lalin River, and Mudanjiang River systems. The annual available water resources are 17 billion cubic meters, and the per capita water resources are 1.8 times the national average and 5.4 times that of northern cities. It can fully develop hydro-power projects and has the conditions to build large-scale pumped storage power stations. The equivalent full load on-grid hours of wind power in various regions mainly range from 2,000 hours to 3 300 hours. Jilin City is located in the central part of Jilin Province, with a total solar radiation of 4,800-5,000 megajoules per square meter, and the radiation levels in various regions of the city are basically the same. The annual sunshine distribution is basically consistent with the distribution of solar radiation, with an average annual power generation hours of 1,320 hours. Jilin City is an important grain production base in the province, with abundant resources of crop straw and forestry processing residues, and superior conditions for biomass energy utilization. Among them, the annual output of agricultural straw resources is 6.53 million tons, and the annual output of forestry resources is 1.5 million tons, both of which can be used for the development of biomass energy. The Songhua River Basin has abundant water resources and stable regional seismic and engineering geological conditions, providing favorable conditions for the development of nuclear energy. In the early stage, nuclear power project sites have been selected in Liangjiashan Mountain of Shulan City, Songjiang Town of Jiaohe City, and Dianjiangtai Site of Huadian City, and research has been conducted on promoting nuclear heating small reactor projects, which has a certain foundation for the development of nuclear energy resources.

The installed capacity of power sources in the city is 6.721 million kilowatts, with an additional 3.279 million kilowatts added during the 14th Five Year Plan period, an average annual growth rate of 8.3%. Among them, coal-fired power generation of 3.07 million kilowatts, accounting for 30.7%; Gas power generation of 860,000 kilowatts, accounting for 8.6%; Wind power of 1.54 million kilowatts, accounting for 15.4%; Photovoltaic power generation of 700,000 kilowatts, accounting for 7%; Hydro-power of 3.5 million kilowatts (3.2 million kilowatts of conventional hydro-power and 0.3 million kilowatts of pumped storage), accounting for 35%; Biomass power generation of 0.27 million kilowatts, accounting for 2.7%; Waste energy generation of 58,000 kilowatts, accounting for 0.6%; The installed capacity of new and renewable energy accounts for 60.7% of the total installed capacity. It is expected that by 2025, the power generation will reach 20.63 billion kilowatt hours, and the total transformer capacity of urban and rural power grids will reach 4891.1 megavolt amperes.

Longtan Economic Development Zone is located in the northern part of Jilin City. The planned area of Longtan Economic Development Zone is 16.66 square kilometers, with a large stock of available land resources for development. The newly added and reserved land can meet the needs of new projects, and the land price is at a low level among 41 cities in Northeast China.

(3) Industrial advantageous

Longtan District has a strong industrial foundation. The first barrel of dye, the first bag of fertilizer, and the first furnace of calcium carbide in New China were born here. It is the cradle of New China's chemical industry and the eldest son of the Republic's chemical industry. It is one of the old industrial bases that was key to national construction during the "First Five Year Plan" period of New China and one of the largest chemical raw material production bases in the country. It is also the Changchun-Jilin-Tumen Industrial Zone of China's chemical industry, a national demonstration base for new industrialization industry, a national carbon fiber high-tech industrialization base, and the largest ABS production base in northern China. There are 25 sets of chemical production facilities ranking among the top three in China, including methyl methacrylate, acrylonitrile, ABS, styrene, styrene butadiene rubber, etc. 13 sets of chemical production facilities have the highest production capacity in the country, with an annual crude oil processing capacity of 10 million tons and an ethylene production capacity of 850,000 tons.

Jilin Chemical Industry Circular Economy Demonstration Park and Longtan Economic Development Zone are home to several large industrial enterprises, including China Petroleum Jilin Petrochemical Company, Jilin Jianlong Iron and Steel Co., Ltd., Jilin Jiangbei Machinery Manufacturing Co., Ltd., Jilin Chenming Paper Industry Co., Ltd., and 73 large-scale or above industrial enterprises, forming two dominant industrial clusters with strong competitiveness in chemical and metallurgical industries. The industrial output value accounts for more than half of the city's total, and the position of the industrial core area is increasingly prominent.

(4) Talent advantageous

There are 5 undergraduate colleges and 6 chemical research and design units in Longtan District, among which Jilin Petrochemical Research Institute and Jilin Petrochemical Design Institute of Petro China Jilin Petrochemical Company are at an advanced level in the field of chemical research and design in China. These colleges provide a continuous supply of talent support for production enterprises.

At the same time, Jilin City has a large number of high-quality industrial and chemical workers. After training by enterprises and public welfare institutions, more than 10,000 skilled talents are sent to the society every year, and more than 20,000 people of various types are trained for the society. The advantage of labor resources is obvious, and the proportion of skilled workers is at a high level in the Northeast urban agglomeration. The labor force is in a dividend period, and the labor cost is relatively low. There is a large number of high-quality industrial workers who can meet the needs of various enterprises.

(5) Location and transportation advantageous

Longtan District is a leading pilot for the development and opening up of Changchun-Jilin-Tumen area, and an important support area for the integration strategy of Changchun-Jilin-Tumen area. In April 2020, with the approval of the provincial government, Longtan Economic Development Zone was designated as a provincial-level development zone. Jilin Longtan Economic Development Zone is located in the northwest of Jilin City, bordering Jiaohe City to the east, Fengman District to the southeast, Changyi District across the river to the south and west, and Shulan City to the north. It is situated in the middle of the Changchun-Jilin-Tumen Development and Opening Pilot Zone, within the radiation range of the Bohai Sea Economic Circle, and is no more than 100 kilometers away from the Changchun Economic Circle and Urban Circle. Longtan District covers an area of 1208.9 square kilometers. The Changchun-Hunchun Expressway has an entrance within the development zone. The development zone is 88 kilometers from Changchun City, 446 kilometers from Shenyang City, 861 kilometers from Dalian Port, 20 kilometers from Jilin Airport, 6.5 kilometers from Jilin Railway Station, and 1.5 kilometers from the Marshalling Yard Jilin North Station. The southern area of the development zone has built a highway network with Hanyang South Street and Xuzhou West Road as the main roads, and there is a dedicated railway line in the area. The convenient transportation environment provides strong support for the smooth flow of passenger and logistics within the development zone.

1.2 Contents and scale of project construction

1.2.1 Scale of project construction

The project covers an area of 700,000 square meters. After completion, the wind power generation capacity will be 800MW, the photovoltaic installed capacity will be 200MWp, and the energy storage capacity will be 150MW/300MWh. It can produce 100,000 tons of hydrogen, 560,000 tons of synthetic ammonia, and 500,000 tons of green methanol annually.

1.2.2 Contents of project construction

The total construction area of the project is 710,000 square meters, mainly consisting of 800MW wind power projects (including booster stations and overhead lines), 200MWp photovoltaic projects, and 150MW/300MWh energy storage projects; The green hydrogen production center mainly constructs 50 sets of 1,000Nm3/h alkaline electrolysis hydrogen production units, 100 sets of 200Nm3/h water electrolysis (PEM) hydrogen production units, 10,000 ton spherical tank hydrogen storage units, and corresponding supporting projects; The synthetic ammonia area only needs to be equipped with synthetic ammonia units, air separation units, biomass boilers, ammonia storage, and liquefied gas tank areas; The green methanol production center mainly constructs gasification+POX, cooling, desulfurization, synthesis gas compression, methanol synthesis, methanol distillation, waste gas incineration and corresponding supporting projects.

1.3 Total investment of the project and capital raising

1.3.1 Total investment of the project

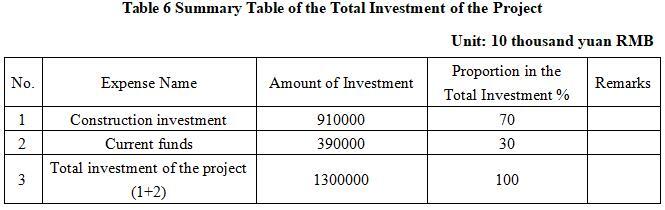

The total investment of the project is 13 billion yuan, including the construction investment of 9.1 billion yuan and working capital of 3.9 billion yuan.

1.3.2 Fundraising

Fundraising by enterprises independently.

1.4 Financial analysis and social evaluation

1.4.1 Main financial indexes

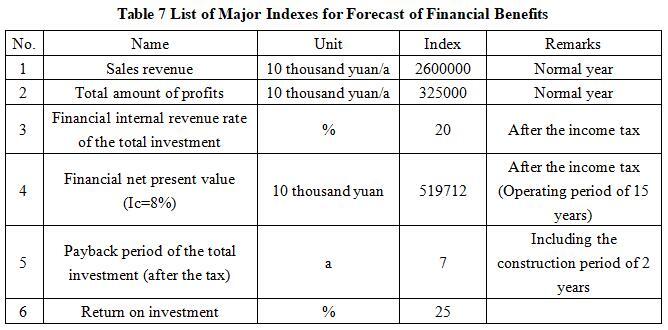

After the project reaches the production capacity, its annual sales income will be 26 billion yuan, its profit will be 3.25 billion yuan, its investment payback period will be 7 years (after the tax, including the construction period of 2 years) and its investment profit rate will be 25%.

Note: “10 thousand yuan” in the table is in RMB.

1.4.2 Social evaluation

This project is the first integrated Electric-Hydrogen-Methanol project in Jilin City, and it has certain guiding significance for the construction of future projects in Jilin City.

This project utilizes wind and solar power generation, advanced PEM hydrogen production, and alkaline electrolysis water technology to produce green hydrogen and green ammonia on a large scale, and further convert them into methanol products, which helps accelerate the achievement of China's Carbon Peak and Carbon Neutrality Goals. In this process, green hydrogen, as a carrier of clean energy, can replace traditional fossil fuels, thereby improving China's energy situation dominated by coal and high dependence on crude oil and natural gas. The construction of the integrated demonstration project of Electric-Hydrogen-Methanol will promote innovation and upgrading of related technologies. By adopting multiple leading technologies, such as integrated matching technology of wind-solar-hydrogen-ammonia-methanol and multi stable state flexible synthesis ammonia technology, it will promote the technological progress and industrial upgrading of the hydrogen energy industry. At the same time, the implementation of this project will also create a first mover advantage for the large-scale development of hydrogen equipment manufacturing industry, providing strong support for the rapid development of China's hydrogen energy industry.

1.5 Cooperative way

Joint venture, other methods can be discussed offline.

1.6 What to be invested by the foreign party

Funds, other methods can be discussed offline.

1.7 Construction site of the project

Longtan Economic Development Zone, Jilin City, Jilin Province.

1.8 Progress of the project

This project is in the stage of external investment promotion.

2. Introduction to the Partner

2.1 Basic information

Name: Jilin City Longtan Economic Development Zone Management Committee

Address: Longtan Economic Development Zone, Jilin City, Jilin Province.

2.2 Overview

Longtan Economic Development Zone is located in the northern part of Jilin City, within the boundaries of Longtan District. It is a leading pilot for the development and opening up of Changchun-Jilin-Tumen area, and an important support area for the integration strategy of Changchun-Jilin-Tumen area. The main industries are metallurgy, chemical engineering, new materials, and high-end equipment manufacturing. In 2023, the total industrial output value of the development zone will reach 19.1 billion yuan.

2.3 Contact method

Postal code: 132000

Contact person: Yu Xueming

Tel: +86-13704316345

E-mail: 804196585@qq.com

Contact method of the city (prefecture) where the project is located:

Contact unit: Investment Promotion Service Center of Jilin Municipal Bureau of Commerce

Contact person: Jiang Yuxiu

Tel: +86-432-62049694

+86-15804325460

E-mail: jlstzcjfwzx@163.com