New Energy

Power Battery Recycling Project of Meihekou City

1 Introduction to the Project

1.1 Project background

1.1.1 Product introduction

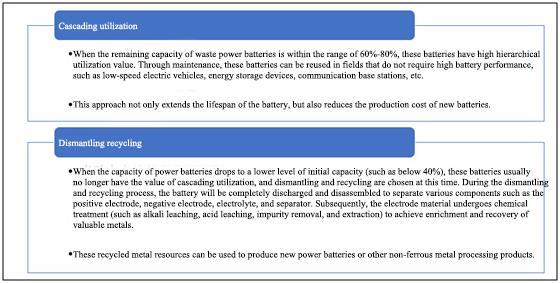

Power battery recycling refers to the process of collecting and reusing used and discarded power batteries. At present, there are two main ways to recycle power batteries: Cascading utilization and dismantling recycling.

Figure 1 Recycling methods for power batteries

The project construction site is located in Meihekou City, and after completion, it can form an annual recycling capacity of 100000 tons of lead-acid batteries and 10000 tons of lithium batteries.

1.1.2 Market prospect

(1) Recycling capacity of power batteries

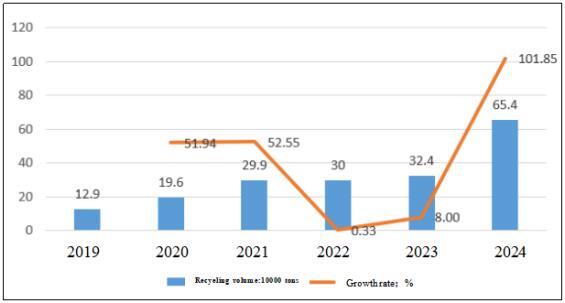

With the centralized retirement of power batteries, China's power battery recycling industry has entered a period of development. Data shows that from 2019 to 2022, the actual recycling volume of power batteries in China increased from 129000 tons to 300000 tons, and reached 324000 tons in 2023. The actual recycling amount of power batteries in 2024 is 654000 tons.

Figure 2 Trend of China's power battery recycling volume from 2019 to 2024

(2) Comprehensive utilization of waste power batteries

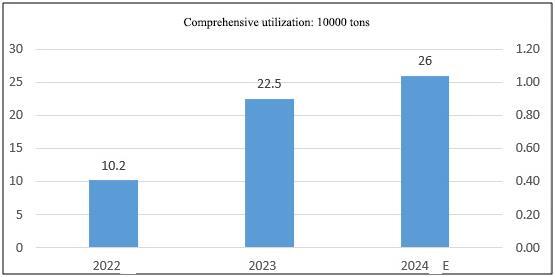

The comprehensive utilization of waste power batteries for new energy vehicles in 2023 has reached 225000 tons, a year-on-year increase of 121%. According to relevant data from the MIIT, it is proposed that the comprehensive utilization of waste power batteries will exceed 300000 tons by 2024, with a year-on-year growth of 33%.

Figure 3 Comprehensive utilization of waste power batteries from new energy vehicles from 2022 to 2024

(3) Market size of power battery recycling

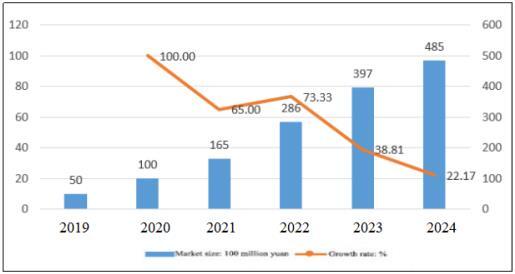

Data shows that the market size of China's power battery recycling in 2023 is 39.7 billion yuan. Power batteries generally have a lifespan of 5-8 years. Based on the second cycle from 2020 to 2022, it is expected that a new wave of power battery retirement will occur around 2025. At the same time, coupled with the recent "trade in" subsidy policy launched by the State Council, the power battery recycling industry is expected to face huge demand. The size of China's power battery recycling market exceeded 48 billion yuan by 2024.

Figure 4 Market scale of china's power battery recycling market from 2019 to 2024

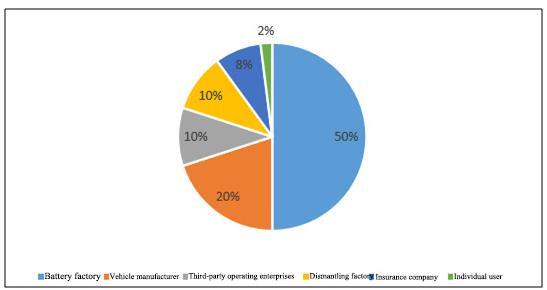

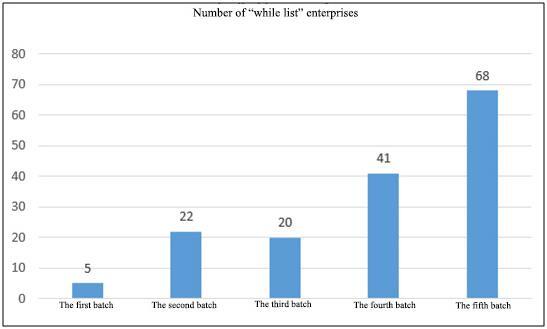

(4) Power battery recycling channel

At present, China has not yet established a unified national recycling channel, and most enterprises are still in the stage of seizing the market. Therefore, there are many and chaotic channels for recycling power batteries. The main channels for recycling power batteries include battery factories, vehicle manufacturers, third-party operating enterprises, dismantling factories, insurance companies, and individual users. Among them, battery factory channels account for 50%, and vehicle enterprises account for 20%.

Figure 5 Proportion of recycling channels for power batteries in China

Figure 6 Key enterprises in power battery recycling channels

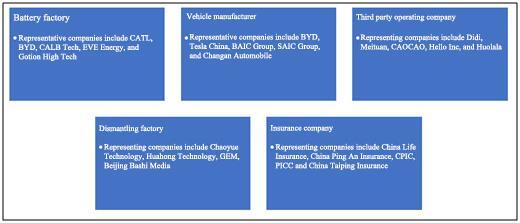

(5) Power battery recycling service outlets

There are a total of 15446 new energy vehicle power battery recycling service outlets recognized by the MIIT, and a preliminary battery recycling and utilization system has been established. From a regional distribution perspective, recycling service outlets are mainly concentrated in the eastern region. There are over 1000 recycling service outlets in Guangdong Province, Jiangsu Province, Shandong Province, and Zhejiang Province, with 1547, 1141, 1138, and 1078 respectively, accounting for 10.0%, 7.4%, 7.4%, and 7.0% of the total. Henan Province, Hebei Province, Sichuan Province, Hunan Province, Fujian Province, and Hubei Province have entered the top ten, ranking 5-10 in order.

Figure 7 Top 10 provinces and cities in China for the distribution of power battery recycling service outlets for new energy vehicles

The recycling service outlets for new energy vehicle power batteries are divided into 3 categories: Official recycling channels of automobile enterprises, specialized dismantling companies under automobile enterprises, and new energy enterprises with various qualifications such as Renewable Resource Operation License and Dangerous Goods Road Transport License.

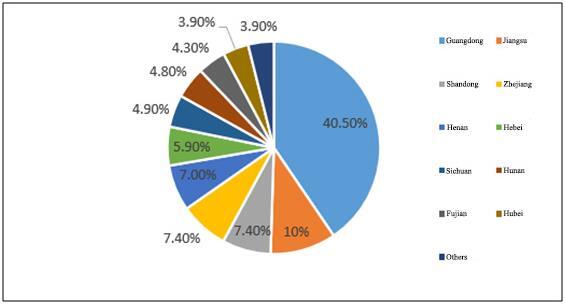

(6) Numbers of power battery recycling enterprises

In order to standardize the development of the industry, in 2018, the MIIT released the first batch of enterprises that meet the Industry Standard Conditions for Comprehensive Utilization of Waste Power Batteries for New Energy Vehicles (hereinafter referred to as the "White List"). As of now, five batches of enterprise "White Lists" have been released, totaling 156 companies, which are considered as the "regular army" of battery recycling. Among them, there are 96 enterprises in the direction of hierarchical utilization and 60 enterprises in the direction of recycling, with only 12 enterprises having both qualifications for hierarchical utilization and recycling. From this, it can be seen that among the large number of about 120000 enterprises, a small number of enterprises have recycling qualifications, and most of them still exist in the form of "small workshops".

Figure 8 Statistics of the numbers of enterprises on the "white list" for comprehensive utilization of waste batteries in China

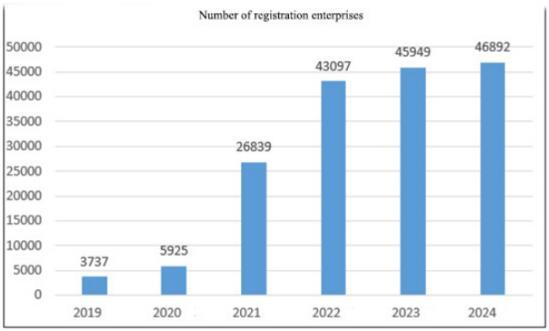

The market size of over 100 billion has attracted tens of thousands of enterprises to enter one after another. Since 2021, there has been a significant increase in the registration of power battery related enterprises, with 46000 registered in 2023 and 46900 registered in 2024.

Figure 9 Registration of power battery recycling related enterprises in China from 2019 to 2024

(7) Development prospects forecast of the power battery recycling industry

The new energy vehicle industry is experiencing explosive growth. In 2023, the production and sales of new energy vehicles reached 9.587 million and 9.495 million respectively, an increase of 35.8% and 37.9% year-on-year, with a market share of 31.6%. The popularization of new energy vehicles not only drives the expansion of the power battery market, but also provides a rich source of raw materials for the power battery recycling industry. In the next few years, a large number of power batteries will face retirement, which brings huge market potential to the recycling industry.

The emergence of new technologies and processes has made the recycling process more efficient and environmentally friendly. For example, some companies have developed advanced technologies such as automated dismantling, rapid sorting and grouping, remaining life assessment, and comprehensive recycling of valuable components, greatly improving recycling efficiency and resource utilization. In addition, the application of intelligent and digital technologies also provides strong support for the digitization and information management of the power battery recycling industry.

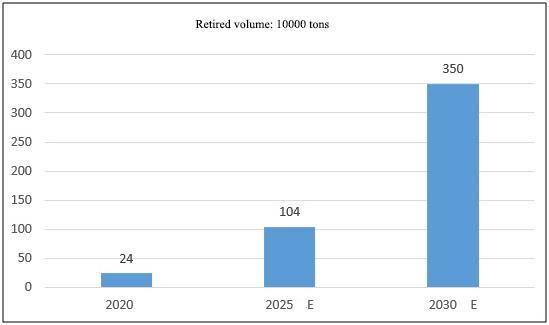

With the rapid development of China's new energy vehicle industry, the retirement amount of power batteries will also increase year by year. Data shows that in 2020, a total of 240000 tons of retired power batteries were produced nationwide. It is predicted that China's retired power batteries will reach 1.04 million tons by 2025 and 3.5 million tons by 2030.

Figure 10 Prediction of retired power batteries in China from 2020 to 2030

The retirement volume of power batteries is increasing year by year, and the demand for power battery recycling services in the market is also continuing to grow. Power battery recycling enterprises can not only obtain valuable metal resources by recycling waste batteries, but also obtain certain economic benefits by providing recycling services. Therefore, the continuous growth of market demand provides broad space for the development of the power battery recycling industry.

1.1.3 Technical analysis

The recycling and reuse of lithium batteries refers to the dismantling of retired lithium batteries through chemical, physical, biological, and other means to achieve the goal of recovering metal elements such as Ni, Co, Mn, Li, and other recyclable materials. At present, the main methods for recycling and reusing lithium batteries include hydro recycling, pyrometallurgical recycling, and biological recycling.

Hydro recycling refers to the selective dissolution of metals in electrode materials using chemical reagents, followed by the separation and leaching of metal elements from the liquid. This technology has the advantages of high recovery rate, high product purity, and low energy consumption, and is currently the most widely used recycling technology.

Pyrometallurgical recycling refers to the process of removing impurities from waste batteries through high-temperature means, ultimately extracting fine powder materials containing metals and their compounds. This technology has a simple operation process. Because of the high efficiency, it is suitable for handling large quantities or complex structures of batteries.

Biological recycling refers to the selective leaching of metal elements from waste batteries using metabolic processes such as microorganisms, in order to extract high-value metal elements. This technology is environmentally friendly, but it is still in the research and development stage and the technology is not yet mature.

This project adopts hydro recycling method to recycle retired batteries. At the same time, a comprehensive recycling system will be established to ensure that waste power batteries can be properly disposed of; Professional tools and equipment will be used during disassembly, crushing, and sorting processes to avoid environmental pollution; The generated waste will be classified, disposed and sent to professional waste disposal institutions for disposal.

1.1.4 Advantageous conditions of project construction

(1) Policy conditions

In February 2024, seven departments including the MIIT issued the Guiding Opinions on Accelerating the Green Development of Equipment Manufacturing Industry, proposing to improve the comprehensive utilization system of waste power batteries in the field of new energy vehicles, promote standardized recycling and graded resource utilization.

On August 14, 2024, the MIIT publicly solicited opinions on the Industry Standard Conditions for Comprehensive Utilization of Waste Power Batteries in New Energy Vehicles (2024 Edition), which required relevant enterprises to actively carry out research and application of recycling technologies, equipment, and processes for positive and negative electrode materials, separators, and electrolytes, as well as ensure effective extraction and recovery of major valuable metals through smelting or material repair. Among them, the lithium recovery rate during the smelting process should not be less than 90%, the copper and aluminum recovery rates shall not be less than 98%, the electrode powder recovery rate after crushing and separation shall not be less than 98%, the impurity aluminum content shall be less than 1%, and the impurity copper content shall be less than 1%.

On March 21, 2022, the Party Working Committee of Meihekou New Area, Meihekou New Area Management Committee, Meihekou Municipal Committee of the Communist Party of China, and Meihekou Municipal People's Government issued the Implementation Opinions on Supporting the Development of the Leading Industry of '4+3+N' in Meihekou City, proposing the establishment of a special fund to support the development of active industries. The equipment manufacturing industry is applicable to enterprises and projects that are registered in accordance with the law, have independent legal person qualifications, and conform to the development direction of the city's equipment manufacturing industry. It focuses on supporting key technological transformation projects in strategic emerging industries, automotive equipment manufacturing, and major equipment manufacturing industries, as well as "zero increase of land use" technology transformation projects that do not require new land and have equipment investment of more than 3 million yuan. It also supports new equipment (including domestic and imported) projects that comply with the encouraged, non-restricted, and eliminated categories in the national Guiding Catalogue for Industrial Structure Adjustment, and other equipment manufacturing projects determined by the municipal party committee and government. For projects recognized by relevant provincial departments as the first new equipment product with an annual sales revenue of 5 million yuan, a one-time financial reward of 300000 yuan will be given.

(2) Resource advantageous

During the 14th Five Year Plan period, Meihekou City is granted more autonomy in land use, project approval, and industrial development to the high-tech zone, allowing for trial and experimentation. In addition, Meihekou City focus on enhancing the flexibility of land management, providing ample construction land for project construction.

The Implementation Plan for Carbon Peak in Meihekou City proposes to accelerate the development and utilization of renewable energy such as solar energy, wind power, and biomass energy. By 2025, Meihekou City's installed capacity of wind power generation will reach 30000 kilowatts. By 2030, the proportion of clean energy and renewable energy utilization will significantly increase. Efforts shall be made to explore the establishment of renewable energy production bases, optimize the allocation of clean power resources, and accelerate the construction of a new type of power system with new energy as the mainstay. By 2025, the construction of new energy storage projects shall be steadily promoted. The 220 kV project of Shuguang Transformer Substation shall be promoted. By 2030, the power grid will have a basic peak load response capacity of 5% to provide energy security for the construction of the project.

(3) Industrial advantageous

As part of Meihekou City's newly planned industrial development, the equipment manufacturing industry and new materials sector have commenced construction of an equipment manufacturing industrial park. Meihekou City has deepened cooperation with BAIC Group, Qingdao Double Star Group, and Dongxu Group, introducing key projects including BAIC's vehicle modification and auto parts production base, as well as Dongxu Group's projects in new energy vehicles, high-end cover glass, and pharmaceutical glass processing. Meanwhile, partnerships have been established with FAW Group, CFAA, and Dongxu Group to advance cooperation in automotive component manufacturing. The equipment manufacturing industry is poised to become a significant growth driver for Meihekou's economy, with its total output value projected to reach 20 billion yuan by the conclusion of the 14th Five-Year Plan period.

(4) Talent advantageous

In recent years, the Meihekou Municipal Party Committee has regarded talent as the "first resource" for building a high-quality development demonstration zone in Jilin Province. It has successively issued policy documents such as the Implementation Opinions on Further Strengthening Talent Work Innovation to Drive High quality Development, the Implementation Plan for the "Hundred, Thousand, and Ten Thousand Talents Introduction Project" in Meihekou City, and the Several Measures for Strengthening Talent Support and Supporting Rural Revitalization in Meihekou City, vigorously attracting talents to return home for employment and entrepreneurship.

(5) Location advantageous

Meihekou City's prominent geographical advantages stem from its status as a vital regional hub in Northeast China. Located in southeastern Jilin Province, it serves as a critical transportation junction, commercial center, and strategic node connecting central and eastern Jilin, while functioning as the regional core city for southeastern Jilin. National Highways G202 and G303 traverse the city, interwoven with the Shenyang-Jilin, Siping-Meihekou, and Meihekou-Ji'an Railway lines, along with the Shenyang-Jilin, Yingkou-Songyuan, Yingkou-Meihekou, and Ji'an-Shuangliao Expressways. This integrated transportation network strategically links Meihekou City to the Changchun-Jilin-Tumen Economic Belt, bridges the Bohai Bay Economic Rim, and connects the Changbai Mountain region. As one of Jilin Province's four pivotal urban nodes alongside Changchun City, Jilin City, and Siping City, Meihekou City has established synergistic development ties with over 10 counties across Jilin Province and Liaoning Province, extending its economic influence to a population exceeding 4 million.

1.2 Contents and scale of project construction

1.2.1 Product scale

After the project is completed, it will have an annual recycling capacity of 100000 tons of lead-acid batteries and 10000 tons of lithium batteries.

1.2.2 Contents of project construction

The project covers an area of 90000 square meters and has a building area of 72000 square meters. It mainly constructs production workshops, raw material warehouses, finished product warehouses, and purchases battery pack dismantling lines, cascade utilization production lines, battery processing lines, etc.

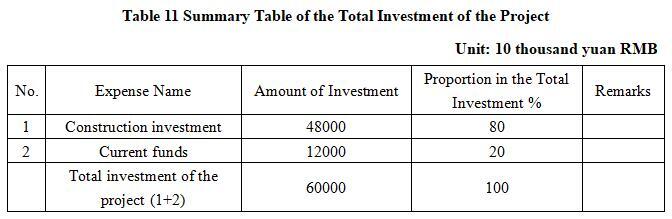

1.3 Total investment of the project and capital raising

1.3.1 Total investment of the project

The total investment of the project is 600 million yuan, including a construction investment of 480 million yuan and a working capital of 120 million yuan.

1.3.2 Fundraising

Fundraised independently by the enterprise.

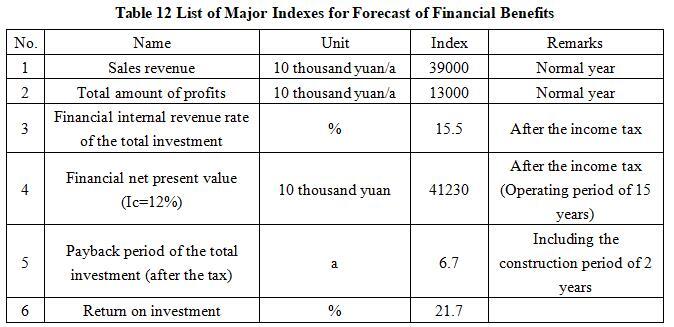

1.4 Financial analysis and social evaluation

1.4.1 Main financial indexes

After the project reaches the production capacity, its annual sales income will be 390 million yuan, its profit will be 130 million yuan, its investment payback period will be 6.7 years (after the tax, including the construction period of 2 years) and its investment profit rate will be 21.7%.

Note: “10 thousand yuan” in the table is in RMB.

1.4.2 Social evaluation

Through the construction of the project, valuable materials from retired power batteries can be recycled and reused, which can reduce production costs, improve resource utilization efficiency, and promote the development of circular economy; Meanwhile, it can provide more job opportunities for the local area, improve the local economic situation, enhance people's living standards, and promote social harmony and development.

1.5 Cooperative way

Joint venture, cooperation, other methods can be discussed offline.

1.6 What to be invested by the foreign party

Funds, other methods can be discussed offline.

1.7 Construction site of the project

Meihekou City, Jilin Province.

1.8 Progress of the project

This project is in the stage of external investment promotion.

2 Introduction to the Partner

2.1 Basic information

Name: Management Committee of Jilin Meihekou High-tech Industrial Development Zone

Address: No. 555 Kangmei Avenue, Guangming Street, Meihekou City, Tonghua City, Jilin Province.

2.2 Overview

Jilin Meihekou High-Tech Industrial Development Zone, formerly known as Meihekou Economic and Trade Development Zone established in February 2002 with an area of 5 square kilometers, was approved as a provincial-level high-tech industrial development zone by the provincial government in December 2019, with a total planned area of 29.82 square kilometers. It ranked first in the comprehensive evaluation of provincial-level development zones and ranked second in the 2020 evaluation. It has been awarded honors such as "National Torch Meihekou Modern Traditional Chinese Medicine Characteristic Industry Base", "Jilin Provincial Medicine High-Tech Characteristic Industry Base and Healthcare Industry Park", "Jilin Provincial High-Tech Industrial Cluster", "National Best Investment Environment Industrial Park", and "The Most Promising Industrial Park in China".

Jilin Meihekou High-Tech Industrial Development Zone actively implements the "4+3" industrial system and has planned an industrial development pattern of "5 Parks, 1 City, and 1 Center", including the Pharmaceutical and Health Industry Park, Healthy Food Industry Park, Modern Logistics Industrial Park, Construction and Supporting Industries Park, Chemical Industry Park, Special Medical Food City, and Northeast Asia Nut Kernels Distribution Center. It has successfully attracted leading enterprises such as Sihuan Pharmaceutical, Buchang Pharmacy, Tianheng Pharmaceutical, Lunan Pharmaceutical, Luzhou Laojiao, and Transfar Logistics. Since the 13th Five-Year Plan period, Jilin Meihekou High-Tech Industrial Development Zone has accumulated 42 billion yuan in fixed-asset investments, and the registered enterprises has increased to 3,778. The awarded titles of Jilin Meihekou High-Tech Industrial Development Zone including "National Torch Traditional Chinese Medicine Characteristic Industry Base", "National Best Investment Environment Industrial Park", and "The Most Promising Industrial Park in China". It ranked among the top two in the comprehensive strength evaluation of Jilin provincial development zones for four consecutive years. In 2023, Jilin Meihekou High-Tech Industrial Development Zone achieved a total output value of 10.33 billion yuan from industrial enterprises above designated size, accounting for 77.9% of Meihekou City.

2.3 Contact method

Postal code: 135000

Contact person: Zhang Yizhen

Tel: +86-13630716007

E-mail: mhxqjhj@163.com

Contact method of the city (prefecture) where the project is located:

Contact unit: Meihekou Municipal Bureau of Commerce

Contact person: Mu Zhanyuan

Tel: +86-15643552255 +86-435-4326686

E-mail: 4965278@qq.com