Modern Service Industry

Environment-friendly Battery and Recycling Industrial Park Project of Baishan City

1. Introduction to the Project

1.1 Project background

1.1.1 Product introduction

Among batteries, chemical batteries are the most important type. Chemical batteries are divided into two categories based on whether they can be recycled: primary batteries and secondary batteries. Among them, a primary battery is a battery in which the active substance can only be used once, also known as a primary battery, such as zinc manganese batteries, alkaline manganese batteries, etc; secondary batteries are rechargeable and reusable, also known as rechargeable batteries. Batteries use active substances inside the battery to undergo chemical reactions in the discharged state to output current, and undergo reverse chemical reactions in the charged state to store electrical energy.

This project plans to establish a waste battery (mainly lead-acid batteries) recycling system and a recycling and dismantling center in Jiangyuan District. The recyclable materials such as lead and plastic in the dismantled batteries will be processed and reused as raw materials in the battery production line to manufacture new batteries and sell them locally.

1.1.2 Market prospect

(1) Analysis of the current situation of the lead-acid battery industry

In 2023, China’s annual sulfuric acid production was 95 million tons, a year-on-year increase of 1.2%. As sulfuric acid is a by-product, its price is less affected by raw material prices and downstream demand. The market price of sulfuric acid in China for the whole year of 2023 was around 500 yuan/ton.

Plastic is the raw material used to manufacture components such as battery cases, separators, and grilles. According to data from Shangpu Consulting Group, the annual production of plastic products in China in 2023 was 82 million tons, a year-on-year increase of 2.5%. Due to the fact that plastic is a petroleum derivative, its price is greatly affected by fluctuations in international oil prices. The market price of plastic in China for the whole year of 2023 was around 12000 yuan/ton.

The downstream of the lead-acid battery industry chain mainly includes application fields such as automobile starting, electric vehicle power, communication, electricity, national defense and military industry. According to data from Shangpu Consulting Group, the size of China’s automotive starter market for the whole year of 2023 was 75 billion yuan, a year-on-year increase of 5%; the estimated size of China’s electric vehicle power market was 55 billion yuan, a year-on-year increase of 10%; the scale of China’s communication market was 10 billion yuan, a year-on-year increase of 8%; the scale of China’s electricity market was 8 billion yuan, a year-on-year increase of 12%; the scale of China’s defense and military industry market was 5 billion yuan, a year-on-year increase of 15%.

Lead acid batteries are mature, reliable, and low-cost chemical batteries, especially in applications such as starting and large-scale energy storage, with irreplaceable advantages. In recent years, with the promotion of policies such as new energy vehicles and new infrastructure, the lead-acid battery industry has shown a stable growth trend. According to data from Shangpu Consulting Group, the annual production of lead-acid batteries in China in 2023 was 24500kVAh, a year-on-year increase of 3.6%; the market size of lead-acid batteries in China was 175 billion yuan, a year-on-year increase of 3.9%.

From the perspective of segmented markets, automobile starting and electric vehicle power are still the main application areas of lead-acid batteries, accounting for over 70% in total. Specifically, in the segmented market structure of lead-acid batteries in China for the whole year of 2023, the proportion of automotive starter batteries reached 44%, electric vehicle power batteries accounted for 27%, communication accounted for 9%, and electricity (wind and solar power generation) accounted for 7%.

The lead-acid battery industry is a typical capital intensive industry with high technological barriers and economies of scale. At present, the lead-acid battery industry in China presents a polarized competitive pattern. On the one hand, large enterprises represented by Camel Group Co., Ltd. and Tianneng Battery Group Co., Ltd. have strong brand influence, channel advantages, technological innovation capabilities, and financial strength, occupying a relatively high market share; on the other hand, there are numerous small and medium-sized enterprises that mainly rely on low price competition and regional operations, facing environmental pressure, rising raw material costs, product homogenization, and other problems, squeezing their living space.

The total market share of the top ten enterprises in China’s lead-acid battery industry in 2023 was 35%, with Camel Group Co., Ltd. and Tianneng Battery Group Co., Ltd. holding 10% and 9% of the market shares, respectively. From a segmented perspective, the automotive starter market is dominated by companies such as Camel Group, Feilo Acoustics Co., Ltd., and Wanxiang Qianchao Co., Ltd.; the electric vehicle power market is dominated by companies such as Tianneng Group, Chaowei Power Holding Limited, and Ultrapower; the communication market is dominated by companies such as CASIC, Shandong Sacred Sun Power Sources Co.,Ltd., and Zhejiang Narada Power Source Co., Ltd.; the electricity market is dominated by companies such as Zhejiang Sunriver Culture Co. ,Ltd, Central Wealth Group Holdings Limited , and AVIC Jonhon Optronic Technology Co.,Ltd.

The downstream demand for lead-acid batteries is mainly influenced by the development of industries such as automobiles, electric vehicles, communications, and electricity.

Car starting is the largest application area of lead-acid batteries, mainly used for functions such as starting, lighting, and ignition of traditional fuel vehicles and hybrid vehicles. In 2023, China’s automobile production and sales for the whole year were 30 million and 29.5 million, respectively, with year-on-year growth of 4.5% and 4.2%. Among them, traditional fuel vehicles accounted for 75%, hybrid vehicles accounted for 15%, and new energy vehicles accounted for 10%. From this, it can be seen that traditional fuel vehicles are still the main source of demand for lead-acid batteries, but their growth rate is slowing down, while hybrid and new energy vehicles are showing a rapid growth trend, especially new energy vehicles. Although most of them currently use lithium batteries as power sources, lead-acid batteries are still needed as auxiliary power sources, so there is also a certain demand for lead-acid batteries.

Electric vehicle power is the second largest application area of lead-acid batteries, mainly used for driving low-speed electric vehicles such as electric bicycles, electric motorcycles, and electric tricycles. In 2023, the production and sales of low-speed electric vehicles in China were 40 million and 39 million, respectively, with year-on-year growth of 8.1% and 7.8%. Among them, electric bicycles accounted for 60%, electric motorcycles accounted for 25%, and electric tricycles accounted for 15%. From this, it can be seen that low-speed electric vehicles are an important source of demand for lead-acid batteries, with a fast growth rate, mainly driven by factors such as urban traffic congestion, increased environmental awareness, and consumption upgrades. At present, lead-acid batteries are still the mainstream in the low-speed electric vehicle market, but they also face the threat of replacing lithium batteries. Therefore, it is necessary to continuously improve the performance and lifespan of lead-acid batteries, reduce costs and weight.

Communication is the third largest application area of lead-acid batteries, mainly used as backup power for mobile communication base stations, fixed telephone exchanges, data centers, and other equipment. According to the data from Shangpu Consulting Group, the annual revenue of China’s communication industry in 2023 was 180 billion yuan, a year-on-year increase of 6.5%. Among them, mobile communication accounted for 70%, fixed communication accounted for 20%, and data centers accounted for 10%. From this, it can be seen that communication is a stable source of demand for lead-acid batteries, with a fast growth rate, mainly driven by factors such as 5G network construction, cloud computing development, and IoT applications. At present, the demand for lead-acid batteries in the communication field mainly focuses on high-performance, high reliability, and long-life valve regulated sealed lead-acid batteries. Therefore, it is necessary to continuously improve the technical level and quality standards of lead-acid batteries.

Electricity is the fourth largest application area of lead-acid batteries, mainly used for energy storage and regulation of equipment such as wind power generation, solar power generation, and energy storage systems. The installed capacity of new energy power generation in China for the whole year of 2023 was 800GW, a year-on-year increase of 10%. Among them, wind power generation accounted for 40%, solar power generation accounted for 40%, and other power generation accounted for 20%. From this, it can be seen that electricity is a potential source of demand for lead-acid batteries, and its growth rate is relatively fast, mainly influenced by factors such as new energy policy support, promotion of energy conservation and emission reduction goals, and progress in energy storage technology. At present, the demand for lead-acid batteries in the power sector is mainly focused on high-capacity, high-efficiency, and low-cost lead-acid carbon batteries and lead-acid crystal batteries. Therefore, it is necessary to continuously improve the energy storage performance and economy of lead-acid batteries.

In summary, the lead-acid battery industry still has significant development space and potential in the future. Environmental governance is a necessary condition for the lead-acid battery industry to fulfill its social responsibility and ensure sustainable development. Shangpu Consulting Group believes that the lead-acid battery industry needs to strictly comply with national and local environmental regulations and standards, strengthen the treatment and disposal of pollutants such as wastewater, exhaust gas, and waste generated during the production process, and reduce the impact on the environment. At the same time, it is also necessary to strengthen the recycling and reuse of waste lead-acid batteries to achieve a circular economy for lead-acid batteries.

Industry integration is an effective means for optimizing resource allocation and improving efficiency in the lead-acid battery industry. The lead-acid battery industry needs to accelerate the pace of industry integration, eliminate outdated production capacity, eliminate disorderly competition, and form economies of scale. At the same time, it is also necessary to strengthen cooperation and alliances within the industry, achieve resource sharing and collaborative innovation, and enhance the overall competitiveness of the industry.

(2) Analysis of the waste battery recycling industry

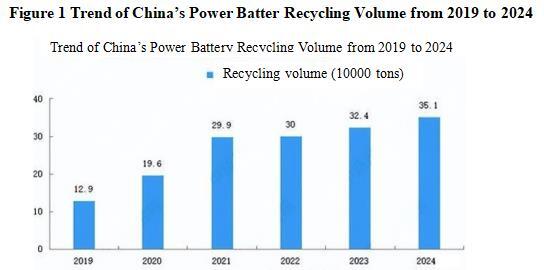

With the centralized retirement of power batteries, China’s power battery recycling industry has entered a period of development. The Research Report on the Development Trends and Investment Risks of China’s Power Battery Recycling Industry from 2024 to 2028 released by China Academy of Commerce Industry Research shows that from 2019 to 2022, the actual recycling volume of power batteries in China increased from 129000 tons to 300000 tons, and reached 324000 tons in 2023. The actual recycling volume of power batteries exceeded 350000 tons by 2024.

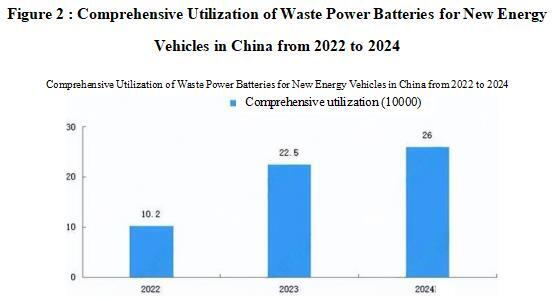

The comprehensive utilization of waste power batteries for new energy vehicles in 2023 has reached 225000 tons, a year-on-year increase of 121%. The Ministry of Industry and Information Technology has proposed to promote the standardized development of the comprehensive utilization industry of renewable resources. By 2024, the comprehensive utilization of major varieties of renewable resources should have steadily increased, and the emerging solid waste utilization system should have been improved, and the annual comprehensive utilization of waste power batteries reached more than 260000 tons .

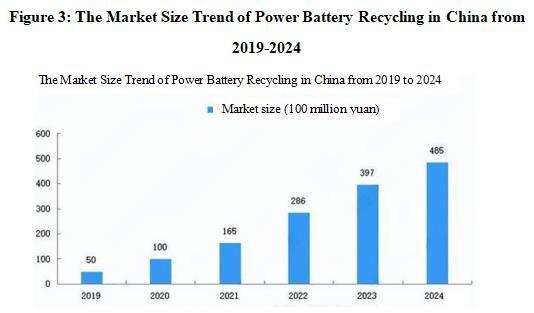

The market size of China’s power battery recycling in 2023 was 39.7 billion yuan. Power batteries generally had a lifespan of 5-8 years. Based on the second cycle from 2020 to 2022, it is expected that a new wave of power battery retirement will occur around 2025. At the same time, coupled with the recent “trade-in” subsidy policy launched by the State Council, the power battery recycling industry is expected to face a huge demand. The size of China’s power battery recycling market exceeded 48 billion yuan by 2024.

By now, China has not yet established a unified national recycling channel, and most enterprises are still in the stage of seizing the market. Therefore, there are many and chaotic channels for recycling power batteries. The main channels for recycling power batteries include battery factories, vehicle manufacturers, third-party operating enterprises, dismantling factories, insurance companies, and individual users. Among them, battery factory channels account for 50%, and vehicle enterprises account for 20%.

In order to standardize the development of the industry, in 2018, the Ministry of Industry and Information Technology released the first batch of enterprises that meet the “Industry Standard Conditions for Comprehensive Utilization of Waste Power Batteries for New Energy Vehicles (hereinafter referred to as the White List). As of now, five batches of enterprise whitelists have been released, totaling 156 companies, which are considered as the “regular army” of battery recycling. Among them, there are 96 enterprises in the direction of hierarchical utilization and 60 enterprises in the direction of recycling, with only 12 enterprises having dual qualifications for hierarchical utilization and recycling. From this, it can be seen that among the large number of about 120000 enterprises, a small number of enterprises have recycling qualifications, and most of them still exist in the form of “small workshops”.

With the rapid development of China’s new energy vehicle industry, the retirement amount of power batteries will also increase year by year. In 2020, a total of 240000 tons of retired power batteries were produced nationwide. It is predicted that China’s retired power batteries will have reached 1.04 million tons by 2025 and 3.5 million tons by 2030. The retirement volume of power batteries is increasing year by year, and the demand for power battery recycling services in the market is also continuing to grow. Power battery recycling enterprises can not only obtain valuable metal resources by recycling waste batteries, but also obtain certain economic benefits by providing recycling services. Therefore, the continuous growth of market demand provides broad space for the development of the power battery recycling industry.

In 2023, the proportion of China’s production of recycled lead to the total lead production exceeded 50%. Although the production of recycled lead in China has achieved rapid growth in recent years, and the proportion of recycled lead in the total production is constantly increasing, there is still a significant gap compared to developed countries in the world. For example, the production of recycled lead accounts for over 92% in the United States and over 80% in Europe. This data indicates that China’s recycled lead industry still has enormous development potential and upward space in the future. By learning and drawing on international advanced experience, improving technical level and management efficiency, China’s recycled lead industry is expected to further narrow the gap and achieve high-quality development.

The rapid development of electric vehicles and electric two wheelers has increased the demand for lead batteries, making the recycling and reuse of waste batteries crucial. With the expansion of the electric transportation market, the lead recycling industry is facing huge market demand and growth potential, providing an important driving force for the industry’s development.

The global emphasis on environmental protection is increasing, and strict environmental regulations and policy support implemented by governments, such as restricting new lead mining and promoting the recycling of waste resources, have provided a favorable policy environment and market opportunities for the lead recycling industry.

1.1.3 Technical analysis

Lead acid battery disassembly technology: remove battery acid - separate positive and negative plates - separate plastic shell - separate lead plate - lead plate melting - lead liquid filtration - lead liquid cooling - purify lead liquid - lead production.

1.1.4 Advantageous conditions of project construction

(1) Policy advantages

The Ministry of Environmental Protection has released the Technical Policy for Pollution Prevention and Control in the Production and Regeneration of Lead Acid Batteries, which proposes the requirements for clean production, air pollution prevention and control, water pollution prevention and control, solid waste disposal and comprehensive utilization, and encourages the research and development of new technologies in the production and regeneration industry of lead-acid batteries. The production and recycling industry of lead-acid batteries should increase efforts in industrial structure adjustment and product optimization and upgrading, reasonably plan industrial layout, and further improve industrial concentration and scale level.

In 2021, the National Development and Reform Commission issued the 14th Five-Year Plan for the Development of Circular Economy, proposing that by 2025, circular production methods will have been fully implemented, green design and clean production will have been widely promoted, the comprehensive utilization capacity of resources will have been significantly improved, and a resource circular industry system will have been basically established. The recycling network for waste materials has become more complete, the ability to recycle renewable resources has been further enhanced, and a resource recycling system covering the entire society has been basically established. The efficiency of resource utilization has significantly improved, and the proportion of renewable resources replacing primary resources has further increased. The supporting and guaranteeing role of circular economy in resource security has become more prominent.

In January, 2022, the National Development and Reform Commission and other departments issued the Guiding Opinions on Accelerating the Construction of the Waste Resource Utilization System, proposing that by 2025, the policy system for recycling waste materials will have been further improved, and the level of resource recycling will have been further enhanced. The network system for recycling waste materials has been basically established, and more than 1000 green sorting centers have been built. The “scattered pollution” situation in the renewable resource processing and utilization industry has significantly improved, with a significant increase in agglomeration, scale, standardization, and informatization levels. The recycling amount of 9 major renewable resources, including scrap steel, scrap copper, scrap aluminum, scrap lead, scrap zinc, waste paper, waste plastics, waste rubber, and waste glass, has reached 450 million tons. The circulation order and transaction behavior of second-hand goods have become more standardized, and the transaction scale has significantly increased. About 60 large and medium-sized cities have taken the lead in establishing a basic and complete waste material recycling system.

In 2023, the Ministry of Industry and Information Technology and four other departments jointly issued the National Catalogue of Advanced Applicable Process Technology and Equipment for Comprehensive Utilization of Industrial Resources (2023 Edition), proposing to further accelerate the promotion and application of advanced applicable technology and equipment from the aspects of industrial solid waste reduction, comprehensive utilization of industrial solid waste, recycling and utilization of renewable resources, and re-manufacturing, continuously improve the efficiency and level of resource recycling, and promote the sustainable innovation and development of China’s resource recycling industry.

The 14th Five-Year Plan for the Construction of “Waste-free Cities” in Jilin Province proposes to promote the construction of “urban mineral” bases. Accelerate the construction of a recycling system for waste materials, promote the integration of garbage classification and transportation with the recycling of renewable resources, and give priority to supporting recycling enterprises with strong comprehensive strength and good business reputation in various regions. Construct demonstration projects for the recycling system of renewable resources, and actively cultivate provincial-level demonstration enterprises for the recycling of renewable resource brands. Build demonstration projects for electronic waste recycling, utilization, and disposal based on disposal enterprises.

(2) Industrial advantages

The amount of waste lead-acid batteries generated in Baishan City in 2022 was 120 tons. Although this data only represents the annual production, it can reflect that there is indeed a resource of waste lead-acid batteries in Baishan City.

With the popularization and accelerated upgrading of transportation vehicles such as cars and electric vehicles, the production of waste lead-acid batteries is also increasing year by year. Therefore, it can be foreseen that the amount of waste lead-acid battery resources in Baishan City will continue to increase in the future.

(3) Talent advantages

Baishan City will transport over 10000 skilled talents and train more than 20000 individuals of various types for the society. The labor resource advantages are obvious, and the proportion of skilled workers is at a high level in the urban agglomeration of Northeast China. The labor force is in a dividend period, and the labor cost is relatively low. There is a large number of high-quality industrial workers who can meet the needs of various enterprises.

(4) Location and transportation advantages

Jiangyuan District is located in the central area of six counties (cities, districts) in Baishan City, adjacent to Fusong County to the east, Liuhe County to the northwest, Hunjiang District to the southwest, Linjiang City to the south, and Jingyu County to the north. It is a must pass place for Liaoning, Hebei, Shandong, Beijing and other places to reach Changbai Mountain Tourist Scenic Area via No. 201 National Highway. It is 270 kilometers away from Changchun Longjia Airport, 100 kilometers away from Changbai Mountain Airport, 90 kilometers away from Tonghua Airport, 50 kilometers away from Linjiang Port, 162 kilometers away from Ji'an Port, and 392 kilometers away from Dandong Port. It is a logistics distribution center, and its service scope is not only based on the economic development of Jiangyuan itself, but also covers surrounding counties and districts as well as major cities outside the district that must pass through Jiangyuan District in transportation. Therefore, Jiangyuan District has obvious location advantages.

Highways and railways crisscross Jiangyuan District, with five national and provincial trunk highways including the Hegang-Dalian Line and Shenyang-Changchun Line running through the area, and the Hunchun-Baishan Line and the Yayuan-Dalizi Line, two railway trunk lines connecting the north and south. The Hegang-Dalian Expressway and Linjiang-Huinan Expressway have been completed and opened to traffic, and the urban area is 5 minutes and 15 minutes away from the two highways respectively. Baishan New Branch Airport is actively advancing, and the early construction section of the Siping-Baishan High-speed Railway Control Project has officially started. There is a station in Wangou Town within the area, and the urban area is only a 10 minute drive from the new airport and Baishan East Station of the Shenyang-Baishan High-speed Railway. Jiangyuan has formed a 1-hour economic circle in Baishan City. With the construction of high-speed railways and airports, Jiangyuan District will form a 3-hour economic circle with Beijing, Dalian, Shenyang and other places, making factor sharing more convenient and smooth.

1.2 Contents and scale of project construction

1.2.1 Construction scale

The project covers an area of 100000 square meters, dismantling 150000 lead-acid batteries and producing 3.5 million batteries annually.

1.2.2 Construction contents

The project covers an area of 100000 square meters and includes the construction of an aggregate center, a dismantling center, a production workshop, a warehouse, a dormitory building, and other supporting facilities. Additionally, two battery production lines will be purchased.

1.3 Total investment of the project and capital raising

1.3.1Total investment of the project

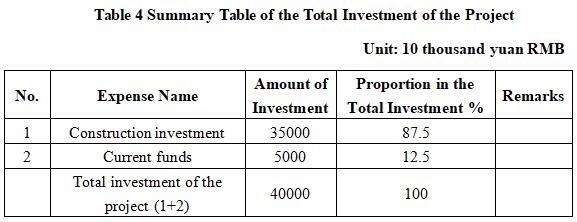

The total investment of the project is 400 million yuan, including teh construction investment of 350 million yuan and current funds of 50 million yuan.

1.3.2 Capital raising

Self-raising by the enterprise

1.4 Financial analysis and social evaluation

1.4.1 Main financial indexes

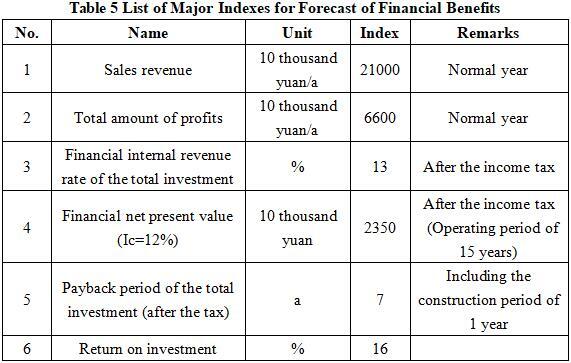

After the project reaches the production capacity, its annual sales revenue will be 210 million yuan, its profit will be 66 million yuan, its investment payback period will be 7 years (after the tax, including the construction period of 1 year) and its return on investment will be 16%.

Note: “10 thousand yuan” in the table is in RMB.

1.4.2 Social evaluation

Waste batteries contain a large amount of valuable metals such as copper, lead, zinc, etc. Through professional processing in industrial parks, these metals can be effectively recycled and reused, reducing dependence on natural resources and mining. This helps to achieve resource recycling and improve resource utilization efficiency.

The construction of industrial parks will drive the development of related industries, including battery production, recycling and processing, equipment manufacturing, etc. This will create a large number of job opportunities for the local area, improve the income level and quality of life of residents.

1.5 Cooperative way

Joint venture or cooperation, other methods can be discussed face-to-face.

1.6 What to be invested by the foreign party

Funds, and other methods can be discussed face-to-face.

1.7 Construction site of the project

Jiangyuan District, Baishan City

1.8 Progress of the project

It is attracting foreign investment.

2. Introduction to the Partner

2.1 Basic information

Name: People’s Government of Jiangyuan District

Address: Jiangyuan District, Baishan City

2.2 Overview

Jiangyuan District, belonging to Baishan City, Jilin Province, is expected to have achieved the main economic and social development goals of a regional GDP growth rate of over 7% by 2024; the total output value of industrial enterprises above a certain scale has increased by more than 20%; the fixed assets investment of the whole society has increased by more than 8%; the total retail sales of consumer goods have increased by over 8%; the per capita disposable income of urban and rural permanent residents has increased by over 6% and 8%, respectively

Jiangyuan District is a must pass area for Liaoning, Hebei, Shandong, Beijing and other places to reach Changbai Mountain Tourist Scenic Area via No. 201 National Highway; Highways and railways crisscross Jiangyuan District, with five national and provincial trunk highways including the Hegang-Dalian Line and Shenyang-Changchun Line running through the area, and the Hunchun-Baishan Line and the Yayuan-Dalizi Line, two railway trunk lines connecting the north and south. Jiangyuan is also the hometown of black fungi and Songhua stone in China; it has two national 3A level scenic spots, that is, the National Forest Park Ganfanpan and the Rare Stone Cultural City.

2.3 Contact method

Contact method of the city (prefecture) where the project is located:

Postal code: 134300

Contact unit: Baishan Bureau of Commerce

Contact person: Zhu Yuze

Tel: +86-439-3367020

+86-15844990231

+86-15567978656