Modern Service Industry

Cainiao Intelligent Storage Center Project of Siping City

1. Introduction to the Project

1.1 Project background

1.1.1 Product introduction

Cainiao is the world’s largest cross-border e-commerce logistics company, with business covering international express delivery, international supply chain, and overseas local services. Through disruptive solutions such as “Global 10-day Delivery” and “Global 5-day Delivery”, it helps small and medium-sized enterprises engage in cross-border trade. Cainiao has established a global intelligent logistics network with end-to-end capabilities. Cainiao operates key logistics facilities in strategic global locations, covering more than 200 countries and regions, and applies its “technology genes” to every aspect of logistics operations. It has also established the world’s largest digital relay station network. Cainiao’s ESG measures are deeply rooted in every link of the logistics value chain, focusing on five areas: green logistics, customer experience, community service, emergency logistics, and high-quality employment.

This product is located in Shuangliao City, with a focus on intelligent warehousing. Construct automated warehouses, comprehensive buildings, and power centers. Strong technical strength and broad market. The project can drive the upgrading of regional logistics service capabilities, making it more convenient for Shuangliao’s good products to be sold nationwide. At the same time, the surrounding infrastructure of the project construction site is complete, with convenient transportation and developed industries such as agriculture, pharmaceuticals, chemicals, and glass building materials. The resource conditions required for production are relatively complete, providing a strong market demand for the construction of Cainiao Intelligent Storage Center.

1.1.2 Market prospect

(1) The current development status of the logistics and express delivery industry

With the widespread use of e-commerce and changes in consumer shopping behavior, the demand for express delivery services continues to expand. Especially with the rise of new e-commerce platforms such as live streaming and short videos, it has further promoted the improvement of express logistics performance time and service quality. Consumers’ expectations for express delivery services have shifted from simple delivery to a greater emphasis on service experience, timeliness, and safety.

From 2015 to 2023, the total revenue of China’s logistics industry continued to expand, exceeding 10 trillion yuan in 2018 and reaching 13.20 trillion yuan in 2023. The growth rate shows fluctuations, with growth rates exceeding 10% in 2018 and 2021. In the first quarter of 2024, the revenue of China’s logistics industry reached 3.10 trillion yuan, an increase of 4.5% compared to the same period in 2023.

Similarly, from 2015 to 2023, the total cost of China’s logistics industry has continued to grow, reaching 18.20 trillion yuan in 2023. The proportion of total logistics industry expenses to the national GDP is generally declining, from 16% in 2015 to 14.4% in 2023. In the first quarter of 2024, the total cost of China’s logistics industry was 4.3 trillion yuan, accounting for 14.4% of GDP. The proportion of total logistics costs to GDP reflects the logistics costs required per unit of GDP. In recent years, this proportion has generally decreased, indicating the improvement of logistics efficiency in China.

The total amount of social logistics refers to the total value of goods that enter the domestic demand field for the first time and flow from the supply location to the receiving location. From 2015 to 2023, the total amount of social logistics in China has steadily increased, from 219.2 trillion yuan in 2015 to 352.4 trillion yuan in 2023, with an average annual compound growth rate of 6.11%. From January to April 2024, the total amount of social logistics in China was 111.9 trillion yuan, an increase of 6.1% compared to the same period in 2023.

From the composition of the total social logistics, industrial logistics has always been the main part of social logistics, but its proportion has continued to decline from 93.04% in 2015 to 88.71% in 2023; the proportion of agricultural product logistics is relatively stable, basically staying at around 1.5%; the proportion of imported goods, renewable resources, and logistics of units and residential goods shows a fluctuating upward trend, especially with the rapid development of logistics of units and residential goods, increasing from 0.23% in 2015 to 3.69% in 2023.

From 2015 to 2023, the fixed asset amount of investment in the transportation, warehousing, and postal industries in China has been increasing year by year, with the growth rate fluctuating first and then rapidly rising. In 2020 and 2021, the growth rate dropped to below 2%. In 2023, the fixed asset amount of investment in the transportation, warehousing, and postal industries in China exceeded 8 trillion yuan, an increase of 10.5% compared to 2022.

Under the intensification of market competition, express delivery companies attach greater importance to improving service quality. According to the satisfaction survey and delivery rate test of express delivery services released by the State Post Bureau, the public satisfaction with express delivery services and the 72-hour delivery rate in key areas have both improved.

Express delivery companies are introducing intelligent and automated sorting equipment to improve sorting efficiency and reduce package damage and loss. At the same time, strengthen employee training, enhance service attitude and professional skills to improve customer satisfaction.

In the wave of digital transformation, the express delivery industry is rapidly developing towards intelligence and automation. From unmanned warehouses to intelligent sorting, from logistics drones to automated delivery vehicles, the application of technology not only improves efficiency but also reduces costs. In the future, express delivery companies will continue to increase their investment in technology and promote digital transformation to improve the service quality.

(2) Prospect analysis of the logistics and express delivery industry

The logistics industry in China has broad prospects and enormous potentials. In emerging fields such as cold chain logistics, instant delivery, digital freight, cross-border e-commerce, and low altitude logistics in segmented markets, rapid growth is expected with deep integration with the industry. Taking cross-border e-commerce as an example, its rapid development has brought new growth points to the logistics industry, requiring enterprises to improve cross-border transportation efficiency and achieve seamless integration in key links such as customs clearance, warehousing, and distribution, while constantly innovating service models.

In terms of green and low-carbon development, the logistics industry accounts for about 9% of the country’s carbon emissions. With the global attention to climate change and China’s implementation of its “carbon peak and carbon neutralization” goals, the logistics industry has a vast potential for green and low-carbon development and market prospects. One of the key measures to promote the green transformation of the logistics industry is to promote the electrification of transportation vehicles, accelerate the establishment of accounting standards for carbon emissions and carbon footprint in the logistics field, and promote scientific and technological research and application.

In terms of ESG system construction, logistics companies will further explore specific practices of ESG based on environmental, social, and governance (ESG) principles, including green infrastructure investment, green operations, green technology research and development, and product innovation, actively participating in the improvement of the ESG evaluation standard system. The government, industry, and society will continue to establish and improve ESG supervision, rating, investment and financing guarantee systems, providing impetus for the green and low-carbon development of the logistics industry.

In terms of enhancing logistics resilience, as China’s economy accelerates its integration into the global market, the role of the logistics industry in ensuring supply chain stability is becoming increasingly important. Enterprises are continuously strengthening their monitoring, early warning, prevention, and response capabilities for supply chain security risks, and developing emergency logistics.

In terms of data elements, the technological innovation led by AI big models has brought new development opportunities to the logistics industry. The role and value of data are more significant, which will effectively promote the prosperous development of new operating models such as supply chain digital platforms, smart warehousing, smart parks, and intelligent driving.

In terms of “going to sea”, as the “Belt and Road” initiative enters its 11th year, China’s logistics enterprises are deeply involved in the international logistics industry system, and will move towards a new development stage of full link business integration and global multi-point layout in the future. By promoting investment in high-quality logistics assets along the line, expanding international supply chain services, and establishing ground business teams, the supply chain, service industry chain, and value chain will be effectively unblocked.

In summary, the logistics industry in China will continue to maintain a good development momentum in the future, constantly innovate and make progress, and contribute greater strength to the economic and social development.

1.1.3 Advantageous conditions of project construction

(1) Policy conditions

The Notice on Doing a Good Job in the Key Work of Cost Reduction in 2024 mentions the improvement of the modern logistics system. Steadily promote the construction of national logistics hubs and national backbone cold chain logistics bases, and promote the high-quality development of modern logistics. Add support for a group of cities to carry out national comprehensive freight hub chain supplementation and strengthening, promoting the integration of cross transportation modes. Continue to implement county-level commercial construction actions, support the construction and renovation of county-level logistics distribution centers and township express logistics stations, improve warehousing, transportation, distribution and other facilities, accelerate the filling of rural commercial facility shortcomings, and improve the county-level and rural logistics distribution system.

The Three-Year Action Plan for Data Element X (2024-2026) points out to promote internationalization, encourage e-commerce enterprises, modern circulation enterprises, and digital trade leading enterprises to integrate transaction, logistics, and payment data under the premise of security and compliance, and support the improvement of supply chain integrated services, cross-border identity authentication, global supply chain financing, and other capabilities.

(2) Project advantages

Relying on silica sand resources, the two major glass giants in China, Jinken Glass Co., Ltd. and Yingxin Glass Co., Ltd., have gathered in Shuangliao, becoming the only glass building materials characteristic park in Jilin Province, the largest glass building materials base in northern China, and a nationally planned northern siliceous raw material production base. Shuangliao is located in the world’s “Golden Corn Belt”, with a total cultivated land area of 2.8 million mu and a stable annual grain production of 3 billion jin. It is the largest livestock distribution center in Jilin Province, Liaoning Province, and Inner Mongolia. It has been successively named as a national grain producing county, a national commodity grain base county, a national sheep base county, a national lean meat pig base county, and a national ecological demonstration county.

During the 14th Five-Year Plan, Shuangliao City will make every effort to build a billion yuan level logistics base that radiates to Mongolia, Jilin, Heilongjiang, and Liaoning, and accelerate the construction of a provincial-level logistics layout city. Taking the logistics park as a platform, it vigorously develops smart logistics, bonded logistics, and cold chain logistics, and strives to build Shuangliao into a commodity gathering and distribution base serving the economic development of Northeast China, as well as a gathering center for logistics, passenger flow, information flow and other elements.

(3) Location advantages

Shuangliao has significant location advantages, located in the central area of Liaoning, Jilin, and eastern Inner Mongolia. In the Central Urban Agglomeration Plan of Jilin Province, Shuangliao has been positioned as the central city and gateway city of western Jilin Province. Shuangliao is a transportation hub in the western part of Northeast China and an important material distribution center in the region.

There are two railways passing through the area: Shuangliao to Dahushan and Siping to Qiqihar; Daqing to Guangzhou, Changchun to Shenzhen, Ji’an to Xilinhot, Nenjiang to Dandong, Shuangliao to Baicheng and other highways intersect in Shuangliao, making it the only city in Jilin Province with multiple highway nodes and 9 highway exits; there are two national trunk highways from Shenyang to Mingshui and from Ji’an to Xilinhot, with G231 Nenjiang-Shuangliao Railway running through the north and south; the provincial trunk road from Changchun to Shuangliao spans from east to west. Shuangliao is a 50 minute drive from Tongliao Airport, and a 150 minute drive from Changchun Longjia International Airport and Shenyang Taoxian International Airport. Shuangliao will integrate into the 1-hour economic circle of Changchun and the 2-hour economic circle of Shenyang.

1.2 Contents and scale of project construction

The project covers an area of 50000 square meters, with an annual transit throughput of about 70000 tons. It will construct an order production center, automated warehouse, comprehensive building, power center, and supporting infrastructure. The total new construction area is 63000 square meters, and new equipment and facilities such as AGV, unmanned forklift with hydraulic lifting platform, Cainiao grounding network digital intelligent asset management system will be purchased. By combining socialized warehousing and distribution resources and capabilities, it provides merchants with industry-specific and e-commerce specific warehousing and distribution services, helping them reduce costs and increase efficiency, greatly improving the logistics experience in Shuangliao.

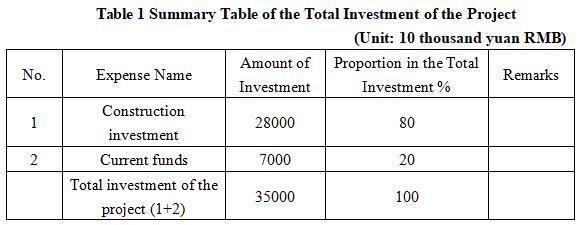

1.3 Total investment of the project and capital raising

1.3.1 Total investment of the project

The total investment of the project is 350 million yuan, including the construction investment of 280 million yuan.

1.4 Financial analysis and social evaluation

1.4.1 Main financial indexes

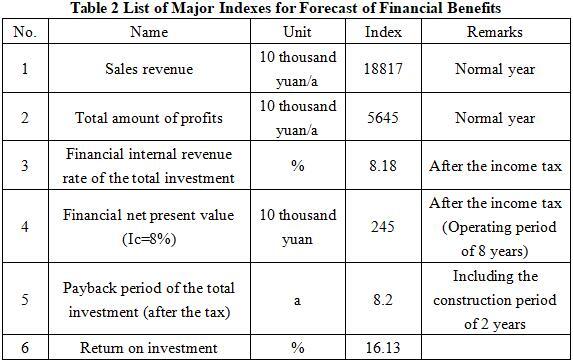

After the project reaches the production capacity, its annual sales revenue will be 188.17 million yuan, its profit will be 56.45 million yuan, its investment payback period will be 8.2 years (after the tax, including the construction period of 2 years) and its return on investment will be 16.13%.

Note: “10 thousand yuan” in the table is in RMB.

1.4.2 Social evaluation

This project is committed to improving the speed and accuracy of logistics distribution, effectively reducing operating costs through an intelligent management system, and creating greater value for partners. At the same time, Cainiao Intelligent Storage Center has also made positive efforts in environmental protection and sustainable development, such as using green building materials and energy-saving equipment, committed to reducing its impact on the environment. These measures not only enhance the image of the Cainiao brand, but also win widespread praise from society, making Cainiao’s intelligent warehousing center a model in the field of intelligent warehousing.

1.5 Cooperative way

Joint venture or cooperation

1.6 What to be invested by the foreign party

Funds, and other methods can be discussed in person.

1.7 Construction site of the project

Shuangliao City

1.8 Progress of the project

The project is in the planning phase.

2. Introduction to the Partner

2.1 Basic information

Name: Shuangliao Municipal People’s Government

Address: 1980 Liaohe Road, Shuangliao City, Siping City

2.2 Overview

Shuangliao City is located at the junction of Jilin Province, Liaoning Province, and Inner Mongolia, adjacent to the Songliao Plain and the Khorqin Grassland, and is known as the place where “chicken crowing is heard in three provinces”. The jurisdiction covers an area of 3121.2 square kilometers, with a permanent population of 320000. It has jurisdiction over 18 townships (streets) and 1 provincial-level economic development zone. There are 2 railways and 4 national and provincial trunk lines within the territory, making it the only node city in Jilin Province with 4 highways and 9 highway exits.

Shuangliao City, with the advantages of the “backyard” and “natural oxygen bar” in western Jilin Province, has integrated local characteristic cultures such as fishing and hunting culture, nomadic culture, agricultural culture, red culture, religious culture, and industrial culture into the construction of scenic spots, urban development, supporting facilities, and commodity development, and built a green ecological barrier in western Jilin. According to the overall plan for the development of comprehensive tourism in Shuangliao City, relying on the existing water system, wetlands, and grassland resources, two corridor style tourism belts will be formed, namely, the “Ecological Experience Tourism Belt” and the “Rural Leisure Tourism Belt”.

The booming tourism economy in Shuangliao City has created a green channel for two-way communication between urban and rural areas, online and offline, and physical and online. With the help of this new sales channel, the development of the ice and snow cultural tourism industry also needs to find a suitable “traffic entrance”, form an effective connection and undertaking platform, and stimulate more ice and snow cultural tourism products and services, becoming a dominant market entity in the industry chain.

2.3 Contact method

2.3.1 Contact method of the partner

Contact person: Huang Xibo

Tel: +86-13844438112

2.3.2 Contact method of the city (prefecture) where the project is located

Contact unit: Siping Bureau of Economic Cooperation

Contact person: Wen Dacheng

Tel: +86-434-3260536

E-mail: spjhjjhk@163.com