New Material

5000 Tons Annual Output Ultra-High Molecular Weight Polyethylene Fiber Project of Jilin City

1. Introduction to the Project

1.1 Project background

1.1.1 Product introduction

Ultra-high molecular weight polyethylene fiber (UHMWPE), also known as high-strength and high-modulus polyethylene fiber, is currently the world's highest specific strength and specific modulus of the fiber, which is spun from polyethylene with its molecular weight in 1 million~5 million.

70% of ultra-high molecular weight polyethylene fiber is used in body armor, bulletproof helmets, bulletproof armor of military facilities and equipment, aerospace and other military fields, and the development of high-performance fibers is the embodiment of a country's comprehensive strength, and is an important material foundation for building a modern power.

1.1.2 Market prospect

(1) Analysis of the current situation of the new material industry

New materials refer to emerging materials with excellent properties or special functions, or materials with significantly improved properties or new functions after traditional materials have been improved in composition, structure, design and process. There is no clear demarcation between new materials and traditional materials, and new materials are often developed on the basis of traditional materials. As the foundation and forerunner of high and new technology, new materials are widely applied, and together with information technology and biotechnology, they have become the most important and promising field in the 21st century. New materials can be divided into metallic materials, inorganic non-metallic materials, organic polymer materials and advanced composite materials according to their composition.

The development of China's new materials industry has mainly gone through four stages. From 1949 to 1978, it was an initial stage, due to historical reasons and weak technical foundation, the production capacity of China's new material industry at this stage was very limited. At that time, China's new materials were mainly imported from the Soviet Union and other countries, and domestic production was mainly concentrated on some basic materials, such as steel, aluminum, copper, etc. The domestic research and development capacity of new materials has not yet been formed, and it is mainly based on learning and imitation.

From 1978 to 1999, it was an early stage of development. In 1978, the policy of reform and opening up brought development opportunities for China's new materials industry, and China began to attach importance to the research and development and production of new materials. At the same time, with the progress of science and technology and the introduction of talents, China's new materials industry began to shift from imports to independent research and development, and gradually mastered the intellectual property rights of some key technologies. New materials began to be used in high-end fields such as aerospace, electronics, optoelectronics, and communications, and at the same time, the research and development of environmentally friendly materials also began to start.

From 2000 to 2015, it was a stage of rapid development, during which China's new materials industry made major technological breakthroughs in many fields, such as high-temperature superconductors, nanomaterials, biomaterials, etc. The scale of the new materials industry has expanded rapidly, the output value and technical level have been greatly improved, and the market share has been continuously improved. At the same time, the state has issued a series of policy documents to support the development of the new materials industry, such as the “Outline of the National Medium and Long-term Science and Technology Development Plan (2006-2020)”, which lists new materials as one of the key frontier technologies for development.

Since 2016, it has been a stage of high-quality development. Since 2016, China's new materials industry has entered a stage of high-quality development, and innovation-driven capacity has become the main driving force for development. Enterprises increase R&D investment to promote technological innovation and industrial upgrading. The new materials industry continues to develop towards higher-end fields, such as new energy, artificial intelligence, biomedicine and other fields, significant progress has been made in the research and development of military materials. At the same time, China continues to introduce relevant policies to support the development of the new materials industry, such as “Made in China 2025”, which lists new materials as one of the key high-end areas for development.

The upstream of the industrial chain of the new materials industry is mainly the production and supply of raw materials, including but not limited to steel materials, non-ferrous metal materials, chemical materials, building materials, textile materials, etc., of which chemical materials include crude oil, coal, natural gas, chemical additives, monomer intermediates, etc. The midstream of the industrial chain is the R&D, manufacturing and production of new materials, covering a variety of new material types, including advanced basic materials, key strategic materials and cutting-edge new materials. These new materials are unique in terms of performance, function and application fields, and are widely used in many downstream industries. The downstream of the industrial chain covers many industries such as electronic information, new energy vehicles, energy conservation and environmental protection, home appliance industry, medical equipment, aerospace, textile machinery, construction and chemical industry.

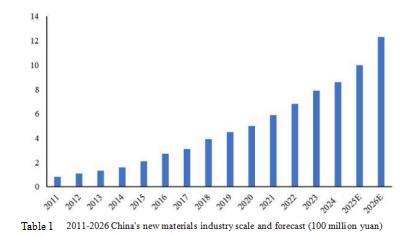

As a strategic and basic industry, the new materials industry has become a key area of high-tech competition at home and abroad. At present, as the “leader” of the world's second echelon, the output value of China's new materials industry accounts for about 1/4 of the world. From 2010 to 2022, the scale of China's new materials industry increased from 0.65 trillion yuan to 6.8 trillion yuan, with a compound annual growth rate of 21.6%. In 2023, the scale of the global and China's new materials industry reached 4.3 trillion US dollars and 7.9 trillion RMB yuan respectively, a year-on-year increase of 13% and 16%, respectively. It is estimated that by 2025, the scale of the global and China's new material industry will reach 5.6 trillion US dollars and 10 trillion RMB yuan respectively; by 2026, the scale of the global and China's new materials industry will reach 6.4 trillion US dollars and 12.3 trillion RMB yuan respectively, with a year-on-year growth rate of more than 10%.

New materials are widely used in electronic and electrical, automobile, new energy, medical, aerospace, new buildings and other fields. With the increasing perfection of the manufacturing industry and the development and growth of downstream emerging industries, the application scenarios of new material products continue to expand, forming a strong driving force for China's new material industry. In the first half of 2024, the added value of China's high-tech manufacturing industry above designated size increased by 8.7% year-on-year, 2.7% higher than that of all industries above designated size, and the added value of digital product manufacturing industries such as communication terminal equipment manufacturing, integrated circuit manufacturing, and display device manufacturing will achieve double-digit growth. In the first half of 2024, the added value of high-tech manufacturing and industrial strategic emerging industries in Henan Province increased by 14.3% and 7.7% respectively, driving the growth of industries above designated size in the province by 1.8 and 1.7%, respectively. The added value of industrial strategic emerging industries and high-tech manufacturing accounted for 22.4% and 12.0% of the province's industries above designated size, respectively.

As the role of industrial clusters in the growth of regional economic development is becoming more and more significant, various localities have proposed to accelerate the cultivation and construction of trillion-level industrial clusters in the medium and long-term development plans and government work reports, and make every effort to build a regional trillion-level industrial cluster with advanced manufacturing as the backbone. At present, Guangdong, Jiangsu, Zhejiang, Shandong and other major economic provinces are at the forefront of developing and cultivating strategic emerging industrial clusters. Among the 45 national advanced manufacturing clusters and 66 national strategic emerging industrial clusters, there are 7 and 14 new material industrial clusters respectively, accounting for 16% and 21% respectively.

Looking forward to the future, China's new materials industry will continue to maintain a rapid growth trend. With the continuous progress of science and technology and the continuous expansion of market demand, new materials will play an important role in more fields. China will continue to increase support for the new materials industry, promote technological innovation and industrial transformation and upgrading, and strive to occupy a larger share in the global new materials market.

(2) Analysis of the current situation of the ultra-high molecular weight polyethylene fiber industry

Ultra High Molecular Weight Polyethylene Fiber (UHMWPEF) refers to a kind of high-strength and high-modulus polyethylene fiber that uses polyethylene with an average relative molecular weight (molecular weight) of more than 1 million as the matrix resin material. In order to ensure that the fiber has excellent comprehensive properties, polyethylene with a molecular weight of 3 million~6 million is generally used as the matrix. Ultra-high molecular weight polyethylene fiber is a high-performance fiber, and is known as the world's three major high-tech special fibers together with aramid and carbon fiber.

According to the group standard T/CCFA 01061-2023 “Ultra-high-strength ultra-high molecular weight polyethylene filament” issued by China Chemical Fibers Association, its breaking strength is greater than or equal to 36cN/dtex, and the initial modulus is greater than or equal to 1300cN/dtex.

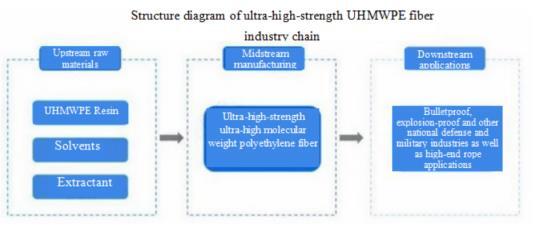

The ultra-high-strength UHMWPE fiber industry chain can be divided into three major links: ultra-high molecular weight polyethylene (UHMWPE) resin, solvents, extractants, etc. in the upstream, ultra-high-strength UHMWPE fiber production in the midstream, and bulletproof, explosion-proof and other national defense and military industries and high-end rope application fields in the downstream. The specific industrial chain structure is as follows:

Table 2 Structure diagram of ultra-high-strength UHMWPE fiber industry chain

As early as the 30s of the 20th century, someone put forward the basic theory of ultra-high molecular weight polyethylene fiber, and in the 70s of the 20th century, Capaccio and Ward of the University of Leeds in the United Kingdom first developed a high molecular weight polyethylene fiber with a molecular weight of 100,000 successfully, which made a phased progress for the ultra-high molecular weight polyethylene fiber. At the end of the 70s of the 20th century, the Dutch company DSM developed the dry spinning technology with decahydronaphthalene as the solvent for the first time to produce ultra-high molecular weight polyethylene fiber, and realized industrial production in 1990.

With the continuous progress of production technology and technology research and development level, the product performance of ultra-high molecular weight polyethylene fiber has been continuously improved, and European and American countries have taken the lead in applying ultra-high-strength UHMWPE fiber in the field of national defense and military industry, including individual protective equipment (such as body armor, bulletproof helmet, bulletproof insert plate, bulletproof shield, explosion-proof clothing, explosive-searching clothing, EOD suit, etc.), helicopter/tank/cash transport vehicle and ship armor protection plate, radar protective shell cover, missile cover, parachute, etc.

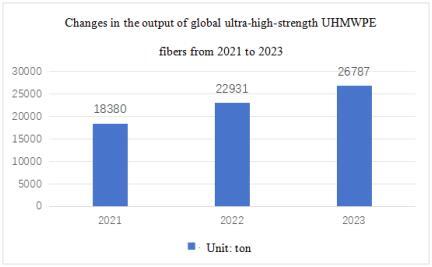

In recent years, the intensification of geopolitical conflicts and international military conflicts have led to the growth of consumer demand for military equipment and supplies, which has led to a significant increase in the consumption demand for ultra-high-strength UHMWPE fiber. In 2023, the total global output of ultra-high-strength UHMWPE fiber will reach 26,787 tons, with a compound growth rate of more than 20% from 2021 to 2023.

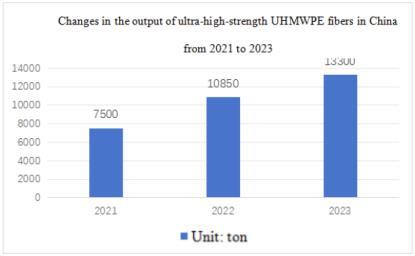

China is the world's second-largest military spender, accounting for 12% of the world's military spending in 2023, second only to the United States. At the same time, China is also one of the world's major manufacturers of military equipment and supplies, and there is a large consumer demand for ultra-high-strength UHMWPE fibers used in the field of national defense and military equipment. In 2023, China's ultra-high-strength UHMWPE fiber output will reach 13,300 tons.

Ultra-high molecular weight polyethylene fiber is an important strategic material urgently needed in China and has been widely used in the military. In recent years, the proportion of China's national defense equipment investment has been increasing, which will greatly promote the demand for ultra-high molecular weight polyethylene fiber in China.

1.1.3 Technical analysis

The main production processes of ultra-high molecular weight polyethylene fiber are as follows: Preparation of raw materials-twin-screw extruder-spinning box-spinneret-extraction-drying-heating and drafting-winding and forming.

1.1.4 Advantageous conditions of project construction

(1) Policy advantages

The “Outline to Improve Quality of Development” proposes to strengthen the main position of enterprise innovation, guide enterprises to increase investment in quality technology innovation, promote the application of new technologies, new processes and new materials, and promote variety development and quality upgrading.

The “Outline of the Strategic Plan for Expanding Domestic Demand (2022-2035)” proposes to promote the research and development and application of cutting-edge new materials. Promote the application and industrialization of major equipment projects, accelerate the research and development of large aircraft, aero engines and airborne equipment, and promote the construction of satellite and application infrastructure.

The “Guiding Opinions on Expanding Investment in Strategic Emerging Industries and Cultivating and Strengthening New Growth Points” clearly states that the strengths and weaknesses of the new materials industry should be accelerated. Focusing on ensuring the stability of the industrial chain and supply chain in key areas such as large aircraft, microelectronics manufacturing, and deep-sea mining, we will accelerate breakthroughs in photoresists, high-purity targets, high-temperature alloys, high-performance fiber materials, high-strength and high-conductivity heat-resistant materials, corrosion-resistant materials, large-size silicon wafers, and electronic packaging materials. Implement the action plan for the innovation and development of new materials, improve the technical level of rare earth, vanadium titanium, tungsten molybdenum, lithium, rubidium, cesium, graphite and other characteristic resources in mining, smelting, deep processing and other links, and accelerate the expansion of the application of graphene and nanomaterials in optoelectronics, aviation equipment, new energy, biomedicine and other fields.

In the “Jilin City Investment Promotion Policy”, it is clear that the investment projects of Jilin Industrial Investment Guidance Fund should be in line with the national and relevant industrial policies and development plans, focusing on tourism, medicine and health, aviation, information technology, new materials, advanced equipment manufacturing, biotechnology, energy conservation and environmental protection, new energy, cultural creativity, modern agriculture, modern service industry and other related industries in Jilin City's “6411” industrial planning, as well as other areas whose development is focused on and supported by the municipal government. In addition to the investment method of equity participation in the establishment of sub-funds, the guidance fund can also adopt follow-up investment, direct investment, etc.; newly introduced eligible investment projects will enjoy tax reduction and exemption in accordance with the current national and provincial tax policies. For projects with a large contribution rate to Jilin City, in accordance with the spirit of the Notice of the State Council on Matters Related to Preferential Policies such as Taxation (Guo Fa [2015] No. 25), the relevant departments shall assist enterprises in applying for tax reduction and exemption in accordance with laws and regulations; Set up special funds for the development of industrial enterprises, and encourage the introduction of traditional industries such as chemical industry, automobile, metallurgy, and agricultural product processing in the “6411” industrial system, which are in line with national industrial policies, have strong industrial support, and have obvious driving effects. Encourage the introduction of emerging industries such as medicine and health, new materials, advanced equipment manufacturing, and electronic information. In the allocation of production factors, we will give priority to recommending relevant national and provincial special fund support.

(2) Resource advantages

Jilin City has great potential for resource development. The installed power capacity of the city was 10 million kilowatts, and the new installed capacity during the “14th Five-Year Plan” period was 3.279 million kilowatts, with an average annual growth rate of 8.3%, including: 3.07 million kilowatts of coal-fired power generation, accounting for 30.7%; 860,000 kilowatts of gas-fired power generation, accounting for 8.6%; 1.54 million kilowatts of wind power, accounting for 15.4%; 700,000 kilowatts of photovoltaic power generation, accounting for 7%; 3.5 million kilowatts of hydropower (3.2 million kilowatts of conventional hydropower and 300,000 kilowatts of pumped storage), accounting for 35%; 270,000 kilowatts of biomass power generation, accounting for 2.7%; Waste-to-energy: 58,000 kilowatts, accounting for 0.6%; New and renewable energy installations accounted for 60.7% of the total installed capacity. It is estimated that by 2025, the power generation capacity will be 20.63 billion kWh in, and the total substation capacity of urban and rural power grids will reach 4891.1 megavolt-ampere.

The land area available for use in Jilin City is 853 hectares, including 74 hectares of commercial land, 500 hectares of industrial and mining storage land, 179 hectares of residential land (of which affordable housing land should be guaranteed), and 100 hectares of other land (including public management and public services, transportation, water and water conservancy facilities and special land). The stock of developable land resources is large, and the new land and reserve land can meet the needs of new projects, and the land price is at a low price among the 41 cities in Northeast China.

(3) Industrial advantages

Jilin City is the old industrial base city in Northeast China, known as the cradle of the national chemical industry, the first metallurgical industrial base, the mother of hydropower in New China. During the “First Five-Year Plan” period, of China's 156 key projects, Jilin City occupied “7 and a half” (Jilin Dye Factory, Jilin Fertilizer Plant, Jilin Calcium Carbide Plant, Jilin Carbon Plant, Jilin Ferroalloy Plant, Jilin Thermal Power Plant, New China Sugar Plant Construction and Operation, Fengman Power Plant Reconstruction and Expansion), contributed the first bag of fertilizer, the first barrel of dye, the first furnace of calcium carbide to China. In terms of chemical industry, it has nearly 1,000 sets of chemical industry-grade devices above designated size, the production capacity of 11 sets of equipment such as methyl isobutyl ketone and methyl methacrylate ranks among the top three in China, and with a total investment of 33.9 billion yuan, the construction of the transformation and upgrading project of Jihua's 1.2 million tons of ethylene is progressing in an orderly manner, which is the largest single investment industrial project in our province since the founding of the People's Republic of China, and it is also the first chemical project of PetroChina Group to use all green electricity. After its completion and operation, PetroChina Jihua Company will march into a world-class enterprise. In terms of carbon fiber industry, it has the only “national carbon fiber high-tech industrialization base” approved by the Ministry of Science and Technology of the People's Republic of China, forming the most complete carbon fiber industrial chain in China from “acrylonitrile-acrylonitrile-based precursor-carbon filament-downstream products”, with the world's first precursor production capacity, the first in China and the second in the world. In terms of metallurgical industry, with the largest metallurgical base in the province and two national metallurgical technology centers, Jianlong Group has become the first steel production enterprise in the province.

(4) Talent advantages

Jilin City has Northeast Electric Power University, Jilin General Aviation Vocational and Technical College, Jilin Technology College of Electronic Information, Jilin Vocational College of Industry and Technology and other colleges and universities, providing a steady stream of talent support for enterprises. These talents not only have rich practical experience, but also have a high level of technology and innovation ability. They are able to solve various technical problems in the production process and improve production efficiency and product quality. At the same time, these professional and skilled personnel can also actively participate in the company's technological innovation and product research and development, providing a strong guarantee for the sustainable development of the enterprise.

At the same time, Jilin City has a large number of high-quality industrialized workers. Trained by enterprises and public welfare institutions, more than 10,000 skilled talents are sent to the society every year, and more than 20,000 people are trained for the society. The advantages of labor resources are obvious, the proportion of skilled workers is at a high level in the Northeast urban agglomeration, the labor force is in the dividend period, the labor cost is relatively low, which can meet the needs of various enterprises.

(5) Location advantages

Jilin City is located in the east of the central part of Jilin Province, bordering Yanbian Korean Autonomous Prefecture in the east, Changchun City and Siping City in the west, Harbin City in Heilongjiang Province in the north, and Baishan City, Tonghua City and Liaoyuan City in the south.

Jilin City is located in the geographical center of Northeast Asia, and its transportation modes include railways, highways, water transportation, aviation and other forms. Jilin Longjia International Airport and Jilin Airport, as well as Changchun-Hunchun and Shenyang-Harbin Expressways, Changchun-Hunchun Intercity Railway, Shenyang-Harbin Double-track Railway and other transportation arteries constitute a three-dimensional transportation network that extends in all directions, fast and convenient.

1.2 Contents and scale of project construction

1.2.1 Scale of Construction

With an area of 120,000 square meters, the project can produce 5,000 tons of UHMWPE fiber annually after completion.

1.2.2 Contents of Construction

With a total construction area of 100,000 square meters, the project is planned to mainly build raw material warehouses, production workshops, drying workshops, molding workshops, product warehouses, trading centers, office centers, etc., and purchase a production line with an annual output of 5,000 tons of UHMWPE fiber.

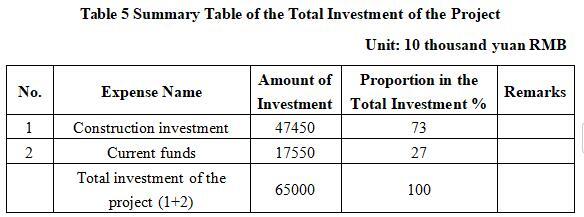

1.3 Total investment of the project and capital raising

1.3.1 Total investment of the project

The total investment of this project is 650 million yuan, including construction investment of 474.5 million yuan and current funds of 175.5 million yuan.

1.3.2 Capital raising

Self-funded by enterprises.

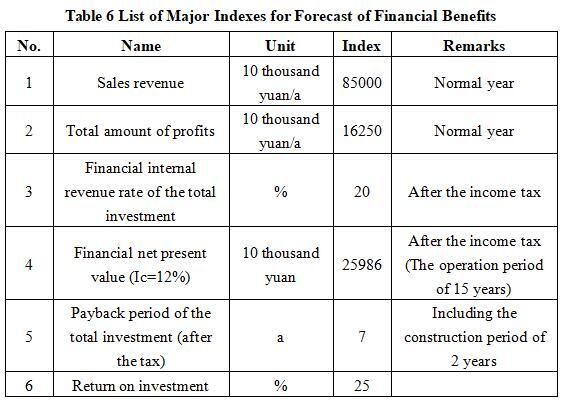

1.4 Financial analysis and social evaluation

1.4.1 Main financial indexes

After the project reaches the production capacity, its annual sales income will be 850 million yuan, its profit will be 162.5 million yuan, its investment payback period will be 7 years (after the tax, including the construction period of 2 years) and its investment profit rate will be 25%.

Note: “10 thousand yuan” in the table is in RMB.

1.4.2 Social evaluation

The development of the ultra-high molecular weight polyethylene fiber project will help promote the development and application of new materials. The fiber has the advantages of high strength, good impact resistance and wear resistance, and can be used in high-tech fields such as automobiles and aerospace. Its application will also improve the performance indicators of related products, promote technological innovation and product upgrading in the industry, and promote the rapid development of social economy. At the same time, it will bring rich economic and social benefits.

1.5 Cooperative way

Joint venture and cooperation, other ways are negotiable.

1.6 What to be invested by the foreign party

Funds, other ways are negotiable.

1.7 Construction site of the project

Jilin Economic and Technological Development Zone.

1.8 Progress of the project

Planning stage.

2. Introduction to the Partner

2.1 Basic information

Name: Management Committee of Jilin Economic and Technological Development Zone

Address: Jilin Economic and Technological Development Zone

2.2 Overview

Jilin Economic and Technological Development Zone was established in 1998, located in the northwest suburbs of Jilin City, 85 kilometers away from the provincial capital city of Changchun, in April 2010, approved by the State Council to promote to the national economic and technological development zone, with an administrative jurisdiction area of 93.06 square kilometers, a planning area of 20.4 square kilometers, and the planning area of four to the scope is: Block 1: It is east to Songhua River, south to Jiuzhan Village, Jiuzhan Township, west to Toutaizi Village, Jiuzhan Township, and north to Tongxi River. Block 2: It is bounded by Jilin Academy of Agricultural Sciences in the east, Jiulong Road in the Development Zone in the south, Changchun-Tumen Railway in the west, and Jiuxing Road in the Development Zone in the north. Block 3: It is east to Changchun-Tumen Railway, south to Fanrong Village, Jiuzhan Township, west to Koujia Village, Jiuzhan Township, and north to Toutaizi Village, Jiuzhan Township. It has passed the certification of ISO14001 environmental management system and ISO9001 quality management system, and is the core area of Jilin National Carbon Fiber High-tech Industrialization Base determined by the Ministry of Science and Technology, and is the most competitive fine chemical industry agglomeration area in Northeast China.

2.3 Contact method

Contact method of the project unit:

Contact unit: Jilin Economic and Technological Development Zone Investment Promotion Bureau II

Contact person: Yang Fenghan

Tel: +86-432-63501333

+86-17644290027

Contact method of the city (prefecture) where the project is located:

Contact unit: Investment Promotion Service Center of Jilin Municipal Bureau of Commerce

Contact person: Jiang Yuxiu

Tel: +86-432-62049694

+86-15804325460

E-mail: jlstzcjfwzx@163.com