New Material

Graphite Industrial Park Construction Project of Liaoyuan City

1 Introduction to the Project

1.1 Project background

1.1.1 Product introduction

Graphite, also known as black lead, is an allotropic form of carbon with a relative density of 2.256 g/cm3. Graphite is opaque and greasy to the touch, the color varies from iron black to steel gray, and the shape can be crystalline, flaked, scaly, striped, and layered. Graphite has low hardness, stable chemical properties, is not easy to react with acids, alkalis and other agents, has high temperature resistance, corrosion resistance, thermal shock resistance, radiation resistance, high strength, good toughness, and also has self-lubrication, electrical conductivity, thermal conductivity and other physical and chemical properties.

Due to its excellent physical and chemical properties, graphite is widely used in many fields:

(1) Refractories: It is used in the manufacture of magnesia carbon bricks, aluminum carbon bricks, crucibles and related products.

(2) Steelmaking: It is used as a carburizer in the steelmaking industry.

(3) Conductive materials: It is used as an anode material for electrodes, brushes, carbon rods, carbon tubes, mercury rectifier anodes, etc., for electrolysis of metals, and conductive materials for resistance furnaces.

(4) Wear-resistant and lubricating materials: Used as a lubricant in the machinery industry, graphite emulsion is also a good lubricant for many metalworkings.

(5) Corrosion-resistant materials: It is used to make heat exchangers, reaction tanks, condensers and other equipment.

(6) Casting, sand turning, stamping and high metallurgical materials: It is used in the foundry and metallurgical industry.

(7) Atomic energy industry and defense industry: It is used for the manufacture of nozzles for solid-fuel rockets, nose cones for missiles, parts for cosmonautical equipment, etc.

(8) Other applications: Anti-scale and anti-rust materials, preparation of graphene, lithium battery anode materials, high thermal conductivity graphite blocks and heat dissipation films, expanded graphite and flame retardant materials, graphite sealing materials, etc.

Relying on the advantages of graphite and carbon fiber industry in Xi'an Industrial Concentration Zone, the project is planned to build a graphite industrial park integrating production, research and development, inspection and testing, and financing services.

1.1.2 Market prospect

Graphite can be divided into two categories according to the source: natural graphite and artificial graphite. Natural graphite mainly comes from graphite ore, and can be divided into scale, soil and block according to different shapes; Artificial graphite is made by processing petroleum coke and asphalt coke that are easy to graphitize.

Synthetic graphite is a carbon material artificially made by chemical or physical methods, with similar structure and properties to natural graphite. The material is widely applied in a variety of fields, from battery manufacturing to aerospace, where synthetic graphite plays a key role. The global synthetic graphite market size was approximately 9.104 billion US dollars in 2023 and is expected to reach 17.86 billion US dollars by 2030, growing at a compound annual growth rate (CAGR) of 8.7% during 2024-2030.

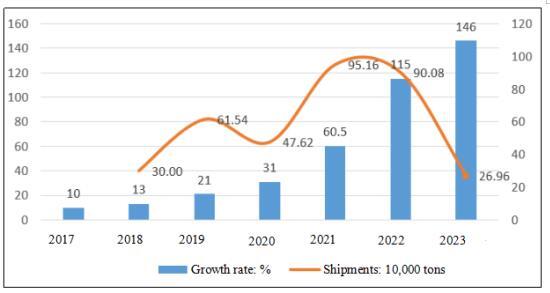

The global synthetic graphite materials market size was valued at approximately 8.678 billion US dollars in 2023 and is expected to reach 17.500 billion US dollars by 2030, with a CAGR of 9.2% during 2024-2030. In 2023, the market size of China's synthetic graphite reached 25.404 billion yuan, and the shipment volume was 1.46 million tons, a year-on-year increase of 26.96%.

Table 1 China's synthetic graphite shipments and growth rate from 2017 to 2023

The core global manufacturers of synthetic graphite include Chengdu Fangda Carbon Composite Materials Co., Ltd., Showa Denko, Graphite India, Jilin Carbon and GrafTech, etc., and the top five manufacturers account for about 46% of the global share. China is the largest market with about 50% share, followed by Japan and Europe with 16% and 12% respectively. In terms of product type, graphite electrodes are the largest segment, accounting for about 60% of the share, while in terms of downstream, the steel industry is the largest downstream segment with a 46% share.

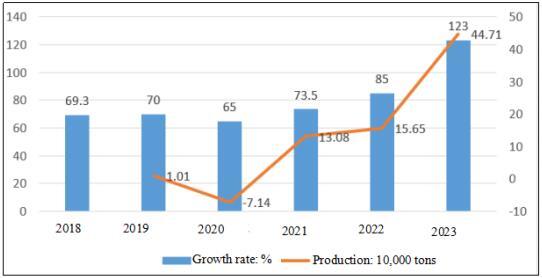

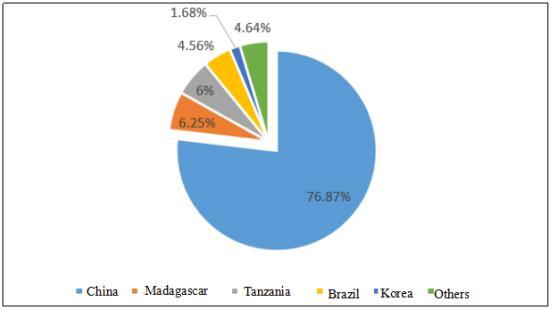

In 2023, China's natural graphite output was 1.23 million tons, a year-on-year increase of 44.71%, accounting for 76.87% of the global total. Global graphite production is growing steadily, and China, as the world's largest graphite producer and exporter, occupies a leading position in both production and export.

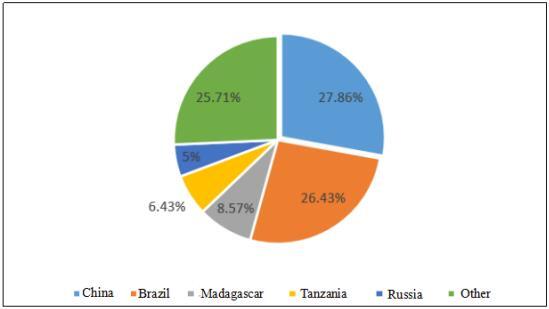

Table 2 Distribution of global natural graphite reserves in 2023

Natural graphite is an important non-renewable mineral resource, and only a few countries have abundant graphite minerals. According to the data, the global natural graphite reserves in 2023 was 280 million tons, of which China's natural graphite reserves rank first in the world, reaching 78 million tons, accounting for 27.86% of the global reserves, mainly distributed in Heilongjiang, Inner Mongolia, Shanxi, Sichuan, Shandong, Hunan and Xinjiang and other regions, dominated by crystalline graphite; This is followed by Brazil and Madagascar, accounting for 26.43% and 8.57% respectively.

Table 3 Natural graphite production and year-on-year growth from 2018 to 2023

China is also the world's largest producer of natural graphite, and its output has long ranked first in the world. According to the data, China's natural graphite production accounted for 76.87% of the global market in 2023, far exceeding the second place Madagascar (6.25%).

Table 4 Distribution of global natural graphite production in 2023

The distribution of natural graphite resources in China is uneven, and the overall distribution is “widely distributed, more in the east and less in the west, and individual enrichment”. In order to integrate advantageous resources, optimize the industrial layout, and promote the cluster development of natural graphite industry, according to the distribution of natural graphite resources, China has formed six natural graphite production and processing bases in five provinces (regions) of Heilongjiang, Inner Mongolia, Shandong, Hunan and Jilin, with an output of more than 80% of that of the whole country. It is reported that the six natural graphite production and processing bases are Heilongjiang (Jixi, Luobei), Shandong (Pingdu) and Inner Mongolia (Xinghe), which mainly produce crystalline graphite (including flake graphite), and Hunan (Chenzhou) and Jilin (Panshi), which mainly produce cryptocrystalline graphite.

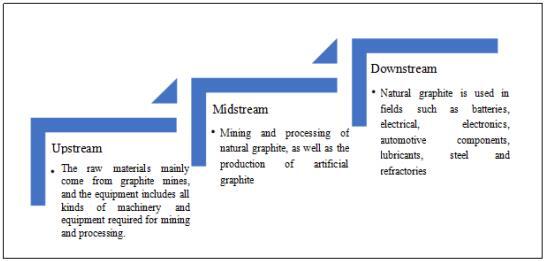

The industrial chain of natural graphite includes upstream raw materials and equipment, midstream product processing (natural graphite and artificial graphite), and downstream end applications (such as lithium batteries and heat dissipation materials).

Table 5 Upstream and downstream industrial chain of natural graphite

At present, the mainstream cathode materials in China are natural graphite and synthetic graphite, which together account for more than 90%. Due to the continuous improvement of the battery life requirements of downstream terminal new energy vehicles, synthetic graphite products have better performance and better use effect, which can better meet the needs of downstream enterprises than natural graphite products. Therefore, synthetic graphite is very popular, and the market share in cathode materials has exceeded 80%. At the same time, in recent years, China has successively issued relevant policies such as the “New Energy Vehicle Industry Development Plan (2021-2035)” to support and promote the development of the new energy vehicle industry. Under the vigorous promotion of national policies, China's new energy vehicle industry has developed rapidly, and its output and sales have continued to rise, bringing sustainable development momentum and broad market space to the synthetic graphite industry. According to the data, its production and sales in 2023 reached 9.587 million and 9.495 million respectively, a year-on-year increase of 35.83% and 37.87%, respectively.

Driven by the rapid development of new energy vehicles and the rise of installed capacity in the field of energy storage, the downstream market demand for synthetic graphite in China is strong, which promotes its market size and shipments. According to the data, its market size exceeded 50 billion yuan in 2022, a year-on-year increase of 100.99%; the shipment volume rose to 1.15 million tons, a year-on-year increase of 88.98%. With the continuous development of the new energy vehicle industry, it is expected that the scale of the synthetic graphite industry will continue to expand in the future.

According to the International Energy Agency (IEA), global demand for graphite resources is expected to surge to 16.023 million tons by 2040, a figure that will quadruple the demand in 2021. This growth trend reflects the dramatic rise in demand for graphite as a building block material as the global economy accelerates its transition to decarbonization and electrification. With the continuous improvement of the performance requirements of the downstream industry for graphite products, high-end and refinement have become an inevitable trend in the development of the graphite products industry.

To sum up, the project relies on the existing foundation of the graphite and carbon fiber industry in the industrial concentration area of Xi'an District to build a graphite industrial park integrating production, research and development, inspection and testing, and financing services, with good market prospects.

1.1.3 Advantageous conditions of project construction

(1) Policy conditions

In order to protectively develop and efficiently utilize graphite resources, optimize the industrial structure, promote technological innovation, protect the ecological environment, and lead the high-quality development of the industry, the Ministry of Industry and Information Technology issued the “Graphite Industry Standard Conditions”.

The “14th Five-Year Plan” for the Development of Raw Material Industry points out: By 2025, the scale of the new material industry will increase, and the proportion of the raw material industry will increase significantly; an industrial development pattern of higher quality, better efficiency, better layout, greener and safer has been initially formed.

In January 2024, the Ministry of Industry and Information Technology and other departments issued the “Implementation Opinions on Promoting the Innovation and Development of Future Industries”, proposing: Promote the upgrading of advanced basic materials such as non-ferrous metals, chemicals, and inorganic non-metals, develop key strategic materials such as high-performance carbon fiber and advanced semiconductors, and accelerate the innovative application of cutting-edge new materials such as superconducting materials.

In 2020, the Office of the People's Government of Liaoyuan Municipality issued the “Implementation Measures for the Flexible Transfer of Industrial Land in Liaoyuan City (Trial)”, proposing; The supply of industrial land by means of flexible term, lease before transfer, combination of lease and transfer, and long-term lease shall be supplied by means of bidding, auction and listing in accordance with the law; In principle, the flexible transfer period of industrial land shall be 10, 20, 30 and 40 years. Enterprises are allowed to voluntarily choose the term of land use right transfer during the period. The “Implementation Measures” not only reduce the cost of industrial land in Liaoyuan City, but also improve the land supply system of Liaoyuan City.

(2) Resource advantages

In recent years, Liaoyuan City has continued to optimize and adjust the energy structure, comprehensively launched the construction of a clean energy heating demonstration city in the north, and carried out 47 clean heating transformation projects such as “coal to gas” and “coal to electricity”, which is expected to reduce coal consumption equivalent to 510,000 tons of standard coal. In addition, Liaoyuan is rich in wind, solar, biomass and other resources, providing support for the construction of green and low-carbon projects.

(3) Industrial advantages

Xi'an District closely focuses on the national industrial policy, combines its own advantages, regards the graphite and carbon fiber industry as the key development direction of the new material industry, and actively promotes the upgrading and cluster development of the graphite and carbon fiber industry, with carbon fiber felt accounting for more than 80% of the national market share.

In recent years, graphite deep-processing products have been widely used in medical equipment, nuclear energy, aerospace and other fields, becoming a “celebrity” in the field of new materials, and being reserved as a strategic resource by developed countries in the world.

(4) Talent advantages

Liaoyuan City is rich in human resources, and there are vocational colleges in the urban area, which can train talents according to the needs of enterprises. Liaoyuan City has a good foundation for industrial development, only 115.13 kilometers away from Changchun, a well-known “university town” and “automobile city”, which can meet the needs of enterprises for all kinds of talents.

(5) Location and transportation advantages

Liaoyuan has obvious geographical advantages, 140 kilometers away from Changchun Longjia International Airport in the north and 240 kilometers away from Shenyang Taoxian International Airport in the south. It is located in the important axis of Changchun one-hour economic circle and Shenyang-Tieling urban agglomeration. Within a radius of 200 kilometers, there are 2 provincial capitals and 8 prefecture-level cities, with a population of nearly 40 million. The urban area has built a transportation network of “three rings, four verticals and six horizontals”. The inter-regional highway and railway traffic is developed. The National Highway 303 and the Siping-Meihekou Railway running through the whole territory, and the Liaoyuan-Xifeng and Liaoning-Changchang Railways, the Changchun-Liaoyuan, Yingchegnzi-Meihekou, Jilin-Caoshi, and Liaoyuan-Xifeng Expressways and the Liaoyuan Civil Airport that will be built soon constitute a comprehensive transportation system that enters the hinterland of the Northeast and enters the sea and customs.

1.2 Contents and scale of project construction

With an area of 58,000 square meters and a construction area of 45,100 square meters, the project is planned to mainly build production plants, R&D centers, warehouses, etc., and purchase production equipment.

1.3 Total investment of the project and capital raising

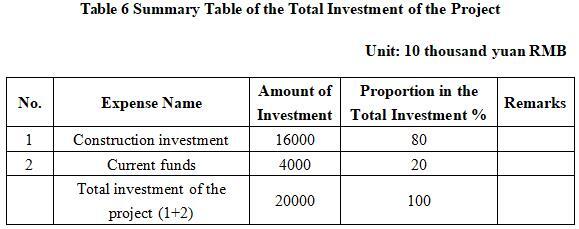

1.3.1 Total investment of the project

The total investment of this project is 200 million yuan, including construction investment of 160 million yuan and current funds of 40 million yuan.

1.3.2 Capital raising

Self-funded by enterprises

1.4 Financial analysis and social evaluation

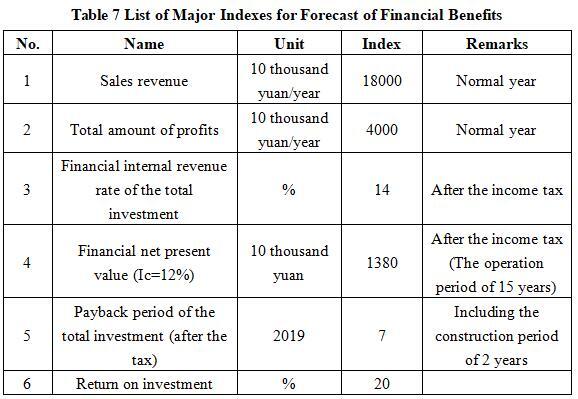

1.4.1 Main financial indexes

After the project reaches the production capacity, its annual sales income will be 180 million yuan, its profit will be 40 million yuan, its investment payback period will be 7 years (after the tax, including the construction period of 2 years) and its investment profit rate will be 20%.

Note: “10 thousand yuan” in the table is in RMB.

1.4.2 Social evaluation

After the completion of the project, it can promote the development of the new material industry in Liaoyuan City and form an industrial agglomeration; at the same time, it can provide more jobs for the local area, improve the local economic situation, improve the people's living standards, and promote the harmonious development of society.

1.5 Cooperative way

Joint venture and cooperation, other ways are negotiable.

1.6 What to be invested by the foreign party

Funding, other ways are negotiable.

1.7 Construction site of the project

Liaoyuan Xi'an Industrial Concentration Zone.

1.8 Progress of the project

Foreign investment attraction.

2. Introduction to the Partner

2.1 Basic information

Name: Liaoyuan Xi'an District Industrial Concentration Zone

Address: No. 1076, Renmin Street, Xi'an District, Liaoyuan City, Jilin Province.

2.2 Overview

Liaoyuan Xi'an Industrial Concentration Zone is a provincial-level industrial concentration zone approved by the provincial government in 2005 and enjoys some provincial-level management authority. It is located in Xi'an District, Liaoyuan City, with a planned area of 20.74 square kilometers. The concentration area is only one hour away from Changchun and Siping, and two hours away from Shenyang. The exit of Liaoyuan-Changchun Expressway is located in the concentration area, and three of the two zones and two parks have special railway lines, which have the relative location advantage of undertaking industrial transfer and spillover of production factors.

There are a lot of coal resources in the ground in the whole area, and there are also high-quality and abundant building raw materials-basalt and granite buried in the northwest. There are 190 industrial enterprises in Xi'an District, with total assets of 648.57 million yuan. An industrial system has been initially formed based on seven pillar industries: health food, mechanical processing, construction development, coal mining, new materials, building materials, and logistics services.

2.3 Contact method

Postal code: 136699

Contact person: Song Wenbo

Tel: +86-437-3635345 +86-15143722888

E-mail: lyxajh@163.com

Contact method of the city (prefecture) where the project is located:

Contact unit: Liaoyuan Municipal Bureau of Commerce

Contact person: Ai Jing

Tel: +86-18643787709

E-mail: lyjhjxmc@163.com