New Material

50,000 Annual Output New Energy Battery Aluminum Shell Project of Meihekou City

1 Introduction to the Project

1.1 Project background

1.1.1 Product introduction

The battery case of new energy vehicles is an important component to ensure the safe and stable operation of the battery. Its main function is to protect the internal battery from the external environment, such as impact, high temperature, moisture, etc., while also providing structural support and thermal management for the battery. When selecting a material, it is important to consider the mechanical properties, thermal management and flame retardancy of the material, as well as other properties such as corrosion resistance and insulation.

There are two main types of battery case materials for new energy vehicles: aluminum case and steel shell, among which aluminum case has the advantages of easy processing and forming, high temperature corrosion resistance, good heat transfer and electrical conductivity. The aluminum alloy power battery case can be stretched and formed at one time, which can save the bottom welding process compared to the steel case, so as to avoid the problem of reducing the quality of the weld due to the burning of metal elements.

Relying on the strategy of Jilin Province to fully promote the “six returns”, the project has the industrial foundation of Meihekou City in equipment manufacturing and new materials, and produces aluminum cases for new energy batteries, providing supporting facilities for Foday Automobile, CATL, BYD, FAW and other enterprises.

1.1.2 Market prospect

(1) New energy vehicle market prospects

New energy vehicles refer to vehicles that adopt new power systems and are driven entirely or mainly by new energy sources, including plug-in hybrid vehicles (including extended range) vehicles, pure electric vehicles and fuel cell vehicles. In terms of environmental protection and energy saving, new energy vehicles have obvious advantages, and in the context of the “double carbon” strategy, new energy vehicles have become a key industry for the development of countries around the world. In 2023, the market size of China's new energy vehicles reached 373.145 billion yuan (RMB), and the market size of global new energy vehicles reached 1,029.366 billion yuan.

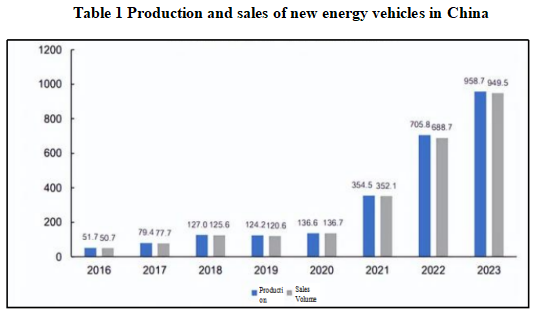

From 2016 to 2020, the growth rate of production and sales of new energy vehicles in China was relatively stable and maintained a high-speed growth since 2021. In 2023, the production and sales of new energy vehicles reached 9.587 million and 9.495 million respectively, maintaining a significant year-on-year growth. The penetration rate increased to 31.55%, an increase of 5.95% compared with 2022, indicating rapid growth in the entire new energy vehicle sector. The production and sales volume of new energy vehicles in China ranks first in the world, and has become an important driving force for the electric transformation of the global automobile industry.

In 2024, the global new energy vehicle market continued to grow. As the world's largest new energy vehicle market, China's new energy vehicle production and sales reached 4.929 million and 4.944 million units in the first half of 2024, an increase of 30.1% and 32% year-on-year, respectively, with a market share of 35.2%. Monthly production and sales continued to hit new highs, and the retail sales of new energy vehicles in August and September continued to exceed the 1 million mark. In 2024, the production and sales of new energy vehicles in China reached 12.888 million and 12.866 million units, respectively. At the same time, the market penetration rate of new energy vehicles continues to increase, and the retail penetration rate has exceeded 50% in the past three months and continues to grow, which means that the era of “more electricity than oil” has arrived. This shows that the new energy vehicle industry is developing rapidly and has great potential in the future.

(2) Power battery market prospects

Power battery is a kind of power supply used to provide power energy, mainly used in various types of electric vehicles (such as electric passenger cars, electric buses, electric special vehicles, etc.) and other equipment that requires electric drive (such as drones, mobile power supplies, etc.). Power battery is the core components of new energy vehicles, and is also an important direction of future energy transformation.

Power batteries are usually composed of battery covers, battery cases, cathode materials, anode materials, battery separators, organic electrolytes, etc. According to different production materials, power batteries can be divided into ternary lithium batteries, lithium manganese oxide batteries, lithium iron phosphate batteries, lithium titanate batteries, etc. As an important part of new energy vehicles, the high-quality development of the new energy vehicle industry will greatly promote the development process of China's power battery industry.

In 2023, the global new energy vehicle battery market sales reached 141.87 billion US dollars, showing a huge market size. It is estimated that by 2030, the global new energy vehicle battery market sales will reach 719.87 billion US dollars, with a compound annual growth rate (CAGR) of 24.7%. The global new energy battery market will maintain a rapid growth trend in the next few years.

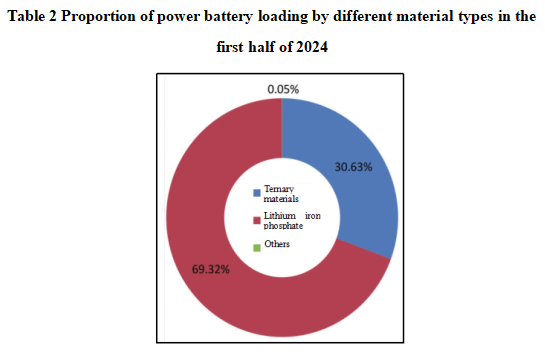

In the first half of 2024, among the total installed capacity of power batteries in China, the cumulative installed capacity of ternary batteries was 62.3GW·h, accounting for 30.63% of the total installed capacity, a year-on-year increase of 29.7%; The cumulative installed capacity of lithium iron phosphate batteries was 141.0GW·h, accounting for 69.32% of the total installed capacity, a year-on-year increase of 35.7%. China's sodium-ion batteries and semi-solid-state batteries have been loaded, and the competition pattern of the power battery sector is still changing. Among them, the installed capacity of semi-solid-state batteries in the first half of the year was 2,154.7MW·h, mainly from Welion New Energy; The installed capacity of sodium-ion batteries is 1.5MW·h, which comes from Funeng Technology, CATL and HiNa Battery.

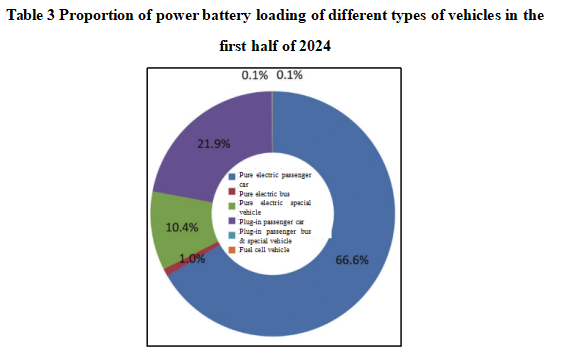

From the perspective of models, the top three types of new energy vehicles in the first half of the year were pure electric passenger cars, plug-in hybrid passenger cars, and pure electric special vehicles, accounting for 66.6%, 21.9% and 10.4% respectively, totaling 98.9%. However, in terms of growth rate, the installed capacity of power batteries for pure electric passenger vehicles increased by 16.3% year-on-year, far lower than the 88.8% of plug-in hybrid passenger cars and 116.4% of pure electric special vehicles.

According to the data of the Ministry of Industry and Information Technology, China's lithium-ion battery industry will continue to grow in 2023, and according to the calculation of the lithium battery industry standard announcement enterprise information and industry associations, the total output of lithium batteries in China will exceed 940GW·h, a year-on-year increase of 25%, and the total output value of the industry will exceed 1.4 trillion yuan.

In the battery sector, the output of consumer, power, and energy storage lithium batteries in 2023 was 80GW·h, 675GW·h, and 185GW·h, respectively. The total export value of lithium batteries in China reached 457.4 billion yuan, a year-on-year increase of more than 33%. In the first-order material sector, the output of cathode materials, anode materials, separators, and electrolytes increased by more than 15% in 2023. In the second-order material sector, the output of lithium carbonate and lithium hydroxide in 2023 was about 463,000 tons and 285,000 tons, respectively.

(3) New energy battery case

With the increasing global attention to new energy vehicles and the rapid expansion of the market, the battery case, as one of its core components, has also ushered in unprecedented development opportunities. As an important protective structure of the battery pack, the design, material selection and manufacturing technology of the battery case are directly related to the safety performance, energy density and service life of the battery.

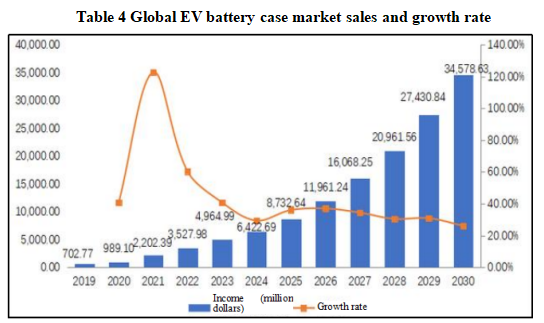

With the rapid growth of electric vehicle projects, the electric vehicle battery case industry is expected to grow rapidly. The global EV battery case market sales reached 4.965 billion US dollars in 2023 and is expected to reach 34.579 billion US dollars by 2030, at a compound annual growth rate (CAGR) of 32.39% (2024-2030).

In new energy vehicles, lithium batteries are the core power source, and the choice of their shell has a decisive impact on the overall performance and safety. In recent years, the range of materials used to develop EV battery cases has expanded, and weight, assembly, and even condensation issues are being addressed. At present, the mainstream lithium battery shell materials on the market are mainly divided into aluminum case and steel case.

The aluminum case is favored for its lightness and is particularly suitable for the manufacture of prismatic lithium-ion batteries. It uses 3003 aluminum plate as the base material, and enhances the performance by incorporating a variety of alloying elements such as manganese, copper, magnesium, silicon and iron, the addition of copper and magnesium effectively improves the hardness and strength of the aluminum shell, while manganese significantly improves its corrosion resistance. In addition, the addition of silicon makes the heat treatment effect better, and the iron element ensures the strength of the aluminum shell in a high-temperature environment. Another advantage of aluminum shells is that they can be directly formed, eliminating the need for welding, and are explosion-proof, high-temperature resistant, and have excellent surface treatment. The material is also easy to customize, making it ideal for the electronics sector, while the recyclability of the aluminium case is environmentally friendly.

Steel shells, as synonymous with sturdiness, once dominated the field of mobile phone batteries. Although the popularity of aluminum shells has had a certain impact on it in recent years, steel shells are still widely used in column-type lithium-ion batteries. The steel's excellent physical stability and ability to withstand pressure have earned it a reputation for safety and reliability. By continuously optimizing the structural design and integrating safety equipment, manufacturers have further improved the safety of steel-shelled batteries, ensuring that they remain ahead of the curve in certain specific application scenarios.

Relying on the industrial foundation of Meihekou City in equipment manufacturing and new materials, the project produces aluminum shells for new energy batteries, providing supporting facilities for new energy battery companies such as Foday Automobile, CATL, BYD, and FAW, with broad market prospects.

1.1.3 Technical analysis

The project adopts modern production technology and automated production line, the manufacturing process mainly includes scrap metal cleaning, molten aluminum mixing, production molding, surface wear detection, board cleaning and exhaust gas treatment, the new molten aluminum uses 70% waste to prepare aluminum alloy, the alloy composition is (mass fraction,%): 0.7~1.3Mn, 1.0~1.5Mg, 0.35~0.5Cu, ≤0.5Si, 0.4~0.65Fe. The strip billet is produced by continuous casting method and hot rolling method with ≥70% reduction, and annealed at a temperature of 700~900°C for more than 0.5h, and then cooled for at least 0.5h. After single-pass cold rolling with 35%~65% reduction, the whole coil is annealed at a temperature of 650~700°C, and then cold rolled to the required thickness at 800~105°C by continuous method. Mature production process and technology, and the conditions for large-scale production.

1.1.4 Advantageous conditions of project construction

(1) Policy advantages

In recent years, China's high-end equipment industry has developed rapidly. The State Council issued the “Decision on Accelerating the Cultivation and Development of Strategic Emerging Industries”, which clarified seven emerging industries: energy conservation and environmental protection, new generation information technology, biology, high-end equipment manufacturing, new energy, new materials, and new energy vehicles. Since then, documents such as “Made in China 2025” have been released. In the “14th Five-Year Plan”, it is mentioned that the core competitiveness of the manufacturing industry is improved, and 8 directions are clarified, namely high-end new materials, major technical equipment, intelligent manufacturing and robotics, aero engines and gas turbines, Beidou industrial applications, new energy vehicles and intelligent (networked) vehicles, high-end medical equipment and innovative drugs, and agricultural machinery and equipment.

On March 21, 2022, the Party Working Committee of Meihe New District, the Management Committee of Meihe New District, the Meihekou Municipal Committee of the Communist Party of China, and the Meihekou Municipal People's Government issued the “Implementation Opinions on Meihekou City to Support the Development of “4+3+N” Leading Industries”, proposing to set up a special fund to support the development of active industries. The equipment manufacturing industry is suitable for enterprises and projects registered in accordance with the law, with independent legal personality, and in line with the development direction of the city's equipment manufacturing industry, focusing on supporting strategic emerging industries, automotive equipment manufacturing and major equipment manufacturing key technological transformation projects, “zero land increase” technological transformation projects without new land and with an equipment investment of more than 3 million yuan, and supporting new equipment (including domestic and imported) projects that are in line with the national “Industrial Structure Adjustment Guidance Catalogue” to encourage and non-restricted, eliminated categories, other equipment manufacturing projects determined by municipal party committees and the municipal government. Where it is proven by the relevant provincial departments as the first piece (set) of new equipment product and a project with an annual sales revenue of 5 million yuan, a one-time financial reward of 300,000 yuan will be given.

(2) Resource advantages

During the “14th Five-Year Plan” period, Meihekou will give the high-tech zone more autonomy in terms of land use, project approval, and industrial development, and allow it to take the lead in experimentation. It will also focus on enhancing the flexibility of land management and providing abundant construction land for the construction of the project.

The “Meihekou City Carbon Peak Implementation Plan” proposes: Accelerate the development and utilization of renewable energy such as solar energy, wind power, and biomass energy, and by 2025, the city's installed wind power generation capacity will reach 30,000 kilowatts. By 2030, the proportion of clean energy and renewable energy utilization will increase significantly. Explore the establishment of renewable energy production bases, optimize the allocation of clean power resources, and accelerate the construction of a new power system with new energy as the main body. By 2025, the construction of new energy storage projects will be steadily promoted. Promote the 220 kV project of Shuguang substation. By 2030, the grid will have a peak load response capacity of 5%. It provides energy security for the construction of the project.

(3) Industrial advantages

With the equipment manufacturing industry and new materials as newly planned and constructed industries, Meihekou City has begun the construction of the equipment manufacturing industrial park, deepened cooperation with BAIC, Qingdao Doublestar Group and Tunghsu Group, introduced BAIC to build automobile modification and parts industrial base projects, and Tunghsu Group to build new energy vehicles, high-end cover glass, and pharmaceutical glass processing and manufacturing projects. At the same time, it has established cooperative relations with FAW Group, Faway Automobile, Tunghsu Group, etc., and will carry out in-depth cooperation in auto parts manufacturing, and the equipment manufacturing industry will become an important increment in the economic development of Meihekou. At the end of the “14th Five-Year Plan” period, the total output value reached 20 billion yuan.

(4) Talent advantages

In recent years, the Meihekou Municipal Party Committee has regarded talents as the “first resource” for the construction of a high-quality development pilot demonstration zone in Jilin Province, and has successively issued policy documents such as the “Implementation Opinions on Further Strengthening Talent Work and Innovation-driven High-quality Development”, the “Implementation Plan of Meihekou City's ‘Millions of Talents Introduction Project'”, and “Several Measures of Meihekou City on ‘Strengthening Talent Support and Helping Rural Revitalization'” to vigorously attract talents to return to their hometowns for employment and entrepreneurship.

(5) Location advantages

Meihekou has outstanding geographical advantages and is an important regional central city in Northeast China. Meihekou, which is located in the southeast of Jilin Province, is an important transportation hub and commercial port in Northeast China, an important node city in the central and eastern parts of Jilin Province, and a regional central city in the southeast of Jilin Province. National Highway 202 and 303 running through the whole territory, and Shenyang-Jilin Railway, Siping-Meihekou Expressway, Meihekou-Ji'an Railway, Shenyang-Jilin Expressway, Yingchengzi-Songjianghe, Yingchengzi-Meihekou Expressway, Ji'an-Shuangliao Transit Expressway, constitute a comprehensive transportation system connecting Changchun-Jilin-Tumen, connecting Bohai Bay and connecting Changbai Mountain. It forms 4 important nodes in the province together with 3 cities of Changchun, Jilin and Siping, and forms an integrated development trend with more than 10 counties and cities in Jilin and Liaoning provinces, radiating and driving more than 4 million people in the surrounding areas.

1.2 Contents and scale of project construction

1.2.1 Product scale

After the completion of the project, the annual output of power battery aluminum cases will be 35,000 pieces.

1.2.2 Contents of project construction

With an area of 20 acres and a construction area of 10,000 square meters, the project is planned to build a new energy battery aluminum shell production line.

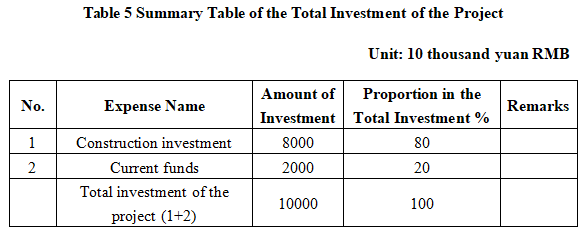

1.3 Total investment of the project and capital raising

1.3.1 Total investment of the project

The total investment of this project is 100 million yuan, including: construction investment of 80 million yuan and current funds of 20 million yuan.

1.3.2 Capital raising

Self-funded by enterprises

1.4 Financial analysis and social evaluation

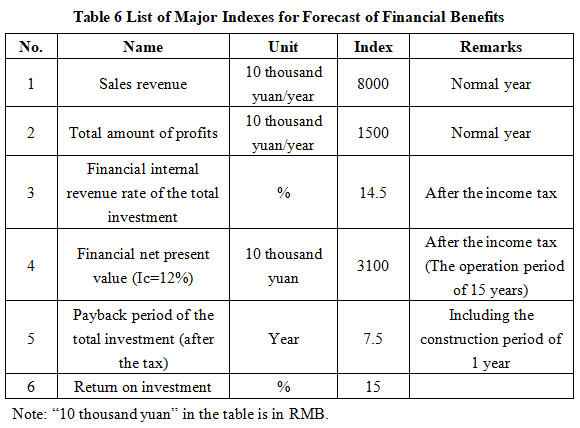

1.4.1 Main financial indexes

After the project reaches the production capacity, its annual sales income will be 80 million yuan, its profit will be 15 million yuan, its investment payback period will be 7.5 years (after the tax, including the construction period of 1 year) and its investment profit rate will be 15%.

1.4.2 Social evaluation

Through the construction of the project, it can promote the development of new energy industry in Meihekou City, extend the new energy industry chain, drive the development of upstream and downstream industries, and form industrial agglomeration; At the same time, it can provide more jobs for the local area, improve the local economic situation, improve the people's living standards, and promote the harmonious development of society.

1.5 Cooperative way

Joint venture and cooperation, other ways are negotiable.

1.6 What to be invested by the foreign party

Funding, other ways are negotiable.

1.7 Construction site of the project

Meihekou City, Jilin Province.

1.8 Progress of the project

Foreign investment attraction.

2. Introduction to the Partner

2.1 Basic information

Name: Meihekou High-tech Industrial Development Zone Management Committee, Jilin Province.

Address: No. 555, Kangmei Avenue, Guangming Street, Meihekou City, Tonghua City, Jilin Province.

2.2 Overview

The predecessor of Jilin Meihekou High-tech Industry Development Zone is Meihekou Economic and Trade Development Zone established in February 2002, covering an area of 5 square kilometers. In December 2019, it was identified as a provincial high-tech zone by the provincial government with a total planning area of 29.82 square kilometers. In the provincial-level development zone comprehensive evaluation, it ranked first in the province, and second in 2020. It has successively won the titles of “National Torch Meihekou Modern Traditional Chinese Medicine Industry Base,” “Jilin Province Pharmaceutical High-tech Industry Base and Pharmaceutical Health Industry Special Park,” “Jilin Province High-tech Industrial Cluster Area,” “National Best Investment Environment Industrial Park,” and “China's Most Promising Industrial Park.”

Meihekou Hi-tech Zone has deeply implemented the “4+3” industrial system, and planned the industrial development layout of “Five Parks, One City, One Center”. It has built pharmaceutical health industry parks, health food industry parks, modern logistics industry parks, construction and supporting industry parks, chemical industry parks, special medical food cities, and Northeast Asia nut distribution centers. Leading industry enterprises, such as Sihuan Pharmaceutical, Buchang Pharmaceutical, Tianheng Pharmaceutical, Lunan Pharmaceutical, Luzhou Laojiao, and Transfar Logistics, have been successfully introduced. Since the “13th Five-Year Plan”, the total investment in fixed assets has reached 42 billion yuan, and the number of registered enterprises has increased to 3,778. It has successively won the honorary titles of National Torch Program Traditional Chinese Medicine Characteristic Industrial Base, Industrial Park with the Best Investment Environment in China, and Industrial Park with the Most Development Potential in China, ranking top 2 in the comprehensive strength evaluation of development zones in the province for four consecutive years. In 2023, the total production value of large-scale enterprises reached 10.33 billion yuan, accounting for 77.9% of the city's total production value.

2.3 Contact method

Postal code: 135000

Contact person: Zhang Yizhen

Tel: +86-13630716007

E-mail: mhxqjhj@163.com

Contact method of the city (prefecture) where the project is located:

Contact unit: Meihekou City Prefecture Bureau of Commerce

Contact person: Mu Zhanyuan

Tel: +86-15643552255

+86-435-4326686

E-mail: 4965278@qq.com