Carbon Fibre

Annual Output of 100,000 Tons Carbon Fiber Project of Changchun City

1. Introduction to the Project

1.1 Project background

1.1.1 Project introduction

Carbon fiber refers to high-strength and high-modulus fibers with carbon content of more than 90%, which is the first of all chemical fibers with high temperature resistance. Carbon fiber is made of acrylic fiber and viscose fiber as raw materials, through high temperature oxidation carbonization, is the manufacture of aerospace and other high-tech equipment of excellent materials, the main products of various grades of high-performance carbon fiber products.

The grades of carbon fiber products are mainly divided according to their mechanical properties, and common grades include T300, T700 and T800. These grades are named with three or four digits at the end representing a specific value of their tensile strength, usually in MPa or GPa. For example, the T700 has a tensile strength of 4,900 MPa, while the T800 has a tensile strength of 5,490 MPa.

1.1.2 Market prospect

(1) Global carbon fiber market

Global carbon fiber demand in 2023 is 115,000 tons, 14.8% lower than 135,000 tons in 2022, breaking the rule of more than 10% growth in recent years. This is the first time since 1995 that the global demand has experienced negative growth, which is an unprecedented experience and challenge for Chinese enterprises.

The application market pattern in 2023 has changed greatly, compared with previous years, the demand for carbon fiber in the wind power market is weak; After 2021, the aerospace and military industry market has rebounded rapidly and returned to the position of leading applications once again.

The sports and leisure market has been on a roller-coaster ride in recent years: Historically, the market has maintained steady growth, with a year-on-year growth of 29.7% in 2022. Western distributors have overstocked their inventory due to market incentives for mass consumption. At the beginning of 2023, the large backlog of inventory in the early period significantly reduced the sales volume, and the sports and leisure use in 2023 fell by 21.7% year-on-year.

In 2023, the pressure vessel market has grown, but due to the tight sales of carbon fiber in 2022, major manufacturers have accumulated a certain amount of inventory at that time, making the supply of carbon fiber in 2023 sufficient, and inventory consumption to meet part of the new demand. In 2023, the global sales amount of carbon fiber is 3.81 billion US dollars, which is 13% lower than that of 4.385 billion US dollars in 2022, and in addition to the reduction in the demand quantity, the price is also significantly lower than the previous two years.

(2) Domestic carbon fiber market

China's total demand for carbon fiber in 2023 is 69,075 tons, compared with 74,429 tons in 2022, a decrease of 7.2%, of which imports are 16,075 tons (accounting for 23.3% of the total demand, 45.4% less than 2022), and domestic fiber supply is 53,000 tons, (accounting for 76.7% of the total demand, an increase of 17.8% over 2022, compared with a growth rate of 53.8% in 2022, and a significant slowdown in 2023).

The Chinese market demand growth throughout the years: 2015 (13.4%), 2016 (16.5%), 2017 (20%), 2018 (32%), 2019 (22%), 2020 (29%), 2021 (27.7%), 2022 (19.3%), 2023 (-7.2%). An inflection point in the market has been reached.

In the current field of carbon fiber application, China's advantageous application industries are sports and leisure, carbon carbon composite (including fire-resistant insulation felt), construction, electronics and electrical; The rapid development of aerospace military industry and pressure vessels has greatly reduced the gap with the international, but the main demand for commercial aviation applications has just started; Wind power (in China's total demand of 17,000 tons, deducting foreign users, only counting the consumption of domestic wind power manufacturers) and the international still have a huge gap; Automotive and hybrid models will have great application potential due to the rapid development of new energy vehicles in China.

(3) Jilin carbon fiber market

By the end of 2023, the province has an annual production capacity of 160,000 tons of carbon fiber, 49,000 tons of carbon fiber, and 22,000 tons of composite production capacity, both of which rank first in China. Product specifications cover 1K, 3K, 6K, 12K, 24K, 48K and other sizes of tow varieties, some product performance has reached T700 level. In 2023, the carbon fiber production of Jilin Province was 111,000 tons, an increase of 39%; The whole industrial chain of carbon fiber completed the total industrial output value of 10.18 billion yuan, an increase of 29.8%. Jilin City carbon fiber industry, with Jilin chemical fiber as the leader, has become one of the three major carbon fiber industry clusters in China, and is now the largest carbon fiber precursor production base and an important low-cost, large tow carbon fiber production base, and the advantages of industrial clusters have initially emerged.

At present, Jilin Province has formed a relatively complete industrial chain of "propylene - acrylonitrile - polyacrylonitrile (PAN) based carbon fiber forefilament - carbon fiber - carbon fiber composite materials and downstream products". Raw silk, carbon silk product specifications cover 1K to 50K and other sizes of 11 kinds of wire tow, of which 12K, 25K, 35K carbon fiber to achieve high-end prepreg, prefab field full coverage, the province's key downstream application enterprises Jilin Guoxing Composite Material Company, Jilin Huayang, Changchun Zhiyuan New Energy Equipment, FAW Group, CRRC Changchun Railway Vehicles, Changchun Long Aerospace, Jilin Yihua Fishing Gear, etc. It involves wind power blades, pressure vessels, lightweight automobile and rail transit, aerospace, weapons and equipment, carbon carbon composite, sports and leisure and other terminal products in many fields.

In general, the carbon fiber industry in Jilin Province has shown a positive development trend in terms of industrial layout, development trend and key enterprises. It is of great significance to promote local economic development and enhance industrial competitiveness.

(4) Carbon fiber product market policy orientation

In recent years, in order to promote the development of the carbon fiber industry, China has issued many policies, such as the "Carbon Peak Action Plan before 2030" issued by the State Council in 2021 to speed up the research and development of basic materials such as carbon fiber, aerogel, special steel, and supplement key parts, components, software and other shortboards.

"Made in China 2025" proposed that the new material industry as a core area and important support for the transformation of the manufacturing industry has received corresponding attention. It is clear that new materials are regarded as one of the ten key areas, and the new materials industry is divided into three key directions: Advanced basic materials, key strategic materials and cutting-edge new materials, and in these three directions, the materials that need to be specifically developed and the specific goals that need to be achieved in 2025 to develop the materials are detailed. The construction of the project is in line with the development direction of the national industry, and the market prospect is optimistic.

1.1.3 Technical analysis

The raw materials of T800 carbon fiber are mainly polymer compounds such as polyacrylonitrile (PAN) or asphalt. These materials are specially treated to form high-strength carbon fiber precursors. The technical process of the project T800 carbon fiber mainly includes raw material selection, spinning, pre-oxidation, carbonization, surface treatment and final processing steps.

1.1.4 Advantageous conditions of project construction

(1) Policy advantageous

Carbon fiber is a dual-use material for military and civilian use, high-end carbon fiber self-reliance is the only way. Therefore, the domestic independent production of high-performance carbon fiber is the only way. In recent years, China has introduced many new policies to promote the development of carbon fiber industry, and began to support the carbon fiber industry with special support funds.

In March 2021, the “14th Five-Year Plan” for National Economic and Social Development and the Outline of 2035 Vision Goals proposed in the outline to strengthen the research and development and application of materials such as carbon fiber in the field of high-end new materials, and local governments have intensively introduced relevant policies to support the development of carbon fiber industry.

In September 2021, the Ministry of Science and Technology plans to promote the establishment of a national technological innovation center for carbon fiber and composite materials. Under the guidance of the government, it will unite carbon fiber and composite materials enterprises, universities and research institutes to break through the common technologies of the whole industry chain, break through the key technical bottlenecks related to the country's long-term development and industrial safety, and support carbon fiber and composite materials enterprises to realize technology, technical equipment and product innovation.

The "14th Five-Year Plan for the Development of Strategic Emerging Industries in Jilin Province" proposes that by 2025, the scale of strategic emerging industries will be further expanded, and a new generation of information technology, biology, intelligent network connection and new energy vehicles will be built up to 300 billion level industries, high-end equipment manufacturing and new materials will be 100 billion level industries. The output value of strategic emerging industries above designated size in the province will increase by 1 percentage point every year to 18.7% by the end of 2025, and strategic emerging industries will become an important support for the comprehensive revitalization of Jilin's old industrial base, with significant improvement in innovation capacity, further optimization of industrial structure, and more rational industrial layout.

(2) Talent advantageous

Changchun is a city located in a university, with 15 state-level key laboratories, 83 independent scientific research institutions such as the Institute of Optical and Mechanical Physics of the Chinese Academy of Sciences, the Institute of Chemical Engineering of the Chinese Academy of Sciences, and the Institute of Geography of the Chinese Academy of Sciences, and 49 institutions of higher learning such as Jilin University and Northeast Normal University. As the main urban area of Changchun City, Kuancheng District has 51 large and middle schools, such as Jilin Engineering Institute, Changchun Institute of Electronic Science and Technology, City College, century-old school Tianjin Road Primary School, which can provide senior managers and technicians for the implementation of the project, and provide high-quality educational resources for employees' children.

(3) Location advantageous

Kuancheng District has a superior geographical position and is the core hinterland of the new city in the north of Changchun. It is located at the intersection of the primary axis of Harbin-Dalian and the main axis of Changchun-Jilin-Tumen pilot area. The Beijing-Harbin Railway divides Kuancheng into two parts: South Railway and North Railway. The South Railway area gathers a number of large commercial and wholesale enterprises, which is one of the most prosperous commercial areas in Changchun. North Railway area is the old industrial base of Changchun, which has a strong industrial base and industrial advantages. In addition, Kuancheng District is adjacent to Changchun New District, in the east, and west to Railway Vehicles Co., Ltd., and other large central enterprises, and is located in the core area of the western industrial corridor in the city's planning layout, and has unique advantages in the future industrial development.

1.2 Contents and scale of project construction

1.2.1 Product scale

The scale of this project is determined to be 100,000 tons of T800 carbon fiber per year.

1.2.2 Contents of project construction

Project construction workshop, office building and supporting facilities.

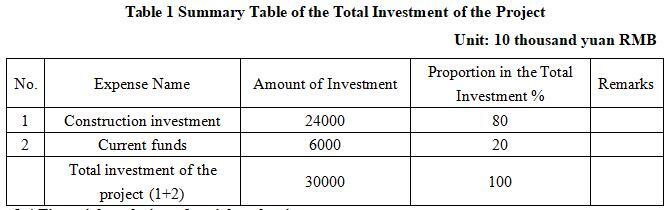

1.3 Total investment of the project and capital raising

The total investment of the project is 300 million yuan, including 240 million yuan for construction.

1.4 Financial analysis and social evaluation

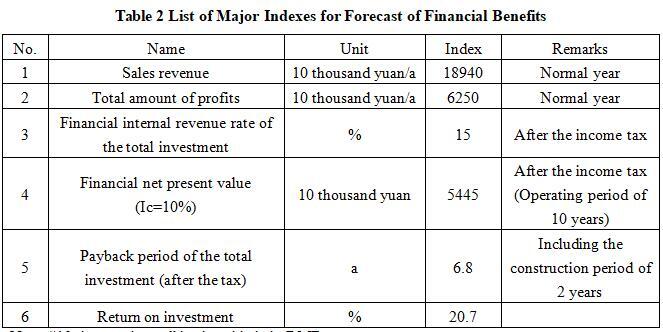

1.4.1 Main financial indexes

After the project reaches the production capacity, the annual sales income is 189.4 million yuan, the profit is 62.5 million yuan, the investment payback period is 6.8 years (after the tax, including the construction period of 2 years), and the investment profit rate is 20.7%.

Note: “10 thousand yuan” in the table is in RMB.

1.4.2 Social evaluation

The commissioning of the carbon fiber project will improve and optimize the local industrial structure and achieve the goal of high-quality development. By improving the production capacity and quality of carbon fiber, we can promote the upgrading of related industrial chains and promote the development of related industries, thus promoting the overall economic improvement.

1.5 Cooperative way

Sole proprietorship, joint venture and cooperation.

1.6 What to be invested by the foreign party

Funds, other methods can be discussed offline.

1.7 Construction site of the project

Changchun Kuancheng Economic Development Zone

1.8 Progress of the project

The project proposal has been prepared.

2 Introduction to the Partner

2.1 Unit basic information

Name: Changchun Kuancheng Economic Development Zone

Address: No.7666, North Kaixuan Road, Kuancheng District, Changchun City, Jilin Province

2.2 Unit overview

Changchun Kuancheng Economic Development Zone (referred to as Changjiang Road Development Zone) was established in April 1998 with the approval of Changchun Municipal Party Committee and Changchun Municipal People's Government. In September 2001, it was approved as a provincial development zone by Jilin Provincial People's Government. In July 2006, the National Development and Reform Commission and the Ministry of Land and Resources passed the audit announcement. Kuancheng Economic Development Zone is located in the northern part of Changchun City, within the Kuancheng District of Changchun City, covering an area of 77.2 square kilometers. It is one of the core members of "Pilot Zone for Open Development in Northeast Jilin" created by Changchun City. Starting from Changjiang Road, a century-old commercial port in Changchun City, and named after the road, the development zone now has two industrial parks, trade services and industrial logistics. The business service park covers an area of 9.2 square kilometers, surrounding Changchun Railway Station and Changchun Passenger Transport Center Station. It is the main commodity distribution center of Changchun City with superior geographical location and obvious geographical advantages. With complete infrastructure, highly concentrated market factors and extensive transportation, the region has great development space and investment potential for the modern service industry. The industrial logistics park covers an area of 68 square kilometers, 7 kilometers away from Changchun urban area. It is an area approved for development by Jilin Provincial People's Government in April 2006. It is located on the main axis of industrial development in the overall plan of Changchun City, and is also the core node of the priority development of the first-level axis of Harbin in the Revitalization Plan of Northeast China. The park has complete infrastructure and supporting facilities, the Changchun City Ring Expressway runs from east to west, the 302 National Highway and the Changchun-Baicheng Railway run from north to south, the North Yatai Street and the North Kaixuan Road are connected with the urban area, the ecological environment is excellent, the geographical trend is flat, the land resources are rich, the labor force is sufficient, and the investment prospects are broad.

2.3 Contact method

Contact person: Xie Jifeng

Tel: +86-431-89991965

Fax: +86-431-89991965

Postal code: 130000

Contact method of the city (prefecture) where the project is located:

Contact unit: Changchun Cooperation and Exchange Office

Contact person: Zhang Junjie

Tel: +86-15704317930

Fax: +86-431-82700590

E-mail: xmc82763933@163.com