Petrochemical

5,000 Tons/Year of Polyphenylene Sulfide Project of Jilin City

1. Introduction to the Project

1.1 Project background

1.1.1 Product introduction

The project relies on the basic production of polyphenylene sulfide (PPS) in the petrochemical industry of Jilin City. After completion, the project will produce 5,000 tons of PPS annually, extending the chemical industry chain of Jilin City and increasing industrial competitiveness.

Polyphenylene sulfide (PPS) is a special engineering plastic with superior comprehensive performance, which has the advantages of high temperature resistance, corrosion resistance, radiation resistance, wear resistance, non-toxicity, flame retardancy, excellent electrical performance, good mechanical performance, dimensional stability, good processing and molding performance, and good bonding performance with metals and non-metals.

1.1.2 Market prospect

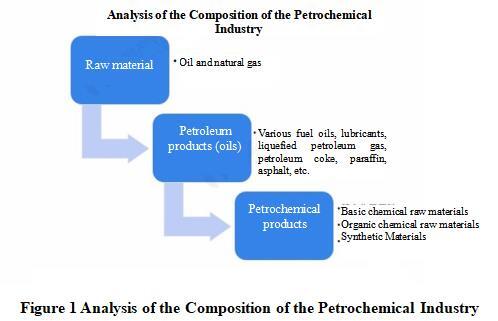

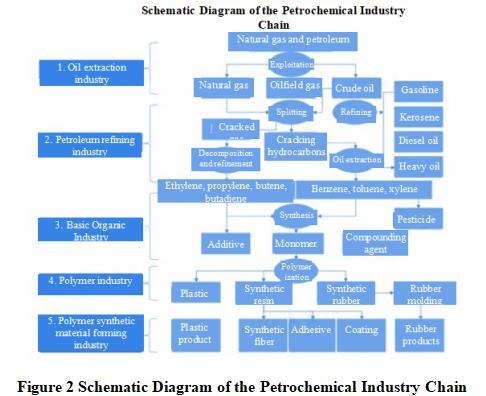

Petrochemical industry refers to the processing industry that uses petroleum and natural gas as raw materials to produce petroleum products and petrochemical products.

Petrochemical products are obtained by further chemical processing of raw oil provided by the refining process. The first step in producing petrochemical products is to crack the raw materials oil and gas (such as propane, gasoline, diesel, etc.) to produce basic chemical raw materials represented by ethylene, propylene, butadiene, benzene, toluene, and xylene. The second step is to produce various organic chemical raw materials (about 200 types) and synthetic materials (plastics, synthetic fibers, synthetic rubber) using basic chemical raw materials. The production of both products falls within the scope of petrochemicals.

The upstream of the petrochemical industry mainly includes the petroleum extraction and refining industry, including oil and gas extraction and transportation, refining, and petrochemical product processing and manufacturing processes. The midstream is the basic organic and polymer industry, and the downstream industry provides supporting and services for agriculture, energy, transportation, machinery, electronics, textiles, light industry, construction, building materials, and other industrial and agricultural sectors as well as people’s daily lives. It should be noted that in the petrochemical production process, chemical catalysts are added to promote refining and decomposition processes to improve processing efficiency.

China’s petrochemical industry has gone through four stages of continuous exploration and development: recovery and development stage, historic transformation stage, new rise stage, and new development stage. China has become the world’s second largest producer and consumer of petroleum and chemicals. The petrochemical industry is an important pillar industry of the national economy. In recent years, China has formulated relevant policies for the development and construction of the petrochemical industry, providing guarantees for the rapid development of China’s petrochemical industry.

Carbon neutrality may bring disruptive changes and opportunities to the petrochemical industry. To achieve carbon peak and carbon neutrality goals, industries such as steel, electricity, petrochemicals, and coal are accelerating their transformation. Many listed companies have developed carbon peak and carbon neutrality roadmaps. The goal of carbon peaking and carbon neutrality has brought significant pressure to the green and low-carbon transformation of petrochemical enterprises. However, in the process of transformation, it also nurtures new development opportunities, including opportunities to develop new energy, new materials, and new business models, promoting the shift from fossil energy dominated energy structure, industrial structure, and economic structure to renewable energy dominated. This process drives the industry to reconstruct its industrial chain and value chain, and requires more reliance on technological innovation to fundamentally change the structural form of the petrochemical industry in achieving carbon reduction targets.

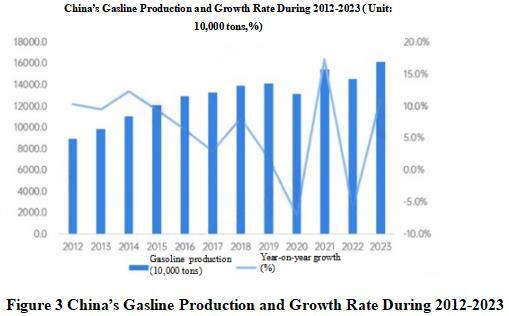

During 2016 - 2019, the overall gasoline output in China has been steadily increasing. Affected by the epidemic, China’s gasoline production decreased to 131.717 million tons in 2020, with a year-on-year decrease of 6.6%. In 2023, China’s gasoline production reached 161.384 million tons, with a year-on-year increase of 11.0%.

During 2010- 2019, China’s kerosene production increased year by year, reaching 52.726 million tons by 2019, with a year-on-year increase of 10.6%; During 2019 - 2022, China’s kerosene production showed a downward trend. In 2022, China’s kerosene production decreased to 29.491 million tons, with a year-on-year decrease of 27.1%. In 2023, China’s kerosene production reached 49.684 million tons, with a year-on-year increase of 68.5%.

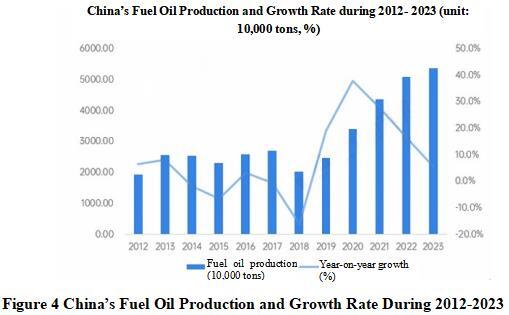

During 2010 - 2019, China’s fuel oil production fluctuated greatly. In 2019, China’s fuel oil production was 24.697 million tons, with a year-on-year increase of 19%. Since 2020, China’s fuel oil production has been increasing year by year, reaching 53.647 million tons in 2023, with a year-on-year increase of 5.8%.

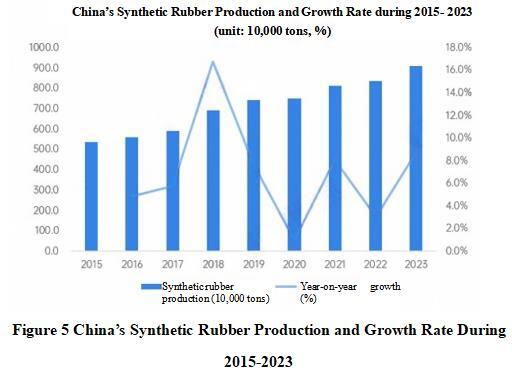

From a full year perspective, the performance of China’s synthetic rubber industry remains robust. The cumulative production for the whole year of 2023 reached 9.097 million tons, with a year-on-year increase of 8.8%, indicating that China’s synthetic rubber manufacturing industry as a whole maintains a high-capacity utilization rate and good development momentum.

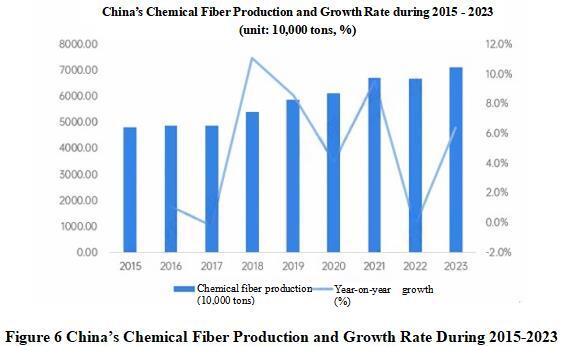

According to the latest data from the National Bureau of Statistics, the overall production of chemical fibers in China has shown an upward trend during 2015- 2023. In 2023, China’s chemical fiber production reached 71.27 million tons, with a year-on-year increase of 6.4%.

Currently, China’s petrochemical industry is undergoing industrial restructuring, with enterprises utilizing both international and domestic markets and resources to promote the adjustment and optimization of industrial structure, including economic structure. In recent years, the regional structure of China’s petrochemical industry has been continuously improving, outdated production capacity has been eliminated, innovation capabilities have been continuously enhanced, and the level of international operation has also been continuously improved. In terms of the number of enterprises in 2023, the top three are Shandong Province, Shaanxi Province, and Guangdong Province.

According to the 14th Five-Year Plan Guidelines for Petrochemical and Chemical Industry released by the China Petroleum and Chemical Industry Federation, the main task of the 14th Five-Year Plan is to promote the modernization of China’s petrochemical industry. Increase the richness and high-end level of chemical new material products, and open up the path of “improve weak links” and “filling gaps”; Intensify efforts to provide customized services for product applications.

With the recovery of the global economy and the rapid development of the Chinese economy, it is expected that the scale of China’s petrochemical market will continue to expand in the next five years. Meanwhile, the promotion of carbon peak and carbon neutrality goals will accelerate the transformation of the petrochemical industry towards green and low-carbon. Green and low-carbon transformation will nurture new development opportunities. Enterprises need to adopt more environmentally friendly production processes and technologies, reduce pollutant emissions, and improve resource utilization efficiency, which will also bring new development opportunities to the industry.

(2) Industry status analysis of polyphenylene sulfide

PPS is the largest variety of special engineering plastics, known as the sixth largest engineering plastic variety after the five major engineering plastics, and also one of the “eight major” aerospace materials. It is an indispensable new material for the upgrading of traditional industries and the development of high, precision, and cutting-edge technologies. PPS is widely used in industries such as automotive, electronics, aerospace, machinery, environmental protection, petrochemicals, pharmaceuticals, and light industry. By now, PPS fiber has become the preferred filter material for flue gas dust removal in coal-fired power plants and exhaust gas filtration and dust removal upgrading in urban waste incineration plants in the field of high-temperature filtration.

Polyphenylene sulfide is the most important type of resin in polyarylene sulfide and belongs to thermoplastic resins. PPS resin is white or nearly white, and is a hard and brittle locally crystalline polymer with a maximum degree of crystallization of 70%. Its melting point is 280-290 ℃, and its molecular main chain structure is composed of alternating benzene rings and sulfur.

(3) Development trend of polyphenylene sulfide industry

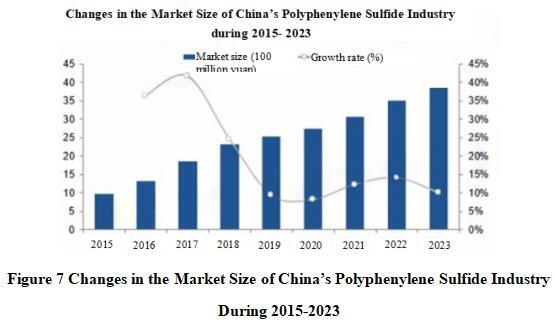

The market size of China’s polyphenylene sulfide industry has shown a steady growth trend in recent years, mainly driven by the increase in downstream demand and technological progress. With the increasing demand for lightweight and high-performance materials in industries such as automotive, electrical and electronics, and aerospace, the application areas of polyphenylene sulfide are gradually expanding. In 2023, the market size of China’s polyphenylene sulfide industry exceeded 3 billion yuan.

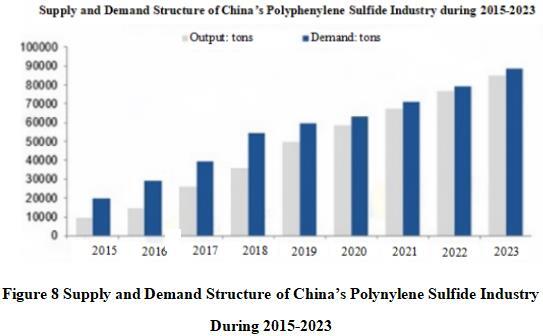

The supply and demand structure of China’s polyphenylene sulfide industry shows a trend of gradually balancing supply and demand. With the widespread application of polyphenylene sulfide in automotive, electronic, electrical and other fields, market demand continues to grow, especially in the areas of lightweight and high-performance materials. In terms of supply, domestic enterprises are gradually increasing their R&D investment and production capacity, which has promoted the technological progress and output increase of polyphenylene sulfide production.

The R&D of green and environmentally friendly production processes will become a key focus to reduce energy consumption and emissions during the production process and meet the requirements of sustainable development. Secondly, the modification technology of polyphenylene sulfide will continue to advance, by doping other high-performance materials to enhance its heat resistance, chemical resistance, and mechanical properties, to meet the needs of different application fields. Furthermore, the intelligence and automation of production equipment will improve production efficiency and product consistency, and reduce production costs. Finally, the application and development of polyphenylene sulfide in emerging fields such as electronic devices, aerospace, and new energy will drive technological innovation and expand its market prospects.

1.1.3 Technical analysis

The synthesis process of polyphenylene sulfide theoretically includes sodium sulfide method, sulfur solution method, oxidative polymerization method, etc. But currently, mainstream manufacturers mainly use the sodium sulfide method to polymerize dichlorobenzene and sodium sulfide in polar solvents N-methylpyrrolidone or hexamethylphosphoramide to produce polyphenylene sulfide.

1.1.4 Advantageous conditions of project construction

(1) Policy advantages

The Implementation Plan for Innovative Development of Fine Chemical Industry (2024-2027) clearly states that by 2027, positive progress will be made in the extension of fine chemical industry in the petrochemical industry. Focusing on the needs of economic and social development, we will tackle a number of key products and further enhance the supply chain guarantee capabilities of key industries; Breakthrough a batch of key technologies for greening, safety, and intelligence, significantly improve energy efficiency, significantly reduce total volatile organic compound emissions, and significantly improve intrinsic safety levels; Cultivate more than 5 world-class enterprises with strong innovation leadership and collaborative integration capabilities, cultivate more than 500 specialized, refined, and innovative “little giant” enterprises, create more than 20 chemical industrial parks dominated by fine chemicals and with strong competitive advantages, and form an innovative development system that integrates large, medium, and small enterprises and collaborates with upstream and downstream enterprises.

The Implementation Guide for Digital Transformation of Petrochemical and Chemical Industry proposes that by 2026, the digital networking level of petrochemical and chemical industry will be significantly improved, the integration of data and reality will continue to deepen, the intelligent manufacturing capacity of enterprises will be significantly enhanced, the platform services based on industrial Internet will make positive progress, and the artificial intelligence engine oriented to subdivided industries will be preliminarily formed, and the leading position in process industry will continue to be consolidated from “deepening application” to “reform leading”.

The Investment Promotion Policy of Jilin City clearly states that the investment projects of Jilin Industrial Investment Guidance Fund should comply with national and relevant industrial policies and development plans, with a focus on investing in tourism, medicine and health, aviation, information technology, new materials, advanced equipment manufacturing, biotechnology, energy conservation and environmental protection, new energy, cultural creativity, modern agriculture, modern service industry and other related industries in Jilin City’s “6411” industrial plan, as well as other areas supported by the municipal government for development with focus. In addition to setting up sub-funds through equity participation, the Guidance Fund can also adopt investment methods such as follow-up investment and direct investment; Newly introduced investment projects that meet the conditions shall enjoy tax reductions and exemptions in accordance with the current national and provincial tax policies. For projects with a significant contribution rate in Jilin City, in accordance with the spirit of the document Notice of the State Council on Relevant Matters Concerning Tax Preferential Policies (GF[2015] No. 25), relevant departments shall assist the enterprises in applying for tax exemptions and reductions in accordance with the law and regulations; Establish a special fund for the development of industrial enterprises, and encourage the introduction of major projects in traditional industries such as chemical, automobile, metallurgical, and agricultural product processing in the “6411” industrial system that comply with national industrial policies, have strong industrial support, and have a significant driving effect; Encourage the introduction of emerging industries such as medicine and health, new materials, advanced equipment manufacturing, and electronic information. Lay emphasis on the allocation of production factors, and give priority to recommend relevant national and provincial special funds for support.

(2) Resource advantages

Jilin City has great potential for resource development. The installed capacity of power sources in the city is 10 million KW, with an additional 3.279 million KW added during the 14th Five-year Plan period, an average annual growth rate of 8.3%. Among them, coal-fired power generation is 3.07 million KW, accounting for 30.7%; Gas power generation is 860,000 KW, accounting for 8.6%; Wind power is 1.54 million KW, accounting for 15.4%; PV power generation is 700,000 KW, accounting for 7%; hydropower generation is 3.5 million KW (conventional hydropower generation of 3.2 million KW and pumped storage is 300,000 KW), accounting for 35%; biomass power generation is 270,000 KW, accounting for 2.7%; waste generation is 58,000 KW, accounting for 0.6%; while the installed capacity of new and renewable energy accounts for 60.7% of the total installed capacity. It is expected that by 2025, the power generation will have reached 20.63 billion kWh, and the total transformer capacity of urban and rural power grids will have reached 4891.1 MVA.

The available land area in Jilin City is 853 hectares, including 74 hectares of commercial land, 500 hectares of industrial and mining storage land, 179 hectares of residential land (including guaranteed land for affordable housing), and 100 hectares of other land (including land for public management and public services, transportation, water bodies and water conservancy facilities, and special land). There is a large stock of exploitable land resources, and newly added and reserved land can meet the needs of new projects. Land prices are at a low level among 41 cities in Northeast China.

(3) Industrial advantages

Jilin City is an old industrial base city in Northeast China, known as the cradle of the national chemical industry, the first metallurgical industrial base, and the mother of hydropower in New China. During the “First Five-Year Plan” period, among the 156 key projects in the country, Jilin City achieved “7 and a half” (Jilin Dye Factory, Jilin Fertilizer Factory, Jilin Calcium Carbide Factory, Jilin Carbon Factory, Jilin Ferroalloy Factory, Jilin Thermal Power Plant, New China Sugar Factory construction and operation, and Fengman Power Plant expansion), contributing the first bag of fertilizer, the first barrel of dye, and the first furnace of calcium carbide to the country. In terms of the chemical industry, it has nearly a thousand sets of chemical industrial scale or above facilities, with 11 sets of facilities including methyl isobutyl ketone and methyl methacrylate ranking among the top three in China in terms of production capacity. The construction of Jilin Chemical’s 1.2-million-ton ethylene transformation and upgrading project, with a total investment of 33.9 billion yuan, is progressing in an orderly manner. This is the largest industrial project in Jilin Province since the establishment of the People’s Republic of China, and also the first chemical project of China Petroleum Group to fully use green electricity. After completion and operation, CPC Jilin Chemical Company will enter the world as a world-class enterprise. In terms of carbon fiber industry, it has the only “National-level Carbon Fiber High-tech Industrialization Base” approved by the Ministry of Science and Technology of the People’s Republic of China, forming the most complete carbon fiber industrial chain in China from “acrylonitrile to acrylonitrile-based raw silk to carbon fiber to downstream products”. The raw silk production capacity ranks first in the world, while the carbon fiber production capacity ranks first in China and second in the world. In terms of metallurgical industry, it has the largest metallurgical base in the province, and 2 national metallurgical technology centers. Jianlong Group has become the first steel production enterprise in the province.

(4) Talent advantages

Jilin City has universities such as Northeast Electric Power University, Jilin General Aviation Vocational and Technical College, Jilin Technology College of Electronic Information, Jilin Vocational College of Industry and Technology. These universities provide a continuous stream of talent support for enterprises. These talents not only possess rich practical experience, but also have high technical level and innovation ability. They are able to solve various technical problems in the production process, and improve the production efficiency and product quality. Meanwhile, these professional skilled talents can actively participate in the technological innovation and product research and development work of the enterprises, providing strong guarantees for the sustainable development of the enterprises.

Meanwhile, Jilin City has a large number of high-quality industrial workers. After training by enterprises and public welfare institutions, more than 10,000 skilled talents are sent to the society every year, and more than 20,000 people of various types are trained for the society every year. The advantage of labor resources is obvious, and the proportion of skilled workers is at a high level in the Northeast urban agglomeration. The labor force is in a dividend period, and the labor cost is relatively low, which can meet the needs of various enterprises.

(5) Location advantages

Jilin City is located in the central eastern part of Jilin Province, is adjacent to Yanbian Korean Autonomous Prefecture to the east, Changchun City and Siping City to the west, borders Harbin City, Heilongjiang Province to the north, and borders Baishan City, Tonghua City and Liaoyuan City to the south.

Jilin City is located at the geographical center of Northeast Asia, with various forms of transportation including railways, highways, water transportation, and aviation, etc. The artery traffics such as Jilin Longjia International Airport and Jilin Airport, Changchun-Hunchun and Shenyang-Harbin Expressways, Changchun-Hunchun Intercity Express Railway, and Shenyang-Harbin Double-track Railway form a convenient three-dimensional transportation network extending in all directions in Jilin City.

1.2 Contents and scale of project construction

1.2.1 Construction scale

The project covers an area of 15,000 ㎡ and can produce 5,000 tons of polyphenylene sulfide annually after completion.

1.2.2 Construction contents

The total construction area of the project is 18,800 ㎡, mainly including the construction of an innovative R&D center, warehouse, standardized production plant, dormitory, duty room, etc., and the purchase of a production line capable of producing 5,000 tons of polyphenylene sulfide annually.

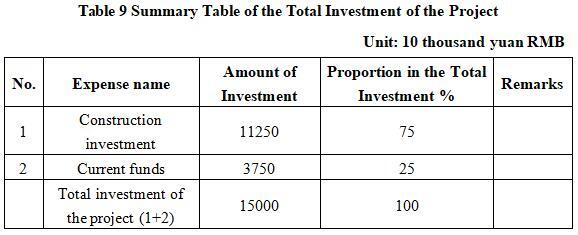

1.3 Total investment of the project and capital raising

1.3.1Total investment of the project

The total investment of the project is 150 million yuan, including the construction investment of 112.5 million yuan, and current funds of 37.5 million yuan.

1.3.2 Capital raising

Raised by the enterprise itself.

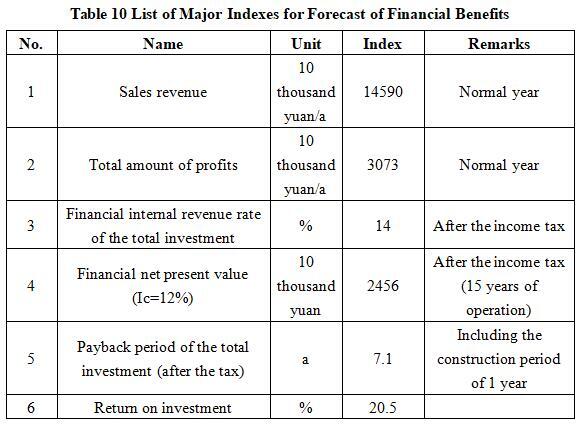

1.4 Financial analysis and social evaluation

1.4.1 Main financial indexes

After the project reaches the production capacity, its annual sales revenue will be 145.9 million yuan, its profit will be 30.73 million yuan, its investment payback period will be 7.1 years (after the tax, including the construction period of 1 year) and its return on investment will be 20.5%.

Note: “10 thousand yuan” in the table is in RMB

1.4.2 Social evaluation

As a high-performance engineering plastic, polyphenylene sulfide has a wide range of applications in various fields such as environmental protection, automotive, electronics, petrochemicals, and pharmaceuticals. The construction of this project will promote the development of related industries in Jilin City, form a synergistic effect between the upstream and downstream of the industrial chain, and enhance the industrial competitiveness of the entire region.

With the rapid development of the domestic economy, the market demand for polyphenylene sulfide continues to grow. The construction of this project will help increase the supply of domestic polyphenylene sulfide, meet market demand, and reduce dependence on imported products.

1.5 Cooperative way

Joint venture or cooperation, other ways can be discussed in person.

1.6 What to be invested by the foreign party

Funds, other ways can be discussed in person.

1.7 Construction site of the project

Jilin Chemical Industry Circular Economy Demonstration Park.

1.8 Progress of the project

It is in planning phase.

2. Introduction to the Partner

2.1Basic information

Name: Jilin Chemical Industry Circular Economy Demonstration Park

Address: No. 6, Hanyang South Street, Longtan District, Jilin City

2.2 Overview

Jilin Chemical Industry Circular Economy Demonstration Park is the birthplace of China’s chemical industry and an important industrial base in Northeast China. After more than 50 years of development, it has formed a relatively complete chemical industry system including petrochemicals, synthetic materials, fine chemicals, etc. There are more than 200 chemical enterprises in the Park, and the main chemical products include basic organic chemical raw materials, synthetic materials, fine chemical products, biochemical products, etc. Where, there are more than 60 products with large production scale and a certain market share at home and abroad, mainly acrylonitrile, ethanol ABS, Styrene, styrene butadiene rubber, ethylene oxide, etc. There are more than 40 large enterprises or groups represented by CPC Jilin Petrochemical Company in the Park. After the transformation and upgrading in 2025, the ethylene production capacity will reach 1.9 million tons, with 130 main refined products. The production capacity of acrylonitrile, methyl methacrylate and other facilities will rank among the top in the country. These valuable resources also provide strong impetus for the industrial extension and growth of the Park.

The raw materials for project production can be purchased from enterprises within the Park, or outsourced based on the Park’s endorsement.

2.3 Contact method

Contact method of the unit where the project is located:

Contact unit: Jilin Chemical Industry Circular Economy Demonstration Park

Contact: Zhao Zirui

Tel: +86-13244459008

E-mail: 1099074441@qq.com

Contact method of the city (prefecture) where the project is located:

Contact unit: Investment Promotion Service Center, Bureau of Commerce of Jilin City

Contact person: Jiang Yuxiu

Tel: +86-432-62049694

+86-15804325460

E-mail: jlstzcjfwzx@163.com