Petrochemical

60,000 Tons/Year Polyacrylonitrile Based Carbon Fiber Project of Tonghua City

1. Introduction to the Project

1.1 Project background

1.1.1 Product introduction

Carbon fiber is the “King of New Materials in the 21st Century” and a typical representative of high-performance fibers. It has the characteristics of low density, high temperature resistance, corrosion resistance, fatigue resistance, as well as good damping, shock absorption, and noise reduction. Particularly outstanding are its high specific strength and high specific modulus. As a high-tech material that can be used for both military and civilian purposes, carbon fiber has been widely applied in cutting-edge fields such as aerospace, national defense and military, as well as civilian industries such as sports and leisure products, medical equipment, construction, marine engineering, rail transit, wind power generation, pressure vessels, etc. It is crucial and role in the development of the national economy and the modernization of national defense.

According to the type of raw materials, carbon fiber is mainly divided into polyacrylonitrile based (PAN-based) carbon fiber, asphalt-based carbon fiber, and adhesive based carbon fiber. PAN- based carbon fiber has become the mainstream of carbon fiber due to its excellent product quality, simple process, and excellent mechanical properties. Its production accounts for more than 90% of the total global carbon fiber production. Therefore, currently, carbon fiber generally refers to PAN- based carbon fiber.

The project is located in the Chemical Industry Park of Tonghua City, using the abundant chemical raw material resources of Tonghua City and Jilin Province to produce 60,000 tons of carbon fiber raw silk and products annually, promoting the development of the chemical industry in Tonghua City.

1.1.2 Market prospect

(1) Market Status of Carbon Fiber Industry

In recent years, the carbon fiber industry market has shown a rapid growth trend. With the increasing demand for high-performance materials in various fields, the market size of carbon fiber continues to expand. Especially in the aerospace industry, the application of carbon fiber is becoming increasingly widespread, is important in driving market growth.

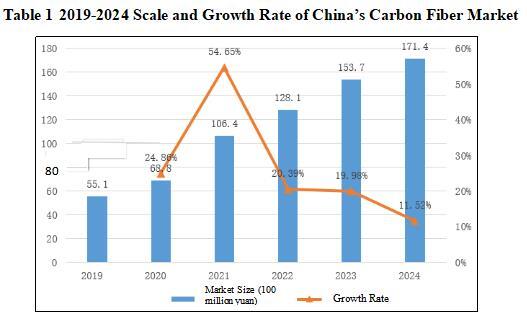

The overall scale of China’s carbon fiber market is on the rise. The market size of carbon fiber in China in 2019 was 5.51 billion yuan. Since then, it has been increasing year by year, reaching 6.88 billion yuan in 2020, 10.64 billion yuan in 2021, 12.81 billion yuan in 2022, and 15.37 billion yuan in 2023, the market size was 17.14 billion yuan by 2024.

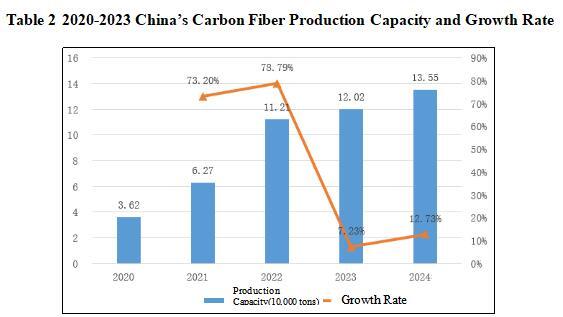

In 2020, China’s carbon fiber production capacity was 36,200 tons, reaching 62,700 tons in 2021, 112,100 tons in 2022, 120,200 tons in 2023, and reached 135,500 tons in 2024. The overall carbon fiber production capacity in China is on the rise, and with the continuous improvement of production capacity, more products was provided to the market.

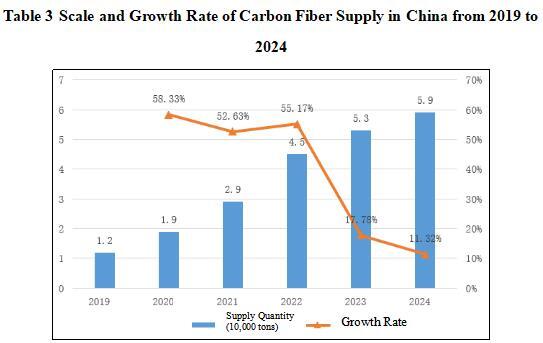

The overall supply of carbon fiber in China is on the rise. The supply of carbon fiber in China was 12,000 tons in 2019, and has been increasing year by year since then. It reached 19,000 tons in 2020, 29,000 tons in 2021, 45,000 tons in 2022, and 53,000 tons in 2023.The supply reached 59,000 tons in 2024.

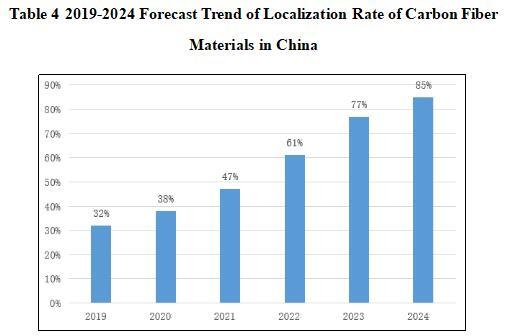

The localization rate of carbon fiber materials in China was 32% in 2019, 38% in 2020, 47% in 2021, 61% in 2022, 77% in 2023, and reached 85% by 2024. With the continuous development of China’s carbon fiber industry, the competitiveness of domestic enterprises is gradually increasing, and the market size is expected to continue to expand under the promotion of localization, with broad prospects.

(2) Market Status of Polyacrylonitrile based (PAN- based) Carbon Fiber Industry

PAN- based carbon fiber has become the main variety of carbon fiber applications due to its excellent product quality, simple process, good structure, and excellent mechanical properties. As an emerging high-end direction downstream of acrylonitrile, PAN- based carbon fiber production accounts for over 91% of the world’s total carbon fiber production.

Polyacrylonitrile based carbon fibers are widely used in various fields. In the industrial field, including body materials for automobiles, car roofs and front and rear bumpers, engine hoods, driveshafts, brake pads, wheel hubs, etc.; In the construction industry, large fiber bundles of carbon fibers are used to enhance cement and repair and reinforce building projects; In the field of biomedicine, due to its excellent biocompatibility and mechanical compatibility, it has been applied to artificial prostheses or bone materials, and is expected to be applied to other parts of the human body; In the field of wind power generation, the application of carbon fiber reinforced plastic in the blade parts of wind turbines is gradually becoming popular; In the power industry, core materials used for transmission lines; In the oilfield industry, it is applied to sucker rods.

The production of carbon fiber in the world is mainly concentrated in a few developed countries such as Japan and the United States. By now, there are eight main PAN- based carbon fiber production enterprises in the world, including three in Japan: Toray Industries, Mitsubishi Rayon Corporation, and Toho Chemical Industry Co., Ltd. Japan is the world’s largest carbon fiber production country, and its three major carbon fiber production enterprises collectively hold more than 50% of the global PAN- based carbon fiber market share; Two companies in the United States: Hershey’s Limited and Cyanamid Industries. The United States is also one of the few countries in the world that has mastered carbon fiber production technology, and also the world’s largest consumer of PAN- based carbon fiber, accounting for about one-third of the world’s total consumption; Others include Aksa Group in Turkey, Sigler Carbon Group in Germany and Taiwan, China Plastic Industry Co., Ltd. in China.

The research on using polyacrylonitrile as raw material to produce carbon fiber in China began in 1962. The Changchun Institute of Applied Chemistry of the Chinese Academy of Sciences and Shenyang Institute of Metals established a research group led by Li Rengyuan on the development of polyacrylonitrile based carbon fiber, which began basic research on carbon fiber. The carbon fiber in Chinese Mainland mainly depends on imports, and the effective production capacity is insufficient. Under the pressure of overseas leading technology blockade and price wars, the development of the domestic carbon fiber industry is slow.

In recent years, China’s carbon fiber industry has entered a period of explosive growth and has begun to take shape. It has successively broken through the 1,000t industrialization of high-performance carbon fibers such as T700 and T800. In 2019, Zhongfu Shenying achieved the engineering of dry spray wet spinning T1000 grade ultra-high strength carbon fiber, marking another step in China’s carbon fiber production technology level. After catching up in recent years, the multi-filament tensile strength and modulus of domestically produced T700S-12K small bundle carbon fiber have reached the same level of Dongli carbon fiber performance, and the gap with the world’s advanced carbon fiber technology level is gradually narrowing.

With the establishment of the “863” program by the Ministry of Science and Technology of China, the focus is on supporting the engineering research of domestically produced PAN- based carbon fibers. The National Development and Reform Commission, the Ministry of Industry and Information Technology, and others have also increased their support for the engineering, industrialization, and application of carbon fibers, and domestic carbon fibers have entered an orderly development stage. The carbon fiber industry has formed industrial clusters mainly in Northeast China, Beijing-Tianjin-Hebei, Yangtze River Delta, Pearl River Delta, Bohai Rim, etc., with a number of iconic enterprises and R&D institutions emerging. We have established carbon fiber production enterprises represented by Zhongfu Shenying, Guangwei Composites, Shanxi Gangke Carbon Fiber, Jiangsu Hengshen, Jilin Guoxing, Jilin Baojing, Jilin Tangu Carbon Fiber, Zhejiang Baojing, Lanzhou Bluestar Fiber, Zhongjian Technology, etc.; We have cultivated carbon fiber research units such as Shanxi Institute of Coal Chemistry, Chinese Academy of Sciences, Beijing University of Chemical Technology, Shandong University, Ningbo Institute of Materials Technology & Engineering, Chinese Academy of Sciences, Changchun University of Technology, and auxiliaries (oil agent and sizing agent) R&D units, such as Beijing Institute of Chemistry, Chinese Academy of Sciences, Fudan University, and Harbin Institute of Technology.

During 2020 ~ 2023, China’s acrylonitrile production capacity officially entered a new investment cycle. As of 2023, China’s acrylonitrile production capacity has increased by 19.6% year-on-year; The production increased by 7.8% year-on-year. China is still a net importer of acrylonitrile, with a year-on-year increase of 88.5% in acrylonitrile imports in 2023; The year-on-year growth in export volume decreased by 19.8%. Acrylonitrile imports are all general trade, mainly from Taiwan, China, South Korea, Japan and other countries or regions, and the total import volume accounts for about 99.0% of the total import volume.

After years of hard work, domestic PAN- based carbon fiber has made significant progress, and the carbon fiber industry is bound to enter an unprecedented new stage of development, with great potential in the “Carbon Peaking and carbon neutrality” action plan.

1.1.3 Technical analysis

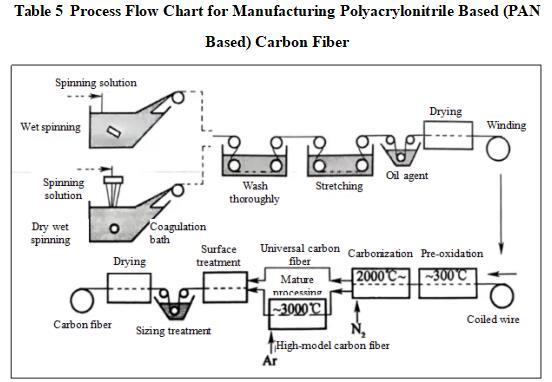

The entire process of manufacturing polyacrylonitrile based (PAN- based) carbon fibers are divided into four stages: preparation of precursor fibers, pre-oxidation, carbonization, and post-treatment. The project plans to use the already large-scale dry spray wet spinning technology to produce carbon fiber, and cooperate with the domestic polyacrylonitrile based (PAN- based) carbon fiber technology research institute to jointly carry out technical R&D and tackle key problems.

1.1.4 Advantageous conditions of project construction

(1) Policy advantages

In October 2021, the State Council released the Action Plan for Peaking Carbon Emissions Before 2030, proposing to accelerate the R&D of basic materials such as carbon fiber, aerosols, and special steel.

In April 2022, the Ministry of Industry and Information Technology issued the Guidelines on High-quality Development of Chemical Fiber Industry, proposing to improve the production and application level of carbon fiber, aramid, ultra-high molecular weight polyethylene fiber, polyimide fiber, polyphenylene sulfide fiber, polytetrafluoroethylene fiber, and continuous basalt fiber during the 14th Five-Year Plan period, and enhance the consistency and batch stability of high-performance fiber quality. Further expand the application of high-performance fibers in aerospace, wind and photovoltaic power generation, marine engineering, environmental protection, safety protection, geotechnical construction, transportation, etc. The specific industry plan for carbon fiber composite materials revolves around carbon fiber composite materials and high-performance fiber innovation platforms.

In January 2024, the Ministry of Industry and Information Technology and seven other departments jointly issued the Implementation Opinions on Promoting Future Industrial Innovation and Development, proposing to promote the upgrading of advanced basic materials such as non-ferrous metals, chemicals, and inorganic non-metals, develop key strategic materials such as high-performance carbon fibers and advanced semiconductors, and accelerate the innovative application of cutting-edge new materials such as superconducting materials.

In March 2023, the National Development and Reform Commission agreed to establish a demonstration zone for industrial transfer in southwestern Jilin, focusing on enhancing industrial transfer capacity, optimizing business environment, deepening open cooperation, effectively undertaking domestic and foreign industrial transfer, promoting industrial transformation and upgrading in the process of undertaking, and striving to build the demonstration zone into a characteristic manufacturing base in Northeast China, a green and low-carbon transformation pilot zone, a new highland for regional cooperation and development, and an important agricultural and special product processing base in China. The demonstration zone covers three cities: Siping, Liaoyuan, and Tonghua. This project is a petrochemical industry project among the seven major undertaking industries in the demonstration zone.

(2) Industrial advantages

Jilin Province is one of the earliest regions in China to engage in R&D of carbon fiber technology, and has established a national carbon fiber high-tech industrialization base. The most complete carbon fiber industry chain in China has been formed, consisting of acrylonitrile - acrylonitrile based raw fibers - carbon fibers, and downstream products. Production capacity of both carbon fiber precursor and carbon filament rank the first nationwide. It is expected that by the end of 2025, the output value of the entire carbon fiber industry chain in Jilin Province will exceed 30 billion yuan. During the 14th Five-Year Plan period, Jilin City will work together to build the “China Carbon Valley”, striving to become the world’s largest producer of large bundle carbon fiber raw fibers and carbon fibers.

There are currently 25 carbon fiber production enterprises such as Guoxing and Tangu Carbon in Jilin Province, with a good industrial foundation and a preliminary clustering scale. Jilin Province is a representative of the “Northern School” of domestic carbon fiber technology and has developed core technologies and key equipment for the industrialization of large fiber bundle carbon fiber (25K-50K).

Jilin Petrochemical Company is located in Jilin Chemical Industrial Park. Currently, the annual production capacity of acrylonitrile in Jilin Chemical Industrial Park reaches 680,000 tons, providing sufficient acrylonitrile raw materials for the daily life of the project.

(3) Location advantages

The highway and railway traffics in Tonghua City extend in all directions, forming a highway network connecting the three provinces in Northeast China, and for customs entry and exit, mainly including Ji’an-Xilingol League Abaga Banner Expressway (National Highway 303), Hegang-Dalian Expressway (National Highway 201), Heilongjiang-Dalian Highway (National Highway 202), and Yingchengzi-Fumin Expressway. The first-class highway from Tonghua to Meihekou has been opened to traffic. There are crisscross Shenyang-Jilin, Meihekou-Ji’an, and Yayuan-Dalizi Railways, as well as direct passenger trains to Beijing, Qingdao, Shenyang, Changchun, Dalian, Baihe and other places.

(4) Talent advantages

At present, Tonghua City has 3 national key secondary vocational schools, 3 provincial key secondary vocational schools, and all its county-level vocational education centers have passed the provincial key school acceptance and entered the top 100 schools in the province. It is the first region in the province where all county-level vocational education centers have entered the provincial key school list. In recent years, by making scientific layout, continuous promotion of vocational education structure adjustment and resource integration, exploration of new paths for diversified education, and continuous improvement of modern vocational education network system construction, the local characteristics of vocational education have begun to form, and the ability to serve economic and social development has gradually improved.

Tonghua Municipal Government has signed science and technology strategic cooperation agreements with provincial universities and research institutions such as Northeast Normal University, Jilin Agricultural University, Changchun Institute of Applied Chemistry, Chinese Academy of Sciences, and Tonghua Normal University, etc., providing scientific and technological support for development of the enterprises. Tonghua City continues to provide assistance for enterprises in talent cultivation and other aspects, vigorously implements the “Plan for Revitalizing Enterprises with Ten Thousand Students” and “Plan for Homing of a Thousand Students”, and continuously attracts college graduates for enterprises.

1.2 Contents and scale of project construction

1.2.1 Product scale

The project produces 60,000 tons of carbon fiber raw silk and products annually.

The project can consume and utilize 66,000 tons of upstream main raw material acrylonitrile. Meanwhile, two series of products, resin based and ceramic based, are produced and manufactured based on the self-produced carbon fiber of the project. The main products of the resin-based series include carbon fiber cloth, carbon fiber prepreg, carbon fiber preform, etc.; The main products of the ceramic based series include crucibles and plates, throat liners and molds, brake discs for automobiles, airplanes, high-speed trains, resin based composite materials, and thermal structural materials for aircraft.

1.2.2 Contents of project construction

The project covers a total area of 900 mu with a total construction area of 500,000 ㎡. The project mainly constructs factories, production workshops, warehouses, laboratories, supporting facilities, etc., and purchases and installs production lines for polymerization, spinning, pre-oxidation, low-temperature and high-temperature carbonization, fiber surface treatment, cleaning, sizing, drying, fiber winding, etc.

1.3 Total investment of the project and capital raising

1.3.1 Total investment of the project

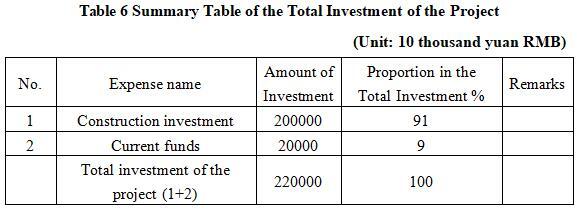

The total investment of the project is 2,200 million yuan, including the construction investment of 2,000 million yuan and current funds of 200 million yuan.

1.3.2 Capital raising

Raised by the enterprise itself.

1.4 Financial analysis and social evaluation

1.4.1 Main financial indexes

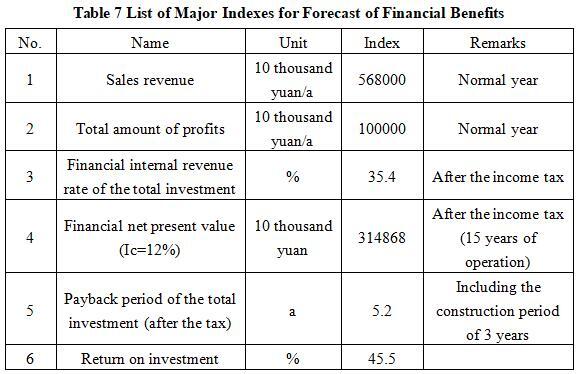

After the project reaches the production capacity, its annual sales revenue will be 5,680 million yuan, its profit will be 1,000 million yuan, its investment payback period will be 5.2 years (after the tax, including the construction period of 3 years), and its return on investment will be 45.5%.

Note: “10 thousand yuan” in the table is in RMB

1.4.2 Social evaluation

As a high-tech material, polyacrylonitrile based carbon fiber is crucial and decisive in the development of the national economy and the modernization of national defense. The construction of the project not only helps to improve the development level of related industries, but also directly or indirectly increases a large number of job opportunities and promotes economic growth.

1.5 Cooperative way

Investor's sole proprietorship.

1.6 What to be invested by the foreign party

Funds, equipment and technology.

1.7 Construction site of the project

Tonghua Chemical Industry Park.

1.8 Progress of the project

The project cooperation plan has been prepared.

2. Introduction to the Partner

2.1 Basic information

Name: Chemical Industry Park Management Bureau of Lugang Economic Development Zone

Address: North of National Highway 303, Tonghua County, Jilin Province

2.2 Overview

Jilin Tonghua Land Port Economic Development Zone, formerly known as Jilin Tonghua International Land Port Zone, is located in the northern part of Tonghua City, with a regional area of 266.96 square kilometers and a planned control area of 79.65 square kilometers. Since its establishment with the approval of the provincial government in 2016, its regional driving capacity and radiation effect have been continuously enhanced. As an important carrier for Jilin Province to implement southward opening up, the Port Area carries and plays a functional role in highway container center stations, railway container center stations, bonded logistics centers (Type B), comprehensive logistics parks, chemical industry parks, etc. It is striving to build an open cooperation zone that integrates bonded processing, modern logistics, industrial cooperation, and technological innovation.

The port area has obvious location advantages, prominent strategic advantages, and convenient transportation and logistics. Located along the border and near the sea, in the center of Northeast Asia, backed by the hinterland of the Northeast East Green Economic Belt; There are five or two railways and Tonghua Airport in the area, and modern logistics platforms such as highway container center stations, bonded logistics centers, and comprehensive logistics parks have been built. A commercial processing entrepreneurship park and a chemical industrial park have been built in the area, and the Northeast Asia International Agricultural and Forestry Products Trading Center is currently under construction. During the 14th Five-Year Plan period, according to the overall requirements of Tonghua City’s 14th Five-Year Plan, the Port Area took the overall idea of Tonghua City’s “one-four-five” as the guide, built “one port and two parks” as the layout, and created a new highland of openness and cooperation as the main line. It adhered to the integrated development of “port industry city”, solidly promoted key projects such as the commercial processing and entrepreneurship industrial park, Tonghua Pharmaceutical and Chemical Industry Park, Northeast Asia Agricultural and Forestry Products Trading Center, continuously optimized the basic supporting capacity, improved the carrying function of the park, enhanced the platform service level, and made every effort to build a commercial logistics and industrial gathering center in the eastern part of Northeast China.

2.3 Contact method

2.3.1 Contact method of cooperator

Contact unit: Chemical Industry Park Management Bureau of Lugang Economic Development Zone

Contact person: Sun Yanna

Tel: +86-18504353555

E-mail: gwqhgyqglj@163.com

2.3.2 Contact method of the city (prefecture) where the project is located

Contact unit: Tonghua Municipal Commerce Bureau

Contact person: Wang Liangchen

Tel: +86-435-3199017+86-18643036783

E-mail: thsswjtck@126.com