Petrochemical

Chemical Active Pharmaceutical Ingredient Production Base Project of Tonghua City

1. Introduction to the Project

1.1 Project background

1.1.1 Product introduction

As active pharmaceutical ingredients, API is made through chemical synthesis, plant extraction, or biotechnology, but cannot be directly taken by patients. It is usually processed by adding excipients to make drugs that can be used directly.

The project relies on the pharmaceutical and chemical industry sector of Tonghua Chemical Industry Park, integrating the production batch numbers of raw materials such as methionine, vitamin U, choline bitartrate, metformin hydrochloride, irbesartan, gatifloxacin, terbinafine hydrochloride, itopride hydrochloride, and econazole nitrate, and constructing a raw material production line. The project adopts optimized production technology to achieve the effects of safety, efficiency, and good quality controllability of the products, creating a leading regional brand.

1.1.2 Market prospect

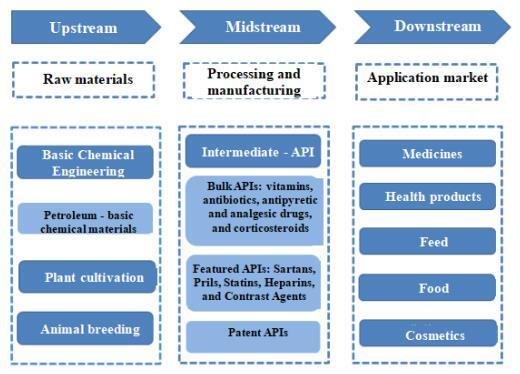

(1) API industry chain

The API industry chain covers the upstream basic chemical industry, agriculture, forestry, animal husbandry, and fishery, mainly including basic chemical industry, plant cultivation, animal husbandry, and some pharmaceutical intermediate system preparation; The production of API in the middle reaches involves the preparation of API through chemical synthesis, animal and plant extraction, microbial fermentation, or other modern biotechnology methods; And multiple links such as downstream chemical production.

Where, the upstream industry is the supply of basic API, the midstream industry is the core production process, and the downstream industry is responsible for converting API into drug formulations that can ultimately be used by patients. In the industrial chain, the production process of APIs has a relatively high technical requirements, and is also affected by fluctuations in upstream raw material prices and changes in downstream market demands. Generally speaking, the gross profit margin of the chemical pharmaceutical industry shows an increasing trend from upstream to downstream, with the gross profit margin of APIs lower than that of chemical inhibitors but higher than that of intermediates.

Table 1 API Industrial Chain Diagram

(2) Current situation of global API market

With the continuous development of the global pharmaceutical market, as an important link in the pharmaceutical industry chain, API can be regarded as the “chip” of the pharmaceutical industry, occupying an important position in the pharmaceutical industry. Their industry development trends and competitive landscape have received widespread attention from the industry.

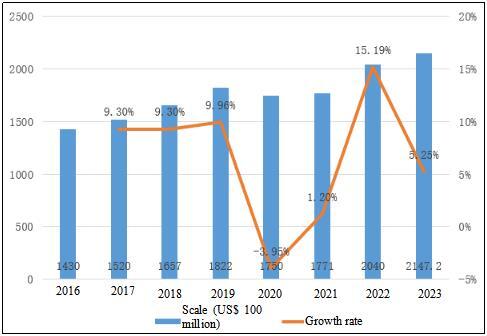

Globally, the API market has gradually recovered its growth after experiencing the impact of the COVID-19 in 2020. Affected by the COVID-19, the global API market size in 2020 has declined compared with 2019, from US$ 182.2 billion to US$ 175 billion, with a decrease of 3.95%; But soon, the market resumed growth from 2021, with the global API market size reaching US$ 204 billion in 2022 and US$ 214.72 billion in 2023.

Table 2 Global API Market Size and Growth Rate from 2016 to 2023

In the current competitive landscape of the global API market, American enterprises have drug patent advantages, Western European enterprises have process advantages, while the API enterprises represented by developing countries such as India and China have relative cost advantages. Based on the gaps in research and development, production processes, and intellectual property protection, the API enterprises from developed countries in Europe and America dominate the high value-added API field; while the API enterprises from countries such as China and India have continuously elevated their position in the API market of generic drugs due to their cost and scale advantages, etc.

Based on indicators such as the sales share of API and the number of export destinations, India has an absolute advantage in 4 out of the top 5 global API manufacturers (exporters). Although there are hundreds of API export companies in China, only a few companies such as North China Pharmaceutical Group, Northeast General Pharmaceutical Factory, Harbin Pharmaceutical, Zhejiang Hisun Pharmaceutical Group and Zhuhai United Laboratories Company have relatively large export scales. The vast majority of domestic API exporters are generally small in scale, so Chinese enterprises rank lower in the international API manufacturer rankings.

(3) The current situation of China’s API drug market

Before the 1990s, Europe and the United States were the main global production areas for API. After the 1990s, due to environmental protection, labor costs, and other reasons, production capacity in Europe and the United States gradually shifted outward, and emerging markets represented by China and India rapidly emerged, gradually becoming the main production and export countries for active pharmaceutical ingredients.

In recent years, China has successively introduced various industrial policies to guide the domestic API industry towards high-quality development, and the API industry has also ushered in new development opportunities. According to data from to data from China Chamber of Commerce for Import and Export of Medicines and Health Products (CCCMHPIE), China has been the world’s largest API manufacturer and exporter for many years. The production capacity of multiple API varieties ranks first in the world or holds a significant market share. The overall production capacity of APIs in China ranks first in the world, accounting for nearly 30%.

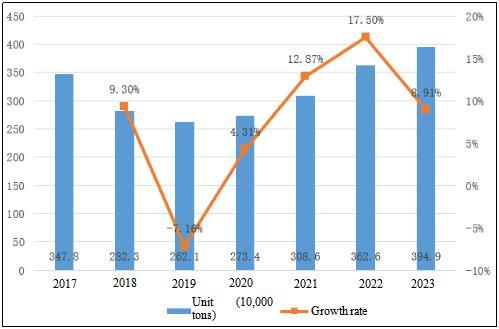

The overall production capacity of APIs in China showed an increasing trend from 2013 to 2017; However, from 2018 to 2019, due to the tightening of environmental safety supervision and the constant deepening of supply reform, some API production capacities with high energy consumption, high pollution and outdated process technology, as well as excess API production capacity were eliminated, resulting in a significant decline in China’s API production capacity; In 2020, despite the impact of the global epidemic situation causing a slight slowdown in the growth of the API market, with the gradual stabilization of China’s epidemic prevention and control situation and the recovery of the global economy, the API industry quickly regained vitality and demonstrated a strong development momentum. By 2023, China’s API production capacity has jumped to 3.949 million tons, with a year-on-year growth of 8.91%. This Table not only demonstrates the new style of China’s API industry after experiencing trials and hardships, but also indicates its huge development potential in the future.

Table 3 Output and Growth Rate of Chemical APIs in China from 2017 to 2023

In recent years, China has vigorously promoted supply-side structural reform, mainly relying on supervision and guidance to gradually eliminate outdated production capacity, encouraging the API enterprises to make transformation and upgrading, and increasing efforts in standardization of the API market to crack down on illegal price increases and malicious sales control behaviors. On the one hand, by reasonably raising the environmental standards, it has guided the leading enterprises to improve their technological level and enhance their competitiveness, promoted high-polluting and non-compliant enterprises to exit the market, and reduced low-priced competitors in the API market; On the other hand, it has issued the Guidelines for Price Behavior of Shortage Drug and API Operators to punish malicious manipulation of API prices. The integration of production capacity, improvement of processes, and maintenance of reasonable profits will lay a more solid foundation for the sustainable and healthy development of China’s API industry in the future. It is predicted that by 2028, the market size of enterprises above designated size in China’s chemical drug raw material industry will exceed 680 billion yuan.

Faced with the rapid changes and fierce competition in the global pharmaceutical market, domestic raw material pharmaceutical companies need to further strengthen technological innovation and industrial upgrading. With the support of national policies and the increasing demand for social development, China’s API industry will continue to develop towards high quality, green, low-carbon, environmental protection, and internationalization, gradually transforming from a major API manufacturing country to a manufacturing power, and making more outstanding contributions to the development of the global medicine industry.

The API produced in the project are not only supplied to the pharmaceutical and chemical industry enterprises in Tonghua Chemical Industry Park, but also to other domestic and foreign pharmaceutical formulation enterprises. The product quality is stable and the market prospects are broad. Gatifloxacin in the product is a Class I new drug in China, while irbesartan is a Class II new drug in China.

1.1.3 Technical analysis

API are the prerequisite for the production of pharmaceutical preparations. In various links of the pharmaceutical industry chain, they play the role of processing and manufacturing basic pharmaceutical raw materials. The production process of API includes chemical synthesis, fermentation, animal and plant extraction, etc. The mature production technology of API is widely used in the market. For the preparation of special API, the project adopts patented technologies and complete sets of equipment for large-scale production at home and abroad for large-scale production.

1.1.4 Advantageous conditions of project construction

(1) Policy advantages

In November 2021, the Notice issued by the National Development and Reform Commission (NDRC) and the Ministry of Industry and Information Technology (MIIT) on the Implementation Plan for Promoting High-Quality Development of The API Industry was issued. This policy encouraged the API enterprises to strengthen innovation in API synthesis processes and development models, widely use green environmental protection technologies and equipment, promote industrial agglomeration and coordinated development of the industrial chain, participate in division of labor of international medicine industry, and make all-round opening up and development.

In January 2022, the 14th Five-Year Plan for Development Plan of the Pharmaceutical Industry required consolidating the advantages of API manufacturing, accelerating the development of a number of new varieties of characteristic APIs with high market potential and technical barriers, as well as new product types such as nucleic acids and peptides, vigorously developing the contract production business of APIs for patented drugs, and promoting the extension of the API industry to higher value chains.

The Outline of the 14th Five-Year Plan for National Economic and Social Development and Vision 2035 of Jilin Province proposed to strengthen TCM, and promote the secondary development and application of large varieties, new dosage forms, new administration routes, and new indications. Accelerate the development of biopharmaceuticals, restore the leading position of biological vaccines in China, break through the technology of genetic engineering drugs and cell pharmaceuticals, and consolidate and expand the leading advantage in the field of recombinant proteins. Cultivate and develop high-end chemical pharmaceutical preparations and establish chemical API export bases. Build medicine characteristic industrial parks in Liaoyuan, Tonghua, Baishan, Meihekou, and Dunhua, etc., and establish a national production base for small variety drugs in Northern China. By 2025, the graphene market size will have reached 200 billion yuan.

In March 2023, the National Development and Reform Commission agreed to establish a demonstration zone for industrial transfer in southwestern Jilin, focusing on enhancing industrial transfer capacity, optimizing business environment, deepening open cooperation, effectively undertaking domestic and foreign industrial transfer, promoting industrial transformation and upgrading in the process of undertaking, and striving to build the demonstration zone into a characteristic manufacturing base in Northeast China, a green and low-carbon transformation pilot zone, a new highland for regional cooperation and development, and an important agricultural and special product processing base in China. The demonstration zone covers three cities: Siping, Liaoyuan, and Tonghua. This project is a petrochemical industry project among the seven major undertaking industries in the demonstration zone.

(2) Resource advantages

Tonghua Chemical Industrial Park is a chemical industrial park characterized by medicines and chemicals, with a safety risk level of C. It was among the first batch to be recognized as a provincial chemical industrial park, and is an information-based and intelligent chemical industrial park. The safety, environmental protection, and industrial carrying capacities of the park are much greater than those of industrial concentration areas. There are complete supporting infrastructure of water supply plants, sewage treatment plants, fire stations, hazardous chemical parking lots, safety and environmental emergency command centers, employee operation skills training bases, dual power supply, and centralized heating centers (including industrial gas and steam), which are under closed management.

(3) Industrial advantages

The planned area of the pharmaceutical and chemical industry zone in Tonghua Chemical Industry Park is 207 hectares. Through internal cultivation and external attraction, building nests and attracting phoenixes, it will form a significant gathering and scale effect, becoming the main gathering and production area for pharmaceuticals in Northeast China, and thus giving birth to more pharmaceutical and chemical projects. The industrial layout, resource allocation, industrial chain, and radiation capability of opening up to the south have great advantages.

(4) Location advantages

The highway and railway traffics in Tonghua City extend in all directions, forming a highway network connecting the three provinces in Northeast China, and for customs entry and exit, mainly including Ji’an-Xilingol League Abaga Banner Expressway (National Highway 303), Hegang-Dalian Expressway (National Highway 201), Heilongjiang-Dalian Highway (National Highway 202), and Yingchengzi-Fumin Expressway. The first-class highway from Tonghua to Meihekou has been opened to traffic. There are crisscross Shenyang-Jilin, Meihekou-Ji’an, and Yayuan-Dalizi Railways, as well as direct passenger trains to Beijing, Qingdao, Shenyang, Changchun, Dalian, Baihe and other places.

(5) Talent advantages

At present, Tonghua City has 3 national key secondary vocational schools, 3 provincial key secondary vocational schools, and all its county-level vocational education centers have passed the provincial key school acceptance and entered the top 100 schools in the province. It is the first region in the province where all county-level vocational education centers have entered the provincial key school list. In recent years, by making scientific layout, continuous promotion of vocational education structure adjustment and resource integration, exploration of new paths for diversified education, and continuous improvement of modern vocational education network system construction, the local characteristics of vocational education have begun to form, and the ability to serve economic and social development has gradually improved.

Tonghua Municipal Government has signed science and technology strategic cooperation agreements with provincial universities and research institutions such as Northeast Normal University, Jilin Agricultural University, Changchun Institute of Applied Chemistry, Chinese Academy of Sciences, and Tonghua Normal University, etc., providing scientific and technological support for development of the enterprises. Tonghua City continues to provide assistance for enterprises in talent cultivation and other aspects, vigorously implements the “Plan for Revitalizing Enterprises with Ten Thousand Students” and “Plan for Homing of a Thousand Students”, and continuously attracts college graduates for enterprises.

1.2 Contents and scale of project construction

1.2.1 Product scale

The project produces 18 varieties of active pharmaceutical ingredients and pharmaceutical intermediates, with an annual output of 2,160 tons of API.

1.2.2 Contents of project construction

The project covers a total area of 300 mu with a total construction area of 200,000 ㎡. The project mainly involves the construction of factories, production workshops, warehouses, laboratories, supporting facilities, etc., and the purchase of raw material drug production lines.

1.3 Total investment of the project and capital raising

1.3.1 Total investment of the project

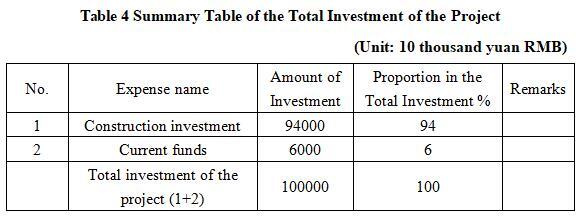

The total investment of the project is 1,000 million yuan, including the construction investment of 940 million yuan and current funds of 60 million yuan.

1.3.2 Capital raising

Raised by the enterprise itself.

1.4 Financial analysis and social evaluation

1.4.1 Main financial indexes

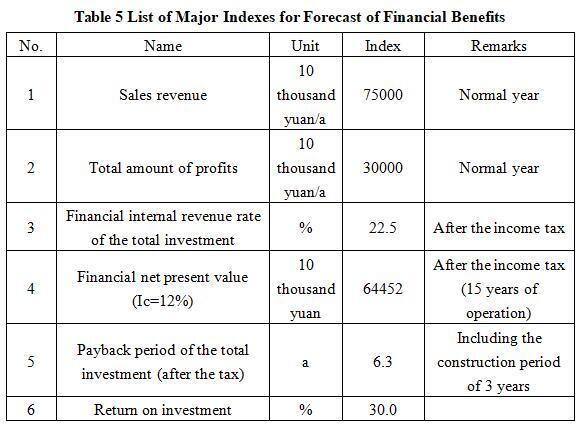

After the project reaches the production capacity, its annual sales income will be 750 million yuan, its profit will be 300 million yuan, its investment payback period will be 6.3 years (after the tax, including the construction period of 3 years), and its investment profit rate will be 30.0%.

Note: “10 thousand yuan” in the table is in RMB

1.4.2 Social evaluation

The construction of the project will effectively integrate local and Jilin Province’s medicine resources, optimize the industrial structure, improve the quality and competitiveness of APIs and their products, and lay a solid foundation for the long-term development of the medicine industry. The project will further promote the development of the health industry, provide higher quality and richer raw materials and products for fields such as medicine and health products, meet the growing health demands of the people, drive the development of related industries, create more employment opportunities, and promote the prosperity and development of the local economy.

1.5 Cooperative way

Sole proprietorship, and cooperation.

1.6 What to be invested by the foreign party

Funds, equipment and technology.

1.7 Construction site of the project

The Medicine and Chemical Sector of Tonghua Chemical Industrial Park.

1.8 Progress of the project

The project cooperation plan has been prepared.

2. Introduction to the Partner

2.1 Basic information

Name: Chemical Industry Park Management Bureau of Lugang Economic Development Zone

Address: North of National Highway 303, Tonghua County, Jilin Province

2.2 Overview

Jilin Tonghua Land Port Economic Development Zone, formerly known as Jilin Tonghua International Land Port Zone, is located in the northern part of Tonghua City, with a regional area of 266.96 square kilometers and a planned control area of 79.65 square kilometers. Since its establishment with the approval of the provincial government in 2016, its regional driving capacity and radiation effect have been continuously enhanced. As an important carrier for Jilin Province to implement southward opening up, the Port Area carries and plays a functional role in highway container center stations, railway container center stations, bonded logistics centers (Type B), comprehensive logistics parks, chemical industry parks, etc. It is striving to build an open cooperation zone that integrates bonded processing, modern logistics, industrial cooperation, and technological innovation.

The port area has obvious location advantages, prominent strategic advantages, and convenient transportation and logistics. Located along the border and near the sea, in the center of Northeast Asia, backed by the hinterland of the Northeast East Green Economic Belt; There are five or two railways and Tonghua Airport in the area, and modern logistics platforms such as highway container center stations, bonded logistics centers, and comprehensive logistics parks have been built. A commercial processing entrepreneurship park and a chemical industrial park have been built in the area, and the Northeast Asia International Agricultural and Forestry Products Trading Center is currently under construction. During the 14th Five-Year Plan period, according to the overall requirements of Tonghua City’s 14th Five-Year Plan, the Port Area took the overall idea of Tonghua City’s “one-four-five” as the guide, built “one port and two parks” as the layout, and created a new highland of openness and cooperation as the main line. It adhered to the integrated development of “port industry city”, solidly promoted key projects such as the commercial processing and entrepreneurship industrial park, Tonghua Pharmaceutical and Chemical Industry Park, Northeast Asia Agricultural and Forestry Products Trading Center, continuously optimized the basic supporting capacity, improved the carrying function of the park, enhanced the platform service level, and made every effort to build a commercial logistics and industrial gathering center in the eastern part of Northeast China.

2.3 Contact method

2.3.1 Contact method of cooperator

Contact unit: Chemical Industry Park Management Bureau of Lugang Economic Development Zone

Contact person: Sun Yanna

Tel: +86-18504353555

E-mail: gwqhgyqglj@163.com

2.3.2 Contact method of the city (prefecture) where the project is located

Contact unit: Tonghua Municipal Commerce Bureau

Contact person: Wang Liangchen

Tel: +86-435-3199017+86-18643036783

E-mail: thsswjtck@126.com