Petrochemical

50,000 Tons/Year High-end Polyolefin Project of Tonghua City

1. Introduction to the Project

1.1 Project background

1.1.1 Product introduction

High-end polyolefins refer to polyolefin varieties with high technological content, high performance, and high market value. Representative products include metallocene polyethylene (mPE), metallocene polypropylene (mPP), polyolefin elastomers (POE), ethylene vinyl acetate copolymer (EVA), ethylene vinyl alcohol copolymer (EVOH), polybutene-1 (PB-1), and ultra-high molecular weight polyethylene (UHMWPE).

High-end polyolefins have the characteristics of light weight, low density, good flame retardancy, and strong chemical resistance. High-end polyolefin products have become an indispensable material in modern industrial production due to their excellent characteristics and wide applications. High-end polyolefin products are used in packaging fields such as food, medicine, cosmetics, and daily necessities; The field of building materials such as underground pipelines, roof waterproofing, and thermal insulation; Customized wardrobes, cabinets, screens, curtains and other furniture and decorations in the home field; The automotive aerospace field includes components such as front and rear bumpers, interior, evaporator, aircraft cargo hold, aircraft baffle, spacecraft shell, etc.

This project is located in the Chemical Industry Park of Tonghua City, using the abundant chemical raw material resources of Tonghua City and Jilin Province. After completion, the high-end polyolefin products produced mainly include ultra-high molecular weight polyethylene (UHMWPE), polyolefin elastomer (POE), metallocene polyolefin and other high-end materials, which is conducive to promoting the development of Tonghua City’s chemical industry.

1.1.2 Market prospect

(1) The current situation of the global high-end polyolefin market

High-end polyolefin materials are important supporting materials for the development of high-tech industries such as aerospace, new energy, and electronic information. They are also the main materials for promoting energy conservation, emission reduction, and low-carbon economy development in traditional industries. The production of high-end polyolefins worldwide is mainly concentrated in Western Europe, Northeast Asia, and North America. Data shows that the global high-end polyolefin market size will increase from US$ 48.751 billion in 2016 to US$ 81.787 billion in 2022. The global high-end polyolefin market will reach US$ 86.4 billion in 2023, a year-on-year increase of 6%.

For global production layout, high-end polyolefin production is mainly concentrated in Western Europe, Southeast Asia, and North America. The Middle East is dominated by bulk general-purpose materials, with Japan being the main producer of high-end polyolefins in Southeast Asia. Related companies include ExxonMobil, Dow Chemical, BASF, LyondellBasell, Total, Mitsui Chemicals, Sumitomo Chemical, Asahi Kasei, etc. Taking mPE as an example, the global mPE production capacity is about 15 million tons, with a market size exceeding 200 billion yuan. Where, there are a total of 5 enterprises with a production capacity of 500,000 tons/year or more, mainly concentrated in the United States. CR5 accounts for about 40%, all of which have their own mPE grades and are subject to technical blockade.

(2) Current situation of China’s high-end polyolefin market

In recent years, China’s polyolefin industry has developed rapidly, with both production and demand showing double growth, becoming a major producer and consumer of polyolefins worldwide. With the continuous development of the Chinese economy and the upgrading of consumption structure, the demand for high-end polyolefin products will continue to increase. In 2023, the production of high-end polyolefin industry in China increased from 1.9343 million tons in 2016 to 5.6875 million tons, and the demand increased from 5.7743 million tons in 2016 to 13.994 million tons. In 2023, the scale of China’s high-end polyolefin market reached 192.827 billion yuan.

Polyolefin products are ubiquitous in daily life, and their industrial development has a significant impact on human production and life. The upstream raw materials of the high-end polyolefin industry chain include oil, natural gas, coal, etc. The midstream mainly focuses on the preparation of high-end polyolefins, and the downstream application fields are very extensive, including aerospace, automotive manufacturing, military equipment, and plastics.

With the increasing demand for high-end polyolefin applications, the market is gradually evolving towards high-end and differentiated directions, which will bring huge space and opportunities for the development of the polyolefin market. By now, China Petroleum, Sinopec, Yantai Wanhua, etc. have begun to lay out their technological accumulation and hardware and software conditions in the industrialization of metallocene polyolefins, and are accelerating the process of high-end polyolefin industry. Policy support also provides opportunities for the development of high-end polyolefins. Domestic high-end polyolefin producers mainly include Levima New Material, Wanhua Chemical, Qilu Petrochemical, Silbon Petrochemical, Maoming Petroleum, Sinochem Quanzhou, Yanchang middling coal, etc.

By now, there is still a significant gap between the overall production technology of high-end polyolefins in China and the international advanced level, and the self-sufficiency rate is still at a low level. The industry has great development space. Against the backdrop of the continuous promotion of building a strong technological country and the increasing support from the government for key materials and high-tech industries, the demand for high-end polyolefin market will continue to grow, and the industry’s prosperity is relatively high. Domestic high-end polyolefin production enterprises need to increase capital investment and R&D efforts, improve production technology, update production equipment, and promote the industry towards high-quality development.

(3) Forecast of high-end polyolefin market prospects

During the 14th Five-Year Plan period, China’s polyolefin industry focused on technological innovation in high-end, differentiated, and diversified product development for upgrading. Intensify the development and market promotion of high-end polyolefin products such as metallocene polyolefin elastomers, bimodal polyolefins, and ultra-high molecular weight polyethylene, and increase the production proportion of high-end and specialized materials such as polypropylene pipe special materials, capacitor film special materials, polyethylene automotive fuel tank special materials, gas pipeline special materials, and automotive insurance bar special materials, to enhance the competitiveness of China’s polyolefin industry. Therefore, high-end polyolefin products will be one of the key directions for the future development of the industry.

① Ultra- high molecular weight polyethylene (UHMWPE)

Ultra-high molecular weight polyethylene (UHMWPE) is a thermoplastic engineering plastic with a linear long-chain structure and superior comprehensive properties. It has excellent characteristics that ordinary polyethylene cannot match, such as extremely high wear resistance, higher strength than most metals, and excellent impact resistance. The molecular structure of UHMWPE is not much different from that of general polyethylene (LDPE, LLDPE, HDPE), but due to its large molecular weight and longer molecular chain, it has more excellent properties and a wider range of downstream applications.

UHMWPE is a typical representative of high-performance polyolefin materials, with a stable linear long-chain structure that gives it many excellent properties such as high strength, impact resistance, wear resistance, self-lubricating, chemical corrosion resistance, and low temperature resistance. In recent years, the processing and modification technology of ultra-high molecular weight polyethylene has been increasingly expanded and optimized, forming a variety of ultra-high molecular weight polyethylene products that are widely used in various military and civilian fields. According to statistics, the market size of ultra-high molecular weight polyethylene in China in 2022 was about 1.797 billion yuan, a year-on-year increase of 5.58%. The market size of China’s ultra-high molecular weight polyethylene industry in 2023 was about 1.889 billion yuan, a year-on-year increase of 5.12%.

In recent years, the production and demand of ultra-high molecular weight polyethylene in China have maintained rapid growth. In 2022, the production of ultra-high molecular weight polyethylene in China was approximately 80,200 tons, with a demand of 105,100 tons; In 2023, the production of ultra-high molecular weight polyethylene in China was approximately 90,300 tons, with a demand of approximately 115,200 tons.

The upstream links of the ultra-high molecular weight polyethylene (UHMWPE) industry chain include the catalytic polymerization of ethylene to form ultra-high molecular weight polyethylene, which is then spun into ultra-high molecular weight polyethylene fibers through dry or wet spinning processes. The main products of UHMWP include fibers, membranes, sheets, and industrial pipes.

The research on UHMWPE in China started relatively late, and the overall situation still presents a surplus of mid to low end production capacity and a shortage of high-end production capacity. In order to achieve the import substitution of high-end fibers in China and promote the development of local industries, China has introduced a series of UHMWPE encouragement policies to promote the healthy development of the ultra-high molecular weight polyethylene industry, continuously guide and further improve the key production and application technologies of key varieties of high-performance fibers, promote the development of ultra-high molecular weight polyethylene fibers and their composite materials, enhance the application level of industrialization, and further expand the application fields of high-performance fibers.

② Polyolefin elastomer (POE)

Polyolefin elastomer (POE) is a random copolymer of ethylene/higher α- olefin with a high content of comonomers, belonging to a new type of thermoplastic elastomer. The unique molecular structure of POE endows it with excellent mechanical properties, rheological properties, and aging resistance. Meanwhile, it has good affinity with polyolefins, outstanding low-temperature toughness, and high cost-effectiveness. It can be used as rubber, thermoplastic elastomer, and impact modifier toughening agent for plastics. It has become one of the new materials with great development prospects to replace traditional rubber and some plastics, and is widely used in medical packaging materials, automotive parts, daily products and other fields.

POE has excellent comprehensive performance and great potential for development. In recent years, China has attached great importance to the development of the polyolefin elastomer (POE) industry and continuously strengthened research on POE production technology. The catalyst with high copolymerization performance developed by research institutions such as Zhejiang University, China Petrochemical Research Institute, and Institute of Chemistry of Chinese Academy of Sciences has laid the foundation for the development of POE synthesis technology and commercial production of POE by domestic enterprises. By now, although some progress has been made in the production technology research of polyolefin elastomers (POE), there is still significant room for development.

Early POE was mainly applied in the automotive industry, and the overall market size of the industry remained stable. With the continuous deepening of POE material R&D, POE has been widely used as a photovoltaic film material in the photovoltaic field, further promoting the growth of POE demand. Due to the fact that China’s POE has not yet achieved industrial production and mainly relies on imports, it is urgent to achieve import substitution as import prices remain high and domestic demand continues to grow. Data shows that the market size of China’s polyolefin elastomer (POE) industry in 2023 was approximately 4.473 billion yuan.

For the industrial chain, the upstream of the POE industry supply chain is the raw material supply link, mainly consisting of ethylene and α-olefins (1-butene, 1-hexene, 1-octene, etc.), which are synthesized into POE under the action of metallocene catalysts; On the downstream side, due to the presence of both crystalline regions provided by ethylene and amorphous regions provided by α-olefins in the POE structure, it has both plasticity and elasticity at room temperature, and has many advantages such as good affinity with polyolefins and outstanding low-temperature toughness. It is widely used in various fields such as photovoltaic films, automotive accessories, wires and cables, packaging materials, and daily products.

By now, China has not yet achieved industrial production of POE, and the POE production process and catalyst are still in the R&D exploration stage. Due to strict patent technology protection for catalysts by foreign POE production companies and restrictions on the production technology of high carbon α-olefins required for POE production, POE R&D still faces significant challenges. Currently, companies such as PetroChina, Sinopec, Wanhua Chemical, Shandong Jingbo, and Sinopec have made positive progress. Meanwhile, under the guidance of national policies, many domestic enterprises have accelerated their layout in the POE field and continued to promote product R&D production. By now, a few enterprises in China with POE research and production capabilities include Wanhua Chemical, Satellite Chemical, Tianjin Petrochemical, Dongfang Shenghong, Maoming Petrochemical, and others. For planned production capacity, Wanhua Chemical, Dingjide, and Zhejiang Petrochemical’s POE plan production capacity are all 400,000 tons per year, while Dongfang Shenghong, Satellite Chemical, Tianjin Petrochemical, Wison New Materials, and Chengzhi Group’s POE plan production capacity are all 100,000 tons or more.

In the future, with the gradual production of R&D enterprise projects, China’s self-sufficiency in POE will continue to improve, and the prospects for product localization are broad.

③ Metallocene polyolefin

Metallocene polyolefin is a new high-end polyolefin product generated through specific polymerization reactions using metallocene complexes as catalysts. Due to the single active center of metallocene catalysts, the resulting polymers exhibit regular stereoregularity and narrow molecular weight distribution, allowing for precise control of polymer properties to meet a wider range of application requirements. Compared with traditional catalysts, the polymerization behavior of metallocene catalyst systems is more diverse and can generate polyolefins with a wider range of structural types.

In 2023, the production capacity of metallocene polyethylene (mPE) in China reached 3.4 million tons. There are 10 main enterprises in China that can commercially produce mPE: Sinopec’s Qilu Petrochemical, Maoming Petrochemical, Yangzi Petrochemical, and Zhongke (Guangdong) Refining and Chemical; PetroChina’s Daqing Petrochemical Company, Dushanzi Petrochemical Company, and Lanzhou Petrochemical Company; Shenyang Chemical Industry Co., Ltd; Zhejiang Petrochemical and Baofeng Energy Group Co., Ltd.

In the downstream demand field of metallocene polyethylene (mPE) in China, the food film industry accounts for 28.4% of the total consumption; The proportion of the wrapping film field is 19.0%, the greenhouse film field is 18.5%, the pipe material field is 9.4%, and the heat shrink film field is 8.9%. In 2022, the demand for metallocene polyethylene (mPE) in China was 2.405 million tons, a year-on-year increase of 10.4%; The demand for metallocene polyethylene (mPE) in China in 2023 is 2.56 million tons, a year-on-year increase of 6.4%.

In recent years, metallocene polypropylene has mostly replaced some of the high-end downstream demands of polypropylene with high-end substitutes. Currently, the main application directions of metallocene polypropylene in China include injection molding, fibers, and film materials. During 2020-2023, the production of metallocene polypropylene in China showed a fluctuating upward trend, with a compound annual growth rate of 10.21%. During 2021-2023, the total supply of metallocene polypropylene in China showed a slow recovery trend after a decline. By 2023, the total production of metallocene polypropylene in China will be 17,400 tons, accounting for 15.76% of domestic consumption. Due to a low base, although the growth rate is still acceptable, the overall supply level is still at a low level.

With the continuous advancement of metallocene polyolefin technology by domestic enterprises, the types of products that can be produced are becoming increasingly diverse, and their application fields are further expanding. The market share is also expanding, and the localization rate will continue to increase. By now, China’s metallocene polyolefin industry has laid a solid foundation in technology development and production, and has initially established a complete industrial chain from scientific research to production, processing and application, accelerating the pace of localization. According to relevant data, the localization rate of China’s metallocene polyethylene (mPE) industry reached 30% by 2024.

1.1.3 Technical analysis

Polyolefin production is divided into gas-phase process, slurry process, solution process, and high-pressure polyolefin process according to different polymerization production processes. According to the different reaction equipment, it can be divided into tubular method, kettle method, fluidized bed method, etc. According to different process parameters and product performance, catalysts can be selected from multiple systems such as Ziegler-Natta, Phillips chromium metal, and metallocene. The slurry process catalyzed by Phillips chromium metal has become a typical process for producing high-density polyethylene (HDPE) due to its advantages of being produced at low pressure and low temperature, and the polymer being insoluble in dilution solvents.

The project plan is to import a complete set of equipment for product production through cooperation before the technology R&D reaches large-scale production. After the mature application of domestic technology, all will be localized.

1.1.4 Advantageous conditions of project construction

(1) Policy advantages

In China’s 14th Five-Year Plan for the Development of Raw Material Industry, it is emphasized that the petrochemical industry should promote the R&D of high-end polyolefin products such as metallocene.

The China Petroleum and Chemical Industry Federation also proposed in the 14th Five-Year Plan for Development Guidelines of the Chemical New Materials Industry to focus on improving the localization capacity of high-end polyolefin plastics, with the goal of striving to increase the self-sufficiency rate to nearly 70% by 2025. The domestic high-end polyolefin industry may usher in rapid development.

In May 2021, the 14th Five-Year Plan for Development Guidelines of the Petroleum and Chemical Industry mentioned that key areas should be developed, including the high-end polyolefin field of green production technology using metallocene catalysts, striving to achieve a self-sufficiency rate of 75% by 2025.

In July 2022, the National Development and Reform Commission and the Ministry of Commerce jointly released the Catalogue of Industries Encouraged for Foreign Investment (2022 Edition), which mentioned encouraging foreign investment in the development and production of high-end polyolefins such as high carbon alpha olefin copolymer metallocene polyethylene and COC/COP cyclic olefin polymers.

In March 2023, the National Development and Reform Commission agreed to establish a demonstration zone for industrial transfer in southwestern Jilin, focusing on enhancing industrial transfer capacity, optimizing business environment, deepening open cooperation, effectively undertaking domestic and foreign industrial transfer, promoting industrial transformation and upgrading in the process of undertaking, and striving to build the demonstration zone into a characteristic manufacturing base in Northeast China, a green and low-carbon transformation pilot zone, a new highland for regional cooperation and development, and an important agricultural and special product processing base in China. The demonstration zone covers three cities: Siping, Liaoyuan, and Tonghua. This project is a petrochemical industry project among the seven major undertaking industries in the demonstration zone.

(2) Industrial advantages

The Tonghua Chemical Industry Park relies on the advantages of Changbai Mountain’s resources such as pharmaceuticals and mountain treasures, as well as the advantages of metallurgy, medicine, mechanical processing and manufacturing industries, to develop chemical raw materials and pharmaceutical intermediates upstream, with a focus on the development of pharmaceutical and chemical industries, fine chemicals, and new chemical materials. Tonghua Chemical Industry Park is one of the first five chemical industrial parks in Jilin Province to pass the review and recognition. It has passed the Level C risk assessment of the Provincial Emergency Department. The Park has a recent planned area of 7.07 k㎡and a long-term planned area of 13.4 k㎡. It has strong land resource supply capacity and has the advantage of undertaking large-scale chemical projects and good projects, with complete infrastructure.

The production of the project requires sufficient supply of raw materials around the chemical industry park in Tonghua City. Ethylene and propylene mainly come from Jilin Petrochemical Company and Fushun Petrochemical Company. Where, Jilin Petrochemical Company’s 1.2 million tons/year ethylene transformation and upgrading can provide reliable raw material guarantee for the project. The maximum transportation radius for the required raw materials for the project is within 300 km.

(3) Location advantages

The highway and railway traffics in Tonghua City extend in all directions, forming a highway network connecting the three provinces in Northeast China, and for customs entry and exit, mainly including Ji’an-Xilingol League Abaga Banner Expressway (National Highway 303), Hegang-Dalian Expressway (National Highway 201), Heilongjiang-Dalian Highway (National Highway 202), and Yingchengzi-Fumin Expressway. The first-class highway from Tonghua to Meihekou has been opened to traffic. There are crisscross Shenyang-Jilin, Meihekou-Ji’an, and Yayuan-Dalizi Railways, as well as direct passenger trains to Beijing, Qingdao, Shenyang, Changchun, Dalian, Baihe and other places.

(4) Talent advantages

At present, Tonghua City has 3 national key secondary vocational schools, 3 provincial key secondary vocational schools, and all its county-level vocational education centers have passed the provincial key school acceptance and entered the top 100 schools in the province. It is the first region in the province where all county-level vocational education centers have entered the provincial key school list. In recent years, by making scientific layout, continuous promotion of vocational education structure adjustment and resource integration, exploration of new paths for diversified education, and continuous improvement of modern vocational education network system construction, the local characteristics of vocational education have begun to form, and the ability to serve economic and social development has gradually improved.

Tonghua Municipal Government has signed science and technology strategic cooperation agreements with provincial universities and research institutions such as Northeast Normal University, Jilin Agricultural University, Changchun Institute of Applied Chemistry, Chinese Academy of Sciences, and Tonghua Normal University, etc., providing scientific and technological support for development of the enterprises. Tonghua City continues to provide assistance for enterprises in talent cultivation and other aspects, vigorously implements the “Plan for Revitalizing Enterprises with Ten Thousand Students” and “Plan for Homing of a Thousand Students”, and continuously attracts college graduates for enterprises.

1.2 Contents and scale of project construction

1.2.1 Product scale

The project has an annual output of 50,000 tons of high-end polyolefins, including 20,000 tons of ultra-high molecular weight polyethylene (UHMWPE), 20,000 tons of polyolefin elastomers (POE), and 10,000 tons of metallocene polyolefins.

1.2.2 Contents of project construction

The project covers a total area of 150 mu with a total construction area of 120,000㎡. The project mainly constructs the main factory building, production workshop, warehouse, laboratory, sewage treatment station, supporting facilities, etc., and purchases and installs production equipment.

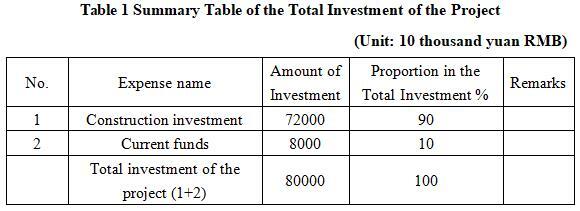

1.3 Total investment of the project and capital raising

1.3.1 Total investment of the project

The total investment of the project is 800 million yuan, including the construction investment of 720 million yuan and current funds of 80 million yuan.

1.3.2 Capital raising

Raised by the enterprise itself.

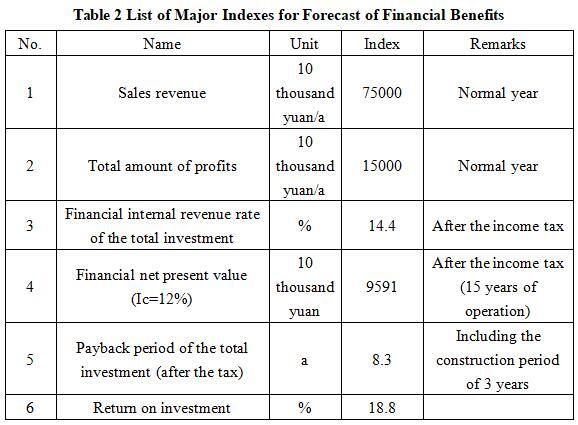

1.4 Financial analysis and social evaluation

1.4.1 Main financial indexes

After the project reaches the production capacity, its annual sales revenue will be 750 million yuan, its profit will be 150 million yuan, its investment payback period will be 8.3 years (after the tax, including the construction period of 3 years), and its return on investment will be 18.8%.

Note: “10 thousand yuan” in the table is in RMB

1.4.2 Social evaluation

After the project is completed and put into operation, it will gradually create a large number of new job opportunities. Meanwhile, through the aggregation of upstream and downstream industries in the industrial chain, it will also increase the employment demand of related enterprises in the industrial chain, thereby directly or indirectly increasing a large number of job opportunities and providing employment opportunities for potential job seekers.

1.5 Cooperative way

Investor's sole proprietorship.

1.6 What to be invested by the foreign party

Funds, equipment and technology.

1.7 Construction site of the project

Chemical New Materials Section of Tonghua Chemical Industry Park.

1.8 Progress of the project

The project cooperation plan has been prepared.

2. Introduction to the Partner

2.1 Basic information

Name: Chemical Industry Park Management Bureau of Lugang Economic Development Zone

Address: North of National Highway 303, Tonghua County, Jilin Province

2.2 Overview

Jilin Tonghua Land Port Economic Development Zone, formerly known as Jilin Tonghua International Land Port Zone, is located in the northern part of Tonghua City, with a regional area of 266.96 square kilometers and a planned control area of 79.65 square kilometers. Since its establishment with the approval of the provincial government in 2016, its regional driving capacity and radiation effect have been continuously enhanced. As an important carrier for Jilin Province to implement southward opening up, the Port Area carries and plays a functional role in highway container center stations, railway container center stations, bonded logistics centers (Type B), comprehensive logistics parks, chemical industry parks, etc. It is striving to build an open cooperation zone that integrates bonded processing, modern logistics, industrial cooperation, and technological innovation.

The port area has obvious location advantages, prominent strategic advantages, and convenient transportation and logistics. Located along the border and near the sea, in the center of Northeast Asia, backed by the hinterland of the Northeast East Green Economic Belt; There are five or two railways and Tonghua Airport in the area, and modern logistics platforms such as highway container center stations, bonded logistics centers, and comprehensive logistics parks have been built. A commercial processing entrepreneurship park and a chemical industrial park have been built in the area, and the Northeast Asia International Agricultural and Forestry Products Trading Center is currently under construction. During the 14th Five-Year Plan period, according to the overall requirements of Tonghua City’s 14th Five-Year Plan, the Port Area took the overall idea of Tonghua City’s “one-four-five” as the guide, built “one port and two parks” as the layout, and created a new highland of openness and cooperation as the main line. It adhered to the integrated development of “port industry city”, solidly promoted key projects such as the commercial processing and entrepreneurship industrial park, Tonghua Pharmaceutical and Chemical Industry Park, Northeast Asia Agricultural and Forestry Products Trading Center, continuously optimized the basic supporting capacity, improved the carrying function of the park, enhanced the platform service level, and made every effort to build a commercial logistics and industrial gathering center in the eastern part of Northeast China.

2.3 Contact method

2.3.1 Contact method of cooperator

Contact unit: Chemical Industry Park Management Bureau of Lugang Economic Development Zone

Contact person: Sun Yanna

Tel: +86-18504353555

E-mail: gwqhgyqglj@163.com

2.3.2 Contact method of the city (prefecture) where the project is located

Contact unit: Tonghua Municipal Commerce Bureau

Contact person: Wang Liangchen

Tel: +86-435-3199017+86-18643036783

E-mail: thsswjtck@126.com