Petrochemical

High Purity Graphite, Graphene Products, and High-End Negative Electrode Graphitization Materials Project of Tonghua City

1. Introduction to the Project

1.1 Project background

1.1.1 Product introduction

Graphite, as a non-renewable resource, has received widespread attention worldwide and has become a strategically controlled resource. The United States, Russia, the UK, Germany and other countries have reserved graphite as a strategic resource, restricted its mining, and instead imported it at low prices from countries such as China. It is of great strategic significance for integrating graphite resources, developing them in a reasonable, orderly, and moderate manner, and increasing product added value. The main growth areas of graphite consumption in the future are photovoltaics, semiconductor materials, lithium batteries, fuel cells, and other fields.

The new energy and new materials industries are key industries for development in China. The government encourages, supports, and guides the healthy development of the new energy and new materials industries through policies, regulations, and industry support. This project uses the abundant chemical raw material resources in Tonghua City and Jilin Province to build a new energy and new material R&D base for high-purity graphite, graphene products, and high-end negative electrode graphitization materials in the Tonghua Chemical Industry Park. After completion, it will have a competitive advantage in the field of graphite and graphite negative electrode materials.

1.1.2 Market prospect

(1) Current market situation of graphite industry

Graphite is an allotrope of carbon, a gray black, opaque solid with stable chemical properties, corrosion resistance, and resistance to reactions with acids, alkalis, and other chemicals. It can be divided into natural graphite and artificial graphite according to its source. Where, natural graphite comes from graphite deposits and usually exists in the form of graphite schist, graphite gneiss, graphite bearing schist, metamorphic shale and other minerals in nature; Artificial graphite is usually made from petroleum coke, asphalt coke, and other raw materials through a series of processing steps. Graphite has characteristics such as conductivity, thermal conductivity, lubricity, chemical stability, and thermal shock resistance, and is widely used in fields such as pencil lead, refractory materials, conductive materials, lubricating materials, carbon manufacturing, and radiation resistant materials.

The Chinese graphite industry is an industry with a long history, with the extraction and use of graphite since ancient times. China’s graphite industry has gone through a long development process from traditional manual mining to modern industrial production, and has now become one of the largest graphite producing countries in the world. With the continuous expansion of high-tech applications, China’s graphite industry is still full of potential and will continue to provide important material support for multiple fields. Data showed that the market size of China’s graphite industry in 2023 was approximately 47.012 billion yuan. Where, the market size of natural graphite was about 6.774 billion yuan, and the market size of artificial graphite was about 40.238 billion yuan.

The products of graphite are very rich, which can be used to prepare cutting-edge graphene materials and high-end materials such as high-purity graphite, spherical graphite, and expanded graphite, and applied in strategic emerging industries such as new energy vehicles, energy storage, and environmental protection; Meanwhile, the mid to low end products of graphite can also be applied to basic traditional industries such as steel and casting. Graphite is a fundamental raw material for multiple industrial sectors in the industrial system and plays an important role in industrial development.

(2) Market Status of Graphene Industry

Graphene is an allotrope of carbon, where carbon atoms form a single-layer hexagonal honeycomb lattice graphene through sp² hybridization bonding. The crystal structure of graphene can be used to construct fullerene (C60), graphene quantum dots, carbon nanotubes, nanoribbons, multi-walled carbon nanotubes, and nanohorns. Graphene is comprised of single-layer graphene, single-layer graphene, few layer graphene, and multi-layer graphene, with excellent optical, electrical, and mechanical properties.

Graphene is a single-layer thin film formed from carbon atoms, which has excellent electrical conductivity, thermal conductivity, and mechanical properties, and is known as the “king of materials”. Graphene has a wide range of applications, including electronic devices, batteries, coatings, pharmaceuticals, etc., making the development prospects of the graphene industry very promising.

From the perspective of the industrial chain. The upstream of graphene can be mainly divided into raw materials and equipment, where the raw materials mainly include graphite, silicon carbide, ethylene hydrogen, argon, and methane; The equipment includes CVD equipment, magnetic stirrer, etching machine, etc. The midstream includes the production and manufacturing of graphene; Downstream industries include aerospace, new energy batteries, coatings, composite coatings, and textiles.

With the continuous advancement of technology and the expansion of applications, the market size of graphene is constantly expanding. According to market research institutions, the global graphene market was expected to reach around 100 billion yuan by 2025. Where, electronic devices and batteries are the largest application fields of graphene, and it is expected to continue to maintain high-speed growth in the coming years.

In China, the development of the graphene industry has received high attention and support from the government. The Chinese government has introduced a series of policies to support the development of the graphene industry, including the National Key R&D Program and the New Materials Industry Development Plan. With the support of the Chinese government, China’s graphene industry has achieved significant results.

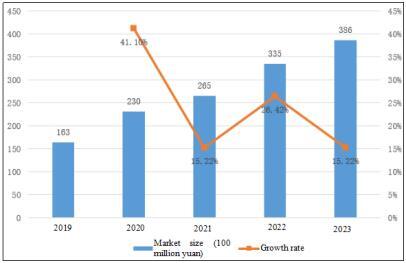

By now, China’s graphene industry chain has been preliminarily established, covering various links from raw material R&D, preparation to application, and has achieved initial industrialization in some key fields, leading the global graphene industrialization process. According to data, the market size of graphene in China was about 33.5 billion yuan in 2022, with a year-on-year increase of 26.42%, and was about 38.6 billion yuan in 2023, with a year-on-year increase of 15.22%, with stable growth for five consecutive years.

Figure 1 Scale and Growth Rate of China’s Graphene Market during 2019- 2023

At present, the Chinese graphene material market is mainly dominated by graphene powder, which accounts for 90.7% of the overall market, and graphene film accounts for 9.3%.

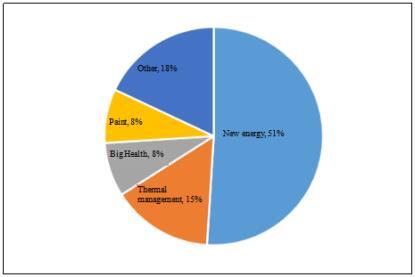

From the perspective of downstream application proportion, the highest proportion of graphene application in China is in the field of new energy, accounting for 51%; Followed by thermal management, accounting for 15% of applications; The third is in the fields of health and coatings, both accounting for 8% of applications.

Figure 2Proportion of Downstream Applications of Graphene in China

Graphene exhibits infinite possibilities in the field of technological innovation due to its unique physical and chemical properties. Its excellent conductivity, thermal conductivity, mechanical strength, and chemical stability make graphene have broad application prospects in various fields such as electronic information, new energy, aerospace, and biomedical research. For example, in the field of electronic information, graphene is expected to replace silicon as the basic material for the new generation of information technology, greatly improving computing speed and efficiency; In the field of new energy, graphene batteries can significantly improve charging speed and endurance, promoting the rapid development of electric vehicles and energy storage technology.

(3) Development Status of Graphite Electrode Industry

Graphite electrode is an important conductive material in the electric smelting industry, with good conductivity and thermal conductivity, high mechanical strength, and good oxidation and corrosion resistance at high temperatures. It has become an important component of the contemporary raw material industry. As a key auxiliary material for steelmaking, the price of graphite electrodes is closely related to the prosperity of the steel industry. Recently, there have been clear signs of recovery in the steel industry, driving a rebound in demand for graphite electrodes.

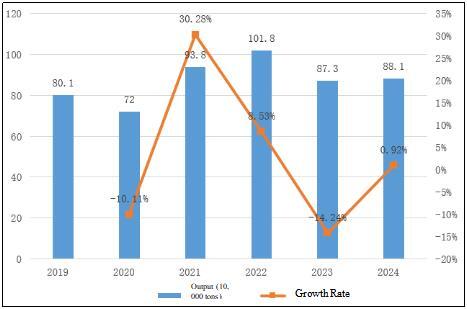

In recent years, the rapid development of industries such as steel, electrolytic aluminum, and industrial silicon has driven the continuous increase in graphite electrode production. According to data, China’s graphite electrode production was 881,000 tons in 2024, with a year-on-year increase of 0.92%. In the future, with the support and guidance of domestic policies for electric arc furnace short process steelmaking to replace converter steelmaking, and the output of graphite electrodes will continue to grow.

Figure 3Production and Growth Rate of Graphite Electrodes in China during 2019 - 2024

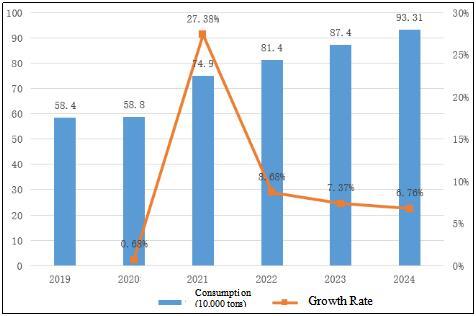

With the increasing demand of downstream industries, the consumption of graphite electrodes in China has been continuously increasing in recent years. According to data, the consumption of graphite electrodes in China reached 814,000 tons in 2022, with a year-on-year increase of 8.68%, and reached about 874,000 tons in 2023. The consumption of graphite electrodes in China reached 933,100 tons by 2024.

Figure 4Consumption and Growth Rate of Graphite Electrodes in China during 2019- 2024

Benefiting from the growth of domestic and foreign terminal markets such as new energy vehicles, China’s lithium battery related industry has developed rapidly, and the demand for negative electrode materials in the market has increased. According to data, the shipment volume of negative electrode materials in China reached 1.711 million tons in 2024, with a year-on-year increase of 19.4%, and the global share further increased to 94.1%. In 2024, the shipment volume will maintain a growth, reaching 2.08 million tons.

Figure 5Shipments and Growth Rates of Negative Electrode Materials for Lithium Batteries in China during 2019-2024

The application fields of graphite electrodes are constantly expanding, gradually expanding from traditional metallurgy, chemical industry, machinery and other fields to emerging fields such as batteries, new energy, aerospace, etc. These emerging fields have higher performance requirements for graphite electrodes, driving continuous innovation and upgrading of graphite electrode technology. With the rapid development of industries such as new energy vehicles and electronic information, the market demand for graphite electrodes will continue to grow, providing broad development space for the industry.

1.1.3 Technical analysis

The project adopts modern production technology and automated production lines, with mature production processes and technologies, and has the conditions for large-scale production.

High-purity graphite is produced through the selection of raw materials, high-temperature removal of impurities, high current density extraction technology, and final purification steps to produce high-purity graphite materials.

Graphene products are prepared by chemical vapor deposition (CVD), which first vaporizes carbon containing substances under certain conditions and undergoes chemical reactions, and then deposits the reaction products onto the substrate surface to produce graphene.

High-end negative electrode graphitization materials have successfully transformed carbon structures into graphite structures through high-temperature graphitization treatment, possessing the corresponding functions of lithium battery negative electrodes. The preparation process mainly includes processes such as graphitization, pressing, sintering, and heat treatment.

1.1.4 Advantageous conditions of project construction

(1) Policy advantages

In September 2020, the Guidelines on Expanding Investment in Strategic Emerging Industries, Cultivating and Strengthening New Growth Points and Growth Poles proposed to implement the Action Plan for Innovative Development of New Materials, improve the technological level of rare earth, vanadium titanium, tungsten molybdenum, lithium, rubidium cesium, graphite and other characteristic resources in mining, smelting, deep processing and other links, and accelerate the expansion of the application of graphene, nanomaterials and other materials in the fields of optoelectronics, aviation equipment, new energy, biomedicine, etc.

In December 2021, the 14th Five-Year Plan for the Development of Raw Material Industry proposed to promote the implementation of ultra-low emission transformation in the steel industry, and to study and promote the implementation of ultra-low emissions in key industries such as chemical, coking, electrolytic aluminum, steel smelting, lead-zinc smelting, cement, glass, refractory materials, graphite deep processing, ceramics, etc.

In January 2022, the Guidelines on Promoting High-quality Development of the Steel Industry proposed to encourage enterprises to develop short process steelmaking using electric furnaces, strengthen the development direction of scrap steel utilization, and provide strong policy support for the future development of graphite electrodes.

In March 2023, the National Development and Reform Commission agreed to establish a demonstration zone for industrial transfer in southwestern Jilin, focusing on enhancing industrial transfer capacity, optimizing business environment, deepening open cooperation, effectively undertaking domestic and foreign industrial transfer, promoting industrial transformation and upgrading in the process of undertaking, and striving to build the demonstration zone into a characteristic manufacturing base in Northeast China, a green and low-carbon transformation pilot zone, a new highland for regional cooperation and development, and an important agricultural and special product processing base in China. The demonstration zone covers three cities: Siping, Liaoyuan, and Tonghua. This project is a petrochemical industry project among the seven major undertaking industries in the demonstration zone.

(2) Resource advantages

China’s flake graphite is mainly distributed in Jixi and Luobei in Heilongjiang, Xinghe in Inner Mongolia, Yichang in Hubei, Panzhihua in Sichuan, Nanshu in Shandong, and Tonghua in Jilin.

There are abundant graphite resources in Tonghua City, mainly distributed in Caiyuan Town, Qinghe Town, Toudao Town, Huadian Town of Ji’an City, and the Sanbanjiang area of Dayuanyuan Township in Tonghua County. It has been found that the graphite resource reserves (ore volume) are 222.4 million tons, with a grade of 3-10%. Mineral processing products with graphite flakes greater than 50 mesh account for more than 20%, and 50-100 mesh account for more than 40%. They have the characteristics of shallow burial, large scales, easy mining and selection, and good quality. The local area can provide sufficient raw materials for the project.

(3) Industrial advantages

Ji’an Caiyuan Xingda Mineral Processing Co., Ltd. is located in Tonghua City, with a designed annual production of 20,000 tons of medium carbon graphite. In 2022, it actually produced 1,440 tons of medium carbon graphite. The Company has established technical cooperation with companies such as China’s Chenggu and currently holds 120 invention patents, including the preparation method of single-layer graphite and the structure of nano graphite sheets. It collaborates with domestic research institutes to conduct key technological breakthroughs, focusing on emerging industries such as graphene, heavy-duty anti-corrosion coatings, and new energy batteries, with a focus on supporting high-purity graphite, graphene anti-corrosion coatings, and graphene electric heating materials. This can also form an industrial support with the new carbon material project of Zhongyi Future (Tonghua) New Energy Technology Company, which wraps lithium carbide negative electrode materials, complementing each other’s advantages.

Jilin Petrochemical Company is located in Jilin Chemical Industrial Park, which can produce 200,000 tons of low sulfur petroleum coke annually, providing industrial support for the production of high-end negative electrode graphite materials for the project.

(4) Location advantages

The highway and railway traffics in Tonghua City extend in all directions, forming a highway network connecting the three provinces in Northeast China, and for customs entry and exit, mainly including Ji’an-Xilingol League Abaga Banner Expressway (National Highway 303), Hegang-Dalian Expressway (National Highway 201), Heilongjiang-Dalian Highway (National Highway 202), and Yingchengzi-Fumin Expressway. The first-class highway from Tonghua to Meihekou has been opened to traffic. There are crisscross Shenyang-Jilin, Meihekou-Ji’an, and Yayuan-Dalizi Railways, as well as direct passenger trains to Beijing, Qingdao, Shenyang, Changchun, Dalian, Baihe and other places.

(5) Talent advantages

At present, Tonghua City has 3 national key secondary vocational schools, 3 provincial key secondary vocational schools, and all its county-level vocational education centers have passed the provincial key school acceptance and entered the top 100 schools in the province. It is the first region in the province where all county-level vocational education centers have entered the provincial key school list. In recent years, by making scientific layout, continuous promotion of vocational education structure adjustment and resource integration, exploration of new paths for diversified education, and continuous improvement of modern vocational education network system construction, the local characteristics of vocational education have begun to form, and the ability to serve economic and social development has gradually improved.

Tonghua Municipal Government has signed science and technology strategic cooperation agreements with provincial universities and research institutions such as Northeast Normal University, Jilin Agricultural University, Changchun Institute of Applied Chemistry, Chinese Academy of Sciences, and Tonghua Normal University, etc., providing scientific and technological support for development of the enterprises. Tonghua City continues to provide assistance for enterprises in talent cultivation and other aspects, vigorously implements the “Plan for Revitalizing Enterprises with Ten Thousand Students” and “Plan for Homing of a Thousand Students”, and continuously attracts college graduates for enterprises.

1.2 Contents and scale of project construction

1.2.1 Product scale

The project produces 20,000 tons of high-purity graphite, graphene products, and high-end negative electrode graphitization materials annually.

1.2.2 Contents of project construction

The project covers an area of 100 mu and a construction area of 80,000 square meters. The project mainly involves the construction of factories, production workshops, warehouses, laboratories, office buildings, and supporting facilities, as well as the purchase of high-purity graphite, graphene products, and high-end negative electrode graphitization material production lines.

1.3 Total investment of the project and capital raising

1.3.1 Total investment of the project

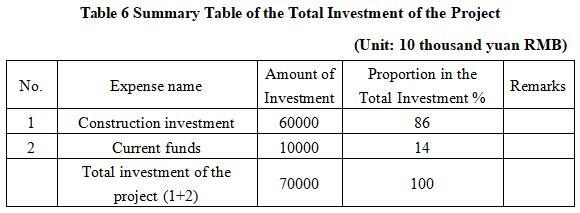

The total investment of the project is 700 million yuan, including the construction investment of 600 million yuan and current funds of 100 million yuan.

1.3.2 Capital raising

Raised by the enterprise itself.

1.4 Financial analysis and social evaluation

1.4.1 Main financial indexes

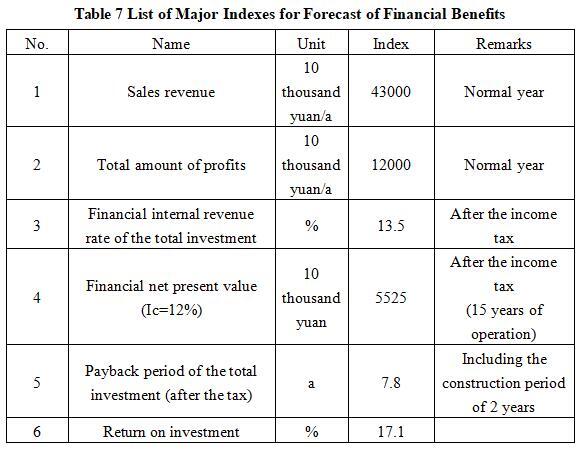

After the project reaches the production capacity, its annual sales revenue will be 430 million yuan, its profit will be 120 million yuan, its investment payback period will be 7.8 years (after the tax, including the construction period of 2 years) and its return on investment will be 17.1%.

Note: “10 thousand yuan” in the table is in RMB

1.4.2 Social evaluation

Project construction can meet market demand, especially in high-end manufacturing, new energy and other fields, helping to enhance the development level and technological progress of related industries. Project construction can also create a large number of employment opportunities, promote local economic development, increase tax revenue, and achieve significant economic and social benefits.

1.5 Cooperative way

Sole proprietorship, joint venture.

1.6 What to be invested by the foreign party

Funds, equipment and technology.

1.7 Construction site of the project

Tonghua Chemical Industry Park.

1.8 Progress of the project

The project cooperation plan has been prepared.

2. Introduction to the Partner

2.1Basic information

Name: Chemical Industry Park Management Bureau of Lugang Economic Development Zone

Address: North of National Highway 303, Tonghua County, Jilin Province

2.2 Overview

Jilin Tonghua Land Port Economic Development Zone, formerly known as Jilin Tonghua International Land Port Zone, is located in the northern part of Tonghua City, with a regional area of 266.96 square kilometers and a planned control area of 79.65 square kilometers. Since its establishment with the approval of the provincial government in 2016, its regional driving capacity and radiation effect have been continuously enhanced. As an important carrier for Jilin Province to implement opening up to the south, the Land Port Zone undertakes and plays the functions and roles as highway container center station, railway container center station, bonded logistics center (type B), comprehensive logistics park, and industrial park platforms, etc., and it is struggling to be constructed into an open cooperation area integrating bonded processing, modern logistics, industrial cooperation, and technological innovation.

The Land Port Zone has obvious location advantages, prominent strategic advantages, and convenient transportation and logistics. Located along the border and near the sea, in the center of Northeast Asia, backed by the hinterland of the Northeast East Green Economic Belt; There are five or two railways and Tonghua Airport in the area, and modern logistics platforms such as highway container center stations, bonded logistics centers, and comprehensive logistics parks have been built. A commercial processing entrepreneurship park and a chemical industrial park have been built in the area, and the Northeast Asia International Agricultural and Forestry Products Trading Center is currently under construction. During the “14th Five-Year Plan” period, Lugang District, according to the overall requirements of Tonghua City’s “14th Five-Year Plan”, the overall idea of Tonghua City’s “one-four-five” was taken as the guide, “one port and two parks” was built as the layout, and a new highland of open cooperation was created as the main line. It adhered to the integrated development of “port-industry-city”, solidly promoted key projects such as the commercial processing and entrepreneurship industrial park, Tonghua Pharmaceutical and Chemical Industry Park, Northeast Asia Agricultural and Forestry Products Trading Center, continuously optimized the basic supporting capacity, improved the carrying function of the Park, enhanced the platform service level, and made every effort to build a commercial logistics and industrial gathering center in the eastern part of Northeast China.

2.3 Contact method

2.3.1 Contact method of cooperator

Contact unit: Chemical Industry Park Management Bureau of Lugang Economic Development Zone

Contact person: Sun Yanna

Tel: +86-18504353555

E-mail: gwqhgyqglj@163.com

2.3.2 Contact method of the city (prefecture) where the project is located

Contact unit: Tonghua Municipal Commerce Bureau

Contact person: Wang Liangchen

Tel: +86-435-3199017+86-18643036783

E-mail: thsswjtck@126.com