Hydrogen Energy

Hydropower-Hydrogen-Methanol Integration Project of Jilin City

1. Introduction to the Project

1.1 Project background

1.1.1 Product introduction

The project covers an area of 260,000 square meters. It constructs a water conservancy and power generation project, produces green hydrogen from green electricity energy water electrolysis of water resources, produces green carbon source carbon dioxide (CO2) from biomass, and ultimately synthesizes green methanol from green electricity, achieving output of 210,000 tons/year of green methanol.

The project utilizes the hydropower advantages and advanced technology of Jilin City for design, there are many chemical enterprises in Jilin City, which can be expanded into the consumption end market.

1.1.2 Market prospect

(1) Analysis of the current market situation of new energy

New energy mainly includes hydropower, solar energy, wind energy, hydrogen energy, nuclear energy, biomass energy, and geothermal energy, etc. According to data, the current global segment market structure of new energy is mainly composed of solar energy and hydropower. As of 2023, the cumulative installed capacity of solar power generation worldwide has been 1.418 billion kilowatts, accounting for 33.31% of the cumulative installed capacity of various types of new energy generation worldwide and the largest share of global new energy generation. In 2024, the global new PV installed capacity reached 450 GW, and the cumulative installed capacity exceeded 2.8 TW, of which China ranked first in the world with a new increment of 230-260 GW, but the growth rate decreased by 27% compared with 2023. In 2025, it is expected that the new installed capacity in the world will reach 560-660 GW, the proportion of distributed PV in China will increase to 45%, and industrial and commercial roof projects will become the main force of growth. By 2030, the global installed capacity will have broken through 800 GW, the PV power generation will have accounted for more than 35%, China will have dominated the global supply chain and occupied more than 60% of production capacity.

The proportion of the new energy industry in China’s energy structure is constantly increasing. As a key link in the new energy industry chain, new energy storage technologies are playing an increasingly important role, not only enhancing the stability and flexibility of the energy system, but also promoting the innovative development of the entire new energy industry. In 2023, China’s new energy storage technology showed a trend of large-scale and diversified development, providing strong support for the continuous expansion of the new energy industry.

The new energy storage market in China is developing rapidly, with optimized and upgraded technological structures. In 2023, the cumulative installed power of energy storage in China was about 83.7 GW, with over 30 million kilowatts of installed capacity already in operation. Among them, the new energy storage contributed the most (accounting for 59.4%), with a cumulative installed power of about 32.2 GW, a year-on-year increase of 196.5%. Pumped storage accounted for 39.9% of the total installed energy storage capacity, with a cumulative installed power of approximately 50.6 GW, a year-on-year increase of 10.6%. By 2024, the cumulative installed capacity of new energy storage in China has reached 73.8 GW/168.0GWh, which has achieved a significant increase of more than 130% compared with 2023.

According to GGII statistical data, in 2024, the shipment volume of the energy storage system in China reached 170 GWh, with an increase of 146%, of which overseas shipments were 46 GWh, accounting for 27%. According to observation by GGII, in 2024, the overseas shipment of energy storage system in China showed the following major trends:

Firstly, the dominance of leading enterprises coincided with the rise of emerging powers. By virtue of technology, brand, cost and other advantages, CATL, AESC and other leading enterprises occupied a large share in the overseas market, and established a deep cooperation relationship with overseas high-quality customers. Meanwhile, HyperStrong, TrinaStorage, PotisEdge and other enterprises also achieved rapid growth in overseas orders.

Secondly, the market was widely distributed, and the efforts to go overseas continued to increase. The overseas destinations of Chinese energy storage enterprises have gradually radiated from Europe and the United States to the Middle East, Australia, Southeast Asia, North Africa and other markets, and the scale of overseas energy storage contracts signed by Chinese energy storage enterprises in 2024 exceeded 100 GWh, and the contract amount exceeded 100 billion.

Thirdly, product competitiveness was improved by technological innovation. In 2024, the series liquid cooled AC-DC integrated 5MWh+ system became the development trend of energy storage system. From 5MWh system, the domestic enterprises have grasped the active discourse right. In April 2024, CATL released the 6.25MWh Tianheng Energy Storage System, BYD released the 6.432MWh MC-Cube-T; in September 9, CRRC Zhuzhou Institute and AESC released the 7.4MWh System and the 8MWh System, respectively, and Fluence, Powin and GE, etc. also introduced 5MWh product successively. The 6MWh+ products will usher in mass production from the first half of 2025, and the 6MWh+ system is expected to become an opportunity for domestic enterprises to go overseas to achieve “corner overtaking”.

Fourthly, localized operations were strengthened. In the face of the strict requirements for product certification standards and after-sales in the overseas energy storage market, Chinese energy storage manufacturers have increased their localized operations overseas. For example, Envision has nine overseas manufacturing sites, and its Spanish Giga-factory will be first lithium iron phosphate battery giga-factory in Europe when completed; Through early in-depth market research, legal research and geopolitical research, SUNGROW has established a mature localization strategy and laid a solid foundation for going overseas.

With the increasingly booming energy storage market, the country strongly supports high-capacity new energy storage projects. Large-scale deployment is a necessary path for flexible electrochemical energy storage technology to play a leading role in the power system. Under the same scale, the large capacity of energy storage devices can reduce the number of individual cells used, and lower the difficulty of achieving uniform balance among individual cells, thus reducing the probability of thermal runaway or even fire in batteries.

(2) Current market situation of hydropower market

Hydropower combines the stability of thermal power with the cleanliness of new energy, playing an important role in optimizing China’s energy structure, ensuring energy security, reducing greenhouse gas emissions, and protecting the ecological environment. Thanks to China’s abundant hydropower resources, emphasis on renewable and clean energy, hydropower policy support, and progress and capital investment in traditional hydropower and pumped storage power generation technologies, China’s installed hydropower capacity and power generation have shown a steady growth trend, from 353.544 billion KWH in 2004 to 1.43 trillion KWH in 2024, at a growth rate of nearly three times. The steady growth of hydropower installed capacity and power generation not only reflects the continuous optimization of China’s energy structure, but also reflects China’s great achievements in the field of hydropower and the steady development trend of China’s hydropower industry. From the data of the proportion of hydroelectric power generation in the total power generation in China, hydropower has always been an important part of China’s energy structure. In 2004, hydropower accounted for about 16.05% of the total power generation in China. During 2004-2022, although the proportion of hydroelectric power generation in the total power generation in China fluctuated, it generally remained between 15% and 20%, which indicated that hydropower occupied an important position in China’s energy structure. Since 2015, with China’s vigorous development of clean energy such as wind power and solar power generation and the continuous progress of clean energy technology, the hydropower generation has remained relatively stable, but the growth rate of hydropower generation has slowed down significantly, and even experienced negative growth in some years (such as in 2023, with an absolute growth rate of -4.91%). Meanwhile, wind power, solar power and other clean energy power generation grew rapidly, which squeezed the hydropower generation and its proportion, and eventually led to the proportion of hydropower in the total power generation in China to decline year by year on the whole. By 2023, the proportion of hydropower generation in the total power generation in China has gradually decreased to 13.6% from 19.44% in 2015, and by 2024, the proportion has slightly recovered (mainly due to the implementation and operation of many pumped storage projects), with an increase of 0.53% compared with that in 2023.

With the transformation of the global energy structure and the continuous growth of electricity demand, the market demand for hydropower, as a clean and renewable form of energy, will continue to grow. Under the dual promotion by policy support and market demand, the hydropower industry will usher in a broader development prospect. Despite facing some challenges such as huge capital investment and long construction periods for construction and operation, as well as the impact on the environment and ecology, the hydropower industry still has vast development space and enormous market potential through technological innovation and policy support.

(3) Market demand for hydrogen energy

Hydrogen, as one of the most important elements on Earth, mainly exists in its chemical form. Its elemental form, hydrogen, is a clean and efficient energy carrier. In recent years, with the increasing global demand for clean energy, hydrogen and its related technologies have received widespread attention. Especially in the context of carbon peaking and carbon neutrality, hydrogen, as a secondary clean energy, is regarded as the “Ultimate Energy of the 21st Century”.

In recent years, China’s hydrogen energy industry has received high attention from governments at all levels and key support from national industrial policies. According to statistics, in 2024, a total of 22 provincial-level administrative regions in China included hydrogen energy in their government work reports, and each region actively developed hydrogen energy from different focuses. Since 2024, China has issued a large number of policies at the national level in the hydrogen energy industry, covering many aspects such as industry standard setting, technology R&D, equipment promotion, urban public transportation updates, and hydrogen energy transportation, aiming to promote the healthy, orderly, and sustainable development of the hydrogen energy industry.

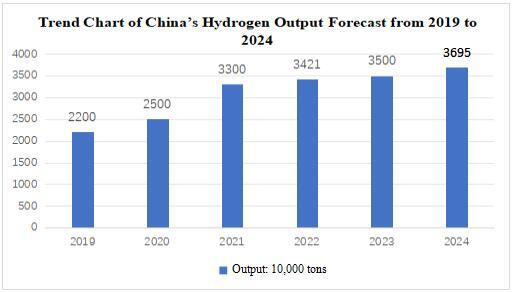

Under the dual promotion of policies and market, China has become the world’s largest country of hydrogen production. As of the end of 2023, the national hydrogen production capacity has been about 49 million tons/year, with an output of about 35 million tons, an increase of about 2.3% year-on-year. In 2024, China’s hydrogen output reached 36.95 million tons.

Under the goal of carbon neutrality, the annual demand for hydrogen in China will have reached 37.15 million tons by 2030, accounting for about 5% of terminal energy consumption. By 2060, the annual demand for hydrogen in China will have increased to around 130 million tons, accounting for about 20% of terminal energy consumption. Among them, the hydrogen consumption in the industrial field still accounts for the largest proportion, accounting for 60% of the total demand.

(4) Current market situation of green methanol

As of June 27, 2024, there have been total 102 green methanol projects planned globally, with a total planned production capacity of 13.27 million tons/year. Most projects are still in the research and planning stage, with 11 projects in operation, 5 projects under construction, 13 projects under planning, and 73 projects in the announcement or feasibility stage. Seeing from the distribution in countries, Spain, Denmark, and the United States are the three countries with the highest number of green methanol projects, with 13, 10 and 10 projects, respectively. In terms of technical route, the project of methanol production from electricity is in the dominant position, followed by the project of methanol production from biomass.

China is the world’s largest consumer and producer of methanol. In 2023, the total methanol production capacity of methanol was 105 million tons, accounting for nearly 60% globally. Despite China’s vast industrial system and huge domestic demand for methanol, it still relies on imports, with an estimated import volume of about 14.55 million tons in 2023. In 2024, there was an increase of about 5 million tons of production capacity, with the total production capacity reaching 112 million tons and the output of about 92.57 million tons. In 2025, it is expected to have an increase of 8.9 million tons of production capacity, of which 5.8 million tons of supporting olefin, 1, 4-butanediol (BDO) and other devices, and 3.1 million tons of non-integrated devices. In 2024, the import volume of methanol was 13.31 million tons, down 7.33% year-on-year, and it is expected to rise again to more than 14 million tons in 2025.

Green methanol, as a low-carbon fuel, has great potential in fields such as automobile fuels, fuel cells, ship fuels, and organic additives. The International Maritime Organization (IMO) has adopted relevant emission reduction strategies to promote the application of green methanol in ship fuel. In addition, the production cost of green methanol is gradually decreasing, and with the reduction of green electricity costs and the expansion of production scale, its economy will be further improved.

1.1.3 Technical analysis

Not limited to current technology, if the resident enterprise has innovative technology, the resident enterprise’s technology will be adopted, and this technical analysis is only for reference.

(1) Hydrogen production from hydropower

Power generation from renewable energy → hydrogen production from water electrolysis (alkaline/PEM/SOFC electrolysis cell) → hydrogen purification.

(2) Green methanol

Pre-processing - gasification reaction - synthesis reaction - separation and purification - storage and transportation.

1.1.4 Advantageous conditions of project construction

(1) Policy advantages

In 2025, the National Energy Administration issued the Guiding Opinions on Energy Work in 2025, proposing that we should adhere to green and low-carbon development, and continue to promote the adjustment and optimization of the energy structure. We should give priority to ecological and green development, and work together to reduce carbon emissions and pollution and promote green growth. We should vigorously develop renewable energy, coordinate the local consumption and delivery of new energy, strengthen the clean and efficient development and utilization of fossil energy, actively promote energy conservation and carbon reduction on the energy consumption side, accelerate the transformation of energy consumption patterns, and increase the proportion of non-fossil energy consumption.

The 14th Five-Year Plan for Industrial Development in Jilin Province clearly proposes to promote the development of hydrogen energy equipment and hydrogen fuel cells around the entire industrial chain of hydrogen “production, storage, transportation, refueling and utilization”. Support the RD of intelligent heat exchange units and new high-efficiency energy-saving heat exchangers. Accelerate the development of environment-friendly equipment such as air pollution control, water pollution control, and solid waste treatment. Cultivate new energy system solution suppliers, and establish RD and manufacturing bases of new energy equipment.

The Mid- and Long-term Development Plan of a Hydrogen-powered Jilin (2021-2035) proposes to make the hydrogen energy industry a key focus for cultivating and developing strategic emerging industries. Based on the chemical industry in Jilin City, Baicheng City, and Songyuan City, we should carry out demonstrations of “Green Chemical Industry in Jilin” (hydrogen-based chemical industry) projects, build diversified hydrogen energy supply, carbon fiber material and other industry auxiliary systems, and expand the business scope of the chemical industry.

The Investment Promotion Policy of Jilin City clearly states that the investment projects of Jilin Industrial Investment Guidance Fund should comply with national and relevant industrial policies and development plans, with a focus on investing in tourism, medicine and health, aviation, information technology, new materials, advanced equipment manufacturing, biotechnology, energy conservation and environmental protection, new energy, cultural creativity, modern agriculture, modern service industry and other related industries in Jilin City’s “6411” industrial plan, as well as other areas supported by the municipal government for development with focus. In addition to setting up sub-funds through equity participation, the Guidance Fund can also adopt investment methods such as follow-up investment and direct investment; Newly introduced investment projects that meet the conditions shall enjoy tax reductions and exemptions in accordance with the current national and provincial tax policies. For projects with a significant contribution rate in Jilin City, in accordance with the spirit of the document Notice of the State Council on Relevant Matters Concerning Tax Preferential Policies (GF[2015] No. 25), relevant departments shall assist the enterprises in applying for tax exemptions and reductions in accordance with the law and regulations; Establish a special fund for the development of industrial enterprises, and encourage the introduction of major projects in traditional industries such as chemical, automobile, metallurgical, and agricultural product processing in the “6411” industrial system that comply with national industrial policies, have strong industrial support, and have a significant driving effect; Encourage the introduction of emerging industries such as medicine and health, new materials, advanced equipment manufacturing, and electronic information. Lay emphasis on the allocation of production factors, and give priority to recommend relevant national and provincial special funds for support.

(2) Resource advantages

Jilin City has great potential for resource development. The rivers in Jilin City belong to the Songhua River Basin, with a total length of 7064.1 kilometers and a river network density of 0.3 kilometers/square kilometer. The rivers within the territory belong to three water systems: the main stream of Songhua River, Lalin River, and Mudanjiang River. Among them, the main stream of Songhua River has a drainage area of 22,336 square kilometers, accounting for 84%; Lalin River accounts for 15%; Mudanjiang River accounts for 1%. There are 72 first-order rivers, including Huifa River, Yinma River, and Lalin River, with a total length of 1,848.7 kilometers; 139 second-order rivers, including Jinsha River, Chalu River, and Xilin River, with a total length of 2,632.3 kilometers; 114 third-order rivers, with a total length of 1,658.2 kilometers; 41 fourth-order rivers, with a total length of 483.4 kilometers; and 5 fifth-order rivers. with a total length of 36.5 kilometers.

The largest river within the territory is the main stream of Songhua River, which flows from south to north from 1 kilometer east of Xijingou Tun in Jiapigou Town, Huadian City to the northwest of Huangyuquan Tun in Fate Town, Shulan City. It passes through Huadian City, Jiaohe City, four urban areas of Jilin City (Fengman, Chuanying, Changyi, Longtan), and seven counties (cities, districts) including Shulan City. The main stream of the river section within the territory is 405 kilometers long, accounting for 49% of the total length of the main stream in the upper reaches of the Songhua River; The watershed area of the river section within the territory is 15,800 square kilometers, accounting for 58.3% of the total watershed area of Jilin City. The main tributaries include Huifa River, Yinma River, and Lalin River, etc.

Jilin City has five large reservoirs, namely Fengman, Hongshi, Baishan, Xingxingshao, and Liangjiashan Reservoirs, as well as 21 medium-sized reservoirs, including the Huanghe, Chaoyang, and Nianzigou Reservoirs.

The installed power capacity of the city is10 million kilowatts, of which 3.5 million kilowatts are hydropower (3.2 million kilowatts are conventional hydropower and 300,000 kilowatts are pumped storage), accounting for 35%.

The available land area in Jilin City is 853 hectares, including 74 hectares of commercial land, 500 hectares of industrial and mining storage land, 179 hectares of residential land (including guaranteed land for affordable housing), and100hectares of other land (including land for public management and public services, transportation, water bodies and water conservancy facilities, and special land). There is a large stock of exploitable land resources, and newly added and reserved land can meet the needs of new projects. Land prices are at a low level among 41 cities in Northeast China.

(3) Talent advantages

Changyi District has gathered rich and high-quality technological innovation and talent resources. The Institute of Special Animal and Plant Sciences of the Chinese Academy of Agricultural Sciences (CAAS) is located in Zuojia Town, and is the only national-level comprehensive scientific research institution specializing in the protection, development, and utilization of special animal and plant resources in China; China Petroleum Jilin Chemical Engineering Co., Ltd. has been selected as Top 100 survey and design units in China in terms of comprehensive strength for many times. It has over 200 technological achievements awarded at the provincial, ministerial, and national levels, and up to 6 technical experts enjoying special allowances from the State Council. The think tank effect of the university and institute is being released in an acceleration, providing solid intellectual support for the high-quality development of Changyi District.

Meanwhile, Changyi District has a large number of high-quality industrial workers. After training by enterprises and public welfare institutions, more than 10,000 skilled talents are sent to the society every year, and more than 20,000 people of various types are trained for the society every year. The advantage of labor resources is obvious, and the proportion of skilled workers is at a high level in the Northeast urban agglomeration. The labor force is in a dividend period, and the labor cost is relatively low, which can meet the needs of various enterprises.

(4) Location advantages

Jilin City is located in the central eastern part of Jilin Province, is adjacent to Yanbian Korean Autonomous Prefecture to the east, Changchun City and Siping City to the west, borders Harbin City, Heilongjiang Province to the north, and borders Baishan City, Tonghua City and Liaoyuan City to the south.

Jilin City is located at the geographical center of Northeast Asia, with various forms of transportation including railways, highways, water transportation, and aviation, etc. The artery traffics such as Jilin Longjia International Airport and Jilin Airport, Changchun-Hunchun and Shenyang-Harbin Expressways, Changchun-Hunchun Intercity Express Railway, and Shenyang-Harbin Double-track Railway form a convenient three-dimensional transportation network extending in all directions in Jilin City.

1.2 Contents and scale of project construction

1.2.1 Construction scale

The project covers an area of 260,000 square meters.

It constructs a water conservancy and power generation project, produces green hydrogen from water electrolysis, and ultimately synthesizes green methanol from green electricity, achieving output of 210,000 tons/year of green methanol.

1.2.2 Construction contents

The total construction area of the project is 300,000 square meters, mainly including hydropower projects (including booster stations, overhead lines), devices for hydrogen production from electrolysis, devices for hydrogen production from water electrolysis (PEM), hydrogen storage devices, and corresponding supporting projects; The green methanol production center mainly constructs gasification + POX, cooling, desulfurization, synthesis gas compression, methanol synthesis, methanol distillation, waste gas incineration, etc. and corresponding supporting projects.

1.3 Total investment of the project and capital raising

1.3.1 Total investment of the project

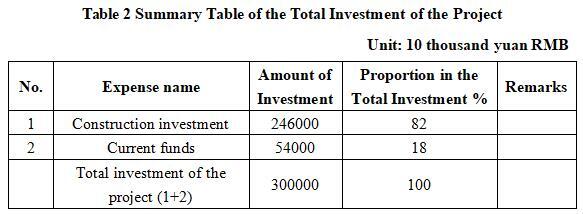

The total investment of the project is 3,000 million yuan, including the construction investment of 2,460 million yuan and current funds of 540 million yuan.

1.3.2 Capital raising

Raised by the enterprise itself.

1.4 Financial analysis and social evaluation

1.4.1 Main financial indexes

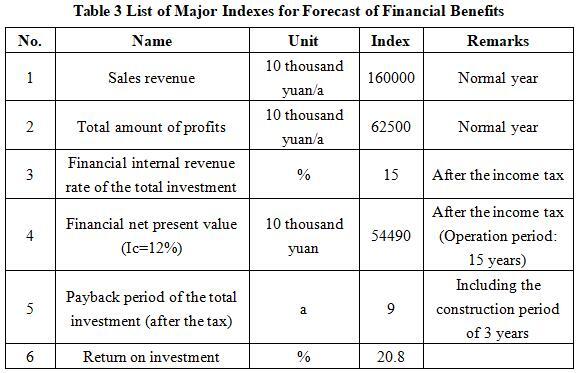

After the project reaches the production capacity, its annual sales revenue will be 1,600 million yuan, its profit will be 625 million yuan, its investment payback period will be 9 years (after the tax, including the construction period of 3 years), and its return on investment will be 20.8%.

Note: “10 thousand yuan” in the table is in RMB

1.4.2 Social evaluation

The green methanol produced by this project not only contributes to the large-scale production and application of hydrogen energy, but also provides a low-carbon and environment-friendly raw material selection for the chemical industry through the production of green methanol. This can help promote the green and low-carbon transformation of the chemical industry, reduce carbon emissions and environmental pollution in the production process, and contribute to achieving the “dual carbon” goals.

1.5 Cooperative way

Joint venture or cooperation, other ways can be discussed in person.

1.6 What to be invested by the foreign party

Funds, other ways can be discussed in person.

1.7 Construction site of the project

The new energy side of this project is planned to be built in Changyi District, Jilin City, Jilin Province, and the chemical consumption side is planned to be built in Longtan District Chemical Industrial Park, Jilin City, Jilin Province. The overall planning company is located in Changyi District.

1.8 Progress of the project

It is in planning phase.

2. Introduction to the Partner

2.1 Basic information

Name: Changyi District Bureau of Commerce, Jilin City

Address: Changyi District, Jilin City

2.2 Overview

Changyi District is an urban area with obvious geographical advantages. Located in the northwest of Jilin City, it is adjacent to Chuanying District on the west side, separated from Fengman District and Longtan District by Songhua River on the south and east sides, and is connected to Jiutai District, Changchun City on the north side. The urban area is surrounded by rivers on three sides and backed by mountains on one side. As a window area of Jilin City, Changyi has obvious geographical advantages and convenient transportation. The train station, passenger station, and intercity railway transfer center are all located within the urban area. By now, Ertaizi Airport is promoting the resumption of flights and will become an air cargo base that can cover a 2-hour flight distance; with railway logistics resources such as the Gudianzi Station secondary logistics base, it is beneficial for Jilin City to expand its opening up and promote development through the China-Mongolia-Russia logistics channel and the China Railway Express; The Hunchun–UlanHot Expressway sets up service areas and entrances and exits in Huapi Factory Town, further improving the regional transportation system. The effective connection of transportation modes such as highways, railways, and aviation has gradually formed an efficient and reliable multi-modal transport network with smooth internal and external connections, providing support for Jilin City to further connect to the “Changchun-Hunchun-Europe” air rail corridor. Meanwhile, in the north-south axis, Changyi District serves as a hub for the development of two national level development zones, Jilin High-tech North Zone and Economic Development Zone; In the east-west axis, taking advantage of the construction opportunity of the national urban-rural integration development pilot area i.e., Changchun-Jilin Junction Area, Changyi has become the main battlefield for the progressive development of Changchun and Jilin cities, having important strategic significance for Jilin City to build a new development pattern and achieve high-quality development.

2.3 Contact method

Contact method of the unit where the project is located:

Contact unit: Changyi District Bureau of Commerce, Jilin City

Postal code: 132000

Contact person: Bi Changxin

Tel: +86-432--63301081

+86-13244207333

E-mail: 249145141@qq.com

Contact method of the city (prefecture) where the project is located:

Contact unit: Investment Promotion Service Center, Bureau of Commerce of Jilin City

Contact person: Jiang Yuxiu

Tel: +86-432-62049694

+86-15804325460

E-mail: jlstzcjfwzx@163.com