Automobile and Parts

600-million-ampere-hour/year Lithium-ion Power Battery Project of Liaoyuan City

1 Introduction to the Project

1.1 Project background

1.1.1 Product introduction

The power battery is the power source that provides the power source for the tool, and mostly refers to the battery that provides power for electric vehicles, electric trains, electric bicycles, and golf carts.

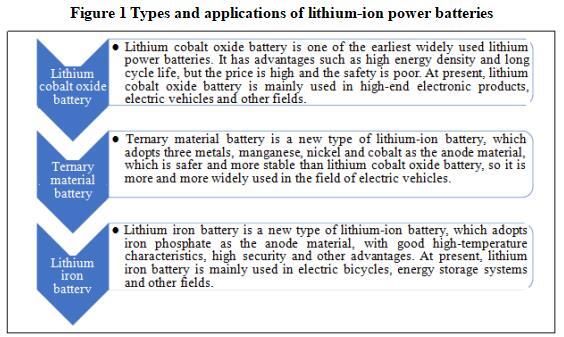

According to different materials and structures, lithium power batteries can be divided into three types: lithium cobalt oxide batteries, ternary material batteries and lithium iron batteries.

The construction site of the project is located in Liaoyuan High-tech Industrial Development Zone, Jilin Province, relying on the existing industrial foundation of Liaoyuan City, through cooperation with large domestic enterprises in this field, to produce lithium-ion power batteries, which can meet the needs of 100000 vehicles.

1.1.2 Market prospect

(1) Global lithium-ion battery market size

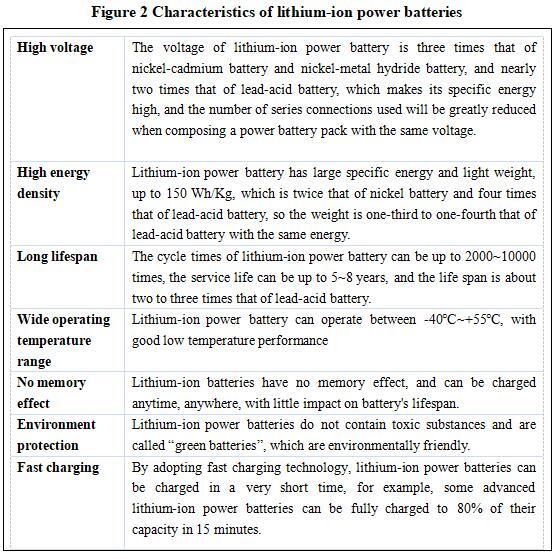

Lithium-ion batteries have high energy density and long shelf life, and are widely used in electronics and automotive fields due to their high efficiency and effectiveness.

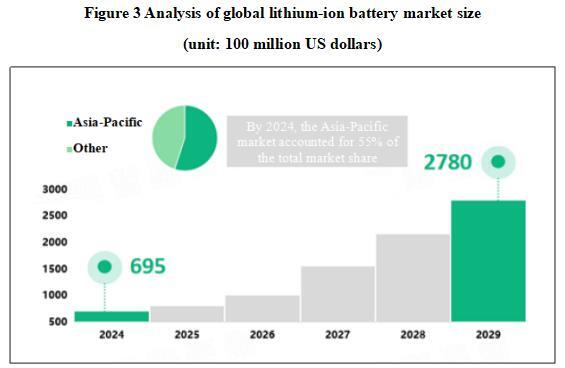

The global lithium-ion battery market size reached 69.5 billion US dollars in 2024, with the Asia Pacific market accounting for 55%, growing at a CAGR of 17% during the forecast period. The surge in demand for smartphones and tablets in emerging countries such as China, Japan, and India has driven the development of the lithium-ion battery market in the Asia Pacific region, with China being the main developing region, accounting for 45%. North America is another important market, with the United States dominating the lithium-ion battery market in the North American region. Factors such as the surge in sales of automobiles and electric vehicles in the region and the growing demand for lithium-ion batteries in mobile phones are driving the expansion and development of the lithium-ion battery market in the North American region.

Among the top 10 lithium battery shipments in the world, 6 enterprises are from China, 3 from South Korea, which are LG Energy Solution, Samsung SDI and SK On, and only 1 from Japan, which is Panasonic. With the local battery enterprises in Europe and the United States gradually put into production in 2025, the proportion of their supporting local vehicle enterprises will increase, and the share of lithium batteries in Europe and the United States will increase in the next 2-3 years.

In 2023, the global power battery shipments reached 859.6 GW·h, a year-on-year increase of 24.2%. Compared with 2022, the top five in the market were still CATL, BYD, LG Energy Solution, Panasonic and SK On, but the specific ranking has changed, mainly because BYD surpassed LG Energy Solution and ranked second in the world. Among them, CATL's power battery shipments reached 276 GW·h, accounting for more than 30%, continuing to lead the development of the global industry.

(2) Prospect of China's lithium-ion battery market

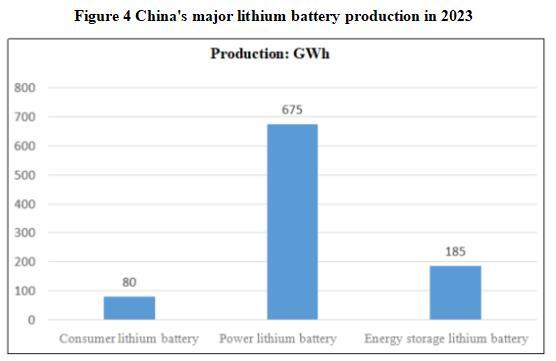

According to the official website of the Ministry of Industry and Information Technology, in 2023, China's lithium-ion battery industry continued to grow, with the industry's total output value of more than 1.4 trillion yuan. The total production of lithium batteries exceeded 940 GWh, a year-on-year increase of 25%. Among them, in the battery sector, the output of consumer, power and energy storage lithium batteries was 80 GWh, 675 GWh and 185 GWh respectively, and the installed capacity of lithium batteries exceeded 435 GWh. In addition, in terms of export trade, the industry also continued to grow, and China's total lithium battery exports reached 457.4 billion yuan in 2023, a year-on-year increase of more than 33%.

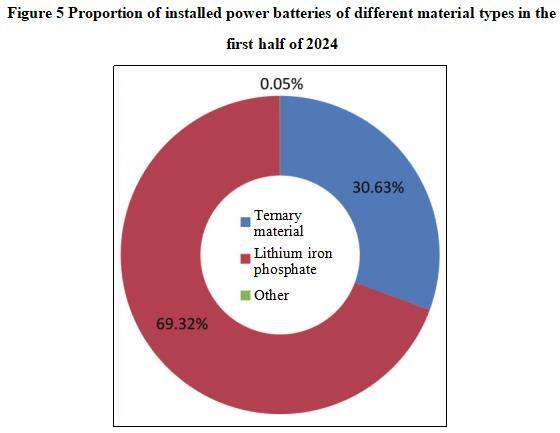

According to data released by the China Automotive Power Battery Industry Innovation Alliance, in the first half of 2024, the cumulative installed capacity of power batteries in China was 203.3 GW·h, a year-on-year increase of 33.7%. The rapid growth of the installed capacity of power batteries reflects the rapid expansion of China's new energy vehicle market and the shift in consumer preferences. At the same time, the sales and export volume of other batteries, including energy storage batteries, was also growing rapidly, and had become a new growth point for major battery companies.

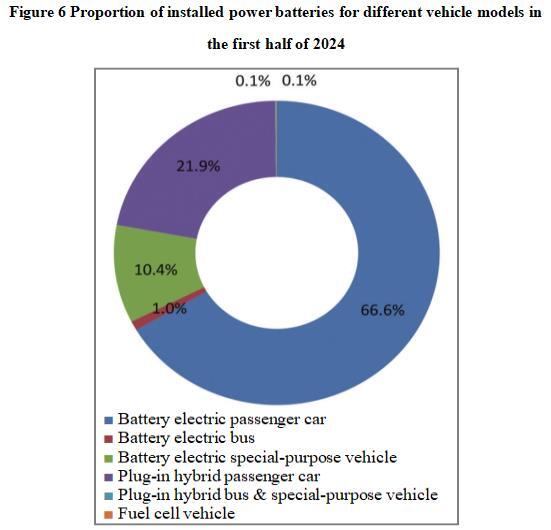

From the perspective of vehicle models, the top three models of new energy vehicles in the first half of the year were battery electric passenger cars, plug-in hybrid passenger cars, and battery electric special-purpose vehicles, accounting for 66.6%, 21.9% and 10.4% respectively, totaling 98.9%. However, in terms of growth rate, the installed volume of power batteries for battery electric passenger cars increased by 16.3% year-on-year, far lower than the 88.8% of plug-in hybrid passenger cars and 116.4% of battery electric special-purpose vehicles. Moreover, in the first half of last year, the installed volume of power batteries for battery electric passenger cars accounted for 76.55%, and its share has fallen by 10% in just one year. Judging from the current development trend, it is very likely that the market share of battery electric passenger cars will continue to be "swallowed up" by plug-in hybrid passenger cars and battery electric special-purpose vehicles in the future.

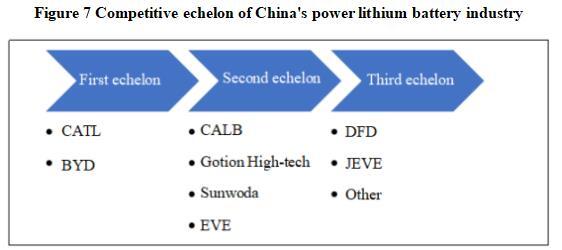

The first echelon enterprises in China's power lithium battery industry are CATL and BYD, with their installed volume of power lithium batteries accounting for over 20%; the second echelon enterprises are CALB, Gotion High-tech, Sunwoda, EVE, etc., with a market share of between 1% and 10%, and the third echelon enterprises are DFD, JEVE, etc., with a market share of less than 1%.

The project relies on the existing industrial foundation in Liaoyuan City, and through cooperation with large domestic enterprises in this field, lithium-ion power batteries are produced, with good market prospects.

1.1.3 Technical analysis

The project is planned to cooperate with large domestic enterprises in this field to make full use of the advantages of lithium iron phosphate cathode materials and polymer lithium-ion batteries to develop new high-power polymer LiFePO4 power battery products. The safety of large-capacity and high-power polymer LiFePO4 power batteries can be further improved by using the unique safety performance of the polymer itself.

1.1.4 Advantageous conditions of project construction

(1) Policy conditions

The New Energy Vehicle Industry Development Plan (2021-2025) proposes to encourage cross-border collaboration among enterprises in the fields of new energy vehicles, energy, transportation, information and communication, and to build ecological leading enterprises that covers key links in the industrial chain such as solutions, research and development and production, usage guarantee, and operation services through open cooperation and benefit sharing around diversified production and diversified application needs.

The Several Measures to Accelerate the Improvement of Transportation Service and Safety Guarantee Capacity of Power Lithium Batteries for New Energy Vehicles proposes that, striving to achieve by 2027, the blocked and stuck points of power lithium battery transportation will be further opened, the transportation efficiency will be steadily improved, the comprehensive transportation structure will be further optimized, and the level of transportation safety and security will be greatly improved, so as to ensure the safety and stability of the supply chain of the new energy vehicle and power lithium battery industry chain, and provide strong support for better serving the "new three" in foreign trade, fully supporting the high-quality development of the economy, and accelerating the construction of a new development pattern.

On November 15, 2024, the Ministry of Industry and Information Technology, the Ministry of Ecology and Environment, the Ministry of Emergency Management, and the National Standardization Administration jointly issued the Guidelines for the Construction of the National Lithium Battery Industry Standard System (2024 Edition). The Guidelines clarifies that by 2026, more than 100 new national standards and industry standards will be formulated, the standard system leading the high-quality development of the lithium battery industry will be sounder, and the role of the standard service industry in consolidating its dominant position will continue to increase. There are more than 1000 enterprises that will carry out the publicity, implementation and promotion of standards, and the effectiveness of the innovation and development of standard service enterprises will become more prominent. The formulation of more than 10 international standards will be participated in, and the international influence of China's lithium battery standards will be further enhanced.

(2) Resource advantages

In recent years, Liaoyuan City has continued to optimize and adjust the energy structure, fully launched the construction of a clean energy heating demonstration city in the north, and carried out 47 clean heating transformation projects such as "coal to gas" and "coal to electricity", which is expected to reduce coal consumption equivalent to 510000 tons of standard coal. In addition, Liaoyuan is rich in wind energy, solar energy, biomass energy and other resources, providing support for the construction of green and low-carbon projects.

(3) Industrial advantages

In order to consolidate and expand industrial advantages and strengthen the automotive industry cluster, in recent years, Liaoyuan City has strengthened cooperation with FAW Group, scientifically formulated the Implementation Plan for the Construction of New Energy Vehicle industry Supporting Base in Liaoyuan, compiled the New Energy Vehicle Parts Industry Development Plan for Liaoyuan City (2021-2025), and created two platforms: New Energy Vehicle Industrial Park and Dongliao Mold Industrial Park in the High-tech Zone.

In recent years, Liaoyuan High-tech Zone has accurately planned and positioned itself, forming a functional layout of "dual-core drive, one district and four parks", and the large-scale and cluster expansion of "4+1 industry", with 2111 enterprises settled. The scale of the supporting industry for new energy vehicles has expanded rapidly; it plans to build a 4 square kilometer new energy vehicle supporting industrial base, forming a new energy vehicle supporting industrial system with Hongtu Lithium-ion Battery Separator, Sinopoly New Energy, Joyson Electronics, Shengyuan New Materials, and Jincheng Heavy Industry as the core, and has been designated as a strategic partner of FAW by the provincial government and signed a strategic cooperation agreement with FAW-FINDREAMS.

(4) Talent advantages

Liaoyuan City is rich in human resources, and there are vocational colleges in the urban area, which can train talents according to the needs of enterprises. Liaoyuan City has a good foundation for industrial development, only 115.13 kilometers away from Changchun, a well-known "University City" and "Automobile City", which can meet the various talent needs of enterprises.

(5) Location and transportation advantages

Liaoyuan has obvious geographical advantages, 140 kilometers away from Changchun Longjia International Airport in the north and 240 kilometers away from Shenyang Taoxian International Airport in the south. It is located in the important axis belt of Changchun one-hour economic circle and Shenyang Railway urban agglomeration. Within a radius of 200 kilometers, there are 2 provincial capitals and 8 prefecture-level cities, with a population of nearly 40 million. The urban area has built a transportation network of "three rings, four verticals and six horizontals". The inter-regional highway and railway traffic is developed, No. 303 National Highway and Siping-Meihekou Railway run through the whole territory, and Liaoyuan-Xifeng, Liaoyuan-Changchun Railways, Changchun-Liaoyuan, Yingchengzi-Meihekou, Jilin-Caoshi, Liaoyuan-Xifeng Expressways, and Liaoyuan Civil Airport that will be built soon, constitute a comprehensive transportation system for entering the hinterland of the Northeast, the sea and customs.

1.2 Contents and scale of project construction

1.2.1 Product scale

After the completion of the project, 600 million ampere hours of lithium-ion power batteries will be produced annually.

1.2.2 Contents of project construction

The project covers an area of 100000 square meters, with a building area of 75000 square meters. It includes the construction of production workshop, raw material warehouse, finished product warehouse, solid auxiliary material warehouse, maintenance workshop, spare parts warehouse, boiler room, circulating water pump room, circulating water pool, waste slag shed and comprehensive office building.

1.3 Total investment of the project and capital raising

1.3.1 Total investment of the project

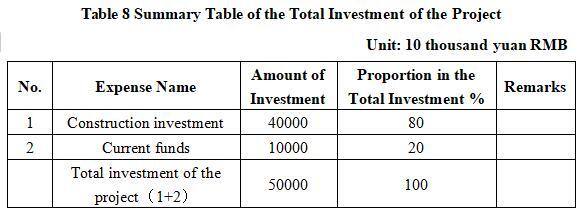

The total investment of the project is 500 million yuan, including the construction investment of 400 million yuan and the current funds of 100 million yuan.

1.3.2 Capital raising

Self-raised by enterprise

1.4 Financial analysis and social evaluation

1.4.1 Main financial indexes

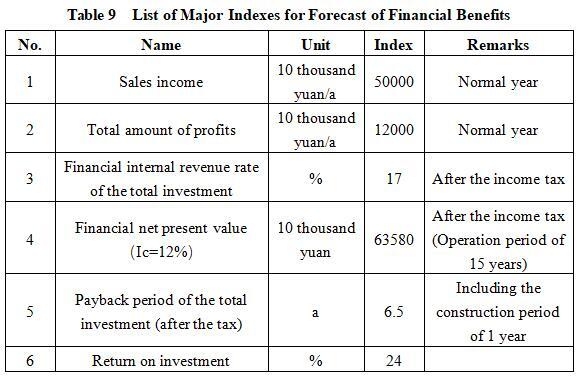

After the project reaches the production capacity, its annual sales income will be 500 million yuan, its profit will be 120 million yuan, its investment payback period will be 6.5 years (after the tax, including the construction period of 2 years) and its investment profit rate will be 24%.

Note: “10 thousand yuan” in the table is in RMB.

1.4.2 Social evaluation

After the completion of the project, it will greatly meet the market demand of various vehicle manufacturers in Jilin Province and even the Northeast China, promote the upgrading of related equipment manufacturing and processing industries in the surrounding areas of Liaoyuan City, drive the development of upstream and downstream production enterprises, and enhance the overall strength of the automotive industry in Jilin Province. At the same time, the project can provide a large number of employment opportunities for the local surplus labor force and urban unemployed people, with good economic benefits and extensive social benefits.

1.5 Cooperative way

Joint venture, cooperation and other ways can be interviewed.

1.6 What to be invested by the foreign party

Funds, technology and other ways can be interviewed.

1.7 Construction site of the project

Liaoyuan High-tech Industrial Development Zone, Jilin Province.

1.8 Progress of the project

Attracting foreign investment.

2. Introduction to the Partner

2.1 Basic information

Name: Management Committee of Liaoyuan High-tech Industrial Development Zone, Jilin Province

Address: No. 1633 Caifu Road, Liaoyuan City

2.2 Overview

Liaoyuan High-tech Industrial Development Zone was established in 2001. In 2019, it was approved by the Jilin Provincial People's Government to be established as a provincial-level high-tech industrial development zone, with a planned area of 16.22 square kilometers and a total population of 29000. Located in the axis belt of the two major economic zones of Changchun and Shenyang, it is 100 kilometers away from Changchun in the north, 200 kilometers away from Shenyang in the south and 500 kilometers away from Dalian Port. No. 303 National Highway and Siping-Meihekou, Liaoyuan-Xifeng, Liaoyuan-Changchun Railways run through the whole territory, forming a comprehensive transportation system that extends in all directions with Changchun-Liaoyuan, Yitong-Kaiyuan, Yingchengzi-Meihekou, Jilin-Caoshi Expressways. As the core of Jilin Province's southward opening portal, it plays an important role in the construction of innovation and transformation core area in the central part of Jilin Province.

As the core of scientific and technological innovation, the engine of industrial upgrading, the window for attracting investment, and the leader of economic development, Liaoyuan High-tech Zone actively cultivates new kinetic energy for development, takes the road of characteristic development and differentiated development, promotes innovation and entrepreneurship, improves the quality of supply, and opens a new model of coordinated development of industrial clusters and chain industries. It has been listed as a pilot for regional brand construction of national industrial clusters, a provincial-level demonstration base for mass entrepreneurship and innovation, a national demonstration base for entrepreneurship and innovation of small and micro enterprises, and a demonstration base for new industrialization industries.

2.3 Contact method

Postal code: 136299

Contact person: Song Yang

Tel: +87-437-3292088

Fax: +87-437-3292088

E-mail: jllyjk@163.com

Contact method of the city (prefecture) where the project is located:

Contact unit: Liaoyuan Municipal Bureau of Commerce

Contact person: Ai Jing

Tel: +87-18643787709

E-mail: lyjhjxmc@163.com