Automobile and Parts

Consumer Lithium Battery Production Project of Liaoyuan City

1 Introduction to the Project

1.1 Project background

1.1.1 Product introduction

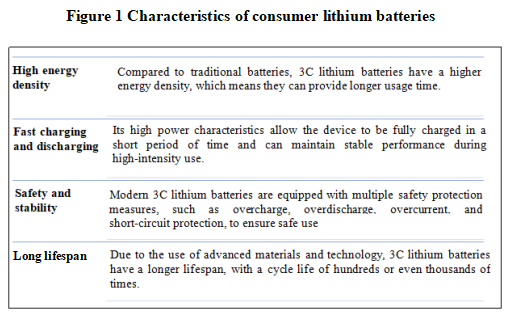

Consumer lithium battery is a type of lithium battery designed to meet the needs of high-power consumer electronic products. It has the characteristics of high energy density, high power, fast charging, and long life, and is widely used in consumer electronic products such as smartphones, tablets, laptops, video cameras, drones, and electric vehicles. It can be divided into three categories: cylindrical lithium-ion batteries, square lithium-ion batteries, and polymer pouch lithium-ion batteries.

The construction site of the project is located in Longshan District, Liaoyuan City, Jilin Province, relying on the new energy industry foundation of Liaoyuan City and the leading advantage of Hongtu Lithium Battery Separator Company in the same type of products in China, to produce consumer lithium-ion batteries.

1.1.2 Market prospect

(1) Global consumer lithium-ion battery market size

Lithium-ion batteries have high energy density and long shelf life, and are widely used in electronic products and automotive fields due to their high efficiency and effectiveness.

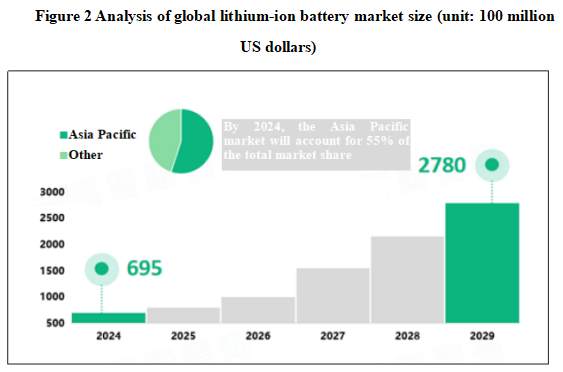

The global lithium-ion battery market size reached 69.5 billion US dollars in 2024, with the Asia Pacific market accounting for 55%, growing at a CAGR of 17% during the forecast period. The surge in demand for smartphones and tablets in emerging countries such as China, Japan, and India has driven the development of the lithium-ion battery market in the Asia Pacific region, with China being the main developing region, accounting for 45%.

North America is another important market, with the United States dominating the lithium-ion battery market in the North American region. Factors such as the surge in sales of automobiles and electric vehicles in the region and the growing demand for lithium-ion batteries in mobile phones are driving the expansion and development of the lithium-ion battery market in the North American region.

Among the top 10 lithium battery shipments in the world, 6 enterprises are from China, 3 from South Korea, which are LG Energy Solution, Samsung SDI and SK On, and only 1 from Japan, which is Panasonic. With the local battery enterprises in Europe and the United States gradually put into production in 2025, the proportion of their supporting local vehicle enterprises will increase, and the share of lithium batteries in Europe and the United States will increase in the next 2-3 years.

In 2023, the global power battery shipments reached 859.6 GW·h, a year-on-year increase of 24.2%. Compared with 2022, the top five in the market were still CATL, BYD, LG Energy Solution, Panasonic and SK On, but the specific ranking has changed, mainly because BYD surpassed LG Energy Solution and ranked second in the world. Among them, CATL's power battery shipments reached 276 GW·h, accounting for more than 30%, continuing to lead the development of the global industry.

(2) Market prospect of China's consumer lithium-ion batteries

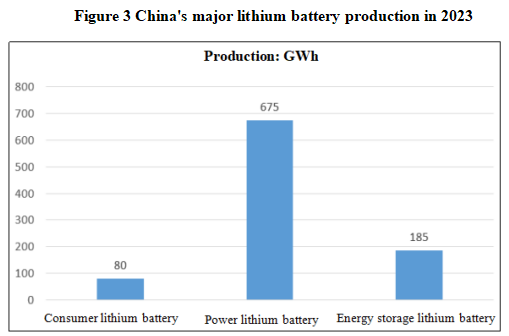

According to the official website of the Ministry of Industry and Information Technology, in 2023, China's lithium-ion battery industry continued to grow, with the industry's total output value of more than 1.4 trillion yuan. The total production of lithium batteries exceeded 940 GWh, a year-on-year increase of 25%. Among them, in the battery sector, the output of consumer, power and energy storage lithium batteries was 80 GWh, 675 GWh and 185 GWh respectively, and the installed capacity of lithium batteries exceeded 435 GWh. In addition, in terms of export trade, the industry also continued to grow, and China's total lithium battery exports reached 457.4 billion yuan in 2023, a year-on-year increase of more than 33%.

The consumer lithium-ion battery market started relatively early and has developed rapidly with the development of the global economy, the progress of electronic science and technology, and the popularization and diversification of consumer electronic products. It is an extremely important part of the lithium-ion battery market.

With the advancement of 5G, Internet of Things, AI and other technologies, emerging consumer electronic products such as Bluetooth headsets, wearable devices, smart speakers, portable medical devices, e-cigarettes, drones, and vehicle recorders constantly emerging, and the number of manufacturers gradually increasing, the demand for the global consumer lithium-ion battery industry continues to grow. Moreover, due to the continuous growth of China's macro economy over the years, the gradual transformation of people's consumption concepts and the continuous improvement in the acceptance of emerging consumer electronic products with diverse functions, the market size of China's consumer electronic products is constantly expanding.

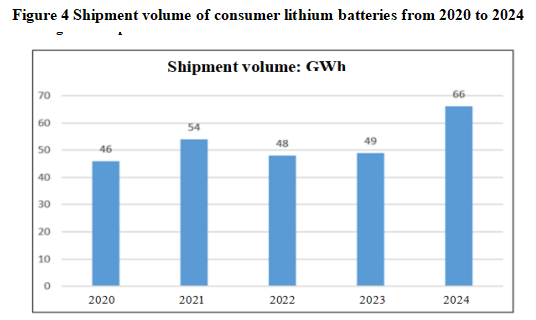

Data show that the shipment volume of China’s consumer battery industry was 49 GW·h, accounting for 43.4% of the global shipment volume. The demand picked up slightly in 2023, and the shipment volume isl reached 88 GW·h in 2024.

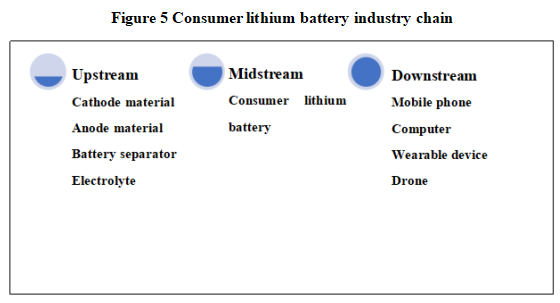

With the strong support of policies and the effective backing of downstream consumer demand, China's consumer lithium battery industry has not only made great progress in the core field of battery cell manufacturing after years of development and improvement, but also gradually established a complete industrial chain including lithium ore mining, material supply, battery cells and pack, battery recycling and other links. The upstream of the industry is mainly key materials such as cathode and anode materials, electrolyte, separator, etc., and the overall supply of raw materials is sufficient. The downstream of the industry is mainly consumer electronic products, including traditional consumer electronic products such as smartphones, laptops and tablets, as well as emerging consumer electronic products such as Bluetooth headsets, wearable devices, smart speakers, portable medical devices, drones, and e-cigarettes. The increase or decrease in demand for consumer electronic products has a direct impact on the development of the consumer lithium battery industry.

(3) Development trend of consumer lithium batteries

① Consumable lithium-ion batteries will develop in the direction of thinness, miniaturization, high safety, high energy density and fast charging

In recent years, traditional consumer electronic products such as smartphones, laptops, and tablets, as well as emerging consumer electronic products such as Bluetooth headsets, smart watches, and smart bracelets, have gradually developed in the direction of thinness, and the specifications of consumer lithium-ion batteries are also changing in the direction of thinness and miniaturization.

In order to ensure that electronic devices can meet the daily use of consumers, there are also higher requirements for battery safety, energy density, charging speed, etc. In the future, consumer lithium-ion battery products will follow the above development trend and develop in the direction of thinner, smaller, higher safety, high energy density and faster charging.

② Emerging consumer electronic products will become an important demand growth point in the industry

The continuous progress of electronic technology has made all kinds of consumer electronic products emerge in an endless stream, and consumer electronic products with diverse functions have greatly met people's growing needs for material, culture and entertainment, and have also greatly improved people's quality of life and work efficiency. With the gradual improvement of the public's consumption level and the continuous innovation of consumer electronic products, the demand for consumer electronic products is also constantly increasing.

Consumer electronic products are an important application area for consumer lithium-ion batteries. With the global market for traditional consumer electronic products such as smartphones, laptops, and tablets becoming mature, the market growth rate is gradually slowing down. Emerging consumer electronic products represented by Bluetooth headsets, wearable devices, and smart speakers are gradually becoming a powerful support for improving the prosperity of the consumer electronic product market.

③ Rapid market response and customized production will become important development trends in the industry, and the battery cell manufacturing process is particularly critical

Since the update cycle of consumer electronic products is often relatively short, the production and design of consumer lithium-ion batteries need to be in line with the changes in the demand of downstream application terminals. It is necessary to continuously improve and upgrade existing products, and simultaneously launch matching battery series with the switching of hot products at the downstream terminals. With the diversification of application scenarios and application functions of consumer electronic products, the types and styles of products are also constantly changing, and various physical indicators change accordingly. Among them, the change in form is a relatively prominent aspect. The trend towards thinness and flatness of traditional consumer electronic products such as smartphones, laptops and tablets, as well as the rise of emerging consumer electronic products such as Bluetooth headsets, smart watches and smart bracelets, all indicate the future development direction of diversified battery forms. The selection of the battery cell manufacturing process is particularly important.

④Automation, intelligence and informatization of the whole process have become the direction of policy guidance

In addition to market factors, industry-related policies have also played a driving role in the development of new production models in the industry. In January 2019, the Ministry of Industry and Information Technology issued the Standard Conditions for the Lithium-ion Battery Industry (2018 Edition), which pointed out that "enterprises are encouraged to strengthen top-level design, promote the upgrading of automation equipment, and promote the improvement of automation level; enterprises are encouraged to integrate automation, informatization, and intelligence into all aspects of design, production, management, and service." The automation, intelligence, and informatization upgrading of production lines is the basic condition for modern manufacturing enterprises to quickly respond to the market and complete the production of large-scale customized products. The formulation of relevant national incentive policies is conducive to the formation and development of customized production models for consumer lithium-ion battery manufacturers.

In summary, the project relies on the leading advantage of Hongtu Lithium Battery Separator Company in the same type of products in China, introduces cathode and anode materials, electrolyte technology and production lines to produce consumer lithium-ion batteries, with a broad market prospect.

1.1.3 Technical analysis

The manufacturing processes of lithium-ion battery cells are mainly divided into two categories: the stacking process and the winding process. The stacking process adopts the method of multi-pole piece parallel connection, which makes the internal resistance smaller, the charging efficiency higher, and the heat generated during the charging and discharging cycle is relatively smaller and more uniform, thus the battery has higher safety. Moreover, the stacking process makes the size and shape of the battery more flexible, and the internal space of the battery is utilized more fully. Therefore, the energy density of the stacking structure is relatively higher, and it is more suitable for small-sized and special-shaped batteries. In terms of battery thickness, due to its laminated characteristics, the stacking structure has strong thickness controllability and is suitable for the production of ultra-thin batteries. However, for the winding structure, due to the limitation of the thickness of the tab, it is more difficult to produce ultra-thin batteries. The project intends to cooperate with large domestic enterprises in this field, and the battery cells will adopt the stacking process.

1.1.4 Advantageous conditions of project construction

(1) Policy conditions

In recent years, the country has successively issued a series of laws, regulations and industrial policies to vigorously support and regulate the development of the consumer lithium-ion battery industry. For example, in November 2023, the State Railway Administration, the Ministry of Industry and Information Technology, and China State Railway Group Co., Ltd. issued the Guiding Opinions on the Railway Transportation of Consumer Lithium Battery Goods, clarifying the regulations on the railway transportation of consumer lithium battery goods and standardizing the railway transportation conditions. In addition, China has also promulgated a number of policies such as the Action Plan for Digitalization of “Increasing Varieties, Improving Quality and Creating Name-brands” in the Consumer Goods Industry (2022-2025) and the Several Measures to Promote the Consumption of Electronic Products to support the development of the downstream consumer electronics industry. The introduction of a series of policies has created a favorable institutional environment for the orderly competition and healthy development of the industry, and has a good guiding and encouraging effect on the industry.

On November 15, 2024, the Ministry of Industry and Information Technology, the Ministry of Ecology and Environment, the Ministry of Emergency Management, and the National Standardization Administration jointly issued the Guidelines for the Construction of the National Lithium Battery Industry Standard System (2024 Edition). The Guidelines clarifies that by 2026, more than 100 new national standards and industry standards will be formulated, the standard system leading the high-quality development of the lithium battery industry will be sounder, and the role of the standard service industry in consolidating its dominant position will continue to increase. There are more than 1000 enterprises that will carry out the publicity, implementation and promotion of standards, and the effectiveness of the innovation and development of standard service enterprises will become more prominent. The formulation of more than 10 international standards will be participated in, and the international influence of China's lithium battery standards will be further enhanced.

(2) Resource advantages

In recent years, Liaoyuan City has continued to optimize and adjust the energy structure, fully launched the construction of a clean energy heating demonstration city in the north, and carried out 47 clean heating transformation projects such as "coal to gas" and "coal to electricity", which is expected to reduce coal consumption equivalent to 510000 tons of standard coal. In addition, Liaoyuan is rich in wind energy, solar energy, biomass energy and other resources, providing support for the construction of green and low-carbon projects.

(3) Industrial advantages

In recent years, Liaoyuan High-tech Zone has accurately planned and positioned itself, forming a functional layout of "dual-core drive, one district and four parks", and the large-scale and cluster expansion of "4+1 industry", with 2111 enterprises settled. The scale of the supporting industry for new energy vehicles has expanded rapidly; it plans to build a 4 square kilometer new energy vehicle supporting industrial base, forming a new energy vehicle supporting industrial system with Hongtu Lithium-ion Battery Separator, Sinopoly New Energy, Joyson Electronics, Shengyuan New Materials, and Jincheng Heavy Industry as the core, and has been designated as a strategic partner of FAW by the provincial government and signed a strategic cooperation agreement with FAW-FINDREAMS.

The upstream enterprise of the project, Liaoyuan Hongtu Lithium Battery Separator Co., Ltd. has zinc-manganese battery separator and high-quality lithium-ion battery separator as its main products. The zinc-manganese battery separator products are exported to South Africa, Japan, South Korea and other countries and regions, and it has been an excellent supplier of Panasonic Corporation in Japan for 10 years. Lithium-ion Battery Separator has become an excellent supplier and main supplier of Tianjin Lishen, and its products have passed the certifications of well-known domestic and foreign enterprises such as Samsung, LG, Sumitomo and Teijin. Over the years, Hongtu Separator has established cooperative relations with Northeast Normal University, Jilin University, Changchun Institute of Applied Chemistry, Chinese Academy of Sciences, and China Battery Industry Association, and hired an expert technical team from abroad, introduced a full set of foreign lithium battery separator production and testing equipment, carried out technological breakthroughs and research and development, and successfully developed 5-micron, 7-micron ultra-thin single-layer separator and high-porosity ceramic coating film for power. The company has 14 patents, including 13 invention patents.

(4) Talent advantages

Liaoyuan City is rich in human resources, and there are vocational colleges in the urban area, which can train talents according to the needs of enterprises. Liaoyuan City has a good foundation for industrial development, only 115.13 kilometers away from Changchun, a well-known "University City" and "Automobile City", which can meet the various talent needs of enterprises.

(5) Location and transportation advantages

Liaoyuan has obvious geographical advantages, 140 kilometers away from Changchun Longjia International Airport in the north and 240 kilometers away from Shenyang Taoxian International Airport in the south. It is located in the important axis belt of Changchun one-hour economic circle and Shenyang Railway urban agglomeration. Within a radius of 200 kilometers, there are 2 provincial capitals and 8 prefecture-level cities, with a population of nearly 40 million. The urban area has built a transportation network of "three rings, four verticals and six horizontals". The inter-regional highway and railway traffic is developed, No. 303 National Highway and Siping-Meihekou Railway run through the whole territory, and Liaoyuan-Xifeng, Liaoyuan-Changchun Railways, Changchun-Liaoyuan, Yingchengzi-Meihekou, Jilin-Caoshi, Liaoyuan-Xifeng Expressways, and Liaoyuan Civil Airport that will be built soon, constitute a comprehensive transportation system for entering the hinterland of the Northeast, the sea and customs.

1.2 Contents and scale of project construction

The project uses the existing plant in the field of Liaoyuan Hongtu Lithium-Ion Battery Separator Technology Co., Ltd. to introduce cathode and anode materials and electrolyte production lines.

1.3 Total investment of the project and capital raising

1.3.1 Total investment of the project

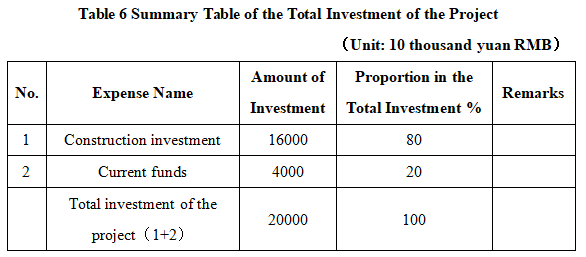

The total investment of the project is 200 million yuan, including the construction investment of 160 million yuan and the current funds of 40 million yuan.

1.3.2 Capital raising

Self-raised by enterprise

1.4 Financial analysis and social evaluation

1.4.1 Main financial indexes

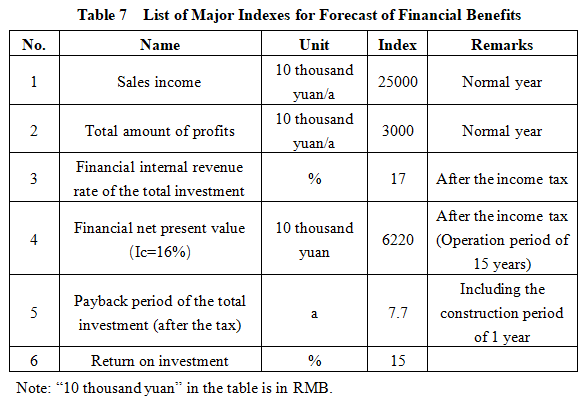

After the project reaches the production capacity, its annual sales income will be 250 million yuan, its profit will be 30 million yuan, its investment payback period will be 7.7 years (after the tax, including the construction period of 1 year) and its investment profit rate will be 15%.

1.4.2 Social evaluation

Through the construction of the project, it will be conducive to the formation of a complete industrial chain of consumer lithium batteries, promote the upgrading of the consumer lithium battery industry in Liaoyuan City, and drive the development of downstream industries; at the same time, it can drive local employment and play a good role in promoting local social development.

1.5 Cooperative way

Joint venture, cooperation and other ways can be interviewed

1.6 What to be invested by the foreign party

Funds and other ways can be interviewed

1.7 Construction site of the project

Longshan District, Liaoyuan City, Jilin Province.

1.8 Progress of the project

Attracting foreign investment.

2. Introduction to the Partner

2.1 Basic information

Name: Liaoyuan Hongtu Lithium-Ion Battery Separator Technology Co., Ltd.

Address: No. 78 Youyi Road, Longshan District, Liaoyuan City, Jilin Province

2.2 Overview

Liaoyuan Hongtu Lithium-Ion Battery Separator Technology Co., Ltd. was established in March 2005, and its main products are zinc-manganese battery separator and high-quality lithium-ion battery separator.

Hongtu Separator is the earliest enterprise specializing in battery separator in China. In 2012, the company introduced foreign advanced technology, digested and absorbed it to research and develop the lithium battery separator, which filled the gap in the domestic separator industry. In 2014, the company's products successfully replaced the imported products to enter into the supplier system of Tianjin Lishen, and became the main supplier of Tianjin Lishen.

The zinc-manganese battery separator products are exported to South Africa, Japan, South Korea and other countries and regions, and it has been an excellent supplier of Panasonic Corporation in Japan for 10 years. Lithium-Ion Battery Separator has become an excellent supplier and main supplier of Tianjin Lishen, and its products have passed the certifications of well-known domestic and foreign enterprises such as Samsung, LG, Sumitomo and Teijin.

2.3 Contact method

Postal code: 136200

Contact person: Bi Chengye

Tel: +86-437-3166166 +86-13258791949

E-mail: lyslsqswj@163.com

Contact method of the city (prefecture) where the project is located:

Contact unit: Liaoyuan Municipal Bureau of Commerce

Contact person: Ai Jing

Tel: +86-18643787709

E-mail: lyjhjxmc@163.com