Processing of Agricultural Products and Food

Pig Slaughtering and Meat Products Deep-processing Project of Jilin City

1. Introduction to the Project

1.1 Project background

1.1.1 Product introduction

The project covers a total area of 150000 square meters and mainly includes the construction of a pig slaughtering workshop, a meat processing workshop, and supporting facilities such as cold chain and power stations for pig slaughtering and deep processing of meat products.

After the completion of the project, it can improve the pig slaughtering capacity and automation level in Jilin City, and increase the added value of Jilin Province’s pig breeding industry through deep processing.

1.1.2 Market prospect

(1) Background of the pork industry

Pork is one of the most important meat on the Chinese table, and its industry occupies an important position in China’s agriculture and animal husbandry. China is not only the world’s largest producer of pork, but also the largest consumer of pork, with pork consumption accounting for over 60%. This industry not only relates to the basic living needs of residents, but also directly affects the stability and development of agricultural economy.

The pork industry can be divided into multiple sub-sectors, mainly including pig farming, feed production, veterinary medicine and vaccines, pig slaughtering, pork processing and sales, and other links. Each segmented field has its unique industry characteristics and representative enterprises.

Among them, pig slaughtering and processing are important links in the pork industry chain, and the final products flow to the end consumer market. The capacity utilization of the slaughtering industry is unstable and the profitability is relatively low, but the profitability of the processing and sales links is high. Representative enterprises include Shuanghui, Yurun, etc. In recent years, large breeding enterprises have gradually entered the slaughter business to improve the overall efficiency of the industrial chain.

(2) Analysis of the current situation of the pork industry

Due to the severe impact of the African swine fever epidemic, the inventory of live pigs dropped sharply by 27.5% to 310 million pigs in 2019. But with the effective control of the epidemic and the implementation of various support policies, the production capacity of live pigs has rapidly recovered. At the end of 2022, the national pig inventory rebounded to 453 million pigs, a year-on-year increase of 0.7%. The year-end inventory of live pigs in China in 2023 is 434.22 million pigs; compared to the same period last year, there were 452.56 million pigs, a decrease of 18.34 million pigs, a decrease of 4.05%. In 2023, the number of live pigs slaughtered was 72662 (10000), and in December, 2023, the number of pigs slaughtered by designated slaughter enterprises above designated size was 39.78 (10000 ). The annual supply of live pigs in 2024 reached 716 million pigs, slightly lower than the 726 million pigs in 2023, but higher than the 699 million pigs in 2022. This indicates that the overall output of live pigs in 2024 is still at a relatively high level. Although the number of live pigs slaughtered has decreased, the decrease in pork production capacity is relatively small, which means that the reduction in the total supply of pork in the country will not be significant. Due to high inventory and low expectations, slaughter companies have continued the pace of destocking frozen goods inventory, easing inventory pressure. The data shows that the frozen product storage capacity rate of key slaughter enterprises in China is showing a fluctuating and decreasing trend.

Market demand is an important support for the development of the pork industry. In 2022, the per capita consumption of pork by Chinese households was 26.9 kilograms, a year-on-year increase of 6.75%. With the improvement of residents' income levels and the advancement of urbanization, the per capita consumption of pork will reach 27.7 kilograms in 2023. With the increase of residents' income level and the change of consumption concept, the demand for high-quality and high nutritional value pork products continues to increase. At the same time, the rise of diversified dietary trends has also prompted consumers to increase their consumption of substitutes such as beef, mutton, poultry, and seafood, which has had a certain impact on pork consumption. However, on the whole, pork is still one of the most important sources of meat consumption for Chinese people, and market demand has maintained a steady growth trend.

At present, the Chinese pork consumption market is still dominated by hot fresh meat, accounting for about 70%, followed by frozen meat (20%) and cold fresh meat (10%). With the continuous improvement of consumers' requirements for food safety and quality, the market share of fresh and frozen meat is expected to further expand.

As the world’s largest producer and consumer of pork, China has a huge market size. According to data, the global pig production and pork market size is expected to reach approximately RMB 1.7776 trillion in 2023, and is projected to reach RMB 1.8988 trillion by 2030, with a compound annual growth rate of 0.8%. The market size of pig farming in China is over one trillion yuan, with enormous development potential.

The competitive landscape of the pork industry is undergoing changes. With the promotion of scale and collectivization, the market share of large aquaculture enterprises is gradually increasing, while small and medium-sized retail investors are gradually withdrawing from the market. In the slaughtering and processing stages, large enterprises also improve the overall efficiency of the industrial chain by integrating upstream and downstream resources.

The pork industry faces multiple challenges and opportunities in its development process. The challenges mainly include cost pressure, food safety issues, environmental pressure, etc. The fluctuation of raw material prices, increasingly strict environmental policies, and intensified market competition have all brought certain uncertainties to the operation of enterprises. However, with the promotion of consumption upgrading, technological innovation, and coordinated development of the industrial chain, the pork industry has also ushered in huge development opportunities. The rise of high-end, functional pork products and plant-based meat substitutes has brought new growth points to the industry. At the same time, the expansion of the international market also provides enterprises with broader development space.

(3) Analysis of the pork deep processing industry

The pork deep processing industry is a key branch of the food processing industry, focusing on transforming raw pork into diverse, high value-added food products. According to authoritative institutions such as China IRN, the market size of China’s pork deep processing industry has reached 2.5 trillion yuan in 2023, a year-on-year increase of 7.2%. It is expected that by 2025, the market size is expected to have grown to 3 trillion yuan, with an average annual growth rate of about 5%. This growth is mainly driven by factors such as consumption upgrading and population growth.

With the increasing awareness of consumer health, the industry is developing towards high-quality, healthy, and diversified directions. Low salt, low-fat, high protein and other healthy products, as well as deep processed products with local characteristics, have become the new favorites in the market.

The pork deep processing industry is fiercely competitive, with large enterprises such as Shuanghui, Jinluo, and Yurun Food occupying market leading positions, as well as numerous small and medium-sized enterprises seeking differentiated development paths in the market. Large enterprises dominate the market by leveraging their advantages in brand, technology, and channels; Small and medium-sized enterprises strive to find a place in the market through innovative products, improving quality, optimizing services, and other means.

In recent years, the pork deep processing industry has made significant progress in technological research and technological innovation. The application of new processes and equipment has promoted the improvement of product quality and the expansion of the market. For example, the application of biotechnology and preservation technology has extended the shelf life of products and enhanced their market competitiveness.

There are various types of pork deep processing products, mainly including ham, sausage, cured meat, grilled meat skewers, meat floss, etc. These products are made through fine processing techniques such as cutting, pickling, smoking, and curing, and have the characteristics of delicious taste, rich nutrition, and long storage time. According to different processing methods and product forms, pork deep processed products can be further subdivided into multiple categories such as ready to eat foods, convenience foods, seasonings, etc.

With the increase of residents’ income level and the change of consumption concept, consumers’ demand for high-quality, healthy, and diversified pork deep processing products continues to increase. The application of automation and intelligent technology has improved production efficiency and quality stability, promoting the rapid development of the industry.

1.1.3 Technical analysis

At present, pig slaughtering and processing is a mature industry in China, with a relatively fixed production process, mainly including “pig receiving → rest → waiting for slaughter → dizziness → bloodletting → hanging and lifting → pre cleaning → scalding → dehairing → secondary hanging and lifting → cooling → pre drying → hair burning → manual hair burning → polishing and cleaning → pubic bone opening → chest opening → anus carving → white dirt removal → inspection meat sampling → red dirt removal → head and tail removal → pig head pre-cutting → automatic splitting → synchronous inspection → removal of three glands and groove heads → hoof removal → plate oil tearing → trimming → grading → scalp meat measurement → head removal → white strip measurement → rinsing → pre-cooling and acid removal → segmentation”.

1.1.4 Advantageous conditions of project construction

(1) Policy advantages

The Implementation Plan for the Regulation of Pig Production Capacity (Revised in 2024) proposes to guide farms (households) to reduce the weight of pigs sold and avoid overcrowding and weight gain when pig prices are low and pig farming is severely losing money, and encourage slaughter enterprises to purchase more standard weight pigs.

The Three-Year Action Plan for “Data Elements x” (2024-2026) proposes to improve the transparency of the agricultural product supply chain, support third-party enterprises to gather and utilize data on the origin, production, processing, quality inspection, etc. of agricultural products, support agricultural product traceability management, precision marketing, etc., and enhance consumer trust. Promote innovation in the integration of industrial chain data, support third-party platform enterprises to provide smart farming, transaction matching, disease prevention and control, market information and other services to farmers, collect data on general materials, drugs, growth, sales, processing, and provide one-stop procurement, supply chain finance and other services. Cultivate a new model of customized production based on demand, support the integration and analysis of agricultural and commercial circulation data, encourage e-commerce platforms, supermarkets, logistics, etc. to provide feedback on agricultural product information to the production and consumption ends based on sales data analysis, and enhance the matching ability of agricultural product supply and demand. Enhance the risk resistance capability of agricultural production, support the integration, release, and application of production capacity, transportation, and agricultural market price data in areas such as pigs, fruits, and vegetables, support agricultural monitoring and early warning, and reduce the damage caused by cyclical fluctuations.

The Three-Year Action Plan for Strictly Standardizing and Promoting Safety in Livestock and Poultry Slaughtering proposes that by 2025, the layout and structure of livestock and poultry slaughtering in China will be further optimized, and slaughtering capacity will be concentrated in the main breeding areas, with a significant increase in matching with breeding capacity; the orderly reduction of outdated production capacity, the solid promotion of centralized slaughter of cattle and sheep, the steady improvement of the utilization rate of livestock and poultry slaughter capacity and industry concentration, and the significant improvement of the standardization, mechanization, and intelligence level of livestock and poultry slaughter.

The People’s Bank of China, the State Administration of Financial Supervision and Administration and other departments issued the Guiding Opinions on Financial Support to Comprehensively Promote Rural Revitalization and Accelerate the Construction of an Agricultural Power, pointing out that focusing on soybean and oil production, live pigs and the “vegetable basket” project, camellia oleifera seed expansion and low yield and low efficiency forest transformation, we will continue to increase credit supply.

The Implementation Opinions of the General Office of the People’s Government of Jilin Province on Promoting the High Quality Development of Animal Husbandry clearly state the need to promote innovation and speed up in the livestock product processing industry, and lead the high-quality development of the industry. Actively introduce and cultivate large-scale projects in the entire livestock industry chain, accelerate the cultivation of a number of national level key leading enterprises in agricultural industrialization, increase research and development investment, vigorously develop deep processing, promote the extension of livestock and poultry products from primary processing to deep processing, realize the transformation from one-time processing value-added to multi-level processing value-added, and expand new space for value-added in the entire industry chain. Adhere to the principle of “full chain and full utilization”, encourage enterprises to take the path of deep processing and series development, highlight the processing of nutritious and convenient cooked food products, vigorously develop biopharmaceuticals, cosmetics, health products, and pharmaceutical intermediates, extend the industrial development chain, improve the processing level, continuously extend and expand to the food industry, pharmaceutical industry, and clothing industry, realize the full processing and utilization of animal fur, bone blood, and internal organs, and build a hierarchical value-added industrial pattern for the production, processing, and comprehensive utilization of livestock products.

The Investment Promotion Policy of Jilin City clearly states that the investment projects of Jilin City’s industrial investment guidance funds should comply with national and relevant industrial policies and development plans, with a focus on investing in tourism, medicine and health, aviation, information technology, new materials, advanced equipment manufacturing, biotechnology, energy conservation and environmental protection, new energy, cultural creativity, modern agriculture, modern service industry and other related industries in Jilin City’s “6411” industrial plan, as well as other areas supported by the municipal government for development. Guiding funds can adopt investment methods such as follow-up investment and direct investment, in addition to setting up sub funds through equity participation; newly introduced investment projects that meet the conditions shall enjoy tax reductions and exemptions in accordance with the current national and provincial tax policies. For the projects with a significant contribution rate in Jilin City, in accordance with the spirit of the Notice of the State Council on Relevant Matters Concerning Tax Preferential Policies (GF [2015] No. 25), relevant departments shall assist enterprises in applying for tax exemptions and reductions in accordance with the law and regulations; establish a special fund for the development of industrial enterprises, and encourage the introduction of major projects in traditional industries such as chemical, automotive, metallurgical, and agricultural product processing in the “6411” industrial system that comply with national industrial policies, have strong industrial support, and have a significant driving effect; encourage the introduction of emerging industries such as medicine and health, new materials, advanced equipment manufacturing, and electronic information. Give priority to the allocation of production factors and recommend relevant national and provincial special funds for support.

China-Singapore Jilin Food Zone is a provincial-level development zone, but has applied for a national level development zone and enjoys the preferential policies of Jilin Province’s “8+2” quasi-national level development zone.

(2) Resource advantage

Jilin City’s unique geographical environment and climate conditions have nurtured extremely rich agricultural characteristic resources. The rice production in the city accounts for a quarter of the grain crops, and the planting area of ginseng under the forest is the largest in the country. One out of every three high-quality ginseng under the forest is produced in Jilin City. The production of Ganoderma lucidum is the highest in the province, and the production of black fungus is the second highest in the province. It can be vividly said that Jilin City is a treasure trove of precious, wild, rare, famous, and excellent agricultural products in the country.

Jilin City enjoys many reputations such as “Hometown of Chinese Japonica Rice Tribute Rice”, “Hometown of Chinese Black Fungi”, and “Hometown of Chinese Sweet and Glutinous Corn”. During the Qing Dynasty, it was a major production area and distribution center for famous agricultural products. The “Jilin” agricultural products have a rich heritage, distinctive characteristics, and excellent quality. Jilin City focuses on amplifying the quality advantages of “green grain”, “safe meat”, “organic fungi”, and “Songhua fish”, cultivating the regional public brand of “Jipinggong” in all categories, establishing enterprise brands such as “Laoyeling” and “Fuyuanguan”, building a brand matrix of “regional brand+enterprise brand+product brand”, expanding the “online and offline” markets, and promoting more high-quality agricultural products to go out of Jilin and the country.

China Singapore Jilin Food Zone is located in Yongji County, Jilin City, with a planned area of 57 square kilometers, including 36 square kilometers of planned land. There is a large stock of available land resources for development, and new and reserved land can meet the needs of new projects. The land price is at a low level among the 41 cities in Northeast China.

(3) Industrial advantages

Jilin City and its surrounding areas have abundant pig farming resources. For example, Zhongxin Zhengda Co., Ltd. has established a pig breeding base in Jilin, with an annual output of 500000 fat pigs, which can ensure the supply of raw materials for the project. In addition, the pig farming industry in Jilin Province is well-developed, with high-quality pork, good taste, abundant lean meat, and low levels of toxins in the body. There are no drug residues in the meat, making Jilin City’s pigs an ideal source of raw materials.

Jilin City and its food processing park have complete power facilities, water supply conditions, and telecommunications network coverage, which can meet the various needs of the project. At the same time, there is also a sewage treatment plant built in the park, which can meet the requirements of treating pig slaughter wastewater.

Chaluhe Town, where China-Singapore Food Zone is located, is situated in the middle section of the south line of Jilin-Changchun Highway, with convenient transportation. It can easily share the scientific and technological education resources, economic resources, etc. of Changchun City and Jilin City, reducing sharing and logistics costs. In order to ensure the freshness and quality of meat products, cold chain logistics is an indispensable part of the industry chain. Jilin City has a comprehensive cold chain logistics system that ensures timely and safe delivery of products to the market.

(4) Talent advantages

Jilin City has universities such as Northeast Electric Power University, Jilin Institute of Chemical Technology, Beihua University, Jilin Agricultural Science and Technology College, Jilin Medical College, Jilin Electronic Information Vocational and Technical College, Jilin Industrial Vocational and Technical College, Jilin Railway Vocational and Technical College, Jilin General Aviation Vocational and Technical College, etc. These universities provide a continuous supply of talent support for production enterprises.

At the same time, Jilin City has a large number of high-quality industrial workers and a large number of highly skilled industrial workers. After training by enterprises and public welfare institutions, more than 10000 skilled talents are sent to society every year, and more than 20000 people of various types are trained for society.

Jilin City has obvious advantages in terms of labor resources, with a high proportion of skilled workers in the urban agglomeration of Northeast China. The labor force is in a dividend period, and labor costs are relatively low. There is a large number of high-quality industrial workers who can meet the needs of various enterprises.

(5) Location and transportation advantages

Jilin City is located in the central eastern part of Jilin Province, serving as a transportation hub in the northeast region. It borders Yanbian Korean Autonomous Prefecture to the east, Changchun City and Siping City to the west, Harbin City in Heilongjiang Province to the north, and Baishan City, Tonghua City, and Liaoyuan City to the south, with a total area of 27120 square kilometers. This geographical location makes Jilin City an important transportation hub in Northeast China.

The transportation network in Jilin City is very developed, including various modes of transportation such as highways, railways, aviation, and water transportation. In terms of railways, Changchun-Tumen Railway runs through Jilin City and has two intermediate railway stations, Jiuzhan and New Jiuzhan. The Changchun-Jilin Intercity Passenger Dedicated Line also has stops in the area. In terms of highways, Changchun-Hunchun Expressway has an exit in Jilin Economic and Technological Development Zone. In terms of aviation, Jilin City is only 60 kilometers away from Changchun Longjia International Airport. In addition, Jilin City also has access to the Songhua River waterway, becoming an important transportation center for inland areas.

1.2 Contents and scale of project construction

1.2.1 Construction scale

The total area of the project is 150000 square meters. After completion, pig slaughtering and meat product processing can be carried out.

1.2.2 Construction contents

The total construction area of the project is 165000 square meters, mainly including 8 standardized pig slaughtering workshops, 5 meat processing workshops, 3 cold chain shops, 1 gas boiler room, 2 dormitory buildings, 1 sewage treatment plant, 1 disinfection room, 1 fire water tank, and other supporting facilities.

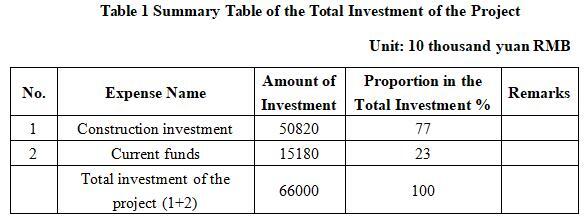

1.3 Total investment of the project and capital raising

1.3.1 Total investment of the project

The total investment of the project is 660 million yuan, including the construction investment of 508.2 million yuan and current funds of 151.8 million yuan.

1.3.2 Capital raising

Self-financing by the enterprise

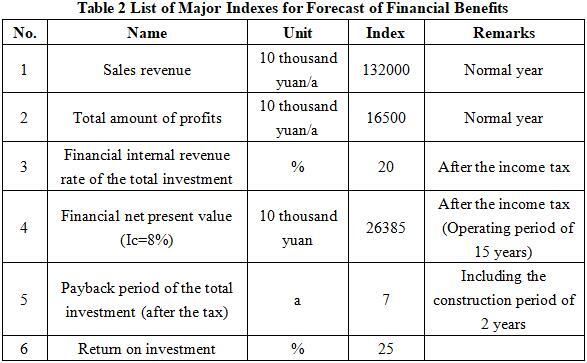

1.4 Financial analysis and social evaluation

1.4.1 Main financial indexes

After the project reaches the production capacity, its annual sales revenue will be 1.32 billion yuan, its profit will be 165 million yuan, its investment payback period will be 7 years (after the tax, including the construction period of 2 years) and its return on investment will be 25%.

Note: “10 thousand yuan” in the table is in RMB.

1.4.2 Social evaluation

The project will rely on existing breeding enterprises in and around Jilin City to supply product raw materials. On the one hand, it can solve the problem of the direction of pig breeding and the problem of excessive breeding capacity, and on the other hand, it can solve the problem of low added value of pigs.

This project can improve the efficiency of pig slaughter and meat quality by adopting modern slaughtering and deep processing technologies, thereby meeting the market demand for high-quality pork products. At the same time, this project will also help optimize the structure of the pig industry, promote the aggregation of factors and industrial concentration in pig breeding and processing industries, and achieve large-scale and intensive operations. It helps to promote the extension and upgrading of the agricultural industry chain, and achieve the integrated development of agriculture with the secondary and tertiary industries. Its construction and operation will effectively promote the development of regional economy. By optimizing the industrial structure, enhancing industrial competitiveness, increasing employment opportunities and residents’ income, this project will inject new vitality and momentum into the economic and social development of Jilin City.

1.5 Cooperative way

Joint venture or cooperation, and other methods can be discussed face-to-face.

1.6 What to be invested by the foreign party

Funds, and other methods can be discussed face-to-face.

1.7 Construction site of the project

China-Singapore Jilin Food Zone, Yongji County, Jilin City

1.8 Progress of the project

It is attracting foreign investment.

2. Introduction to the Partner

2.1 Basic information

Name: Management Committee of China-Singapore Jilin Food Zone

Address: China-Singapore Jilin Food Zone, Yongji County, Jilin City

2.2 Overview

China-Singapore Jilin Food Zone is located in Chaluhe Town, Yongji County, Jilin Province, with an administrative area of 57 square kilometers. On December 19, 2019, China-Singapore Food Zone was selected as a national pilot zone for urban-rural integrated development. The food zone is planned with a core area and a control area, forming a radiating area outward. Core area: located in Chaluhe Town, Yongji County, with a planned area of 57 square kilometers, it is planned to have six functional areas including food processing, warehousing and logistics, modern commercial and residential, administrative office, leisure vacation, and landscape green space, promoting the construction of an ecological city. Control Zone: With a planned area of 1450 square kilometers, it extends from Zhanghualing in the east, Ma’an in the south, Yinmahe in the west, and Taiping Wetland in the north. The zone’s rivers and wetlands are used as natural barriers to form a closed system. In accordance with the standards of the World Organization for Animal Health (OIE), strict control and management are implemented to focus on the construction of disease-free and breeding parks, and to carry out experimental demonstration work in modern agriculture. Radiation areas: Radiate to Jilin, Liaoning, Heilongjiang provinces, and some areas of Inner Mongolia Autonomous Region from the control zone. Through strict quality certification, select and determine the raw material production base in the food zone to meet the supply of raw materials in the food zone.

2.3 Contact method

Postal code: 132000

Contact person: Li Qigui

Tel: +86-13804441992

E-mail: lqg5818@163.com

Contact method of the city (prefecture) where the project is located:

Contact unit: Investment Promotion Service Center of Jilin Municipal Bureau of Commerce

Contact person: Jiang Yuxiu

Tel: +86-432-62049694 +86-15804325460

E-mail: jlstzcjfwzx@163.com