Processing of Agricultural Products and Food

50000-ton/year Soy Sauce Production and Processing Project of Jilin City

1. Introduction to the Project

1.1 Project background

1.1.1 Product introduction

The project covers an area of 100000 square meters, with a building area of 50000 square meters. The project has an annual production capacity of 50000 tons of soy sauce and soy sauce meal.

Soy sauce can be divided into mainstream products, functional products, and high-end soy sauce. The mainstream products include gold medal soy sauce, silver medal soy sauce, umami soy sauce, and shiitake soy sauce. The functional products are divided into cold dish soy sauce, braised dish soy sauce, and children’s soy sauce. The high-end soy sauce is divided into special grade gold medal soy sauce, extremely fresh soy sauce, and seafood sesame oil. Soy sauce is an essential seasoning for daily cooking, mainly made from soybeans. Soy sauce has always been known as the “soul of Chinese cuisine”. The ingredients of soy sauce are quite complex. In addition to salt, there are also various amino acids, sugars, organic acids, pigments, and spices. It is mainly salty, but also has freshness, aroma, etc. It can enhance and improve the taste of dishes, as well as add or change the color of dishes. The ancient Chinese laboring people had already mastered the brewing process thousands of years ago. Soy sauce generally has two types: dark soy sauce and light soy sauce: dark soy sauce is lighter and used for color enhancement; soy sauce is salty and used for freshness extraction.

1.1.2 Market prospect

(1) Market situation of soybeans

Soybean is a fundamental strategic agricultural product that is closely related to the national economy and people’s livelihood. Its production and development have special significance for China’s food and oil security. Soybeans are native to China and are cultivated in various parts of the country, as well as widely cultivated around the world. Soybean is one of the important grain crops in China, with a cultivation history of five thousand years. In ancient times, it was called bean and the main production area is in Northeast China. According to data from the National Bureau of Statistics, except for Qinghai, Hong Kong, Macao, and Taiwan, soybean cultivation and production are found throughout the country.

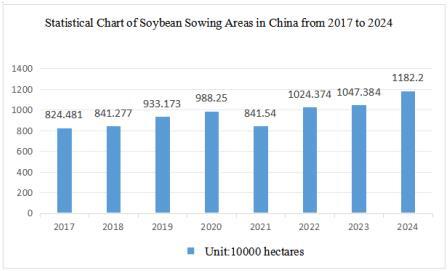

The soybean planting area in 2024 will increase by about 10% compared with that in 2023. The No. 1 Document of the Central Government has obvious influence on soybean planting over the years. 2023 is a year of “stability of two aspects, expansion of two aspects and improvement of two aspects”. The area and yield will be stabilized, the soybean and oil plants will be expanded, the unit yield will be increased, and the self-sufficiency rate will be increased. In 2024, the No. 1 Document of the Central Government proposed “stability of three aspects, expansion of one aspect and improvement of one aspect”, which is to stabilize food rations, corn and soybeans.

Figure 1 Statistical Chart of Soybean Sowing Areas in China from 2017 to 2024

From the perspective of planting areas, the soybean planting area in Northeast China has increased due to higher subsidies and farmers' willingness to plant. The planting area of soybeans in the North China Plain has declined, and the selling price of soybeans will be low in 2023. Farmers’ planting income is not good. If calculated based on a yield of 400 kilograms per mu, the average selling price of gross grain is about 2.30 yuan/kilogram, and the income per mu is 860 yuan, which is lower than that of crops such as corn and peanuts. From the perspective of planting income, farmers should switch to other crops. Secondly, after the wheat harvest, there was no rainfall in the North China Plain for a long time. Soybeans need to be drought resistant for planting. In dry weather conditions, the planting and emergence of soybeans are better than corn. Under the influence of this year’s special weather, some farmers have also switched to planting soybeans.

Among the above provinces, Xinjiang’s performance is relatively impressive. In 2023, the soybean planting area in Xinjiang increased by 561000 mu, or 93.4%, compared to 2022. In 2024, the soybean planting area in Xinjiang continued to increase. Xinjiang also vigorously implemented the soybean production capacity improvement project, introduced a series of stable soybean production policies, and provided subsidies for soybean planting, which stimulated farmers’ enthusiasm for planting soybeans.

Soybean production has reached a new high for two consecutive years. In 2023, the production reached 20.84 million tons, an increase of 560000 tons from the previous year, exceeding 20 million tons for two consecutive years, with a significant increase in high oil and high-yield soybeans. Among them, in 2016, while maintaining a basic yield of corn, the average yield of soybeans per mu was 84 kilograms, an increase of 5 kilograms compared to the previous year, contributing more than 1.6 million tons of production. The production of oilseeds has increased for five consecutive years, with a total output of oilseed crops such as rapeseed, peanuts, and sunflower exceeding 37 million tons, an increase of nearly 1 million tons from the previous year. Among them, the rapeseed production exceeded 15 million tons and has increased continuously for 7 years.

In 2023, the Ministry of Agriculture and Rural Affairs will launch a large-scale action plan to increase the yield of major crops such as grain and oil, and formulate and issue a three-year action plan to increase the yield of soybeans. The plan will focus on 100 major soybean producing counties, with a focus on promoting density tolerant varieties and high-performance seeders, integrating supporting high-yield cultivation technologies, and promoting yield improvement through comprehensive construction. According to the dispatch, the average density of soybeans per mu in 100 counties has increased by 1375 plants and the yield per mu has increased by 19.9 kilograms, contributing more than 70% to the county’s production increase. This has driven the national soybean yield per mu to 132.7 kilograms, an increase of 0.7 kilograms year-on-year, which is the highest level in history.

The domestic soybean supply mainly includes two parts: domestically produced soybeans and imported soybeans. Domestic soybeans are affected by multiple factors such as planting area, yield, and policy adjustments, resulting in a relatively stable supply but limited growth. The supply of imported soybeans is uncertain due to multiple factors such as international market price fluctuations, trade policies, and exchange rate fluctuations.

China imported a total of 106.2 million tons of soybeans in 2024, an increase of 6.74 million tons or 6.8% compared to 99.41 million tons in 2023. Due to the significant increase in imported soybeans in China in the third quarter, the current domestic soybean inventory far exceeds that of last year. The soybean supply from oil factories in China is more relaxed in the fourth quarter compared to last year.

The domestic demand for soybeans continues to grow, mainly driven by the growth in consumer demand for soy products, meat, and the development of the oil processing industry. However, with the increase in domestic soybean production and the supply of imported soybeans, the supply-demand relationship in the domestic soybean market is gradually approaching the balance.

(2) Current situation of the soybean processing industry

In recent years, with the continuous advancement and application of technology, soybean processing technology has also been constantly innovating and improving. The application of new processing technologies and equipment has improved the quality and quality of soybean deep processing products, while also reducing production costs. For example, the continuous improvement of production technology and application level of deep processed products such as soy protein powder and soybean phospholipids has brought new growth points to the soybean processing industry.

Soybean processing is the process of making soybeans more suitable for consumption or meeting the requirements of other food ingredients through physical, chemical, and microbiological treatments. In addition to processing whole soybeans for food production, there are also protein processing and oilseed processing that utilize their main components. The history of soybean processing is long, going through several stages of manual operation, semi mechanized processing, and contemporary automated production lines.

The soybean processing industry has a wide range of products, mainly including soy sauce, soy sauce, soybean meal, soybean products (such as tofu, soybean milk, etc.), soybean protein, soybean phospholipid, etc. The soy product market is also constantly expanding, meeting consumers' demand for healthy and nutritious food. In addition, with the continuous advancement of technology, soybean deep processed products such as soybean protein powder and soybean phospholipids have gradually gained market favor.

In recent years, the soybean processing industry has achieved significant development. Thanks to the continuous progress of agricultural technology and the continuous optimization of planting techniques, China's soybean production has shown a steady growth trend. By promoting efficient planting methods, improving farmland management, and introducing excellent varieties, significant improvements have been achieved in soybean yield and total yield. This growth trend not only enhances the supply capacity of the domestic soybean market, but also provides strong guarantees for meeting the growing demand for soybean consumption. In 2022, the market size of China’s soybean processing industry reached 676.341 billion yuan, an increase of 17.21% compared to 577.016 billion yuan in 2021. The output value of soybean deep processing industry in 2023 is 676.341 billion yuan, a year-on-year increase of 17.21%.

With the continuous advancement and application of technology, soybean processing technology is also constantly innovating and improving. The application of new processing technologies and equipment has improved the quality and quality of soybean deep processing products, while also reducing production costs. For example, the continuous improvement of production technology and application level of deep processed products such as soy protein powder and soybean phospholipids has brought new growth points to the soybean processing industry. In addition, the application of intelligent technology has also improved the efficiency and quality of soybean planting and processing, reduced production costs, and enhanced market competitiveness.

The government promotes the development and upgrading transformation of the soybean industry by formulating relevant policies and plans. For example, introducing a package of support policies to stabilize soybean production, increasing subsidies for soybean producers, increasing financial credit support, exploring the establishment of soybean full cost insurance and planting income insurance, etc. These policy measures help to improve the enthusiasm and efficiency of soybean cultivation and processing.

With the rise of healthy eating trends, soybeans and their deeply processed products are favored due to their high protein, low fat, and rich nutritional content. This change in market demand provides more development opportunities for soybean deep processing enterprises. In addition, with the increasing demand for healthy diets and the rapid development of livestock and poultry farming, the market demand for soybeans and their products continues to expand.

In summary, the soybean processing industry in 2024 has shown a strong development trend in terms of output, market size, technological progress, policy support, and market demand, and there is still significant growth potential in the future.

(3) Market situation of soy sauce

Soybeans are an important raw material for making soy sauce, and the yield of soybeans affects the supply trend of soy sauce, which has a certain impact on soy sauce.

The upstream of the soy sauce industry is the cultivation of raw materials, mainly including soybeans and wheat, as well as food additives and packaging; the midstream includes soy sauce manufacturers such as KIKKOMAN, Haitian Flavoring and Food Co., Ltd., LEE KLM KEE, Qianhe Flavoring and Food Co., Ltd., and Jiajia Flavoring and Food Co., Ltd.; the downstream industries include the catering market such as Haidilao, as well as online sales platforms such as supermarkets, convenience stores, and e-commerce.

Before the 1990s, China’s soy sauce industry mainly relied on other bulk soy sauce produced by local soy sauce factories due to imperfect brewing techniques; in the 1990s, AMOY soybean soy sauce entered the mainland market and quickly replaced local bulk soy sauce; in the late 1990s, Cantonese thick soy sauce, represented by Haitian, entered the inland market and gradually opened up the market nationwide. Currently, its frequency of use is gradually higher than that of thick soy sauce.

In the past, the soy sauce industry was a very traditional industry, with over 60% of B2B sales determining a company’s business thinking. However, under the trend of new consumption, this thinking needs to be transformed. The current channels are essentially integrated, without pure TO B or TO C soy sauce brands. The “new” of new consumption is caused by changes in underlying technology. Whether it is big data, cloud computing, blockchain or AI, in fact, it is all achieved through empowerment and transformation.

In the past, over 90% of soy sauce usage occurred in the kitchen. However, with the gradual emergence of niche products such as crab vinegar and dumpling vinegar, the usage of soy sauce has completed the transition from the kitchen to the dining table. In the future, it may also expand to gift giving and social occasions, as the continuous development of high-end products and supply side upgrades will provide underlying drivers for demand side tasting needs.

From the historical evolution of soy sauce, the upgrading of soy sauce products in China conforms to the trend of functionalization and healthiness. Currently, major soy sauce manufacturers are catering to the trend of consumer upgrading, laying out zero additive and organic soy sauce. In the future, the soy sauce industry will develop towards zero additive and organic soy sauce.

The proportion of soy sauce and vinegar in the retail sales of China’s seasoning industry is as high as 62.6%. Next are soup seasoning, chili sauce, oyster sauce, pickled products, wet/cooked seasoning, and monosodium glutamate, accounting for 6.9%, 5.9%, 5.0%, 5.0%, 4.2%, and 3.9% respectively.

In 2023, the total sales volume of soy sauce in China was 8.976 million tons, a year-on-year increase of 5.9%. The market retail sales amounted to 96.939 billion yuan, with an average annual compound growth rate of 7.2% over the past five years. In the Chinese soy sauce market, 58% of consumers purchase mid to high end soy sauce, including Haitian, LEE KLM KEE, JONJEE, etc., which are generally dark soy sauce, light soy sauce, and high freshness soy sauce; 45% of consumers purchase low-end soy sauce, usually loose soy sauce from small manufacturers and workshops, while the remaining 2% of consumers purchase ultra high end soy sauce, mainly consisting of zero additive soy sauce and organic soy sauce.

The price of soy sauce is mainly affected by raw material prices and product upgrades. The main costs of soy sauce are soybeans, white sugar, and packaging materials, accounting for about 80%. The increase in raw materials will force soy sauce manufacturers to raise prices.

According to e-commerce channel data, the unit price of “zero additive” soy sauce is generally more than three times that of “first grade soy sauce”, while the price of “organic soy sauce” produced from organic soybeans is more than four times.

As the low-end soy sauce market gradually enters a stable period and tends to be saturated, major brand enterprises are supporting the high-end market, and consumption continues to upgrade. After upgrading low-end soy sauce to high-end soy sauce markets such as zero additives and light salt, major brands will continue to launch ultra high end soy sauce products.

In recent years, the Chinese soy sauce industry has shown a diversified development trend, among which reducing salt, promoting health, and improving quality have become the dominant trends. This trend not only reflects consumers’ pursuit of high-quality and healthy living, but also reflects the innovation and development momentum of the industry.

At present, a series of new development trends are emerging in the industry, among which the most significant are health and specialization. Taking healthization for example, in order to meet consumers’ pursuit of healthy eating, many companies have launched new soy sauce products such as zero additive and organic.

The gradual improvement of living standards has made consumers increasingly picky about the choice of soy sauce, and high-quality, healthy, and pure soy sauce has gradually become the first choice on the dining table. According to statistics, the sales of high-quality soy sauce increased by 18% year-on-year in 2023, which is significantly higher than the overall growth rate of the soy sauce market.

It can be seen that high-end soy sauce products are increasingly favored by consumers, and their market size will gradually increase in the future.

1.1.3 Technical analysis

The production technology of soy sauce peptide soy sauce mainly includes the following steps:

Raw material preparation: Select high-quality soy protein as the main raw material, mix it with water in proportion, and add Aspergillus oryzae protease for hydrolysis until the degree of soy protein hydrolysis is 30% -40%, then inactivate the enzyme to obtain soy protein hydrolysate.

Yeast making: After steaming soybean meal or soybeans, mix them with flour, cool them down, inoculate them with Aspergillus oryzae extract, and ferment them to make yeast.

Fermentation: Mix koji with soy protein hydrolysate and ferment using high salt dilute soy sauce brewing method for 60 to 90 days.

Squeezing and filtering: After fermentation is completed, pressing and filtering is performed to obtain soy sauce extract.

1.1.4 Advantageous conditions of project construction

(1) Policy advantages

The Opinions on Effectively Promoting the Comprehensive Revitalization of Rural Areas through Learning and Applying the Experience of the Thousand Village Demonstration and Ten Thousand Village Rectification Project proposes to consolidate the achievements of soybean expansion and support the development of high oil and high-yield varieties. Appropriately increase the minimum purchase price of wheat and reasonably determine the minimum purchase price of rice. Continue to implement subsidies for farmland fertility protection, subsidies for corn and soybean producers, and subsidies for rice.

The People’s Bank of China, the State Administration of Financial Supervision and Administration and other departments issued the Guiding Opinions on Financial Support to Comprehensively Promote Rural Revitalization and Accelerate the Construction of an Agricultural Power, which focused on soybean and oil production, live pigs and the “vegetable basket” project, camellia oleifera seed expansion and low yield and low efficiency forest transformation, and continued to increase credit supply.

The Opinions on Practicing the Big Food Concept and Building a Diversified Food Supply System proposes to deepen the implementation of the soybean and oilseed production capacity improvement project, and steadily improve the self-sufficiency rate of edible vegetable oil.

The Notice of the General Office of the People’s Government of Jilin Province on Issuing the Work Plan for Expanding the Planting of Soybean and Oilseed in Jilin Province mentions that in accordance with the development concept of “focusing on the eastern region, developing the western region, and stabilizing the central region”, the planting area of soybeans should be consolidated and increased, and high protein soybean planting should be developed according to local conditions. Based on market demand, the planting of high oil soybean varieties should be vigorously promoted. Select a batch of soybean and peanut varieties to plant in suitable areas. Intensify support for innovation in soybean oilseed breeding. Promote the construction of the National Soybean Modern Agricultural Industrial Park. Optimize the subsidy policy for purchasing agricultural machinery and improve the mechanization level of soybean oil production. Strengthen the regulation of the supply and demand situation of agricultural inputs such as soybean oilseeds, herbicides, fertilizers, and agricultural machinery in the market.

The Implementation Plan for Optimizing the Investment Promotion Mechanism in Huadian City proposes to establish specialized investment promotion teams for five industrial chains: mineral processing, new energy and new materials, modern agriculture, medicine and health, ecotourism, and ice and snow. Special actions will be carried out to optimize and improve the business environment, and the optimization and improvement of “the environment of six aspects”, that is, government affairs, market, elements, rule of law, openness, and credit will be implemented. All matters will be accessible online, and the occupancy rate of government service centers will reach 99.24%.

The Work Plan for the Four in One and Five Joint Guarantees” Project Construction in Huadian City proposes to clarify the work tasks of a special service team with the city-level leaders as “secretaries general”, and select deputy-township-bureau level or above leaders who understand the business, have strong abilities, and a sense of responsibility to serve as project secretaries to lead and handle the preliminary procedures of the project. From the start of project construction to completion and production, high-standard, comprehensive, and deep-level guarantee services will be carried out.

(2) Resource advantages

Huadian City will continuously optimize its industrial structure in 2023. The three dominant industries of soybeans, sweet glutinous corn, and beef cattle have strong growth momentum. The planting area of soybeans increased by 40.6%, the processing capacity of sweet glutinous corn reached 110 million ears, and the number of beef cattle raised reached 300000, an increase of 14.06%. In the first half of 2024, Huadian City will prioritize the development of agriculture and rural areas, with a total planting area of 1.94 million mu of grain crops in the city.

The total supply of state-owned construction land in Huadian City is planned to be controlled at 224.56 hectares in 2024. In the total planned supply, there are 10.57 hectares of commercial land, 76.42 hectares of industrial and mining storage land, 19.48 hectares of residential land, 4.5 hectares of public management and public service land, 113.59 hectares of transportation land, 453121.93 hectares of forest land, 6.7967 million mu, and 938.53 hectares of grassland, 1.41 million mu.

Huadian City has a large stock of exploitable land resources, and newly added and reserved land can meet the needs of new projects. Land prices are at a low level among 41 cities in Northeast China.

(3) Talent advantages

Jilin City has universities such as Northeast Electric Power University, Jilin Institute of Chemical Technology, Beihua University, Jilin Agricultural Science and Technology College, Jilin Medical College, Jilin Electronic Information Vocational and Technical College, Jilin Industrial Vocational and Technical College, Jilin Railway Vocational and Technical College, Jilin General Aviation Vocational and Technical College, etc. These universities provide a continuous supply of talent support for production enterprises. These talents not only possess rich practical experience, but also have high technical level and innovation ability. They are able to solve various technical problems in the production process, improve production efficiency and product quality. At the same time, these professional skilled talents can actively participate in the technological innovation and product research and development work of the enterprise, providing strong guarantees for the sustainable development of the enterprise.

At the same time, Jilin City has a large number of high-quality industrial workers. After training by enterprises and public welfare institutions, more than 10000 skilled talents are sent to the society every year, and more than 20000 people of various types are trained for the society.

The proportion of skilled workers in the Northeast urban agglomeration is at a relatively high level, and the labor force is in a dividend period. The labor cost is relatively low, which can meet the needs of various enterprises.

(4) Location and transportation advantages

Huadian City has formed a well connected transportation network, 67 kilometers west of Panshi City, 110 kilometers north of Jilin City, and 240 kilometers away from Changchun City, the provincial capital. 663 highways have been built, with a total length of 3188.58 kilometers (including 274 high-grade roads and 1198.91 kilometers). Among them, there are 3 provincial trunk lines with a total length of 264.44 kilometers (3 high-grade road surfaces with a total length of 174.26 kilometers); there are 4 city (county) level highways with a total length of 202.57 kilometers (4 high-grade roads with a total length of 188.13 kilometers); 64 dedicated highways with a total length of 795.46 kilometers (including 2 high-grade roads with a total length of 18 kilometers); there are 91 township level highways with a total length of 763.61 kilometers (70 high-grade roads with a total length of 543.4 kilometers); there are 501 village level roads with a total length of 1162.5 kilometers (195 high-grade roads with a total length of 275.12 kilometers).

1.2 Contents and scale of project construction

1.2.1 Construction scale

The total area of the project is 100000 square meters. After the project is completed, it will produce 50000 tons of soy sauce and soy sauce meal annually.

1.2.2 Construction contents

The total construction area of the project is 50000 square meters, mainly consisting of a soy sauce meal production workshop, a filling workshop, one medicinal koji peptide soy sauce filling production line, and one soybean sauce filling production line.

1.3 Total investment of the project and capital raising

1.3.1 Total investment of the project

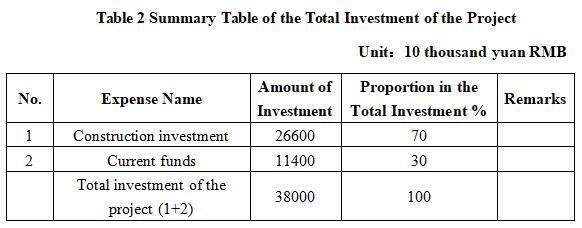

The total investment of the project is 380 million yuan, including the construction investment of 266 million yuan and current funds of 114 million yuan.

1.3.2 Capital raising

Self-financing by the enterprise

1.4 Financial analysis and social evaluation

1.4.1 Main financial indexes

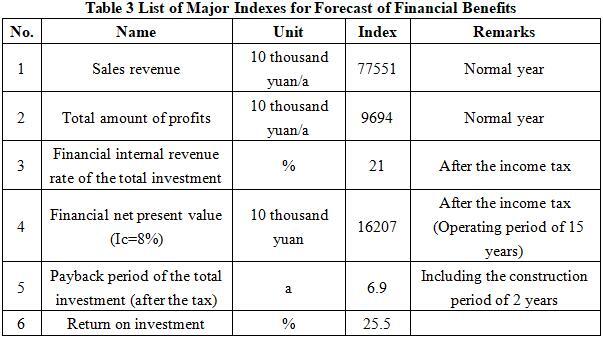

After the project reaches the production capacity, its annual sales income will be 775.51 million yuan, its profit will be 96.94 million yuan, its investment payback period will be 6.9 years (after the tax, including the construction period of 2 years) and its return on investment will be 25.5%.

Note: “10 thousand yuan” in the table is in RMB.

1.4.2 Social evaluation

The project will drive the development of related industries such as soybean planting, procurement, storage, and transportation, forming a complete industrial chain and further promoting the diversification and sustainable development of the local economy.

The project promotes the adjustment of agricultural structure in Huadian City, encourages farmers to plant more high-quality soybeans, and increases the added value of agricultural production, thus promoting the overall progress of agricultural technology and assisting in the implementation of the rural revitalization strategy.

1.5 Cooperative way

Joint venture or cooperation, and other methods can be discussed face-to-face.

1.6 What to be invested by the foreign party

Funds, and other methods can be discussed face-to-face.

1.7 Construction site of the project

Huadian Economic Development Zone

1.8 Progress of the project

It is attracting foreign investment.

2. Introduction to the Partner

2.1 Basic information

Name: Huadian People’s Government

Address: Huadian City, Jilin City, Jilin Province

2.2 Overview

Huadian City has one provincial-level economic development zone, five streets, nine townships, and a total population of approximately 341300 people. The city’s population is mainly Han Chinese. In March, 2001, it was designated by Jilin Municipal Government as a pilot project for building medium-sized cities and granted partial prefecture level management authority.

The urban area of Huadian City is located on the Huifa River in the southwest central part of Huadian City. The terrain of the city is flat, surrounded by mountains, and the transportation is convenient. It is the political, economic, and cultural center of the city, with a built-up area of 15 square kilometers.

The Economic Development Zone is located in the northwest of the city, with a planned area of 6.29 square kilometers and jurisdiction over 7 administrative villages.

In 2023, Huadian City achieved a regional GDP of 11.22 billion yuan, an increase of 8.3% over the previous year. Among them, the added value of the primary industry was 3.54 billion yuan, an increase of 4.1%; the added value of the secondary industry was 2.72 billion yuan, an increase of 18.4%; the added value of the tertiary industry was 4.97 billion yuan, an increase of 7%. The ratio of the three industrial structures is 31.5:24.2:44.3.

2.3 Contact method

Postal code: 132000

Contact person: Zhang Hao

Tel: +86-432-66221983

+86-13331700111

E-mail: swjxmk66221983@163.com

Contact method of the city (prefecture) where the project is located:

Contact unit: Investment Promotion Service Center of Jilin Municipal Bureau of Commerce

Contact person: Jiang Yuxiu

Tel: +86-432-62049694

+86-15804325460

E-mail: jlstzcjfwzx@163.com