Low Altitude Economy

Carbon Fiber UAV Production Base Project of Jilin City

1. Introduction to the Project

1.1 Project background

1.1.1 Product introduction

Drones refer to aerial vehicles that use aerodynamics as their lift source and are carried by unmanned personnel. They are commonly used in industries such as entertainment, aerial photography, agriculture, logistics, and surveying.

The project relies on Jilin Chemical Fiber Group’s advantages in carbon fiber production, technology, and price throughout the entire product chain, and uses its carbon fiber products to produce carbon fiber drones.

1.1.2 Market prospect

1. Development status and trends of China’s low altitude economy industry

(1) Development status

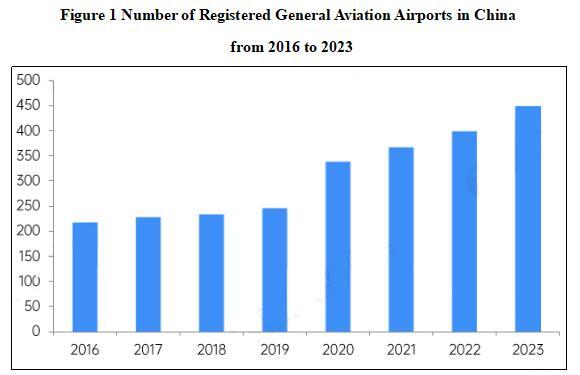

1) There are over 400 registered general aviation airports.

According to data from China AOPA General Aviation Airport Research Center, the number of certified general aviation airports in China has shown an increasing trend from 2016 to 2023. As of December 31, 2023, there are 449 registered general airports in China, including 106 airports that have obtained a general airport use permit and 343 airports that have completed registration through the general airport information management system (B-class general airports and A-class general airports only for helicopter takeoff and landing).

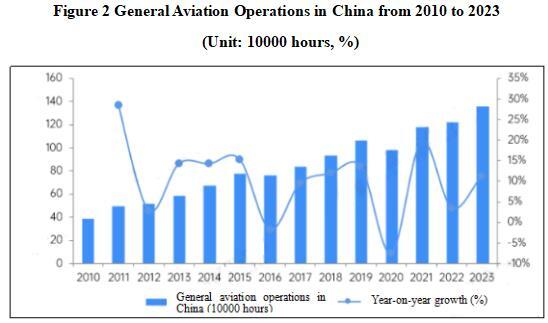

2) The workload of the general aviation industry shows a fluctuating growth trend.

From 2010 to 2019, the overall operational volume of China’s general aviation industry showed an increasing trend. In 2020, due to the impact of the global COVID-19 on the aviation industry, the annual operating volume of China’s general aviation will be 984000 hours, down 7.6% year on year. In 2023, China’s general aviation operations reached 1.357 million hours, an increase of 11.3% compared to 2022.

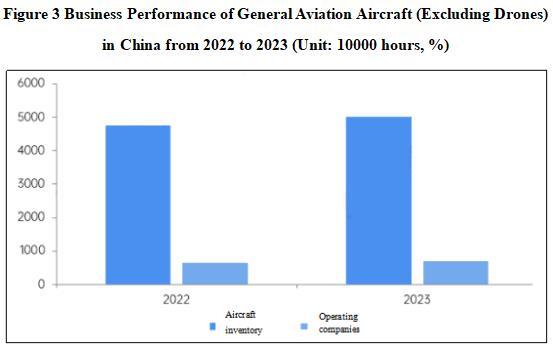

3) The total number of general aviation aircraft exceeds 5000。

As of the end of 2023, the number of general aviation aircraft (excluding drones) in China is about 5000, an increase of 5% compared to 2022. There are 690 traditional general aviation operators (excluding drones), an increase of 4% compared to 2022.

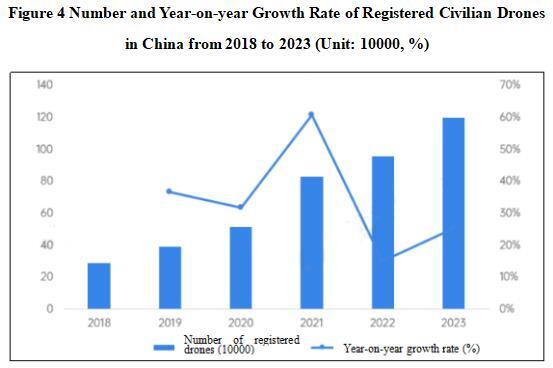

4) The registered number of civilian drones has reached 1.2 million.

With the improvement of China’s per capita consumption level and UAV technology level, the public’s demand for intelligent life has increased, driving the development of civil UAV industry, and the number of registrations has grown rapidly. According to data released by the Civil Aviation Administration of China, the registered number of civil drones in China reached 1.2 million in 2023, a year-on-year increase of 25%.

(2) Industry development prospects and trend prediction

Drones have basically achieved test flights in various scenarios, but there are still technical, infrastructure, ecological and other limitations and bottlenecks. It is expected that in the future, there will be more and more scenarios for public management and services using low altitude flight methods, such as emergency rescue, medical rescue, police security, customs anti smuggling, and government aviation. Especially with its convenience, efficiency, low cost, and wide applicability, drones will become effective tools for government law enforcement, social services, and other departments.

According to the National Three-dimensional Transportation Network Planning Outline, by 2035, the central government expects the industrial scale of China’s low altitude economy to have exceeded 6 trillion yuan. Based on this, it is estimated that the average annual growth rate of China’s low altitude economy industry market size from 2022 to 2035 will be 6.9%. It is predicted that by 2028, the market size of China’s low altitude economy industry will have reached 3.7 trillion yuan.

2. Development status and trends of China’s drone industry

(1) Development status

On October 26, 2024, China Air Transport Association released the China Civil Unmanned Aerial Vehicle Development Report 2023-2024 at the 2nd CATA Aviation Conference. The report shows that the annual growth rate of China’s unmanned aerial vehicle industry is 10 percentage points higher than that of traditional aviation, becoming an important driving force for the development of the low altitude industry. Driven by market demand, the application scenarios of drones continue to enrich, and the industry scale continues to expand. In 2023, the scale of the civilian drone industry reached 117.43 billion yuan, a year-on-year increase of 32%. Based on the 76% share of civilian drones in the global drone market in 2023, the size of China’s drone market in 2023 is estimated to be approximately 154.51 billion yuan.

(2) Industry competition pattern

1) Regional competition: Beijing and Guangdong have the most concentrated distribution.

From the regional distribution of representative enterprises in the drone industry, they are mainly distributed in Beijing, Guangdong, Jiangsu, Sichuan, and some provinces in the eastern region. Among them, HTCHUAV and AVIC, the leading companies in the military drone industry, are distributed in Zhejiang and Sichuan, respectively. Guangdong Province has the densest distribution of drone companies, but most of them are civilian drones.

2) Enterprise competition: Drone companies have different focuses in their layout.

According to the wing structure, drones are mainly divided into four categories: fixed wing drones, multi rotor drones, unmanned helicopters, and composite wing drones. From the perspective of market participants, fixed wing unmanned aerial vehicle companies mainly include AVIC, HTCHUAV, Beihang UAS, etc. In the field of multi-rotor unmanned aerial vehicles, DJI, MMC, Feima Robotics, XAG, etc. are the main participants in China. The main participating companies in unmanned helicopters include Beijing AVIC Intelligent Technology Co., Ltd., AirCamel Tech, Ziyan UAV, etc. In the composite wing unmanned aerial vehicle market, the main participating companies include JOUAV, Volitation, eVTOL, etc.

(3) Industry development prospects and trend prediction

1) The future drone market continues to expand in size.

With the support of national industrial policies, the gradual maturity of technological conditions, and the release of downstream consumer demand, the size of China’s drone market is expected to continue to rise between 2024 and 2029. The market size is expected to exceed 600 billion yuan in 2029, with a compound annual growth rate of 25.6% from 2024 to 2029.

2) Miniaturization, high-speed and long endurance, and intelligent autonomy are the main trends.

At present, Chinese drone companies are continuously making breakthroughs in flight control systems, navigation technology, sensors, and endurance capabilities, and are gradually shifting from relying on imported technology and key components to independent research and development. With the advancement of technology, the development of micro-drones is accelerating. Smaller core components such as sensors, batteries, and processors reduce the overall size and weight of the drone. The application potential of micro drones in military, reconnaissance, surveillance, and consumer markets is enormous, especially in scenarios that require concealment and flexibility. In addition, with the development of artificial intelligence and machine learning technology, the intelligence level of drones will continue to improve, enabling more accurate autonomous flight, obstacle avoidance, target recognition, and task execution, reducing human intervention, and improving operational efficiency and safety.

1.1.3 Technical analysis

There are four commonly used molding processes for composite components of unmanned aerial vehicles:

1. Vacuum bag forming

The vacuum bag forming process is simple and does not require excessive investment in the early stage. The operation difficulty is moderate, but the forming pressure is relatively small, making it suitable for the production of composite material components with low quality standards. In actual drone manufacturing, vacuum bag forming technology is often used for the production of honeycomb sandwich structures and laminated plate structures that do not exceed 1.5mm.

2. Compression molding

The compression molding process combines the advantages of hot press can molding technology and vacuum bag molding technology, and the compression molding process is relatively simple. The composite materials with foam sandwich structure, such as the control surface of UAVs, mostly use this molding process. Molding is to first make foam core and lay it on the skin, then the laid foam core can be put into the molding mold, where the composite material is compacted and solidified.

3. Low temperature molding technology

The low temperature forming technology can be seen as a supplement to hot press can forming technology. The cost and energy consumption of hot press can forming process are relatively high, so more and more countries are starting to study other composite material forming technologies. The low temperature molding technology is a process of curing materials at 60-80℃, and low-temperature polymer resins can be molded through this technology.

4. Hot press molding

The composite material components of unmanned aerial vehicles manufactured by hot press molding process have relatively lighter weight, excellent mechanical properties, better internal quality, and more uniform resin content. For composite components and main load-bearing components of unmanned aerial vehicles with high speed requirements, hot press molding technology is often used for production and manufacturing. However, the hot press molding technology also has certain shortcomings. This process requires high equipment requirements, high initial investment and processing costs, and relatively poor economic efficiency.

1.1.4 Advantageous conditions of project construction

(1) Policy advantages

The Implementation Plan for Innovative Applications of General Aviation Equipment (2024-2030) proposes that by 2030, a new development model for the general aviation industry characterized by high-end, intelligent, and green features will be basically established, supporting and ensuring the safe and efficient operation of the “short distance transportation+electric vertical takeoff and landing” passenger transport network, the “trunk support terminal” unmanned aerial vehicle distribution network, and the low altitude production operation network that meets the needs of industry and agriculture. General aviation equipment will be fully integrated into various fields of people's production and life, becoming a powerful driving force for low altitude economic growth and forming a trillion level market scale.

The Interim Regulations on the Management of Unmanned Aerial Vehicle Flight propose to regulate the entire life cycle of unmanned aerial vehicle flight activities, including production, registration, and operation management, providing strong support and guarantee for unmanned aerial vehicles to fly smoothly, conveniently, and safely. At the same time, it provides strong guidance and a good environment for regulating the development of the unmanned aerial vehicle industry and creating an ecosystem for unmanned aerial vehicle applications.

The Special Plan for the Development of General Aviation in the 14th Five-Year Plan proposes that by 2025, the number of unmanned aerial vehicle enterprises will have reached 18000, and the number of civil unmanned aerial vehicle pilot licenses will have reached 220000, promoting the widespread application of unmanned aerial vehicles and vigorously developing a new low air economy driven by new intelligent unmanned aerial vehicles.

(2) Resource advantages

Jilin Chemical Fiber Group’s 30000 ton high-performance carbon fiber precursor project, which aims to break through the T800 and T1000 level high-performance indexes, was officially put into operation in April, 2024. This project adopts independently developed dry spray wet technology, and the product strength reaches T800 level. The product is mainly used in the high-end market. At the same time, Jilin Chemical Fiber Group is expanding its carbon fiber composite market into multiple fields, with market shares exceeding 80% and 90%, respectively in the fields of unmanned aerial vehicles and wind power applications. In 2024, it signed carbon fiber composite production agreements with 43 enterprises in Texas, Beijing and other places. Jilin Guoxing Composite Materials Co., Ltd., a subsidiary of Jilin Chemical Fiber Group, currently has a production capacity of 20000 tons of carbon fiber extruded sheets, 8 million square meters of carbon fiber woven fabrics, 5 million square meters of carbon fiber prepreg, and 100000 lightweight parts, which can ensure the production of raw materials for the project.

Jilin City has abundant hydropower, developed thermal power, and sufficient power supply. At present, the average electricity price per kilowatt hour in large industries is 0.6 yuan. After the completion of the “Land, Wind and Solar Three Gorges” Project in the province, the carbon fiber industry in Jilin Economic Development Zone will convert and consume a large amount of green electricity produced in Songyuan, Baicheng and other places, and the price can be controlled within an average of 0.4 yuan per kilowatt hour, further reducing the cost of electricity consumption for enterprises. The surface water resources are 7.855 billion cubic meters, and the groundwater resources are 1.842 billion cubic meters. The total year-end storage capacity of large and medium-sized reservoirs in the city is 11.35 billion cubic meters.

(3) Industrial advantages

Jilin City is one of the first pilot areas for the opening of low altitude airspace and the first pilot cities for the comprehensive demonstration zone of the aviation industry in China. It is also the only national carbon fiber high-tech industrialization base recognized by the Ministry of Science and Technology, and the only demonstration base for carbon fiber and differentiated fiber new industrialization industry recognized by the Ministry of Industry and Information Technology. The carbon fiber raw material production capacity ranks first in the world, and the carbon fiber production capacity and output rank first in the country.

In recent years, Jilin City has made every effort to build a carbon fiber new material industrial park, striving to create a new form of industry that integrates the industrial chain, supply chain, and innovation chain. At present, the park covers an area of 145000 square meters and has 4 carbon fiber enterprises settled in. The main products include needle punched felt, carbon felt, graphite felt and other carbon fiber composite materials, which are widely used in fields such as monocrystalline silicon, polycrystalline silicon, vacuum furnace, aerospace, etc.

(4) Talent advantages

There are a total of 9 universities stationed in Jilin City. There are nearly 100000 full-time students and about 30000 graduates from higher education institutions every year. There are about 61000 professional and technical talents and 496000 skilled talents in the city, including 144000 high skilled talents.

In 2024, Jilin General Aviation Vocational and Technical College reached a series of cooperation agreements with key enterprises such as Shanghai Autoflight Co., Ltd. and Jilin Civil Aviation Airport Group Co., Ltd. on the construction of unmanned aerial vehicle assembly and key component production bases, industry education integration training bases, and civil aviation ground service talent employment bases. Jilin Chemical Fiber Group has signed a cooperation framework agreement with Jilin Institute of Chemical Technology, Heilongjiang Bayi Agricultural Reclamation University, Inner Mongolia University of Technology and other universities for the promotion of lightweight technology for low altitude aircraft and the training of composite material processing talents. At the same time, four domestic vocational colleges serving the general aviation industry, including Jilin General Aviation Vocational and Technical College, jointly signed the Memorandum of Cooperation for the Low altitude Economic and Technical Skills Talent Innovation and Training Alliance.

(5) Location advantages

Jilin City is located in the core area of Changchun-Jilin-Tumen in Northeast Asia, adjacent to Yanbian, Tongjiang, and Dahai to the east, Harbin, Changsha, and Shenyang to the west, Liaodan to the south, and Sanjiang Plain to the north. The road transportation is convenient, with distances of 64.5 kilometers from Longjia Airport, 117 kilometers from Changchun, 397 kilometers from Shenyang, 355 kilometers from Harbin, 780 kilometers from Dalian Port, and 1020 kilometers from Tianjin Port. It can connect with Beijing-Tianjin-Hebei, radiate to Northeast Asia, and has obvious geographical development advantages. The expressway forms a “radiating” road network, while the railway forms a cross shaped support. It has intercity railways such as Changchun-Hunchun, Changchun-Tumen, Jilin-Shulan, and Shenyang-Jilin, as well as dedicated and connecting lines for railways such as Jiuzhan-Jiangyuan, Jiuzhan-Qipan, and Xishan-Hadawan. The railways in Jilin City send 26.706 million tons of freight and receive 28.17 million tons of freight.

1.2 Contents and scale of project construction

1.2.1 Construction scale

After the completion of the project construction, an annual output of 100000 carbon fiber unmanned aerial vehicles will be achieved.

1.2.2 Construction contents

The project covers an area of 20000 square meters with a building area of 24000 square meters. Production line equipment will be purchased, and supporting facilities such as production workshop, warehouse, comprehensive building, research and development center, and site pipelines will be constructed.

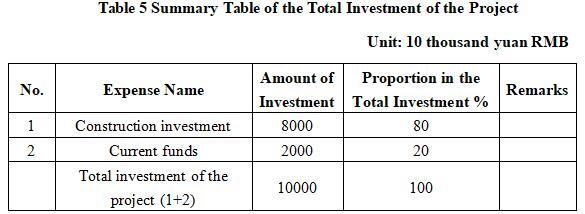

1.3 Total investment of the project and capital raising

1.3.1 Total investment of the project

The total investment of the project is 100 million yuan, including the construction investment of 80 million yuan and current funds of 20 million yuan.

1.3.2 Fund raising

Self-financing by the enterprise

1.4 Financial analysis and social evaluation

1.4.1Main financial indexes

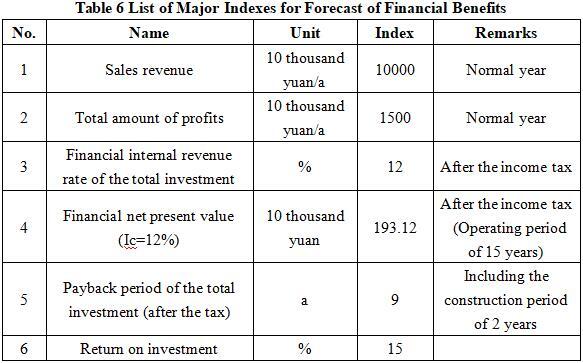

After the project reaches the production capacity, its annual sales revenue will be 100 million yuan, its profit will be 15 million yuan, its investment payback period will be 9 years (after the tax, including the construction period of 2 years) and its investment profit rate will be 15%.

Note: “10 thousand yuan” in the table is in RMB.

1.4.2 Social evaluation

The construction of the project is conducive to fully leveraging the spatial and facility advantages, industrial advantages educational advantages, material advantages and market advantages of Jilin City in the field of low altitude economy, which will promote the high-quality development of low altitude economic industrial clusters, accelerate the cultivation and development of new quality productive forces, and shape the new momentum and advantages for the revitalization and development of Jilin City.

1.5 Cooperative way

Joint venture, cooperation or sole proprietorship, and other methods are negotiable.

1.6 What to be invested by the foreign party

Funds, and other methods can be discussed in person.

1.7 Construction site of the project

Jilin Economic and Technological Development Zone

1.8 Progress of the project

It is currently seeking external investment.

2. Introduction to the Partner

2.1 Basic information

Name: Management Committee of Jilin Economic and Technological Development Zone

Address: 499 Jiujiang Road, Jiuzhan Neighborhood, Jilin City

2.2 Overview

Jilin Economic and Technological Development Zone is located in the northwest suburbs of Jilin City. It was established in 1998 and promoted to a national level economic and technological development zone in 2010. The administrative jurisdiction covers an area of 93 square kilometers, with a built-up area of 20.4 square kilometers. The leading industries include new materials, fine chemicals, biology, medicine, etc. It is a national level carbon fiber high-tech industrialization base recognized by the Ministry of Science and Technology, a national level science and technology enterprise incubator for chemical new materials mainly based on carbon fiber, a demonstration base for new industrialization of carbon fiber and composite materials recognized by the Ministry of Industry and Information Technology, a national level patent industrialization pilot base recognized by the Intellectual Property Office, the first batch of national general aviation industry comprehensive demonstration zones approved by the National Development and Reform Commission, a research and production base for large fiber bundles of carbon fiber and products recognized by the Chemical Fiber Association, and the most competitive fine chemical industry cluster in Northeast China. District.

The power supply, heating, gas supply, water supply, drainage, communication, sewage treatment and other facilities in the area are complete, with complete functions such as research and development testing and enterprise incubation. In the development of the new area, specialized parks such as Jilin National Carbon Fiber Industrial Park and High Performance Fiber Composite New Materials Industrial Park have been established to enhance the industrial carrying capacity. This year, a new carbon fiber “zero carbon” product industrial park has been planned to further enhance the comprehensive supporting functions and industrial carrying capacity of the park, providing comprehensive public works and element guarantee services for projects entering the park.

2.3 Contact method

Postal code: 132000

Contact person: Chai Mao

Tel: +86-432-66490891 +86-17704321998

E-mail: 33591982@qq.com

Contact method of the city (prefecture) where the project is located:

Contact unit: Investment Promotion Service Center of Jilin Cooperation and Exchange Office

Contact person: Wang Yanchao

Tel: +86-15843218881